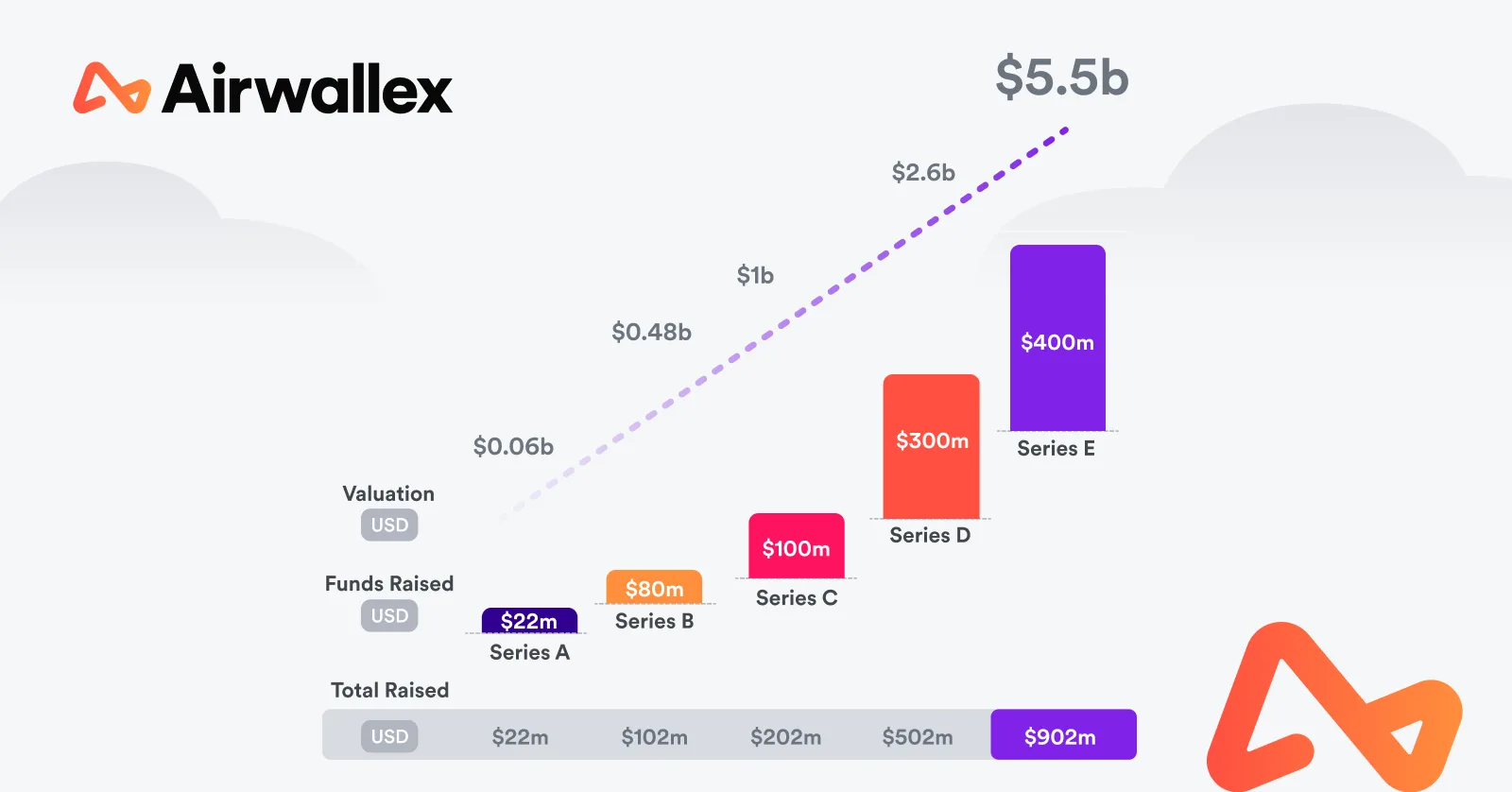

The news is full of stories about volatility in the financial markets, but a crisis is an opportunity for some. Payment technology provider Airwallex bumped its series E round up to $400m last week with an offering seemingly designed for fluctuating currency markets.

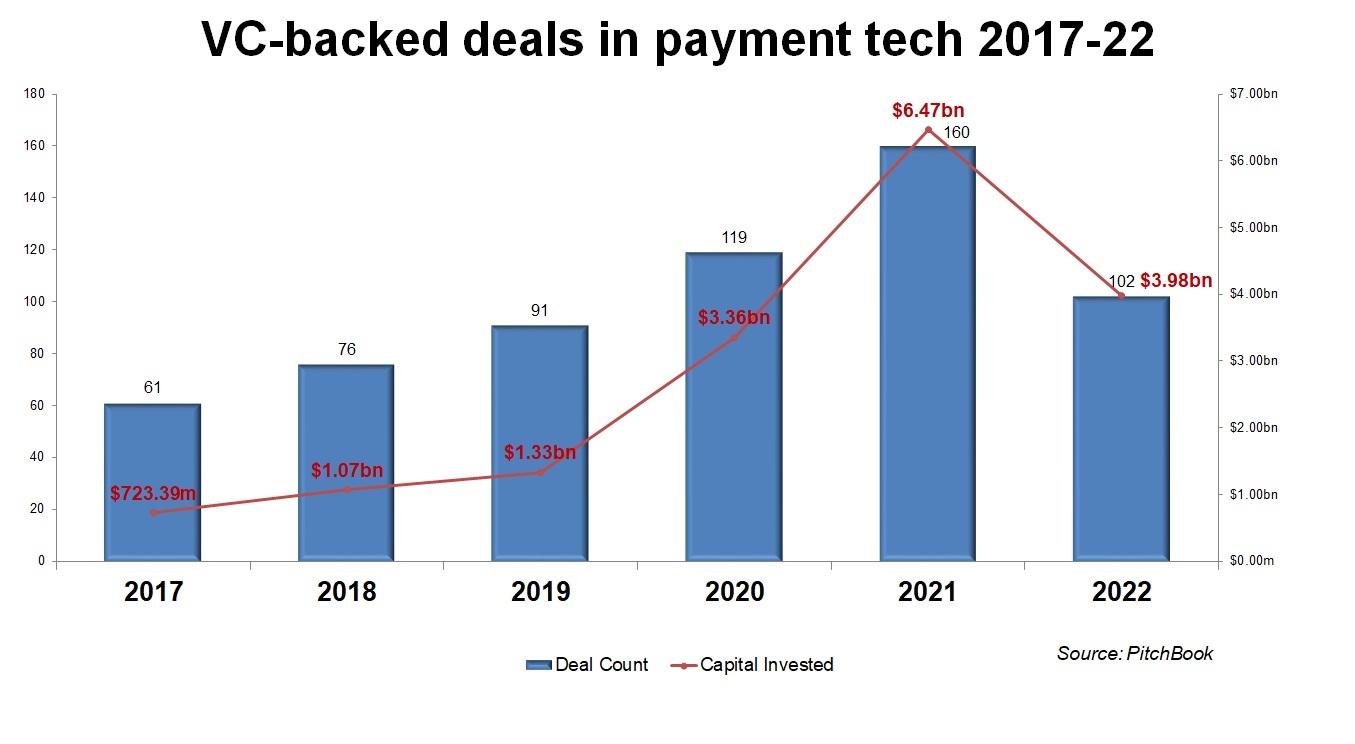

Payment technology experienced a big surge in popularity during the coronavirus pandemic as substantial parts of the economy moved online and businesses looked to digitalise their existing systems, but that growth has slowed significantly since then along with other sectors, such as on-demand groceries and virtual events.

Airwallex however has moved against that flow, adding $100m to its latest round at a steady $5.5bn valuation. It is the largest round for any Australia-based company so far this year, and includes internet group Tencent, banking group ANZ’s 1835i Ventures affiliate and enterprise software producer Salesforce.

“The valuation underscores investors’ confidence in Airwallex’s core business value and fundamentals, said Jack Zhang, Airwallex’s co-founder and CEO, reiterating the startup’s ambition to become a global business.

“The market environment remains challenging in the foreseeable future, and while we remain well capitalised, this additional runway allows us to continue our growth plans, product expansion and hire some of the best talents in the world”

A model that sticks out in the payment technology sector

Payment technology companies reached an annual high of nearly $6.5bn in venture funding in 2021 according to Pitchbook stats but 2022 has seen a visible dip, with that volume yet to reach $4bn as we approach the end of the year.

The fall has been even more evident in the public markets, where companies have largely seen their share price slide to 2020 levels.

For incumbents like Mastercard and Visa that’s a relatively narrow fall, but for the likes of PayPal or Block it’s a decline of up to 80% in just over a year. Stripe, valued at $95bn in early 2021, has meanwhile delayed what was expected to be one of this year’s largest IPOs.

Airwallex however has a particular focus which makes it appealing in the current climate. Its software helps businesses expand internationally by enabling them to accept and make payments across a range of markets and currencies.

The approach makes sense for any business in an increasingly global economy, but it means customers can also settle payments in whatever currency they wish without having to set up accounts on the ground in those countries.

Why is that important? Because many markets are facing volatility right now and their currencies are fluctuating. The euro has fallen some 20% compared to the US dollar in the past year while the pound has gone from nearly $1.40 to the brink of drawing level to the dollar for the first time in history.

Airwallex’s platform lets companies set up multiple accounts in different currencies for free, so they can choose to convert their cash to whichever currency they need to when it is most advantageous. In other words, you can effectively mitigate against currency fluctuations.

Why are corporates interested?

All three corporates in the round — Tencent, ANZ and Salesforce — invested in Airwallex at series D stage in 2020, and ANZ has provided banking services for the company since 2017. There’s a longstanding connection, as Zhang served a short stint designing foreign exchange tools for the bank before helping set up Airwallex.

Tencent however is the longest standing backer of the three, having led Airwallex’s 2017 series A round at a valuation of just $60m. It launched a cross-border payment subsidiary called WiseFX during the pandemic but has also been gearing up its contact with cross-border payment providers of late.

The corporate invested in Easy Transfer, which offers an international payment service for foreign students, in January this year, shortly after forming a partnership with Paysend enabling users of Tencent’s WeChat messaging platform to accept international payments through the app.

However, both those offerings are targeted at individuals while Airwallex’s is tailored for corporate customers.

China eased previously strict rules on cross-border transactions and foreign exchange accounts for businesses in 2019, and it’s worth noting the Chinese yuan has also dropped 14% against the dollar in the past year. It is easy to see why Airwallex represents an interesting target for a China-based corporate.

Airwallex has, however, also expanded into markets including New Zealand and Malaysia in recent months and said it has more than doubled its customer base year on year.

With the International Monetary Fund warning last week that global financial uncertainty had reached a new high, there is likely to be more growth for companies offering some solutions.