Germany-based producer of green hydrogen-based fuels Hy2gen received €200m ($227m) in financing from a host of investors, featuring energy engineering firm Technip Energies. Hy24, a hydrogen-focused investment vehicle of private investment firm Ardian and investment manager FiveT Hydrogen, led the round, which also included Caisse de dépôt et placement du Québec and Mirova. The company claims the round is the largest to date to be raised by a green hydrogen company, which underscores the growing importance of hydrogen in the ongoing energy transition.

Launched in 2017, Hy2gen produces hydrogen for environmentally friendly fuels to be used across air, maritime and ground transport as well as in industrial applications. While the process of generating hydrogen typically employs fossil fuels, the “green” hydrogen is produced through electrolysis that separates the element from water using renewable energy, without requiring hydrocarbons.

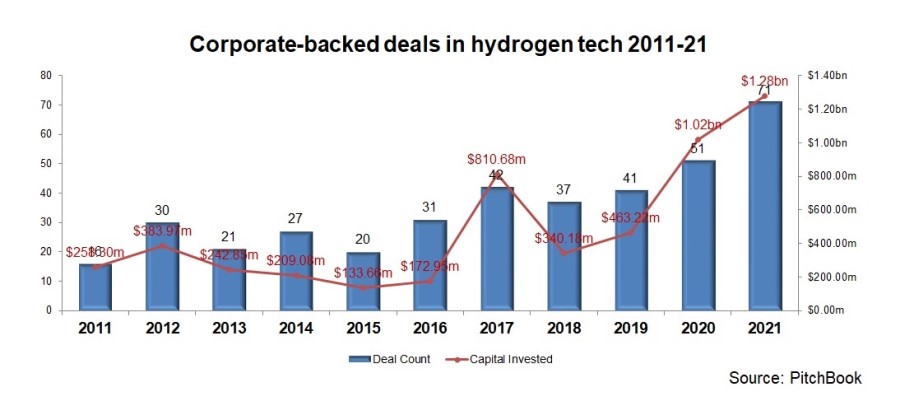

Hy2gen forms part of the broader hydrogen tech space, which has been slowly developing over the past decade but has not escaped the radar of corporate venture investors, as the PitchBook chart below illustrates. While there have been corporate-backed rounds over the past decade, it was not until 2019-2020 that the technology began to be more talked about in the media. This was reflected in the increase of both deal numbers and total estimated capital in 2020 and 2021. This interest among corporate investors will likely remain high, as hydrogen is by now considered a crucial piece of the decarbonisation puzzle on the way to net zero.