US-based provider of biomedical data analysis software DNAnexus received $200m in funding from investors including GV, a corporate venturing subsidiary of internet and technology conglomerate Alphabet. The round was led by alternative investment firm Blackstone’s Growth and also included Perceptive Advisors, Innovatus Capital Partners, Foresite Capital and Northpond Ventures. GV is a returning investor that had first participated in the company’s $15m series B round in 2011. Other corporate backers from previous rounds include pharmaceutical firm WuXi AppTec and software provider Microsoft. The round hiked the clinical data software provider’s overall funding to over $470m.

Launched in 2009, DNAnexus runs a cloud-based platform enabling clinical researchers to store, share, analyse and manage complex clinical data. The company claims its platform contains 65 petabytes of data, employed by more than 12,000 users in 48 countries.

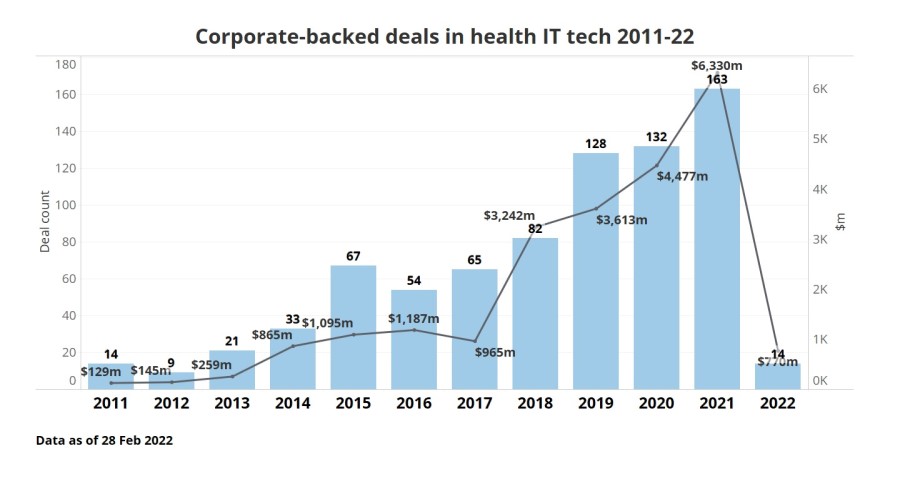

DNAnexus is part of the broader healthcare IT space, which has attracted the attention of corporate venture investors over the years, as our graph with GCV data below shows. The number of corporate-backed deals in this space has been on the rise over the past few years, having reached a peak by the end of 2021, when we reported 163 deals in that space, up from 82 in 2018. The same applies to the total estimated capital which nearly tripled over the same period – from an estimated $2.24bn in 2018 to $6.33bn in 2021. This implied surge in valuation, all too common in recent years of the pandemic in many areas of life sciences and healthcare, is also due to the enormous potential advances which IT applications to health may bring.