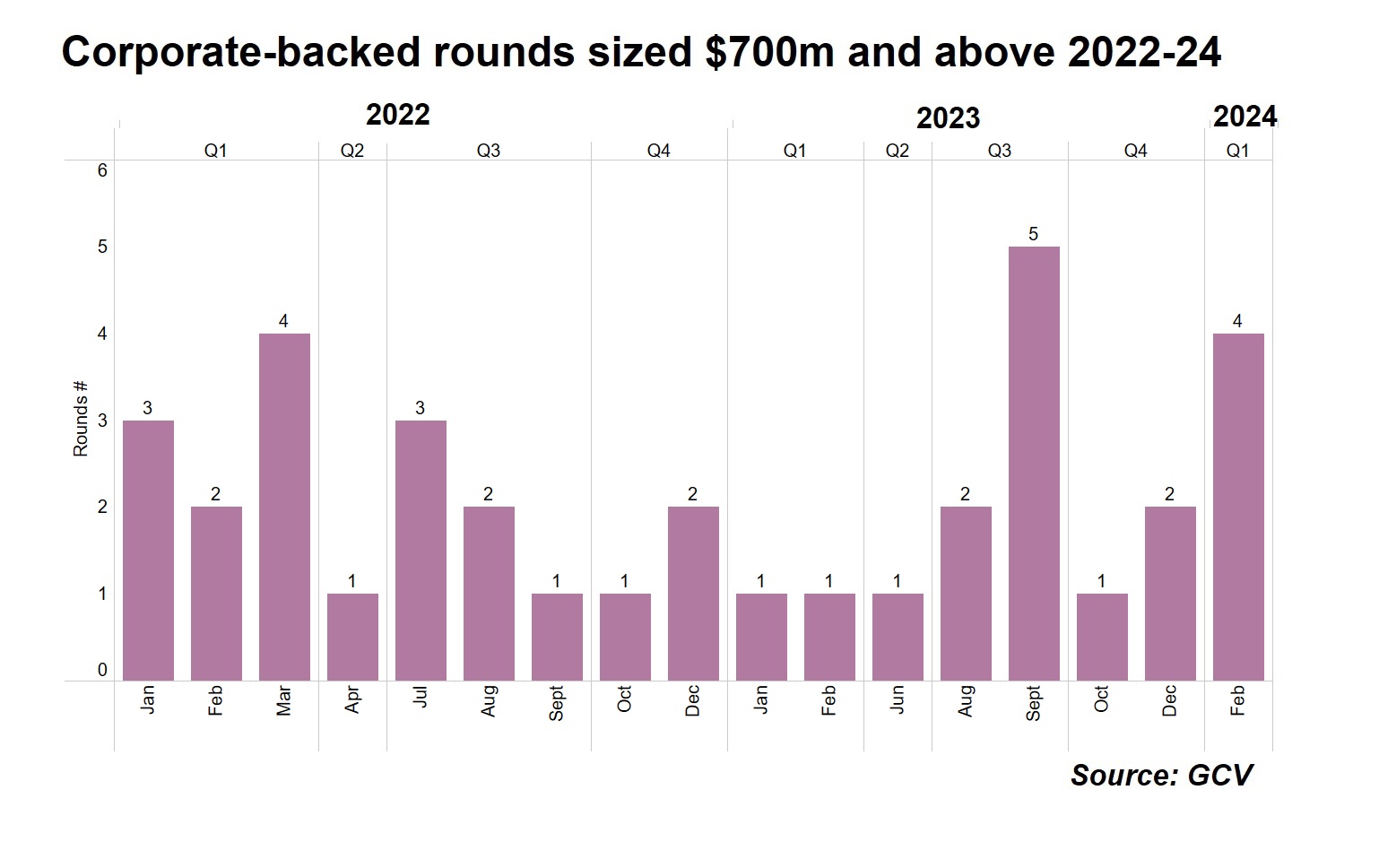

February reiterated a trend we’ve seen of late, with four corporate-backed funding rounds sized $700m and above. There have now been more rounds that size in the past four months than in the eight that came before, showing that the bear market is not deterring corporates from spending heavily for the right deal.

These outsized deals came from a variety of sectors.

- Walt Disney paid $1.5bn for a 6.7% stake in video game developer Epic Games, part of a deal that will involve them collaborating on a games and entertainment universe based on Disney characters. Fortnite has already been a goldmine for Epic, so what could it do with IP that stretches from Star Wars to The Simpsons, Marvel to Mickey Mouse?

- Ecommerce group Alibaba led a round for Moonshot AI, creator of a Chinese text-focused large language model, sized at over $1bn and including Meituan and Xiaohongshu. It’s a huge round for a company less than a year old. Alibaba is also said to be leading a $600m round for another gen AI developer, MiniMax.

- Shanghai Spacecom Satellite Technology closed a gargantuan early-stage round, pulling in $933m in series A funding from backers including Asiainfo Security Technologies for its low-orbit internet satellite system.

- Ascend Elements, which is developing electric vehicle battery recycling technology, closed a $704m series D round backed by Tenaska, Alliance Resource Partners, CMA CGM, BHP Ventures and Hitachi Ventures.

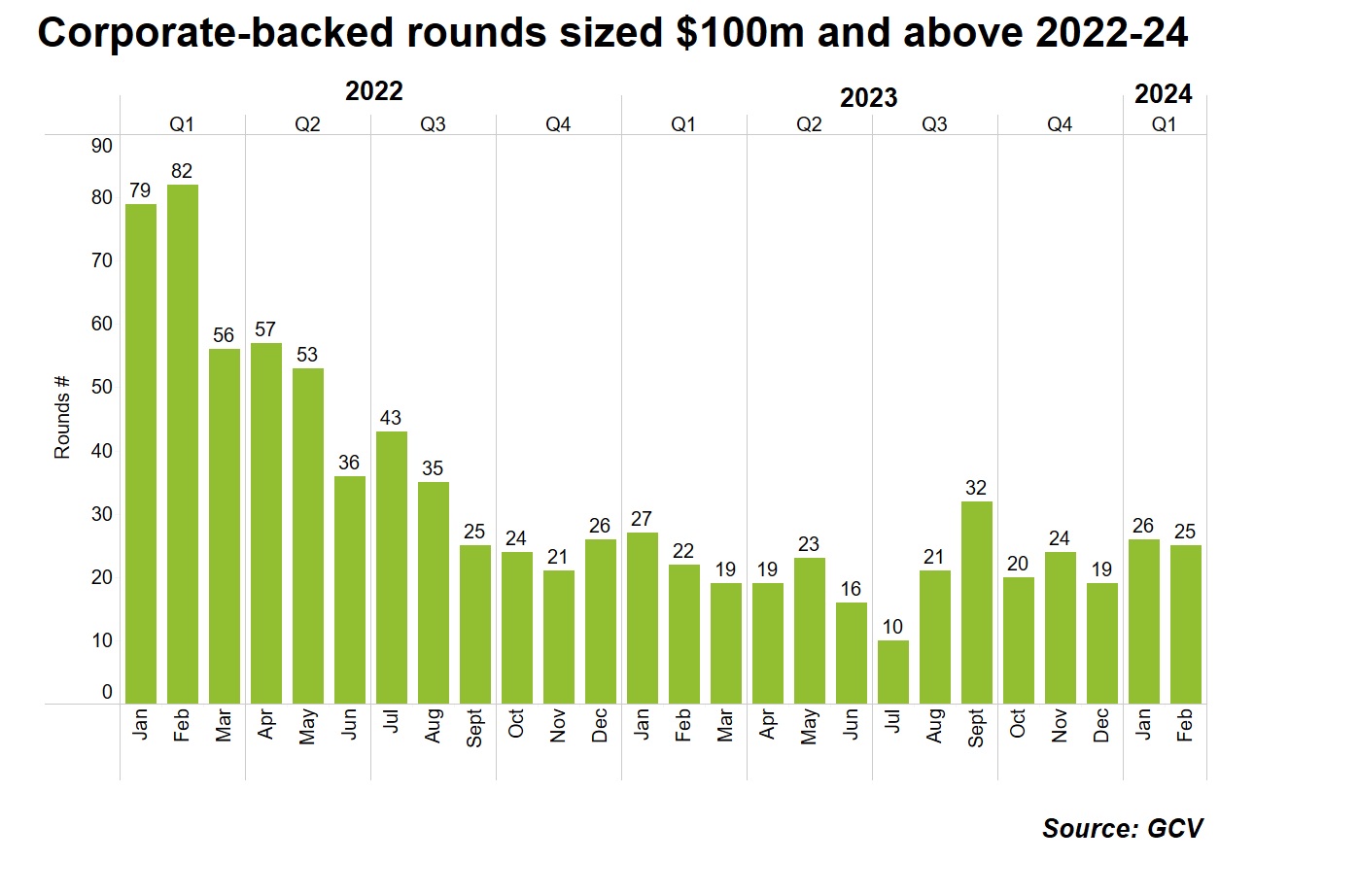

These mega rounds are something of an outlier as, overall, the number of corporate-backed funding rounds above $100m continues to be stagnant. The number of large funding rounds in February was less than a third of the level seen in the same month in 2022.

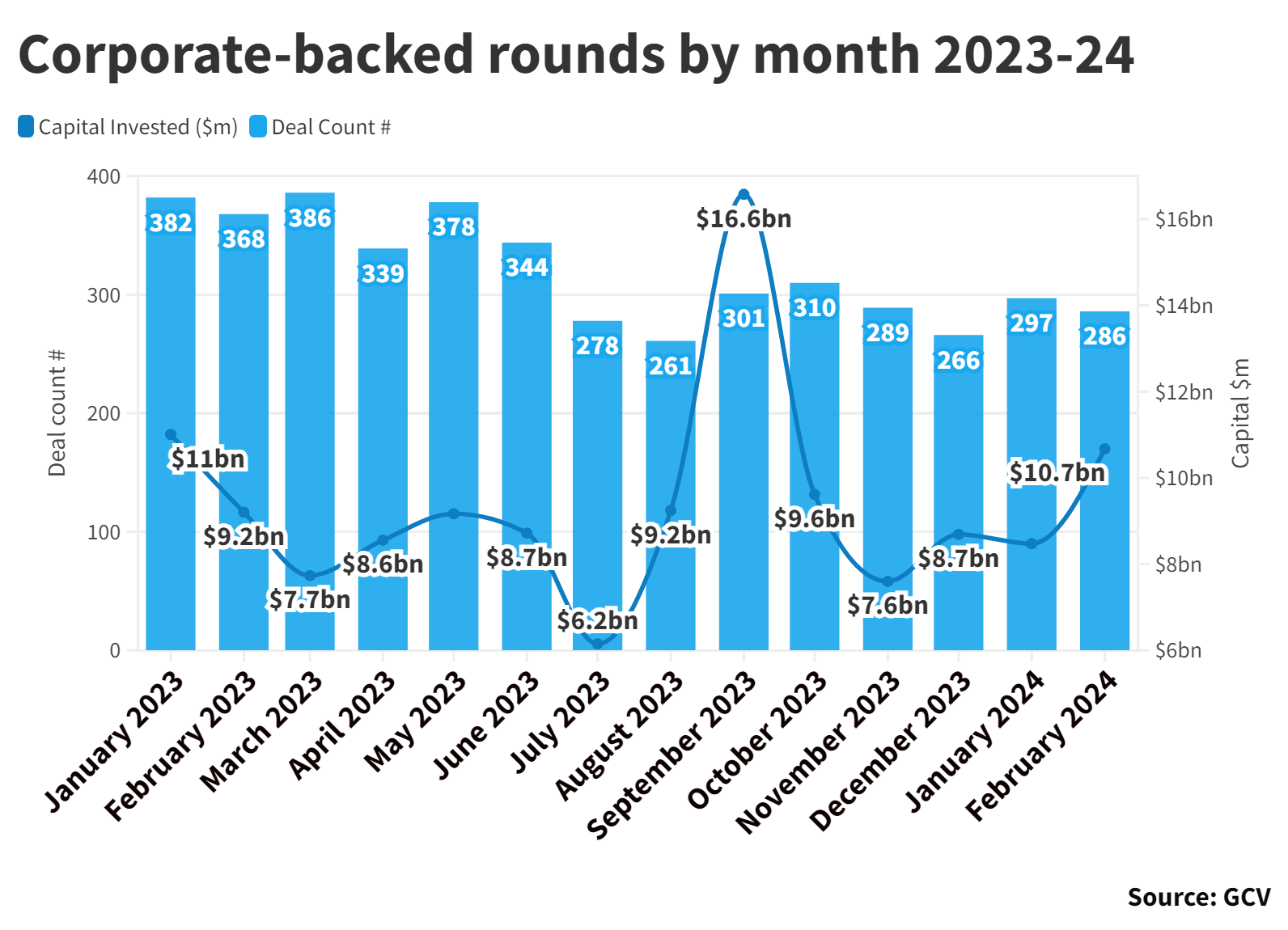

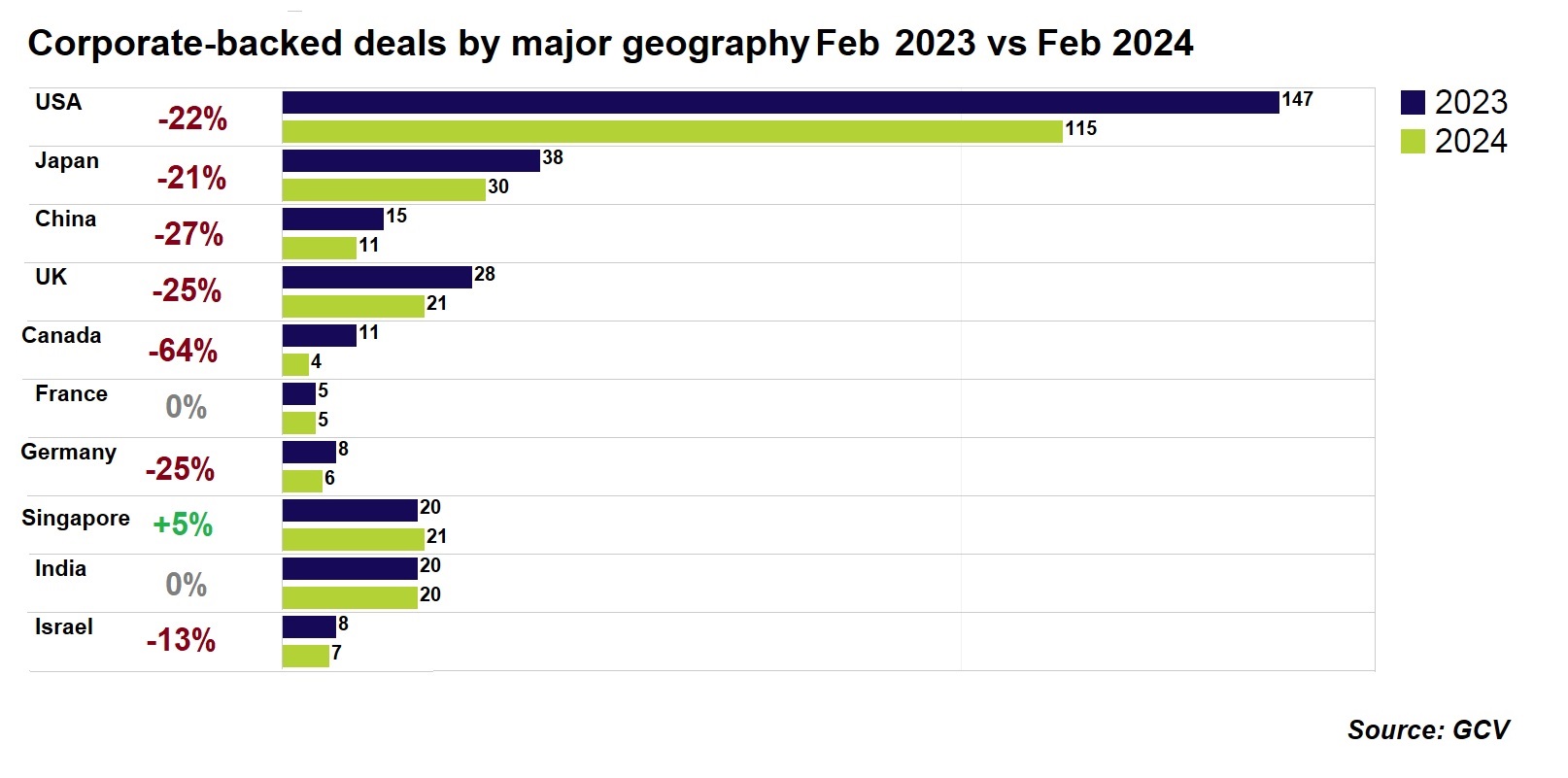

The handful of mega rounds are helping push up the amount of money being spent in corporate-backed rounds. While the number of funding rounds fell 22% year-on-year from 368 in February 2023 to 286 last month, the total estimated dollar value of those rounds was $10.7bn,up 16% from a year ago.

Cryptocurrency continues to boost the Singaporean startup scene

A number of trends we noted in January have continued. As the price of Bitcoin and other cryptocurrencies have rebounded towards previous highs, corporates have been busy investing in crypto-related innovation.

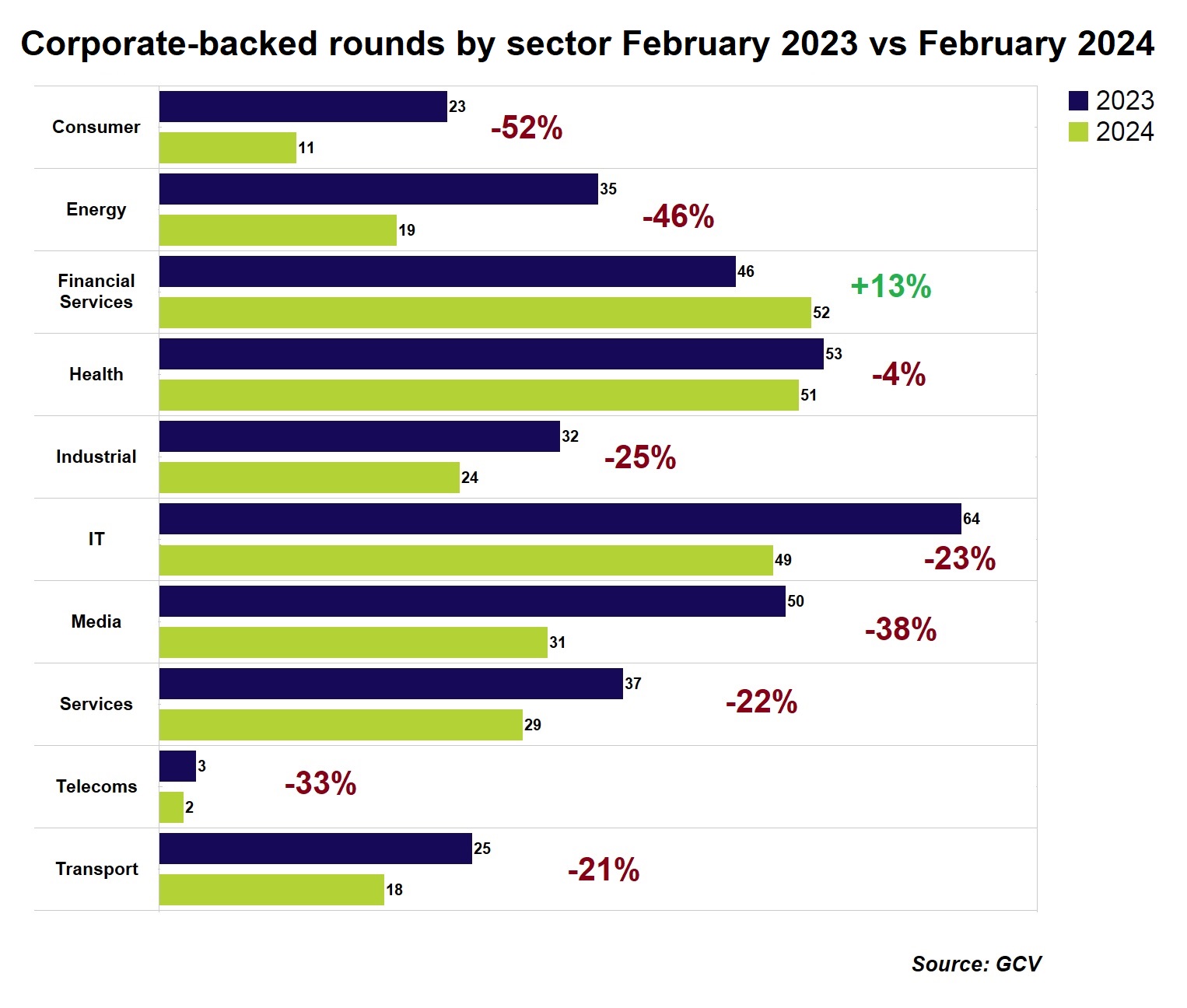

In fact, fintech is the only sector that registered a year-on-year increase in February. The number of funding rounds rose 13% from the same month last year, largely because of crypto and blockchain tech which accounted for nearly half of those deals. Most other sectors registered a drop of 21% or more, except for life sciences, where the decrease was only marginal – a drop of approximately 4%.

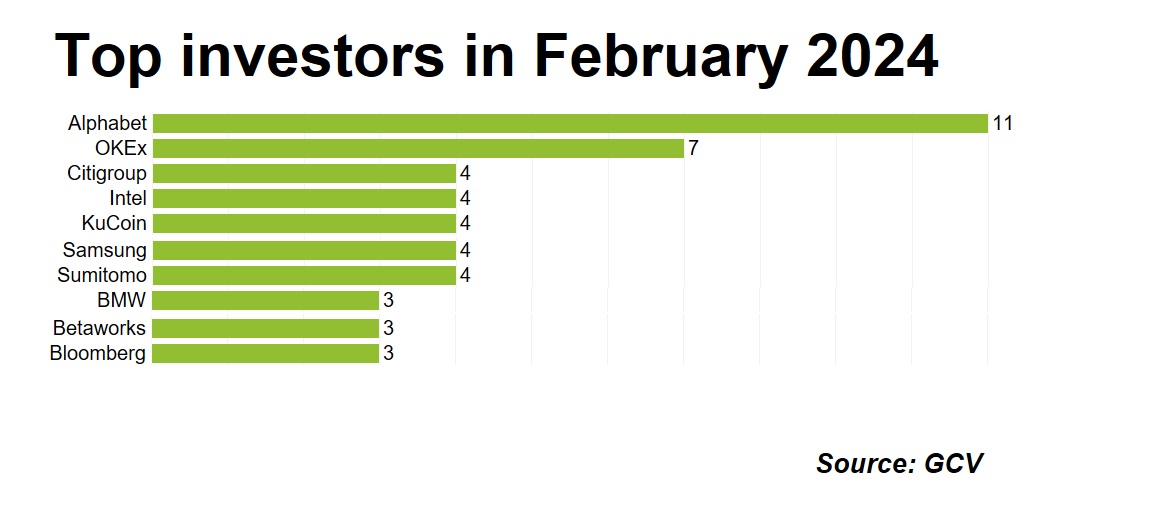

This revival is also being driven by certain cryptocurrency exchanges. The likes of Binance and Coinbase may have cooled off, but OKX and KuCoin were both among the most active investors last month. Kraken’s venture arm recently told us it’s been encouraged by more attractive valuations and great products at very early stage,

Singapore was the only country to record an increase in venture rounds year on year, though France and India remained flat, and that can be partly attributed to its strength in crypto and Web3 startups, which accounted for a third of its 21 deals in February.

Oobit, developer of a crypto-focused mobile payment app, was the top fundraiser in that sector, securing $25m in a series A round led by stablecoin developer Tether International, with most of the other rounds taking place at seed stage. They joined the likes of semiconductor packaging tech developer Silicon Box, which raised $62m from investors including Intel Capital, and carbon credit marketplace Climate Impact X, which received $22m in a round backed by Standard Chartered, Singapore Exchange, DBS Bank and Mizuho Financial Group.

New IPOs in life sciences

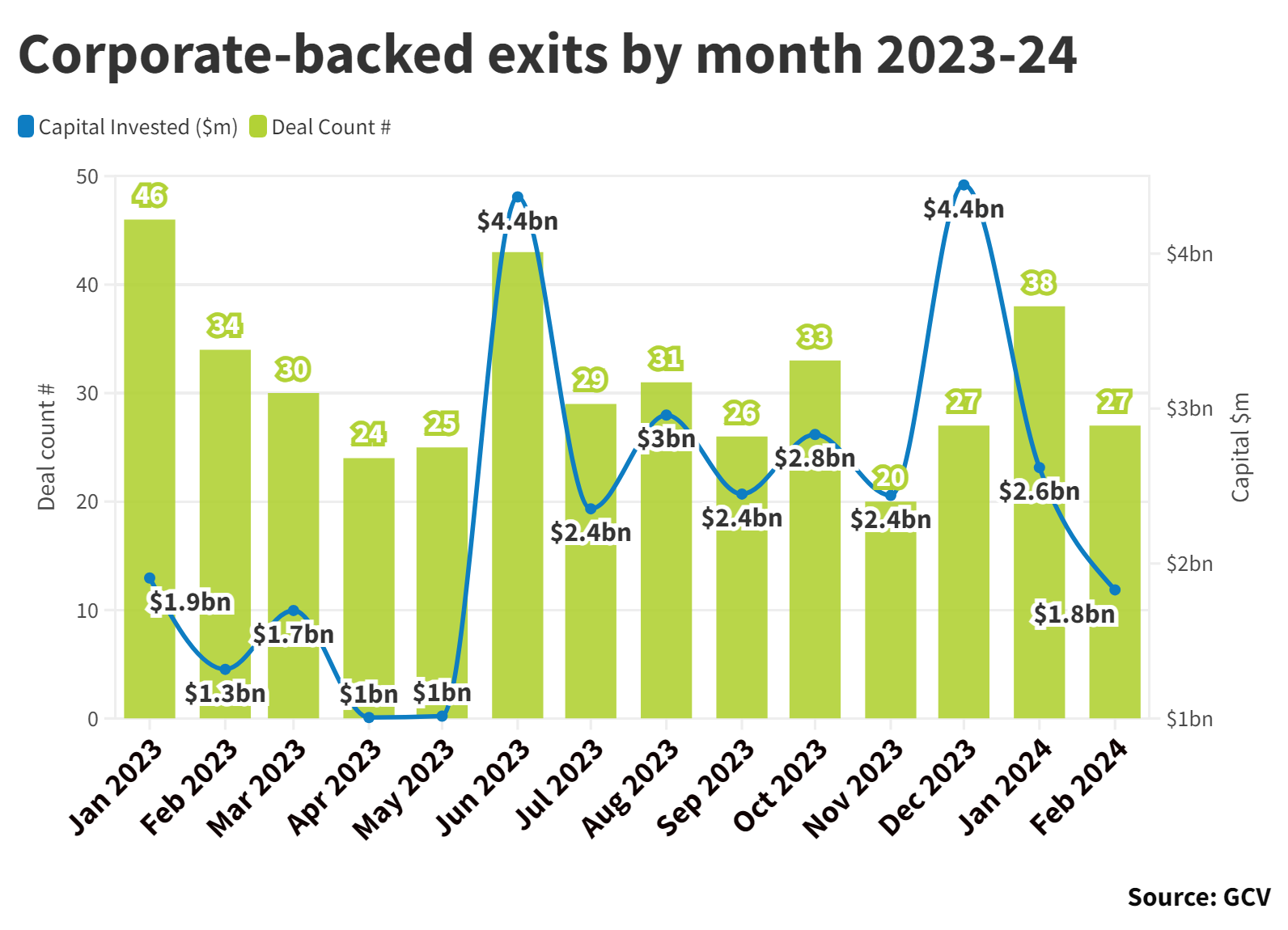

The total number of exits remained relatively stable in February. We tracked 27 transactions, down 20% from 34 in February 2023, though the total estimated dollar value was $1.8bn, up 38% from $1.3bn a year ago.

What was noteworthy however was that four pharmaceutical companies successfully closed initial public offerings (IPOs) in the US.

- Kyverna Therapeutics, which is developing cell therapies to treat autoimmune diseases, raised $319m in an upsized IPO that allowed Gilead Sciences and Intellia Therapeutics to exit;

- Alto Neuroscience, which is utilising AI biomarker technology to create precision medicines, also floated in an upsized offering that was sized at nearly $129m;

- Fractyl Health secured $110m in an IPO that will support development of metabolic therapeutics to treat type 2 diabetes; and

- Precision genetic medicine developer Metagenomi went public in a $97.5m offering that provided exits for Novo Holdings, Leaps by Bayer, Bristol Myers Squibb, Ionis Pharmaceuticals and Moderna.

With IPOs now flowing returns back into the sector, we should be seeing an increase in investment activities in the pharmaceuticals sector. Some of this is already beginning: BioAge Labs, Neurona Therapeutics and ProfoundBio each raised over $100m in February, part of nine corporate-backed rounds for life sciences startups that were sized at over $50m.