Tipwimol Chintana has deep technical knowledge of the cement sector in her role at Thailand-based Siam Cement Group. While this is helpful in analysing the value of new technologies that decarbonise the emissions-intensive industry, she lacked the financial experience of investing in startups.

So, she jumped at the opportunity earlier this year to do a secondment at Emerald, a Swiss venture capital firm that Siam Cement Group invests in as a limited partner. During a three-and-half months assignment at the VC firm, she learned the financial side of VC investment, getting to grips with how to analyse the market and startups’ business models.

She has since applied this knowledge in her role as open innovation manager, where she collaborates with the parent company’s corporate venturing team to source deals. “After I went to Emerald, I came back here with a different kind of view. We look more at the business model and how the company can make money before we invest in them. It has changed my idea of investment,” says Chintana.

Secondments – temporary assignments that employees at one organisation undertake at a partner organisation – can be a good way for staff who are new to CVC to learn the ropes of venture capital. Many corporates are limited partners in venture capital funds, and with this investment sometimes comes the opportunity for employees to do a secondment at the limited partner.

Corporates that have just set up an investment fund may want to send an employee on assignment at a VC to learn the basics of venture capital investing. More established CVCs may want to learn about an area that that their VC partner has more expertise in, such as a new geography or a new sector.

Even though CVCs are becoming more sophisticated at venture capital investment, staff turnover is often high and there is usually someone new on the team who needs training. “Even within relatively sophisticated organisations, there may be new people they want to train up and we can be an avenue for that,” says Stephen Marcus, who oversees the secondment programme at Emerald. “We also have a lot of LPs that are just starting out in the CVC world, and a secondment caters to them as well.”

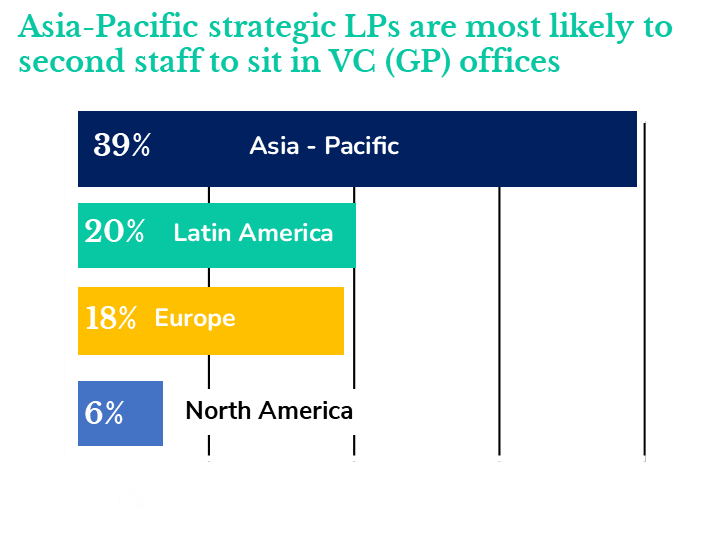

Secondments are most common at Asia Pacific CVCs. Global Corporate Venturing Keystone benchmarking data show that almost 40% of corporate VC investors in the Asia Pacific region send employees on secondments. Close to one-fifth of Latin American and European CVCs do so. It is less common in North America.

Secondments are also a good way to strengthen the bonds between a venture capital firm and its corporate limited partners, says Marcus. “We speak to [our LPs] every month. We bring them together for our investor forums. But having somebody in your office and working with you day in and day out, you get to know them much more personally. And they really get to know the inner workings of Emerald in a different way to having not done the programme,” he says.

More than 25 secondees have completed Emerald’s programme, which started in 2001. It lasts between four weeks and six months. Many of its secondees come from Asian countries such as Japan and Thailand but Emerald has also had secondees from European countries such as Germany and Poland.

Corporates should be aware of cultural differences in their expectations of secondments. Companies in Asian countries such as Japan, for example, send employees on secondments that typically last between two and three years, much longer than programmes in Europe. Japanese pharmaceutical company Astellas Pharma sent employee Chihiro Hosoya on a secondment to California-based venture capital fund DigiTx Partners in 2016. She is still there, although she spends only about 10% of her time on secondee duties and the rest of her time doing fund and direct investments for the parent company.

Despite secondments having lots of benefits, they can also be disruptive to the secondee by requiring them to spend time away from their family and job. Hosting secondments can also take up a lot of time and resources.

Here are some key considerations to make before going on one:

Make clear before you go what you want to learn from the experience

A big learning that Emerald made from holding its secondment programme is the importance of understanding from the get-go what the person who is considering a secondment wants from the programme. The secondee needs to be clear want they want to learn, and the host should be certain they can deliver on that expectation.

Some secondees want a general experience of VC investing; others want to learn something more specific such as financial modelling or ecosystem building. “We try to understand these projects and goals before we agree to doing the secondment. That allows us to make sure we can align on our internal resources so that we know we can cater to it,” says Marcus.

Secondees should also be clear what they can contribute to the parent company by undertaking the assignment. Hosoya, who is head of venture capital management and business development of digital health at Astellas Pharma US, said it took her a long time to learn what she could contribute to the parent company as a secondee. The venture capital fund where she was seconded was a newly launched fund that her parent company had helped set up.

“The team was new, the GP was new, the managing director was new to the area, so they were trying hard to establish their own presence there,” she says. It took her a long time to understand what unique perspective she could provide to the parent company, she says. “I would say [it took] maybe even more than two to three years just to understand what’s my perspective and how it is relevant to this VC role.”

Make sure the LP partner isn’t overloaded with too many people on secondment

Another key learning Emerald made is not to take on too many secondees at the same time. If there are, say, three secondees at the same time, there are often not enough deals that everyone can contribute to, says Marcus. “We only have one secondee per office at the moment to give them enough time. At the end of the day, they have made a big commitment in relocating for a few months, so we want to make sure that we can offer then the best they we can,” he says.

On the flipside, Chintana, from Siam Cement Group, liked that she was a secondee at Emerald at the same time as another secondee who was visiting from Mitsubishi Heavy Industries. “It was the first time they had two secondees at the same time. It was helpful because his background is in business and my background is in technical. We supported each other really well,” she says.

The secondment should be well structured and programmatic

It is a good idea to research how structured the secondment is going to be so that the secondee will get the most they can from the assignment. Some programmes such as Emerald’s are well structured. Secondees who come for shorter stints get a taster course on how the firm approaches venture capital investment, including how it decides to make an investment and what deal terms it looks for. Secondees who stay for longer can join deals from beginning to end. “They can even start working on their own VC projects, which we can also support them with,” says Marcus.

But this kind of well-structured programme is uncommon.

“Effectively managing secondment relationships needs to be well defined and programmatic on both sides – expectations, timeframe, secondee selection, GP [general partner] orientation and secondee management,” says Liz Arrington, co-founder and managing director of the GCV Institute. “Not many GPs do this well or are even willing to accept LP staff for extended stays.”

Consider how long you should go on secondments

How long secondees spend on assignment is an important consideration and secondees’ expectations vary by culture. It is more common for Japanese employees, for example, to spend longer on secondments when they go abroad because of the perception that it will take time for them to get used to the different way of life, says Hosoya. “Two years probably includes coming abroad and getting used to the life there. If you stay in the same country and it doesn’t require any life change, then maybe six to nine months can happen,” she says.

Masayuki Shibuya, senior deputy manager of business development and venture investment at Mitsubishi Heavy Industries, who went on secondment at Emerald the same time as Chintana, says he learned a lot about venture capital investment but that three months was too short. At least six months is an optimal amount of time to experience the whole dealmaking process, he says. Chintana has a similar view, adding her three-month assignment ended before she saw the close of an investment.

Consider a part-time secondee role for long assignments

For those on longer secondments that last between two and three years, a part-time assignment should be considered, says Hosoya. Her company used to send secondees on full-time assignments but found that sometimes after a year, they “started to get lost”.

“Because they are not employed by the VC, eventually they don’t know that they are valued. They continue to be a guest, and the VC eventually doesn’t care whether they perform or not,” says Hosoya. Astellas Pharma changed the role to part-time so that the secondee could also work on their own VC investment projects for the parent company.

“It is very important for the parent company or LP to design the secondment job description. Is it just experience? If so, two years is maybe too long. If the parent VC wants to find investment opportunities, that is a different story too,” she says.