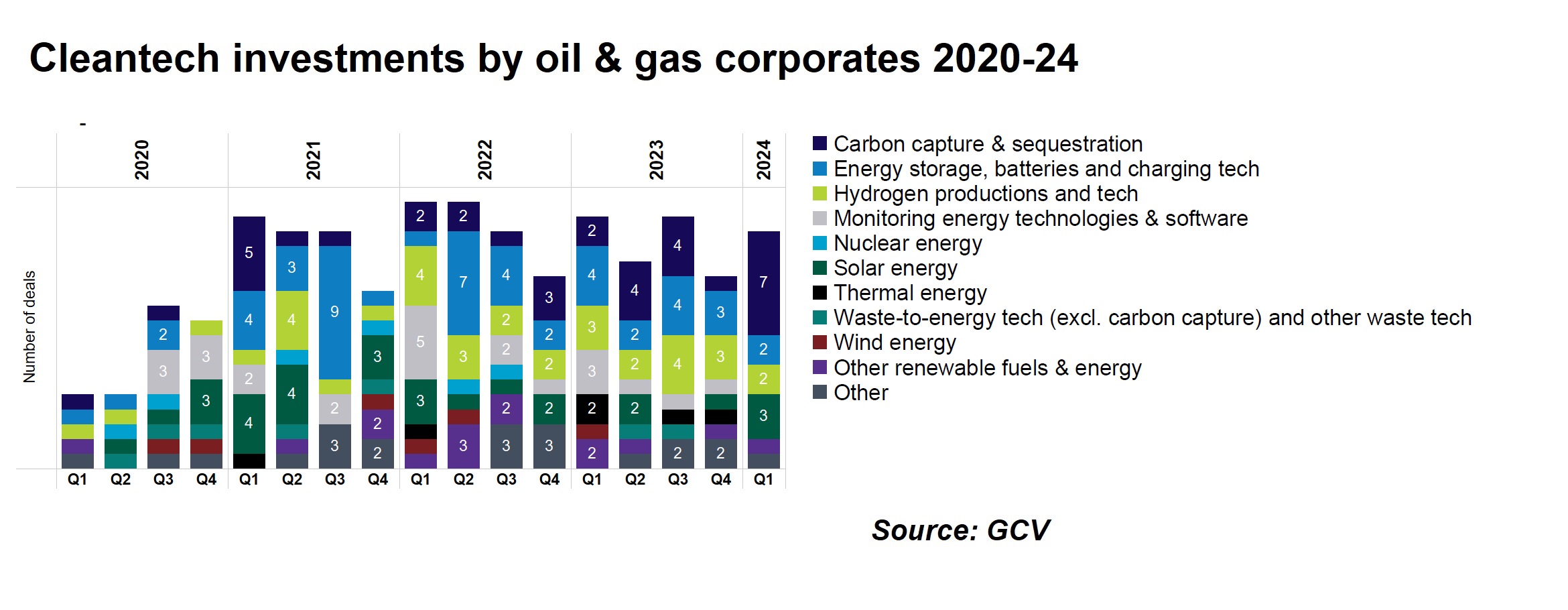

Corporate investments in carbon capture-related startups jumped in the first quarter of 2024 amid an otherwise subdued but steady investment climate in the energy sector.

There were seven deals into startups developing carbon capture technology in the first three months of the year, the largest of which was the additional $90m series A funding round for CarbonCapture, a US-based CO2 removal technology developer. This was backed by Aramco Ventures, Amazon’s Climate Pledge Fund and Siemens Financial Services.

Other carbon capture-related deals included the $36m series A round by direct air capture tech developer Avnos, backed by Shell Ventures. Similarly, UK-based electrochemical developer Mission Zero Technologies received $28m in a series A round, backed by Siemens. US-based ocean’s carbon removal tech developer Captura also closed a $22m series A round that featured Aramco Ventures, Equinor Ventures as well as other corporates like Eni, Hitachi and EDP.

Some of the most active investors into carbon capture have been Saudi Aramco, Siemens and Equinor Ventures.

Cleantech holds up

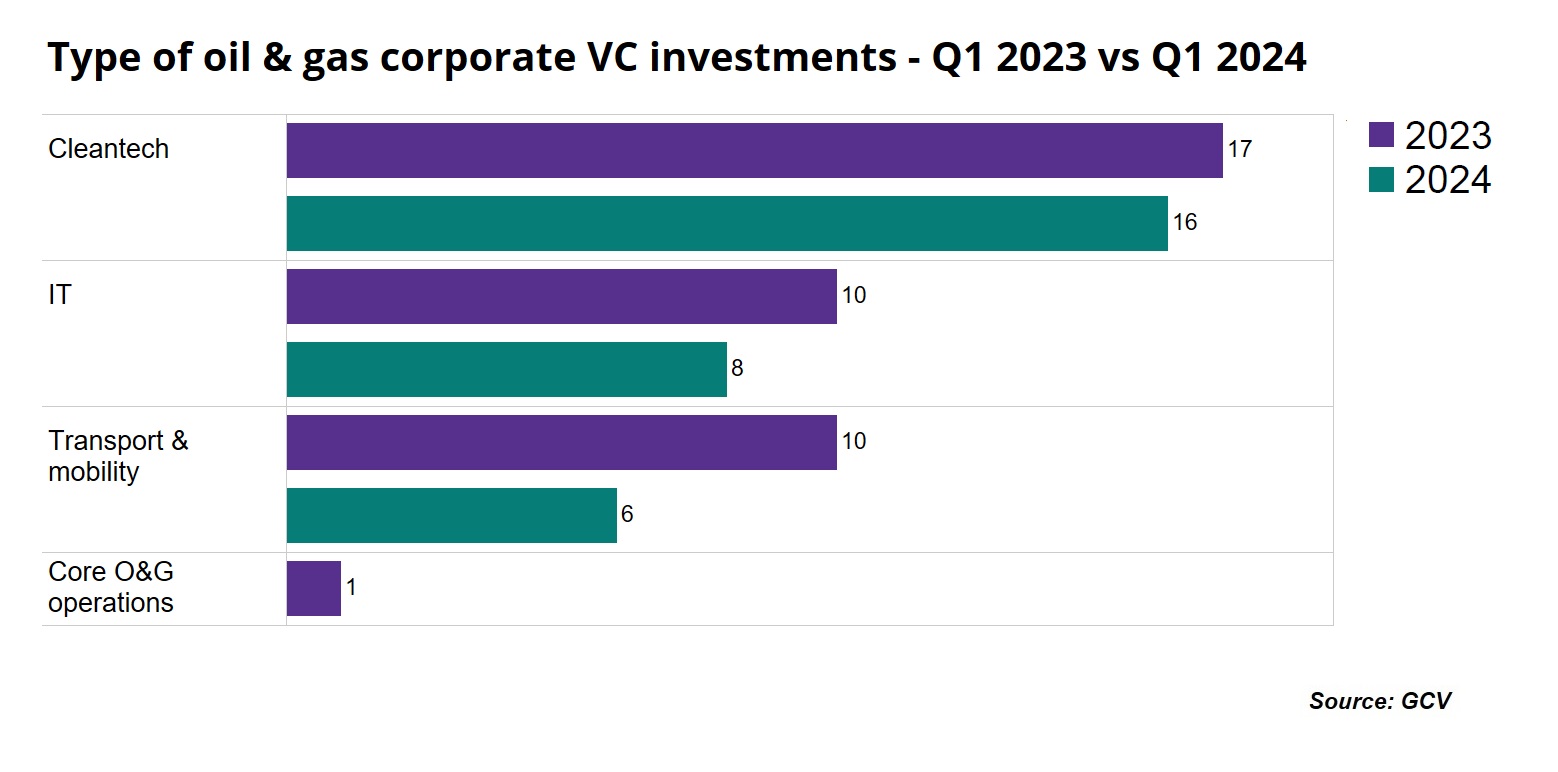

Cleantech, in general, has held up best in terms of startup investment among the group of oil and gas corporate venturers that we track.

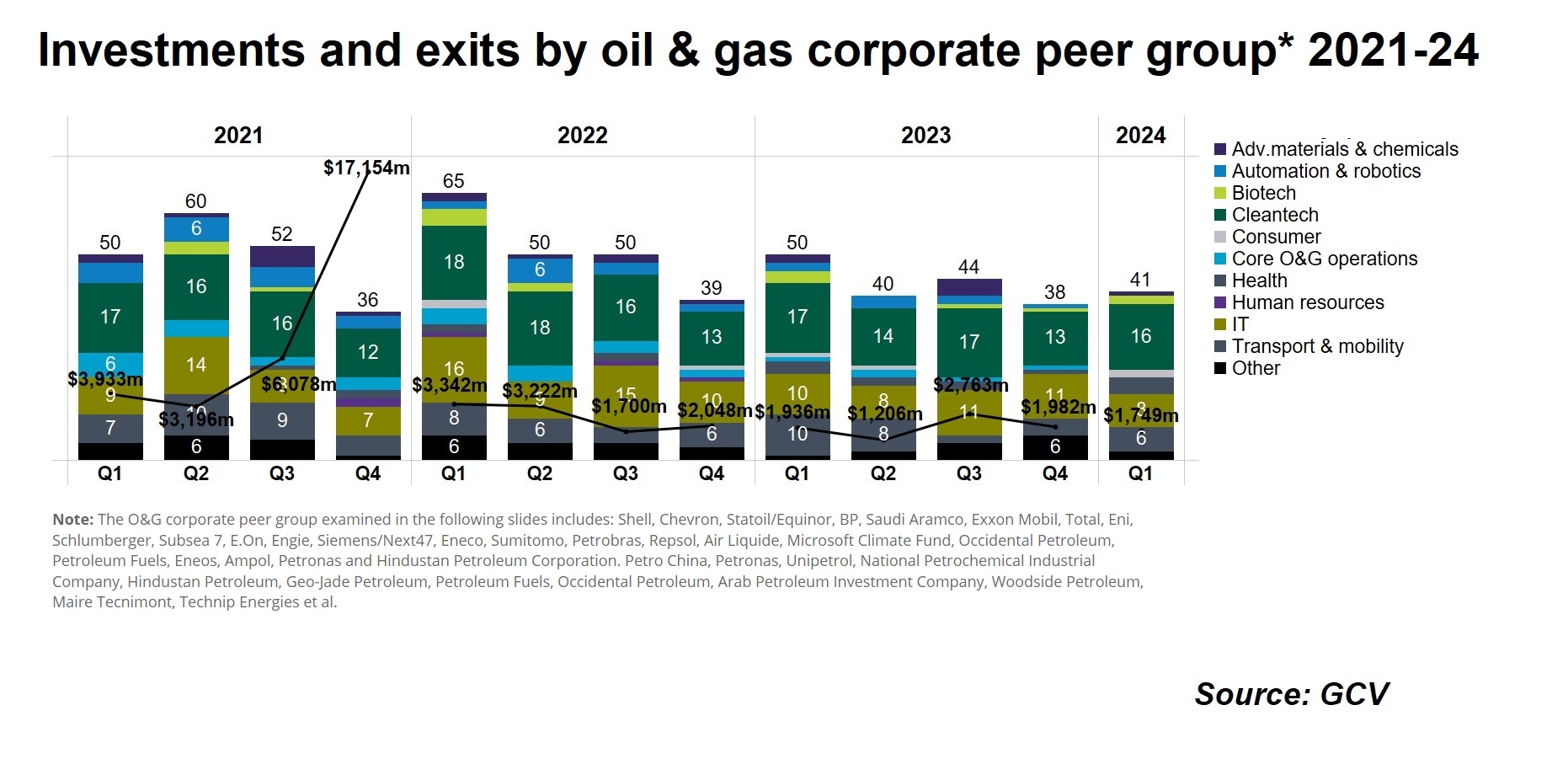

Investment overall is down, with just 41 startup rounds for this group during the first quarter of this year, down 18% from the 50 tracked in the same quarter in 2023. The total estimated dollar value of those deals stood at $1.75bn, down 10% from the estimated $1.94bn deal value of the same period last year.

But while investments decreased in all major interest areas for the peer group – including core oil and gas (O&G) tech, IT and mobility – investments in cleantech startups have remained steady, with 16 investments in the first quarter, compared with 17 in the year-ago period.

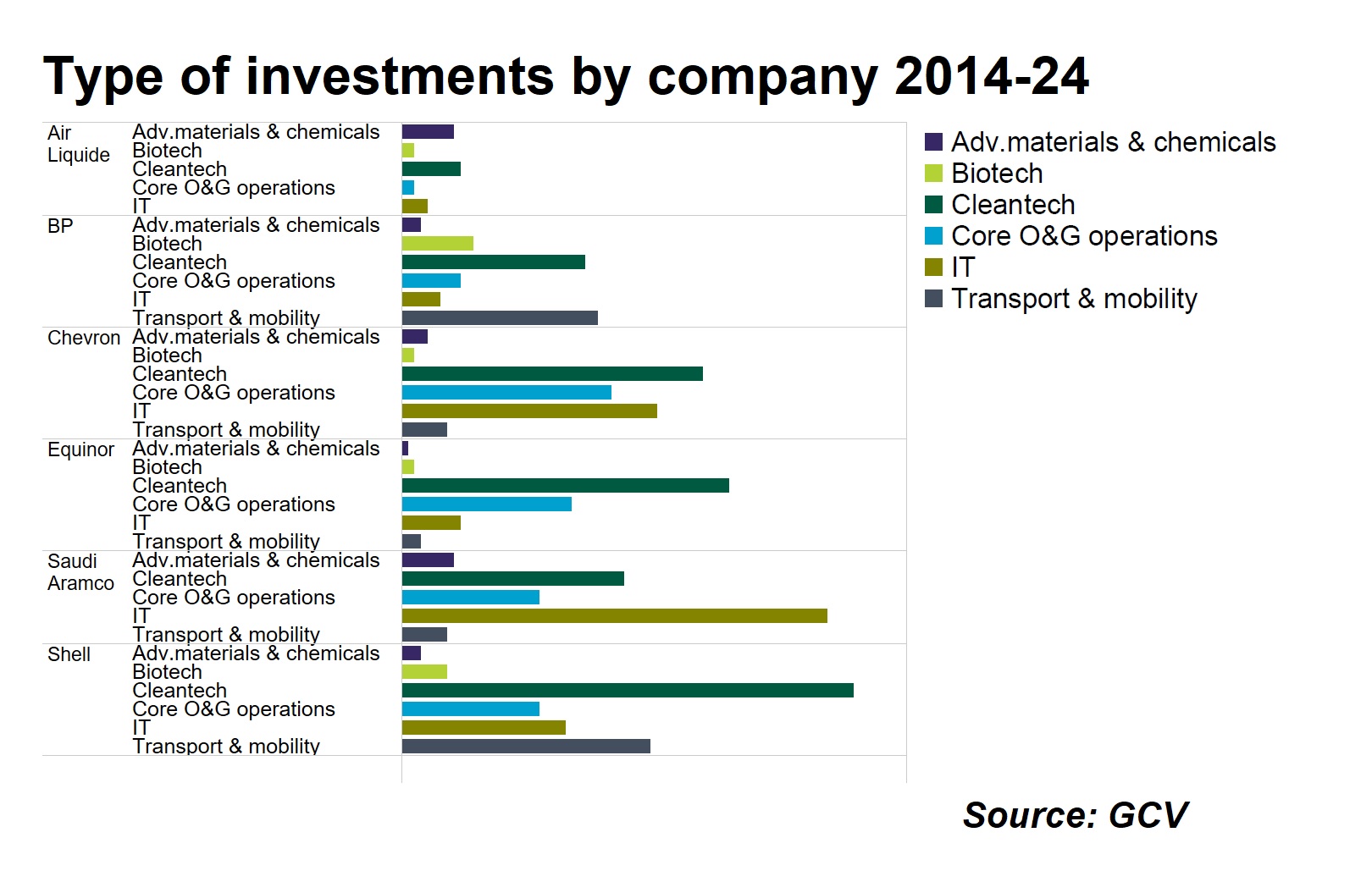

Since 2014, Shell, Chevron, and Equinor have been strongest in early-stage cleantech investments among the oil and gas corporates. Saudi Aramco and Chevron have dominated in the IT technology area, while Shell and BP have been the biggest investors in the transport and mobility sector.

Over time, we’ve seen an ongoing shift in focus among corporate venture investors from the oil and gas sector toward non-core domains, particularly IT, cleantech and transport and mobility.

A flurry of new cleantech funds

We also saw a number of new sustainability-related CVC funds formed, or saw existing ones increase their capitalisation.

Saudi Aramco set the pace for oil and gas-related investment funds, with the allocation of an extra $4bn for its Aramco Ventures investment unit, doubling the fund’s capital to more than $7bn. Aramco Ventures runs a sustainability fund, alongside the Digital/Industrial fund and Prosperity7 Ventures, which targets non-energy tech.

Nio Capital, the VC firm spun out of Shanghai-based electric vehicle producer Nio, also raised RMB3bn ($417m) for a domestic-oriented fund. According to Nio Capital managing partner Ian Zhu, the fund will continue focusing on innovative technologies in the automotive and sustainable energy industries.

In Europe, Swiss electrical equipment producer ABB unveiled an open innovation and venturing arm dubbed ABB Motion Ventures to back startups developing sustainability and resource-efficient technologies. The unit will be led by Ana Troncoso Ceola out of London. Ceola previously spent over a decade at mining group Rio Tinto and almost four years as Shell’s global VP of acquisitions, divestments, and new business development.

Future Energy Ventures secured €110m ($120m) for the initial close of its climate tech fund, Future Energy Ventures Fund I SCA SICAV-RAIF. Established in 2022 after spinning out of utility company E.on, Future Energy Ventures invests in energy transition and sustainability tech developers across Europe, Israel, and North America. The fund operates independently, although E.on remains its anchor investor.

Private equity firm Corran Capital closed its second fund, Corran II, with £80m ($102m) for investments in UK clean energy and climate tech. Supported by Scottish & Southern Energy (SSE), the fund acquired a 30% stake in Vital Energi, a heat infrastructure and energy efficiency company. Collaborating closely with Vital Energi’s management, Corran aims to accelerate the delivery of low-carbon heat and energy efficiency solutions across the UK.

Read more about the energy fundraising in the full report.