Justin LaRocca, director of Allison Ventures. Image courtesy of LinkedIn.

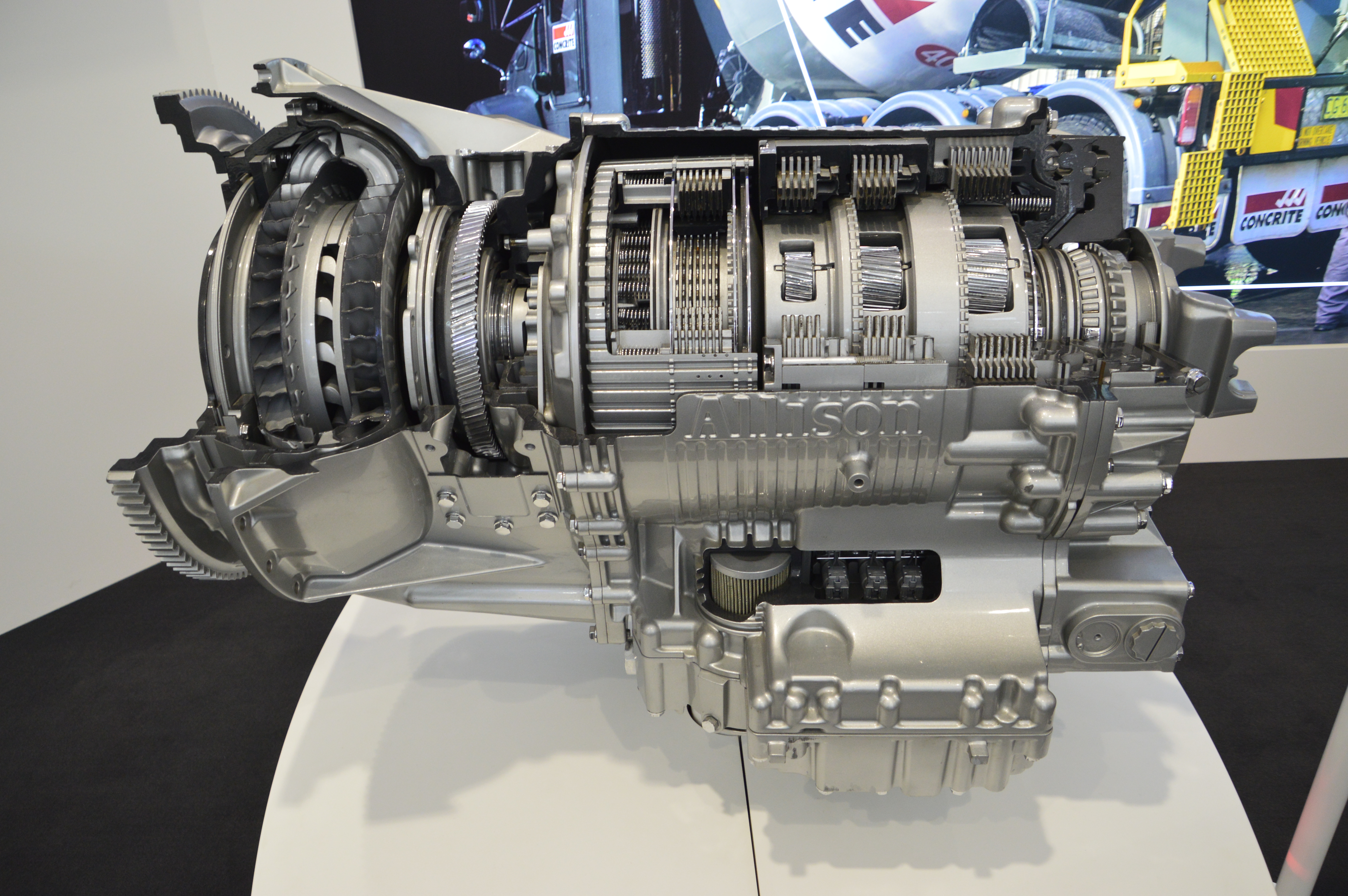

Allison Transmission, the US commercial and defence vehicle propulsion system manufacturer, is the latest mobility company to create a corporate venture capital arm amid the industry shift to electrification.

Electric cars don’t need a transmission, leaving Allison with a need to diversify its business model.

“We’re currently focusing on off-highway automation, hydrogen economy and e-fuels, fleet planning and optimisation, EV charging and infrastructure, and battery circular economy,” Justin LaRocca, director of Allison Ventures, tells Global Corporate Venturing.

The company may, to some extent, be insulated from the electrification trend because so many of its transmission systems are used in heavy vehicles from buses to waste collection lorries, fire engines and military tanks, many of which are less suitable to run on electric motors. In fact, the US army recently awarded Allison an $83m contract to supply upgraded transmissions for Abrams tanks.

Nevertheless, the company is keen to stay ahead of trends and innovations in the auto industry.

Allison Ventures’ investment thesis

“We’re evaluating technology that is five to 10 years down the road and has the potential to be transformative to commercial-duty mobility and work solutions,” says LaRocca.

Allison Ventures is not a separate investment fund but falls under the parent firm’s corporate development team. The unit has five core members, with additional support from the global Allison staff.

While the total capital allocation is undisclosed, Allison Ventures plans to invest between $1m and $5m per deal, with possible follow-on funding. It will target commercial-duty mobility companies from seed to series B stages in North America, Europe and Asia.

The unit’s areas of interest include technologies related to connectivity, digitalisation, automation, sustainability, electrification, manufacturing and operations in the commercial vehicle and defence industries.

“Our initial challenge will be to ensure we are investing in the right partners that will provide clear solutions to industry challenges,” LaRocca says.

LaRocca joined Allison’s corporate development team in February 2022 as a senior manager.

“Through my background in finance, along with extensive business case and modelling experience, and my most recent work in corporate development dedicated to mergers and acquisitions, I gained valuable insight into what it takes to successfully manage CVCs,” he says.

Allison Ventures is based in Michigan, the state that houses most auto suppliers in the US. Hella Ventures, the CVC arm of car parts producer Hella, recently moved to the state from Silicon Valley.

Other automotive corporate investors located in the state include GM Ventures and Magna Technology Investments, part of General Motors and Magna International, respectively.

Read more:

- LaRocca joins Allison Transmission’s new CVC

- German car parts maker Hella moves venture unit to Detroit

- Transport in 2024: investors eye pick-up in startup deals after a stalled year

- From AR to biochar – the thinking behind Stellantis’ startup investments

Recently, Allison announced strong financial results for the fourth quarter of 2023, with net sales of $775m, representing an 8% increase from the year before, and its full-year revenue exceeded $3bn, up 10% from 2022.

This was due to rising demand for vocational vehicles such as tractors and trailers as well as medium-duty trucks.

Fund investment strategy

A year before launching the CVC unit, Allison began exploring corporate venture through a limited partnership investment in Autotech Ventures, a US mobility-focused venture capital firm with more than $500m under management.

“I recently participated in the Autotech Ventures’ fellowship programme, which helps initiate individuals into venture capital theory, practices and valuations,” LaRocca says.

LaRocca adds that Allison’s initial investment in Autotech Ventures provided an opportunity for him to meet and learn from other corporate VCs who helped Allison Ventures create structure, process and procedures through collaboration.

Other corporate LPs in Autotech Ventures include automotive component producer American Axle & Manufacturing and Volvo Group Venture Capital, part of vehicle manufacturer Volvo Group.

In the future, Allison Ventures will continue to evaluate potential fund investments.

“Allison has a wide aperture, and we look forward to evaluating a broad range of technologies to support the commercial vehicle and defence industries,” says LaRocca.