A year ago cryptocurrency management technology producer BlockFi was valued at nearly $5bn — but now it may be sold at a fraction of that, an ominous sign for corporate investors who have backed startups in the sector.

Cryptocurrency exchange FTX has agreed to provide BlockFi with a $400m revolving credit facility and has secured an option to fully acquire the company for up to $240m dependent on undisclosed variables, BlockFi CEO Zac Prince revealed in a Twitter post on Friday. It had previously supplied a $250m facility the week before.

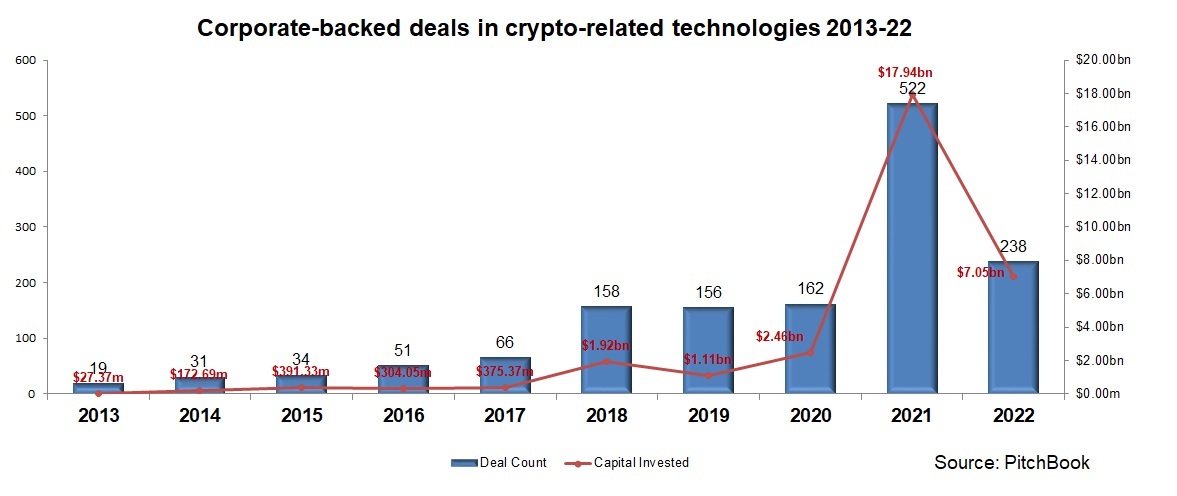

The deal looks like it could be a harbinger of consolidation in the Web3 space, which incorporates not only digital currency-focused companies but those working with NFTs, decentralised finance, blockchain technology, the metaverse and gaming guilds. The amount invested in corporate-backed rounds for cryptocurrency-focused companies topped $17.9bn in 2021 and $7bn in the first half of this year, according to Pitchbook data.

BlockFi offers a range of blockchain-powered wealth management tools for cryptocurrency investors, and regulatory documents last July stated it was set to close a $500m series E round featuring Coinbase Ventures – the investment arm of digital currency exchange Coinbase – at a $4.75bn valuation, a 70% jump in just four months.

The round was never confirmed as closed, and regulatory clouds had already emerged when the US states of Texas, Alabama and New Jersey filed cease-and-desist orders arguing that BlockFi’s interest accounts qualified as unregistered securities. It ended up having to pay $100m in fines in April this year to settle the issue.

BlockFi’s valuation has since plummeted. Reports on June 7 stated it was looking to raise cash at a $1bn valuation. A leaked investor call by hedge fund Morgan Creek Digital on June 28 revealed it was in talks to buy a 51% stake in the company for $250m. Two days later sources were telling CNBC the price for FTX would be either $25m or $50m.

Nor is BlockFi the only company in the sector being bailed out. Alameda Research, the quantitative crypto trading firm formed by FTX founder and CEO Sam Bankman-Fried, recently provided a $500m facility for digital currency exchange Voyager Digital before the latter suspended all withdrawals and trades on Friday.

Trouble in the wider markets

It’s no coincidence both companies have run into trouble – all the major cryptocurrencies have been losing value in recent months. Bitcoin’s price peaked at nearly $69,000 in November but fell below $20,000 last week for the first time since 2020. Ethereum, which neared $5,000 late last year, is currently hovering just above $1,000.

The fall in digital currency prices has its own knock-on effects, particularly if you’ve bet big on them. Voyager Digital’s cashflow troubles are linked to $10bn crypto hedge fund Three Arrows Capital defaulting on a $650m loan before it reportedly filed for bankruptcy last week.

Celsius Network, a cryptocurrency finance provider with some $12bn under management, halted withdrawals and transfers in early June and is reportedly approaching insolvency. It had raised $400m in late 2021 at a valuation topping $3bn.

Investors in Celsius include Tether, a stablecoin issuer which has seen investors withdraw over $10bn of its circulating supply in recent weeks. Another stablecoin provider, Terra, collapsed in May along with its Luna token, having raised over $50m from investors including Coinbase, leading to fears Tether would be similarly vulnerable.

NFT prices have also been plunging this year, with the latest knock being news last week that China’s largest online companies, including Tencent, Ant Group and Baidu, have banned the financial trading of NFTs following a similar decision on cryptocurrencies in 2021.

Companies across the tech space are finding themselves having to raise down rounds at substantially lower valuations, but the Web3 space looks especially shaky given recent developments.

FTX may have passed on lending to Celsius, but the willingness of it and Alameda Research to extend financing to beleaguered cryptocurrency companies suggests there may be winners as well as losers in this market.

Bankman-Fried bought a 7.6% stake in publicly-listed online share trading platform Robinhood in early May, showing his interest won’t be restricted to private companies. He told Bloomberg late last week he is interested in potential acquisitions in the cryptocurrency mining sector.

The fact both FTX and Alameda are also early-stage investors and oversee a combined portfolio of nearly 200 companies, including unicorns like Near, Polygon, Yuga Labs and Anchorage can only help.

On the other hand, several companies in the space run active VC arms, and plunging valuations do not augur well for returns.

If you’re Solana Ventures and you don’t invest past series B, that may not be a huge concern. If you’re Coinbase Ventures and you’ve taken part in more than a dozen nine-figure rounds since the start of 2021, you might be sweating a bit more. BlockFi itself lost $80m due to its exposure to Three Arrows, indicating how much of a disadvantage the connectedness that characterises the Web3 space may turn out to be.

The other big names

BlockFi’s series E round does not appear to have closed, but it secured $350m in a March 2021 series D backed by quantitative trading firms Hudson River Trading and Susquehanna International Group, valuing it at $3bn and hiking its total funding to over $510m. Its earlier shareholders include corporate investors Consensys Ventures, SoFi, CMT Digital, SCB 10X, Akuna Capital and Recruit Strategic Partners.

However, BlockFi is only one of a raft of companies in the cryptocurrency and Web3 space to have raised money at large valuations over the past two years. How are some of the other big names doing?

FTX

Last reported valuation: $32bn (January 2022)

Corporate investors: SoftBank Vision Fund 2, Circle, Binance, Coinbase, Hudson River Trading

As noted above, FTX appears to be taking the Littlefinger view that chaos is a ladder, issuing loans and looking to snap up some of the more troubled operators in the sector. Bankman-Fried claimed as recently as May this year that the company is profitable, but drops in price for both NFTs and digital currencies could hit the revenues of its trading platform, and it has been one of the bigger marketing spenders in the sector, buying naming rights for NBA franchise Miami Heat’s arena and hiring Larry David for a Superbowl commercial.

Ripple

Last reported valuation: $15bn (January 2022)

Corporate investors: Accenture, CME, Seagate, Standard Chartered, Siam Commercial Bank, Santander (through Mouro Capital), Alphabet (through GV)

Financial services provider SBI must count itself lucky it exited Ripple through a January share repurchase valuing the blockchain-driven money transfer service at a 50% premium to the series C round in which it invested. Ripple has been locked in a legal battle with the US Securities and Exchange Commission since late 2020, and although it sold $1bn of its XRP tokens in the fourth quarter of 2021, the value of said tokens has sunk from $1.41 in September to just over $0.30 today.

Near Protocol

Last reported valuation: $10bn (April 2022)

Corporate investors: FTX Ventures, Jump Crypto, Coinbase Ventures, Ideo Colab Ventures, Ripple (through Xpring)

Near is the creator of a decentralised finance app development platform. Its token is trading 80% below its January price but the company’s future will be more closely linked to its ability to establish itself as a more user-friendly alternative to market leader Ethereum, which generates billions of dollars per quarter through transaction fees.

Dapper Labs

Last reported valuation: $7.6bn (September 2021)

Corporate investors: GV, Samsung Next, Coinbase Ventures, Animoca Brands, Warner Music Group, Axiomatic

Dapper Labs specialises in blockchain games, some of which are tied into famous franchises like the NBA, UFC and La Liga, while others, like CryptoKitties and Cheeze Wizards, are its own creations. It’s also the developer of a digital asset storage system and a specialised gaming blockchain called Flow. Although NFT floor prices have not been doing well in general, Dapper Labs’ proprietary technology insulates it somewhat, though falling user numbers for its games must be a concern in the long run.

Gemini

Last reported valuation: $7.1bn (November 2021)

Corporate investors: Commonwealth Bank of Australia, Mogo, UTA Ventures

The cryptocurrency exchange is one of several companies in the sector to have undertaken significant staff cuts, laying off 10% of its workforce at the start of last month and shutting down its physical offices. Because Gemini – like FTX – is private, it’s difficult to put a firm figure on its financial state. However, publicly-listed Coinbase records about five times as many visitors, and its revenue fell 35% in the first quarter of 2022 while an $840m net profit in previous quarter was reversed to a $430m net loss. Just going by the sheer number of exchanges currently operating, this is a subsector more than ripe for consolidation.