Corporate venture capital (CVC) has grown significantly over the past decade. Between 2011 and 2021, annual venture capital investing by corporations grew more than 15 times to $200bn, according to Pitchbook. This represents approximately 30% of all venture dollars deployed. Not surprisingly, the number of corporations investing in venture capital also increased. According to Pitchbook, 990 corporate entities made an investment in 2021, compared with just 273 in 2011.

This study examines data from Global Corporate Venturing, Pitchbook and Crunchbase, as well as new corporate venture capital fund announcements throughout the year.

Our research indicated that corporations invested in 365 new venture capital funds in 2021, including traditional institutional VCs and corporate venture funds. Based on data from Global Corporate Venturing, more than 225 corporate limited partner investments were made into traditional venture funds in 2021. This article focuses on the remaining 140 CVC funds where the majority of the capital came from a single corporate investor to fund its own programme.

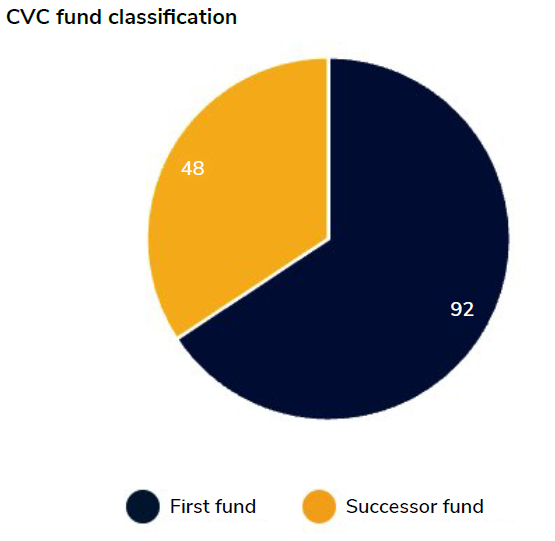

Of those 140 funds, 92 (66%), were new corporate venture programmes, while the remaining 48 (34%) were successor funds for corporations with an existing CVC effort.

Examples of new CVC funds

Prominent companies launching venture funds in 2021 included Alaska Airlines, CVS, Draft Kings, Spin Master, United Airlines, Volkswagen, Xerox and Zoom.

New corporate VC funds came from a combination of public and private companies that operate in nearly every sector of the economy. In announcing these new funds, the corporations cited several benefits of launching a new corporate VC vehicle:

Identifying disruptive technologies – Many corporations seek intelligence on trends and technologies that have the potential to disrupt their industry. For example, CVS’s new corporate venture fund launched with a focus on the “potential for technology-enabled innovation and disruption in digital healthcare”.

Ecosystem support – Corporations launch venture capital programmes to help expand their ecosystem. Circle Ventures, the new corporate venture fund of the payments company Circle, is “excited to support our industry’s innovators and entrepreneurs and identify compelling early-stage companies, technologies, projects and protocols to help realise our mission”.

Customer experience – Corporates cited benefits to end customers, too. Masco Corporation, a Touchdown corporate partner said, “our investment (in Masco Ventures) underscores our commitment to enhance the way consumers all over the world experience and enjoy their living spaces”.

Sustainability – Multiple corporates launch corporate venture programmes to meet sustainability goals. United Airlines, mentioned above, announced a corporate venture fund in 2021, stating that the “new fund will concentrate on sustainability concepts that will complement United’s goal of net zero emissions by 2050”.

92 new corporate venture funds: public versus private

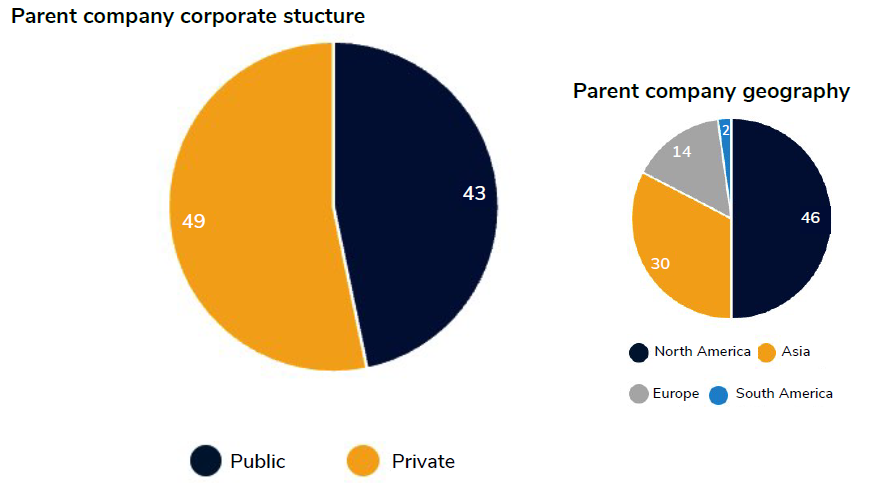

In 2021, more privately held companies launched their first corporate VC fund than publicly traded corporations. The average market capitalisation for public companies starting new CVCs was $35bn. The valuation of private companies is not available.

Geography

About half of the 92 corporations that started new CVC funds are based in North America, while one-third are based in Asia.

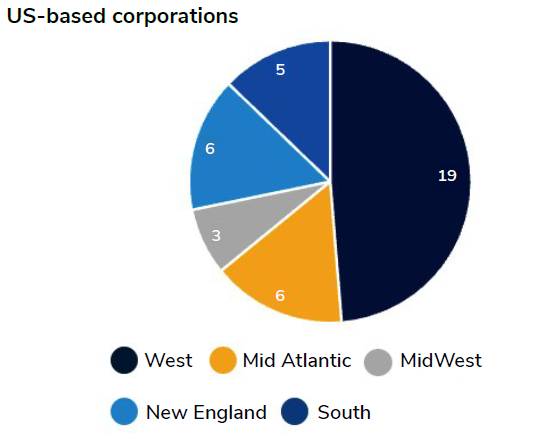

Of the 39 US-based corporations that started new venture funds in 2021, about half of those are headquartered in California, with the others are dispersed across the country.

Industry sector

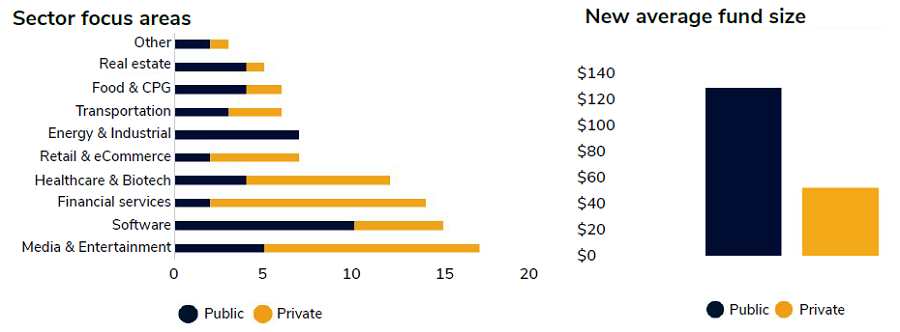

About half of the 92 new corporate VC funds started in 2021 were started by companies in three industry sectors: media & entertainment, software and financial services.

Publicly traded corporations launching CVCs in 2021 were concentrated in the software, energy & industrial, and food & CPG sectors. Privately held companies started CVCs in media & entertainment, financial services and healthcare industries.

Within financial services, there was a significant focus in crypto-based companies starting new corporate VC funds. Examples included Crypto.com, Alchemy, Kraken Digital Asset Exchange, Circle, Zilliqa and Huobi.

In 2021, more software companies launched venture funds to support startups that further advance their particular ecosystem. Notable examples include Zoom’s $400m fund to stimulate growth of its ecosystem of videoconferencing applications. DocuSign also launched DocuSign Ventures to invest in “innovative technologies being used to transform how agreements are created, executed, and managed”.

Size of new corporate VC funds

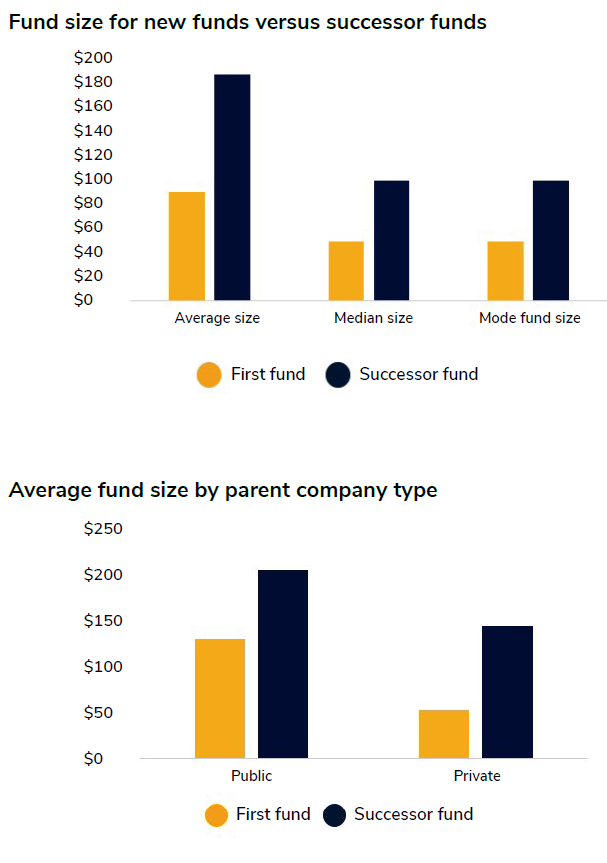

The average size of new CVC funds in 2021 was approximately $91m, with a median size of $50m. The smallest fund was under $10m, and the largest was a Singapore-based eCommerce and video game company called Sea Group. Sea Group announced a commitment of over $1bn to a new corporate venture capital unit called Sea Capital.

The average fund size was significantly different for publicly traded vs. privately held companies. Publicly traded new corporate venture funds were double in size as compared with privately held new corporate VC funds, at an average size of $153m compared with $31m for private companies.

Successor funds

Several corporations launched successor funds in 2021 to expand upon existing CVC efforts. The average size for successor funds was $186 million, almost twice the average fund size for first time corporate VC funds in 2021.

This increase in capital commitments illustrates that these corporations perceive value in their existing venture funds and a willingness to “double down” on corporate venture if it is working.

Not surprisingly, publicly traded corporations had larger average successor fund sizes compared with privately held corporations: $207m versus $146m. In both cases, successor funds tend to be larger than first funds.

Examples of prominent successor funds in 2021 include Boeing, Merck and BMW. Overall, the corporate venture industry continues to thrive, with 92 corporations launching new funds in 2021 and many more corporates continuing to invest in their existing corporate venture strategies.