Kaloyan Andonov: The global advanced materials market is expected by some to reach $2.1 trillion in value by 2025 at a moderate CAGR of 4-5%. TDK Ventures clearly invests in startups in this space. How important is this broad space to the corporate mothership?

Anil Achyuta: TDK is a renown components company delivering cutting-edge solutions for a smart society. Built on a foundation of material sciences, TDK focuses on demanding markets in automotive, industrial and consumer electronics, as well as information and communication technology. Electronic components, whether it is a silicon chip, capacitor or an inductor, are more often than not made of some type of advanced material. If you go one step further and look at batteries, sensors and so on – all of these are made with advanced materials. TDK is something of an advanced material company, even though we sell components rather than advanced materials. What TDK does really well is material processing. In short, you have to process all of those materials to get them to the final stage of a component product or a module, which means advanced materials are critical to TDK. That is why, as a major part of our investment thesis, we are seeking to invest in fundamental materials science companies that unlock meaningful megatrends in digital, energy and environmental transformation.

KA: What are the growth prospects you see in the areas in which you are involved?

AA: From a tactical perspective, growth outlook for sensors appears quite attractive and we are only in the early stages. Another area that boasts both stable and fast growth is lithium-ion batteries – and this is purely from the perspective of the corporate mothership. To TDK Ventures, decarbonisation, industry 5.0, computing and connectivity are key areas that will have a significant effect on our business, maybe not in the very near future, but longer term, within five to 10 years. That encompasses advanced materials within decarbonisation, electrification, robotics and semiconductors. Those spaces would be instrumental for major growth.

KA: What are some of the interesting sub-areas within those?

AA: Electrification is critical and within it there are two areas that are even more critical for TDK and TDK Ventures – electric two- and three-wheeled vehicles in emerging markets and residential energy storage. The latter is one area where TDK has made major strides over the past few years and is now selling fully functioning Tesla Powerwall-type systems in Asia.

KA: How so?

AA: One of our subsidiaries has developed lithium-ion cells that are packaged in a very economical fashion and they are using some advanced LFP chemistry [lithium iron phosphate] which is advantageous at the cost level. For Tesla, the gateway to the energy storage business was the car. That is how it sells its Powerwall and now it is also selling it through the solar energy business segment, which is bundled with the storage. TDK on the other hand has a very healthy lithium-ion cells business that we cater to the consumer electronics market at a massive scale. We are leveraging this core competency to build residential energy storage units that are highly competitive in the marketplace.

KA: How is the electric two-wheeled vehicle sector growing?

AA: TDK is already the largest battery maker for electric two-wheeled vehicles in China. There is plenty of ambition to take it to other emerging markets. One market we have our eyes on is India.

KA: Does TDK Ventures look into other electrification technologies?

AA: Yes, we go one step further. We have invested in areas such as lithium-ion battery recycling (Ascend Elements), solvent-free manufacturing of electrodes (AM Batteries), hydrogen electrolysers (Verdagy) and hydrogen alkaline fuel cells for back-up power (GenCell), to name a few. We have also looked into a few carbon capture companies and grid-scale energy storage companies, although we have not made an investment yet. We are trying to push the envelope as much as we can, so it makes a lot of sense for us to have our eyes on those things. We want to invest in areas that other institutional VCs will invest in, because financial returns are critically important to us at TDK Ventures. Our mandate is to catch the next big wave and get presence now rather than say, “we missed on this”, later. The exploration element is one of the major parts of our mission and we are always honest about it. It is our raison d’être.

KA: Aside from decarbonisation, are there other ESG technologies you are excited about?

AA: Yes, battery recycling. This is one of the most important innovations that are going to be a game changer. One of the critical problems we are facing today is the current raw material crunch. If electrification goals are real and we try to reach them, then we are definitely in a supply crunch for lithium, cobalt, nickel, copper and many other inputs. But why mine more and pollute the flora and fauna if we can use feedstock that is already available instead and just put it back into the supply chain. We have a lot of feedstock from consumer electronics and electric vehicles. This is why we think recycling will be a game changer for this decade. Lead acid batteries (used in cars) are quite toxic and we recycle 99% of them. As for lithium-ion batteries in electric cars, we are just beginning to use them more, so it is better to start early.

The recycling company we have invested in is called Ascend Elements and the company not only recycles lithium-ion batteries in various chemistries and formats, but also builds advanced battery grade graphite, cathodes and cathode active materials, which other recycling companies do not do very well.

Most companies are discussing the idea of converting recycled elements into battery-grade cathodes or anodes, but Ascend is truly changing the game and is already putting recycled cathodes into US military vehicles.

KA: Are there specific advanced materials you are interested in?

AA: We try to be agnostic of specific advanced materials investing, but we are very sensitive to the applications of the materials. It is applications that drive the demand for materials and, more specifically, applications that are more suited for high growth, venture-backed companies to go in and take the market by surprise. It is always better to look at it based on which application could drive the fastest and biggest disruption and then figure out which material, new process or material combination is enabling this disruption.

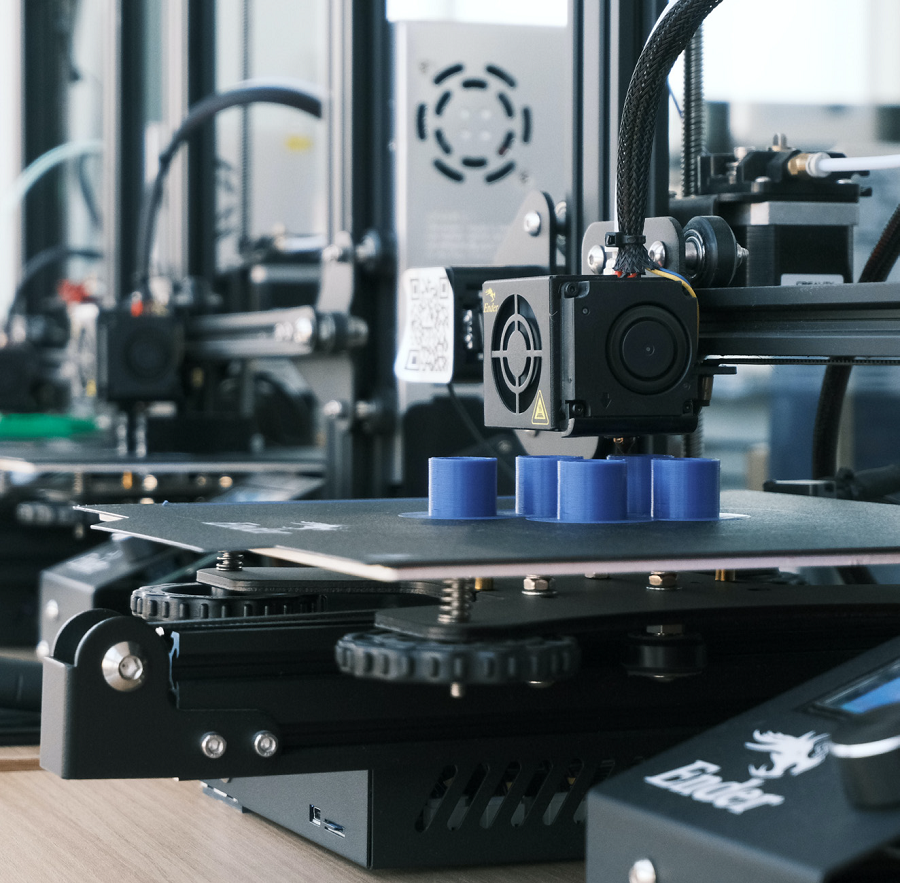

KA: There has been some hype around certain materials. We have seen this in ceramics, 3D printing and other areas. Have you noticed that type of trend and hype as an investor and to what extent do you see things as economically feasible and as just part of a hype?

AA: I am not an expert in ceramics and composites, but I am an investor in 3D printing companies, so I can shed some light on that. You are right that 3D printing is not economically a one-size-fits-all solution for various applications. However, there are applications where 3D printing is an incredible technology. For example, dental applications are one such area where 3D printing can truly play a major role. This is because there is a mass customisation which is required. If you imagine it on a classic graph of unit costs and volume, the 3D printing’s cost curve would be more or less flat. With increasing volume, your cost does not go down as much so you do not get economies of scale with 3D printing. However, any application that requires such mass customisation is where 3D printing can come into its own.

Another area where additive manufacturing can thrive is very high margin products. One can think of medical devices or rocket engines being such products, where the parts are so expensive and have to guarantee flawless performance. Barriers to entry are very high, but if you get it right, you can get a long-tail product with high-tech scientific customers and make a great business from it.

The other trend I see in 3D printing is when you have an environmental goal that also tends to bring some economic benefit. For example, material powders are normally very expensive (gold, copper or any metal you can think of) because they use argon gas to make them into nicely distributed particles with a tight size range. In order to use powder-bed fusion or other type of additive manufacturing, you need this expensive feedstock. So, if you have an input that is more expensive than the material itself, it becomes very uneconomical.

Sometimes, making those powders is also not very environmentally friendly. You use a lot of heat and electricity, burning fossil fuels in the pre-processing to get there. So, if you use additive manufacturing with copper sulphate solution (like the process that our portfolio company Fabric8 Labs uses), which is very cheap compared with copper powder, this is a multifold improvement which reflects on the margins and you get a lot of ESG benefits from it.

KA: Does that extend to energy storage tech?

AA: Dry electrodes technology is another area of interest. One of the most important things in lithium-ion battery manufacturing is the solvent that is used to help coat the electrode of the lithium-ion cell. In the production process, you have powders that are mixed in a slurry to coat the electrodes. The powders are dissolved in a solvent that is used to aid the mixing process. Once the electrodes are coated with this slurry, the solvent needs to be evaporated in huge drying ovens. These ovens are the size of a football field, which you have to heat up to evaporate the solvent. Up to 50% of the energy required for the entire process goes into heating that surface to deal with the solvent. We have made some back-of-the-envelope calculations of our own and, for large-scale operations (100GW/h types), the battery manufacturer could save up to $1bn per year. You can also think of the extrusion technology – that is what ultracapacitor and battery company Maxwell Technologies, which was acquired by Tesla in 2019, does. We invested in AM Batteries, a manufacturer of lithium-ion batteries using solvent-free electrode technology.

KA: You have invested in other types of material-related companies as well, would you tell us a bit more about those?

AA: To be precise, from the 24 companies we have invested in so far, 11 have a new material technology – Fabri8Labs, AM Batteries, Gencell, actnano, Origin, Verdagy, Metalenz, Ascend Elements, Exo, Mojo Vision and SLD Laser. One of those, GenCell, which has developed a hydrogen fuel cell used for backup generators, already went public. GenCell also happens to have a very interesting catalyst discovery, so there is a lot of material science behind it. This is all done in a quest for a non-noble metal catalyst. Generally, these fuel cells use platinum, iridium and palladium – all expensive noble metals. GenCell uses nickel, which is generally cheaper, although nickel has been an issue recently, with significant activity on the London Metal Exchange.

Actnano is another example. It is a surface coating technology that is widely applicable to various segments that TDK is involved in, specifically the automotive sector. There is a coating technology which preserves the electronics and there is potential for it to be used for many other things, too.

KA: You also have interest in metamaterials?

AA: There are some interesting applications in metamaterials, especially in imaging and more so in consumer technology. For example, face identification is now available because of better cameras and advanced software and is something many of us use routinely on our smartphones.

However, with metamaterials, there are other applications in security technology and autotech, for instance. There is also a potential application in virtual reality and metaverse-related electronics.

Fundamentally, metamaterials are useful when you need to do multi-modal imaging rather than just one type of imaging. This may be of use to the health, beauty, security and gaming industries. When we invest, we want to make sure there is a material technology that can ideally be applied to a range of industries, ideally with strong traction in one main application. However, we also weigh this with next-generation application enablers as well and sometimes we do not even know what they are going to be.

KA: Are there any other material-driven areas you are looking to invest in but have not yet?

AA: We are also interested in next generation materials related to big data hardware – silicon photonics. We have someone on the team, Henry Huang, who leads investments for TDK Ventures in that space. Data centres and 5G connectivity are two big areas that we are looking into, with a view of making potential investments. We have not done much in those areas yet, but it is a fertile ground, and I would say you will see some investments from us.

Another area is agricultural tech, which may have plenty of applications in both sensing and actuation, which TDK excels in. Soil health is quickly becoming one of the most important factors. With our experience in sensors, we should be able to contribute to solving this problem.

Advanced farming with robotics is another area that requires a combination of machine vision, robotic grippers (hence good actuators are key here) and the use of artificial intelligence. Investing in this area will have some fundamental materials science advances we can contribute to.

Ultimately, our core values at TDK Ventures are to contribute to society with an entrepreneur-first mindset delivered through deep insights in our areas of knowledge. We believe most material-driven technologies fall into this sweet spot, hence this is such an exciting area for us.