How many sensors does a modern-day car have? It is a simple question with a surprisingly tricky answer. The number can vary greatly anywhere from as little as 30 in somewhat dated vehicles to well over 200 in high-end modern ones.

While cars have had sensors for some time, they are coming into a new prominence now, with the quest for smarter and safer vehicles pushing demand for sophisticated sensor technologies.

The automotive sensor market was estimated at $27.5bn in 2021, according to a recent report by Mordor Intelligence. The report forecasts that the market will see a compound annual growth rate of 13.6% until 2027, driven by the rise of electric vehicles (EVs) and autonomous driving as well as the proliferation of advanced driver-assistance systems (ADAS) in most conventional internal combustion engine vehicles.

Making sense of sensors

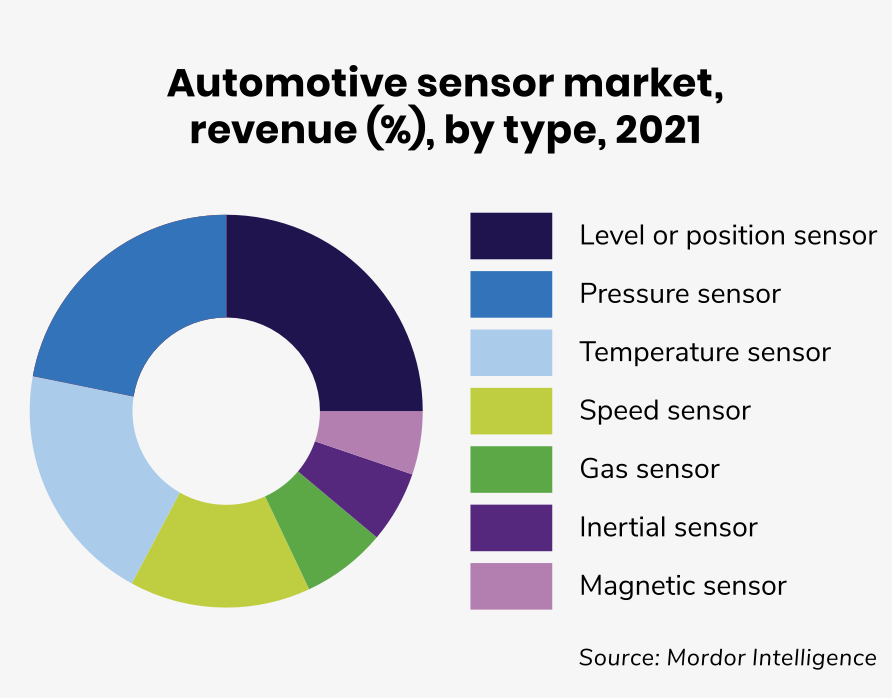

Automotive sensors can be categorised in different ways, in terms of type (pressure, position, temperature, speed, level, gas, inertial etc.) or application (vehicle security, telematics, powertrain and so on).Pressure, position, temperature and speed sensors command the largest market share according to the Mordor Intelligence report.

The number of pressure and magnetic sensors is expected to increase as the mass market for electric vehicles grows, the report says. Batteries are the backbone of EVs, and there will be growing demand for the magnetic sensors used for their monitoring and management.

Driver assistance and automotive systems, meanwhile, will increase the need for position sensors that detect people, vehicles or other objects in motion.

This article is part of our Automotive sensors report. To see the full report, including 12 startups to watch, click here.

Wrong turn for autonomous driving?

Self-driving cars are one of the big drivers for sensors in cars. The project to create truly driverless cars, however, has been slower than originally anticipated, with major automakers taking a step back from the technology.

Volkswagen (VW) and Ford’s autonomous vehicle unit, Argo. AI, for example, was shut down last year, with Ford reporting in its Q3 2022 earnings call that it had taken a “$2.7bn non-cash, pre-tax impairment on its investment in Argo AI, resulting in an $827m net loss [for the quarter].”

Ford said that it would focus on advanced driver assistance (so called Level 2 and Level 3 autonomy), rather than the Level 4 and 5 autonomy (essentially driverless cars) that Argo.ai was pursuing.

Meanwhile, a former Tesla engineer testified in court that one of the company ́s driverless promoting videos from 2016 was staged, as reported by TechCrunch. Tesla has privately admitted, according to released documents, that its Autopilot system is only a Level 2 autonomy despite hype generated by Elon Musk.

All these developments are casting certain doubt about the feasibility of fully autonomous vehicles, but this does not necessarily change the market for sensors, as the majority of new vehicles being commercialised today are equipped with ADAS and need to be laden with sensors.

Driver assistance coming — whether drivers like it or not

Consumer enthusiasm for advanced driver assistance systems has been muted in some markets, like Europe. One study, conducted by Siemens, demonstrated a lack of enthusiasm about ADAS among consumers in Europe and the US, where only 56% of Europeans and 57% of Americans claimed to be interested in purchasing ADAS features, as opposed to 83% in China.

Another one, conducted by software developer CCC IS, found that more than half of drivers claim to seek a long list of safety features. However, most not only lack deeper understanding of ADAS a but also as many as 70% actually disable such features in their vehicles.However, consumer preferences might not be the deciding factor. With many regulatory bodies setting safety standards around the globe, driver assistance systems may be implemented regardless.

The EU, for example, already adopted its revised General Safety Regulation, which introduced a range of mandatory ADAS to improve road safety — although it is worth noting that the US Federal Motor Vehicle Safety Standards (FMVSS) do not mandate nor regulate any particular ADAS to date, according to the American Bar Association.

Coveted high-value sensors

Much of the excitement about this market revolves around high-value sensors, which help to improve safety, fuel efficiency and environmental impact of a vehicle. The most-talked about such technology has been, undoubtedly, light detection and ranging (lidar), sometimes also referred to as “3D scanning” or “laser scanning”. That is precisely what this tech does – it creates an accurate 3D image of surrounding surveyed areas.

However, like most innovative tech, it is somewhat controversial. In addition to natural technical difficulties of measuring accurately under adverse conditions, the biggest drawback of lidar has to do with its cost. Lidar systems can vary in price from $4000 to $80,000 and beyond, according to Neuvition.

Lidar technology can be categorised into mechanical, pure solid-state and semi-solid lidar. The price tag of mechanical lidar is generally high, which is why it is primarily used in test vehicles. While pure solid-state technology is not fully mature, semi-solid lidar has become the most commonly used in motor vehicles today because of their lower relative cost. The average price of vehicle-mounted semi-solid lidar system stands at about $1,000.

According to Mordor Intelligence, lidar sensors tend to be more expensive compared to radar sensors because of the rare earth metals required to produce them. From the manufacturers ́ standpoint, this also makes them more susceptible to supply chain disruptions. Elon Musk had famously dubbed lidar “a fool’s errand”.

Lower cost alternatives to lidar

There are alternatives to the pricey lidar tech, though. The most commonly found one is computer vision. This technology uses inexpensive cameras and an array of sensors bult into the vehicle to detect obstacles, other vehicles, pedestrians etc. Its biggest drawback is the unreliable detection of objects at a distance beyond 50 metres (164 ft).

It is already employed for a variety of purposes by manufacturers like Tesla and Toyota, including collision avoidance, automated braking, driver’s behavioural analysis and even in assembly automation by carmakers, according to AIMultiple.com.

Another alternative to lidar are the high resolution automotive radars, also known as 4D imaging radars. This technology is reportedly able to provide and draw a detailed image within a range of over 300m (1000 ft). Such radars can also detect objects on the side of the road as well as specific targets (e.g. a person or a bike), even if those are partially hidden by a large object, like a truck or a tree.

It is no surprise that high resolution radars, for that reason, are believed to be potentially the next step to Level 4 and Level 5 autonomy.

In fact, vehicle manufacturers are already taking an active interest in this space. In 2021, automaker General Motors, for example, invested in radar software company Oculii back in 2021. The startup aims to improve the spatial resolution of radar sensors by up to 100-fold, according to TechCrunch.

Automotive component manufacturer Denso has backed across multiple rounds California-based Metawave, alongside Hyundai, Toyota and Saic Motors, among other investors. The company is developing advanced vehicle and aerial imaging radar technology. It claims to be the first company to demonstrate realisable analogue beamforming and steering radar solutions for the mobility and autonomy markets.

The price of the hardware required for lidar and other sensor technologies has made some entrepreneurs and investors seek solutions with virtual or software-based sensors. There are also other innovative startups whose technologies simply aim to better adapt lidar. For example, US-based Phlux Technologies lidar that uses antimony rather than silicon. The company works with robotics, industrial automation, and autonomous vehicle companies to help their systems navigate better.

Similarly, Neural Propulsion Systems offers a multi-modal sensor system which blends intelligently solid-state lidar, radar and cameras.

VC and CVC involvement in the space

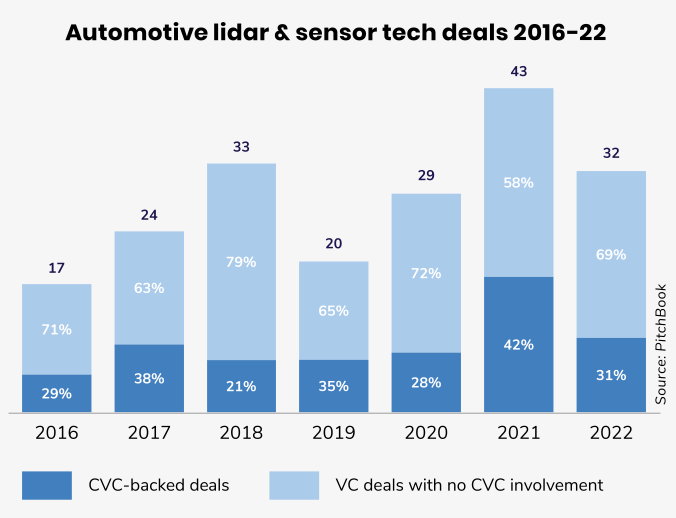

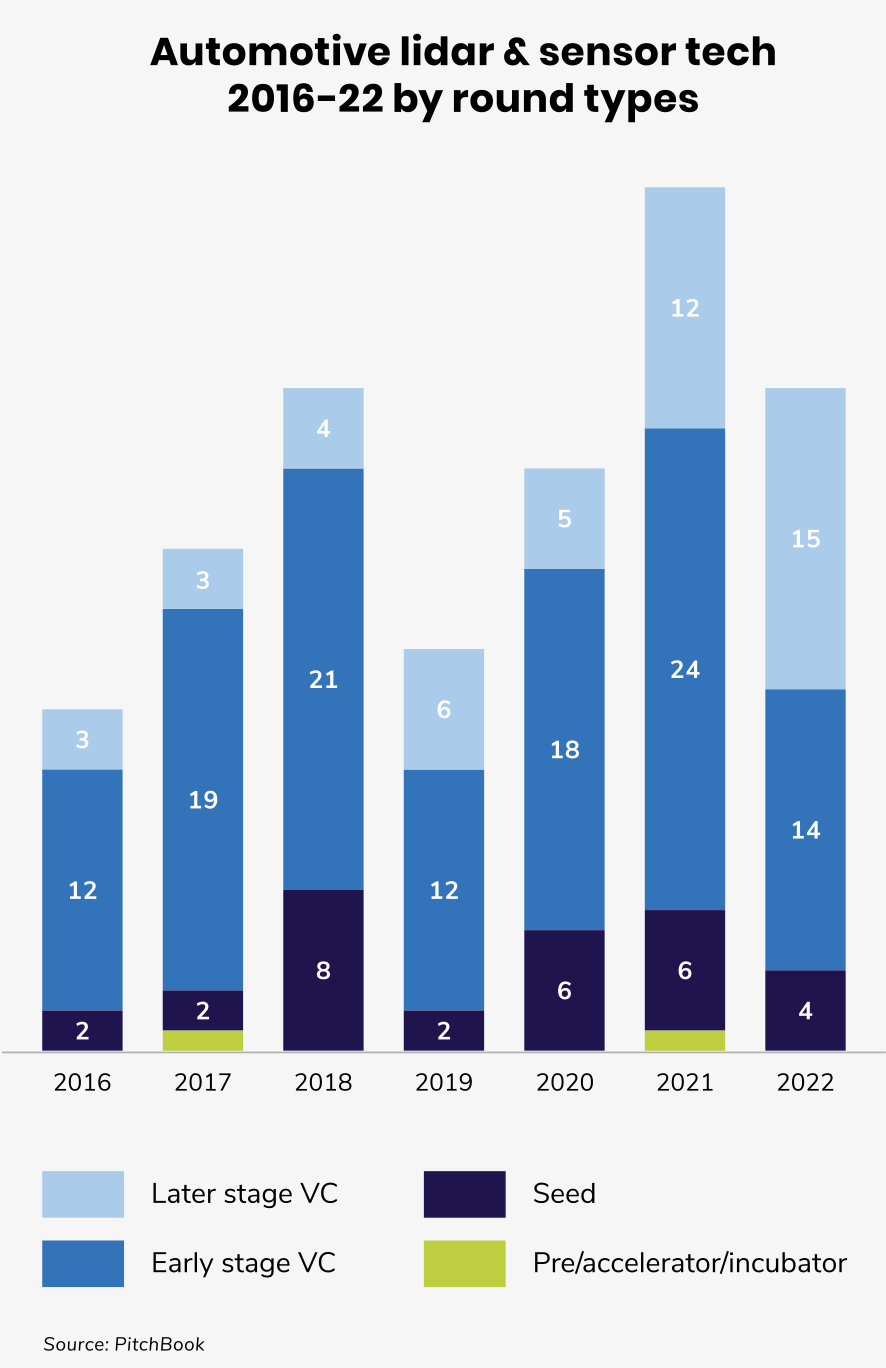

Venture capital investors have been backing a few dozen lidar and sensor startup funding rounds each year for the last few years, with deal numbers in 2022 down from a high in 2021. About a third of deals have had a corporate backer.

The median size of those has stood for the most part at or above $9m per round. Similarly, median post-money valuations ranged mostly below $100m from 2016 onward, suggesting that such rounds are likely early-stage and thus reflecting the relative infancy of the technology.

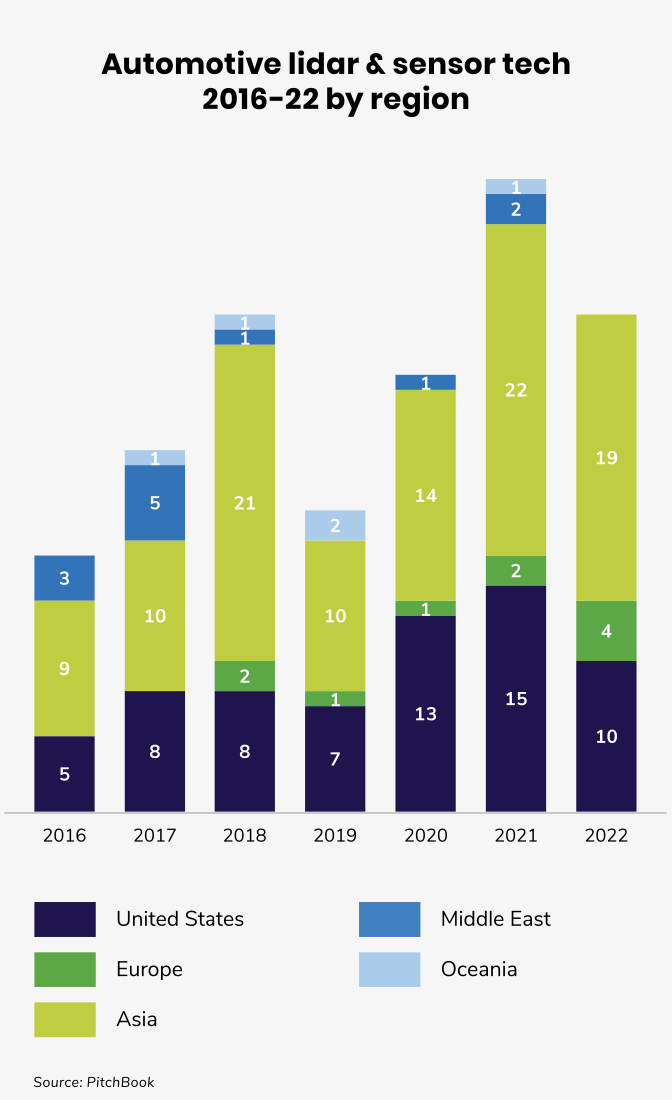

In fact, if we look at the round type breakdown, most rounds in this space were indeed early stage or seed. Geographically speaking, most VC deals in specialised businesses in this space were concentrated in the US and Asia (both East Asia and Israel).

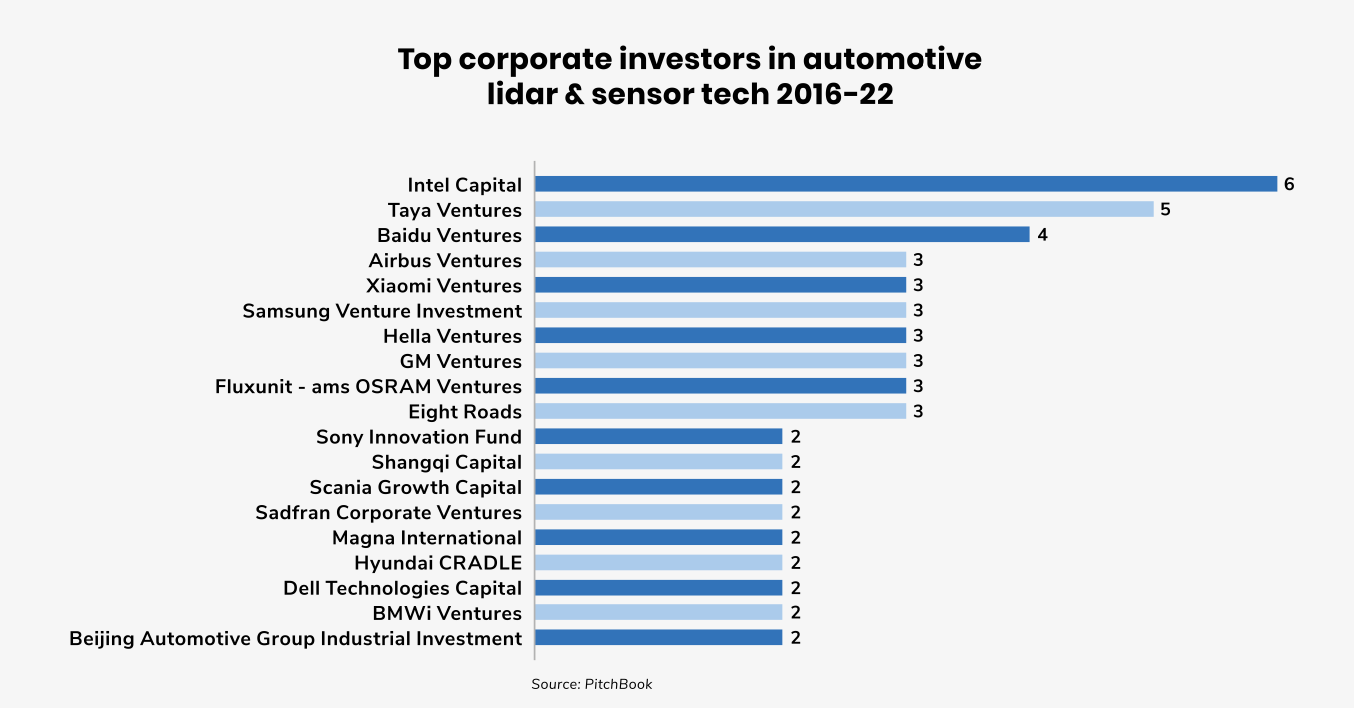

The automotive sensors space has proved attractive to traditional VC and CVC investors alike. The top corporate investors by deal count between 2016 and 2022, according to PitchBook ́s data, were Intel Capital, Taya Ventures, part of Israel’s Taya Media Group, and Baidu Ventures.