The broader consumer sector has been marked by a search for customer centricity, married with technological progress. Over the past decade, it has largely revolved around digital transformation and changing consumer preferences and behaviour. The covid-19 pandemic interrupted supply chains for a while and that can still be felt today. However, its disruptive force also helped to change consumer habits by boosting e-commerce businesses and hitting hard traditional brick-and-mortar retailers. As vaccines have been rolled out and the world is generally leaving the pandemic behind, we are still to see how many of those changes will remain permanent.

Previous reports we have dedicated to this sector over the years have, on multiple occasions, stressed on the importance of demand side pressures on consumer products along with supply side disruption, thanks to the rise of e-commerce and the digitisation of retail. These general trends have only intensified with the pandemic and will likely continue to strengthen. Digitisation of the consumer sector has created the necessity to understand and interpret correctly consumer preferences by increasing one-on-one connections.

The timely and massive monetary intervention of central banks in major world markets stalled the possibility of a severe recession with the outbreak of the pandemic but now the threat of rampant inflation is making monetary authorities take on a course of monetary tightening. That, coupled with some remaining supply chain disruptions, the current conflict in Europe and upward pressure in prices of many commodities, is likely to have a somewhat negative impact on discretionary spending in the short and medium term, which had kept its normal pace despite the pandemic and lockdowns. The potential menace of stagflation, as the one in the 1970s, is well on the agenda of economic policy makers around the globe now.

The 2022 Consumer Products Industry Outlook report by consulting firm Deloitte reveals sentiment of top executives in the sector, based on a survey it has conducted. They seem to hold a largely positive and optimistic outlook: “As with last year, driving greater revenue is the top goal for executives in Deloitte’s 2022 outlook survey (93%). The “no-regret moves” companies undertook during the prior year’s uncertainty are paying off. And despite rising costs, at least half of consumer product companies surveyed expect their operating margins to increase. This coincides with an environment conducive to raising prices for end consumers, a large factor in why two-thirds of publicly traded companies are already reporting higher profit margins relative to pre-pandemic levels.”

However, the Deloitte report points out that executives from the sector are aware there will likely be bumps on the road: “Supply chain struggles are unlikely to be resolved fully or quickly, labour is hard to come by and keep, and costs of all kinds are increasing rapidly. All are affecting the industry’s ability to achieve desired growth. As evidence, nine in ten executives surveyed rate supply chain issues as the greatest threat to growth. Additionally, six in ten say labour shortages (and separately inflationary pressures) are already threatening growth this year.”

Digitisation takes a central place in the process of building trust for consumer product brands, according to the Deloitte report: “Half of companies surveyed believe that consumers lose trust in brands that fail to engage with them in a personalised manner. Consumer product brands are changing their go-to-market strategies to do just that. This change is needed in part because the consumer and their circumstances are changing.” It is therefore likely that consumer product brands will continue to allocate resources to improving their e-commerce capabilities and direct-to-consumer channels, which will create opportunities for more synergies with emerging digital businesses.

Food and beverages is a subsector, which saw much growth, even during years prior to the pandemic and stay-at-home orders. This was clearly captured by our data, as outlined further below. According to a recent report entitled “Food and beverage services global market report 2022”, the food and beverages global market was expected to grow to an estimated $3.67 trillion by the end of 2022, up from $3.23 trillion in 2021, at a CAGR of 13.8%. The report attributes this growth to companies rearranging operations and recovering from the pandemic impact. It also forecasts the market to reach $5.23 trillion by 2026 at a CAGR of 9.2%. The report explains: “The food and beverage services market is expected to benefit from rising digitalisation of food services. Consumers are increasingly preferring to order food online for home deliveries.”

In the post-pandemic context, consumers are ever more health and environmentally conscious and a number of wider trends that have been shaping the industry will likely continue to do so, including experience-based shopping, plant-based food, premiumisation of some categories along with of private label growth in others, added nutritional benefits to food and beverages (such as electrolytes, minerals, adaptogens, probiotics), and the comeback of tobacco-based products under different formats.

On a larger level, it is big demographic trends that drive the underlying growth for the sector. According to data cited by the European Commission, the global middle class grew from 1.8 billion people in 2009 to about 3.5 billion in 2017. Furthermore, well over half of the world’s population (5.3 billion people) is expected to reach middle class status by 2030, with some 87% of the additional middle class population being Asians. This demographic trend will tend to translate into expected growth in e-commerce and overall retail consumption.

Even prior to the pandemic and stay-at-home orders, e-commerce already appeared to have exerted burdensome impact on traditional retail, as some analysts spoke of a “retail apocalypse”, as we saw some retail brands going bankrupt. If we are to enter into a prolonged period of stagflation, this negative trend may seriously deepen.

The rise of private label and a general “shift to value” has been a phenomenon observed in many markets, as consumers look for ways to save money. According to report on private label brands by consumer research firm Nielsen from 2019, this was true for both developed and developing markets alike: “Nielsen study from across more than 60 countries shows that private label products continue to gain share across all major geographies. The relentless store expansion by retailers over the past decade has given shoppers more access to private label and to brands. In recent years, e-commerce has given brands another way to reach the consumer. However, private-label growth is also being driven by the wider choice that the digital economy offers to consumers and the globalisation of shopping trends (media, technology, e-commerce). This growth is also accelerating wherever disruption is present in the trade structure.”

According to data cited by the Forbes magazine, this trend deepened during pandemic lockdowns in 2020. Nielsen found that about two-thirds of consumers rank store brands as being as good in quality as traditional brands, and more than a third even ranked some private label as better. Consumers were showing a higher propensity to save money before the pandemic hit, as many were already anticipating an economic reversal of some sort. It is unclear and hard to predict to what extent this propensity will remain or even significantly increase. On the one hand, there is the real possibility of prolonged stagflation and, on the other, we have also seen a contrary process of premiumisation of brands in certain categories related to environmentally-friendly products, such as plant-based food, for example.

The potential further increase of propensity to save may erode consumer brands. This is one of the major reasons why executives from the sector obsess about customer centricity. Through interactions with consumers, their brand offering and image can be enhanced and converted into opportunities to monetise. So, the heightened interest in companies offering in-depth market research or tools to help with this is likely to remain.

The fast-moving consumer goods (FMCG) segment benefitted almost immediately from the pandemic and the stay-at-home orders. The global FMCG market was estimated to reach $15.36 trillion by 2025, at an estimated CAGR of 5.4% from 2018 to 2025, according to a report dubbed “Global FMCG market 2018-2025”, curated by Allied Market Research. The report attributes the expected long-term growth due to rise in disposable income, increase in consumer demand for sustainable products as well as to technology advances.

Aside from e-commerce and the FMCG space, there are notable trends in the clothing and apparel subsector, where digitisation has already played a key disruptive role. When analysing the textile and fashion industry, it must also be kept in mind that, globally speaking, it is a rather concentrated one. The top 20 players, mostly from the luxury segment, are estimated to earn more than 90% of profits of the entire industry.

“The State of Fashion 2022” report by The Business of Fashion and McKinsey, maintains a rather optimistic tone with respect the near-term prospects: “With much of the world under covid-19 related restrictions through 2020 and 2021, the global fashion industry has faced exceptionally challenging conditions. But after nearly two years of disruption, the industry is beginning to find its feet again.”

Despite recognising the rough patch in 2021 with growing number of takeovers and bankruptcies, the report holds that recovery to pre-pandemic levels will continue in the short run. McKinsey Fashion Scenarios expects global fashion sales to reach 103-108% of 2019 level in 2022 in a rather uneven way: “Still, while overall sales are expected to make a full recovery next year, performance will vary across geographies, with growth likely driven by the US and China, as Europe lags. In addition, as international tourism remains in the doldrums, the shape of consumption will continue to evolve, sparking a growing focus on domestic spending. In response, many companies will recalibrate their retail footprints, even amid uncertainty as to whether these pandemic-induced behaviour shifts will stick.”

The report points out the longer-term trends in the fashion industry, revolving around digitisation, social and environmental concerns as well customer centricity and competition to retain and attract talent remain in place: “Despite widespread operational disruptions, the pandemic has done little to slow down the megatrends reshaping the industry. In fact, these have accelerated over the past year, with industry leaders making bold moves in digital, taking action on environmental and social priorities and focusing more sharply on diversity, equity and inclusion in response. However, concerns around slow progress in these areas, coupled with all-time high job vacancies, mean brands will need to work hard to attract and retain talent in the year ahead.” With such megatrends, venturing activity may also be expected to continue.

A crucial piece of the consumer sector puzzle is the e-commerce space, which has been given a boost by the pandemic. According to “Global Ecommerce Forecast 2022” from consulting firm Insider Intelligence, global retail and retail ecommerce spending were “expected to stabilise in 2022, after two years of unpredictable circumstances and unusual growth patterns.” The report expects worldwide e-commerce sales to exceed $5 trillion for the first time, accounting for more than a fifth of overall retail sales. Despite slowing growth rates, the authors of the report expect total spending will surge past $7 trillion by 2025. This growth could only potentiate further disruption and synergies between incumbents and innovative new businesses.

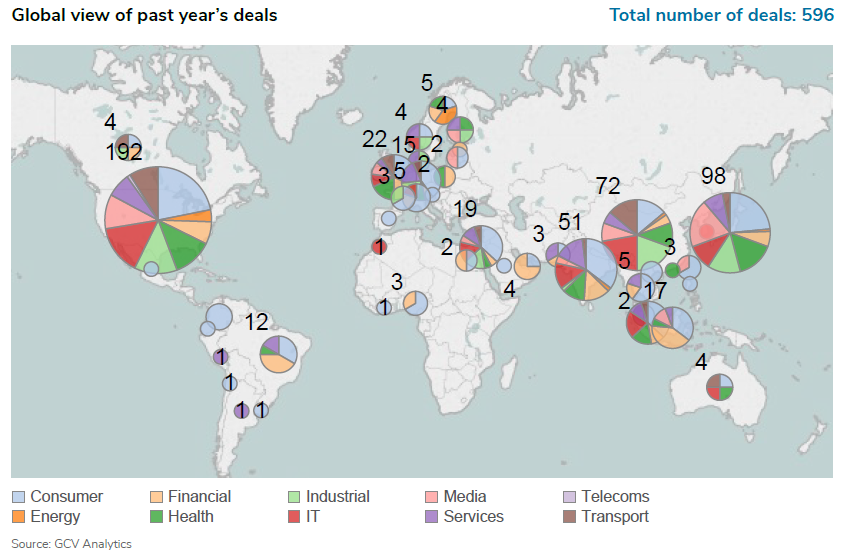

For the period between March 2021 and February 2022, we reported 596 venturing rounds involving corporate investors from the consumer sector. A considerable number of them (192) took place in the US, while 98 were hosted in Japan, 72 in China and 51 in India.

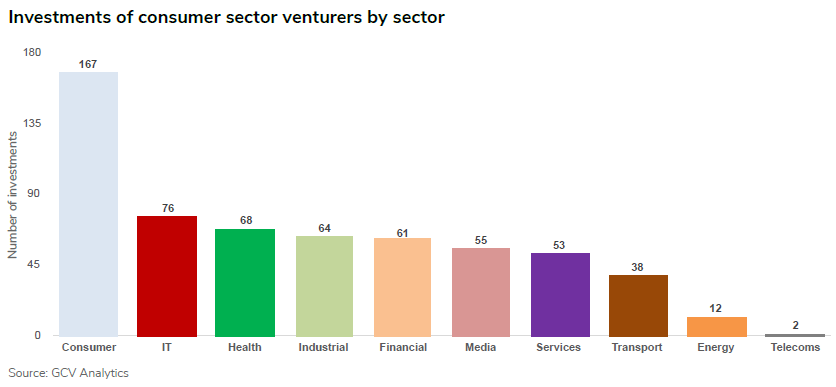

Many of those commitments (167) went to emerging enterprises from the same sector (mostly food and beverage, e-commerce as well as fashion and apparel) but also with the remainder going into companies developing other technologies in synergies with the consumer sector: 76 deals in the IT sector (enterprise software, AI and big data), 68 in health (primarily devices and diagnostics as well other health applications) and 64 in industrial (mostly robotics and drones, agriculture and other industrial applications) and 61 in financial (mostly payment tech, insurtech and alternative lending).

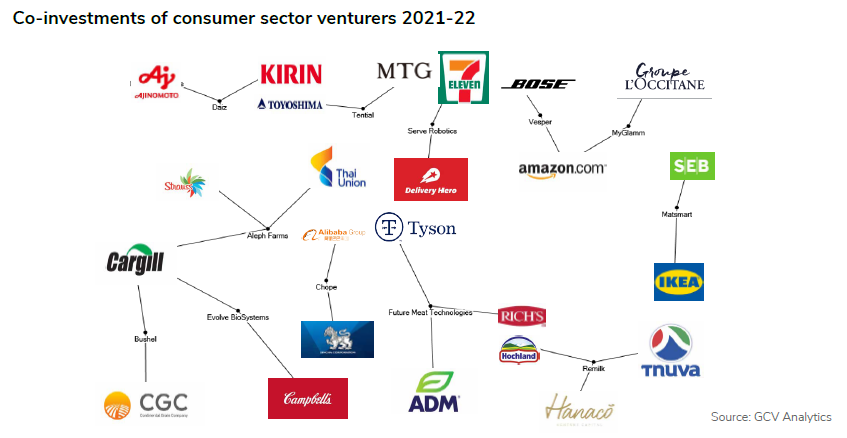

The network diagram, illustrating co-investments of consumer corporates, shows the range of investment interests of the sector’s incumbents. The commitments ranged widely from alternative proteins (Aleph Farms, Daiz, Float Foods, Future Meat, Remilk) and online food services (Chope, Matsmart, Serve Robots) through probiotics (Evolve Biosystems) to beauty and wellness (My Glamm and Tential) and electronics (Vesper). All these co-investments match the specific technological needs and interests of incumbent corporations in the sector, as outlined above.

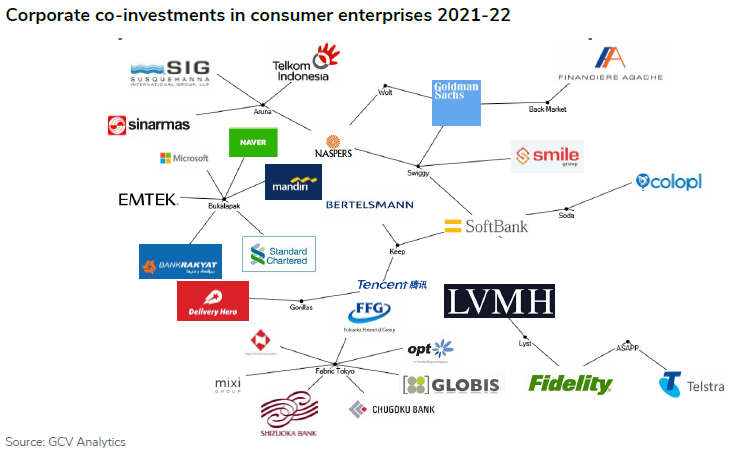

The emerging consumer businesses in the portfolios of corporate venturers came from a range of innovation applications ranging from e-commerce (Aruna, ASAPP, Back Market, Bukalapak) through fashion and apparel (Fabric Tokyo, Lyst, Soda) to food delivery services (Gorillas, Swiggy, Wolt) and wellness (Keep, Whoop).

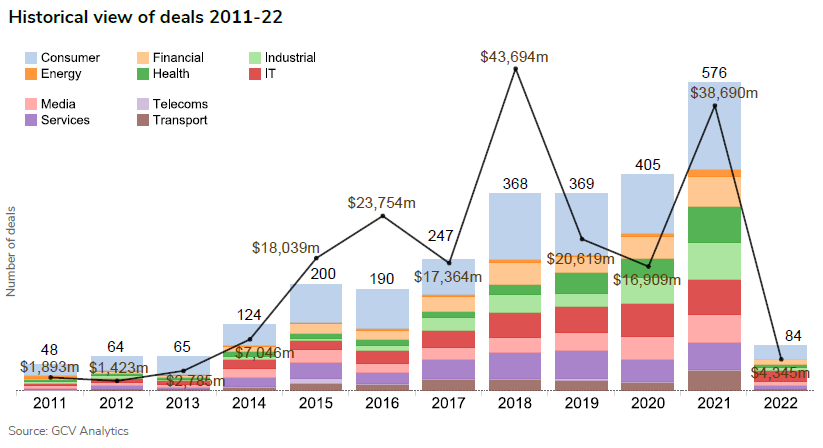

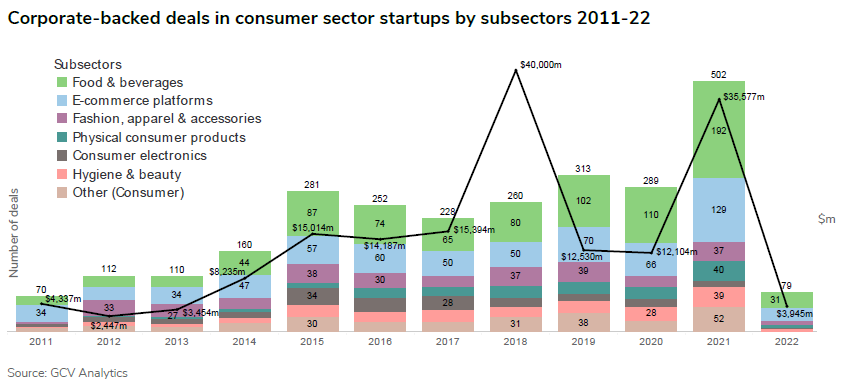

On a calendar year-on-year basis, total capital raised in corporate-backed rounds went up substantially from $16.9bn in 2020 to $38.69bn in 2021, suggesting a nearly 130% surge. The deal count also increased by 42% from 405 deals in 2020 up to 576 tracked by the end of last year. As outlined further in this article, the ten largest investments by corporate venturers from the consumer sector were not necessarily concentrated all in the same industry.

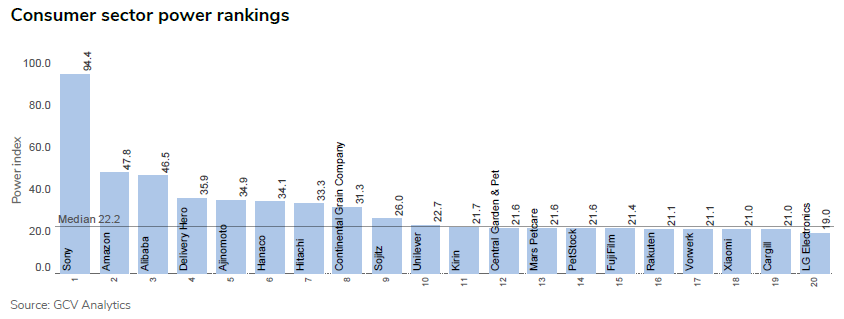

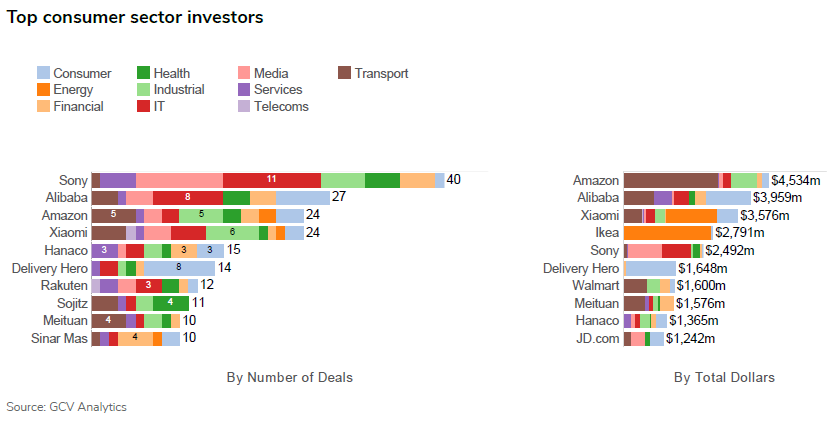

The leading corporate investors from the consumer sector in terms of largest number of deals were electronics producer Sony, e-commerce firm Alibaba and e-commerce and cloud computing services provider Amazon. The list of consumer corporates committing capital in the largest rounds was headed by Amazon, Alibaba and electronics producer Xiaomi.

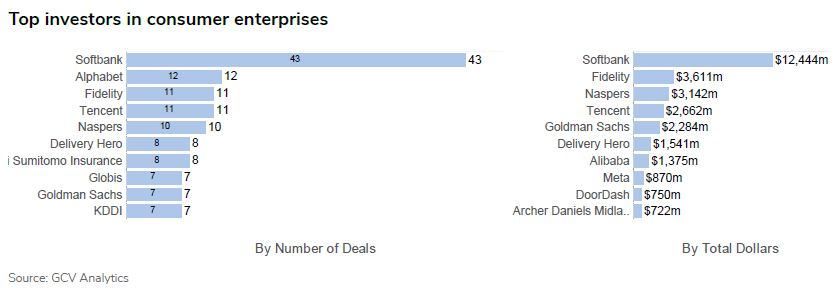

The most active corporate venture investors in the emerging consumer companies were financial telecoms and internet conglomerate SoftBank, diversified internet conglomerate Alphabet and internet company Tencent.

Overall, corporate investments in emerging consumer-focused enterprises went up drastically from 289 rounds in 2020 to 502 by the end of 2021, suggesting a 74% increase. Estimated total dollars in those rounds nearly tripled from $12.1b n in 2020 up to $35.58bn by the end of last year.

Sector specialist: Rahul Ray, Tyson Ventures

Rahul Ray serves as senior director for Tyson Ventures, the corporate venturing arm for US-based protein-based food processing firm Tyson Foods.

Tyson Ventures partners and invests in promising entrepreneurial businesses that align with Tyson Foods’ corporate strategy and can benefit from the firm’s expertise and scale. Tyson Foods innovates continually to make protein more sustainable, tailors food products and raises the world’s expectations for how much good food can do. The Tyson Ventures team plays a role in delivering this innovation strategy.

Founded in December 2016 with $150m of capital, the fund seeks partnerships with startups that align with Tyson Food’s long-term corporate strategy. Tyson Foods focuses on providing affordable, nutritious and sustainable food from a variety of global sources to nourish the world’s growing population.

Ray said: “At Tyson Ventures, we are looking to connect with builders, investors and enablers of human capital productivity via automation, robotics, artificial intelligence and machine learning, sustainability and food and agricultural technologies.”

Sector specialist: Paul Bernard, Amazon Alexa Fund

The Amazon Alexa Fund is US-based e-commerce, cloud and internet technology group Amazon’s corporate venturing fund, began in 2015. It is dedicated to finding and supporting startups that work with voice technology.

Paul Bernard, who leads the fund, said in an interview with GCV: “Our goal is to identify startups creating new experiences with Alexa or advancing the state of the art in voice technology and to give them the resources they need to grow their business.

“We have invested in more than 80 companies across a range of segments from smart home and wearable technology to education, entertainment, and health and wellness, as well as technologies like microphones and processors that unlock new use cases for Alexa.”

The Alexa Fund focuses on voice technology innovation that is compatible with Alexa voice recognition systems. The team believes human voice-enabled devices will boost the way users interact with technology. In addition to funding, the fund supports entrepreneurs to transform their innovative ideas into products and services.

Deals

Corporates from the consumer sector invested in large multimillion-dollar rounds, raised mostly by enterprises from other sectors.

Sweden-headquartered battery producer Northvolt raised a $2.75bn private placement, featuring furniture retailer Ikea and co-led by automotive manufacturer Volkswagen, which invested $620m, and commercial vehicle producer Scania. AMF, ATP, Baillie Gifford, Baron Capital Group, Bridford Investments, Compagnia di San Paolo, Imas Foundation, EIT InnoEnergy, Norrsken VC, PCS Holding, Stena Metall Finans and private investors Cristina Stenbeck and Daniel Ek completed the investor list. Northvolt manufactures lithium-ion batteries for use in electric vehicles in addition to portable electronics products such as drones, and the storage of renewable energy. The financing will support the expansion of the company’s Gigafactory from a capacity of 40 GWh per year to 60 GWh per year.

Amazon’s Climate Pledge Fund and automotive manufacturer Ford Motor Company co-led a $2.5bn funding round for US-based electric truck developer Rivian. The round was also co-led with investment firm D1 Capital Partners and funds and accounts advised by T Rowe Price, and included Third Point, Fidelity, Dragoneer Investment Group and Coatue Management. Rivian produces a range of electric trucks that include an electric pick-up truck dubbed the R1T as well as the R1S, an all-terrain electric sports utility vehicle. Its vehicles were also set to be supplied to Amazon to serve as their last-mile delivery vans.

SVolt Energy Technology, a China-based energy storage and battery technology developer spun off by carmaker Great Wall Motor, completed a RMB10.28bn ($1.58bn) series B round backed by Xiaomi. Heavy equipment manufacturing company Sany also took part in the round, which was led by Bank of China Group Investment, a subsidiary of financial services firm Bank of China. SVolt is working on solid-state, cobalt-free car batteries and artificial intelligence-powered smart manufacturing technology. It was created by Great Wall Motor in 2012 and spun off in 2018.

Chipone Technology, a China-headquartered manufacturer of chips for electronic display panels, raised more than RMB6.5bn ($1bn) in series E financing from investors including smartphone producer Vivo at a valuation of over $4.7bn. Oceanpine Capital led the round, which also featured Unic Capital Management, CCB Private Equity Investment Management, GGV Capital, Prosperity Investment, Citic Private Equity, Beijing Singularity Power Investment Management and Silk Road Huachuang Investment Management. Founded in 2008, Chipone designs display chips for mobile display, panel display, LED panel display and LED lighting, providing products that can be used in TV sets, monitors, notebooks, tablets, smartphones and other wearable devices.

US-headquartered video game developer Epic Games closed a $1bn funding round, featuring a $200m investment Sony, valuing it at $28.7bn. Sony was joined by investment and financial services group Fidelity, Appaloosa, Baillie Gifford, GIC, Ontario Teachers’ Pension Plan Board, Park West, KKR, AllianceBernstein, Altimeter Capital, Franklin Templeton, Luxor Capital, funds and accounts advised by T Rowe Price and funds and accounts managed by BlackRock. Epic specialises in multiplayer online games using its Unreal Engine, and its most famous titles are battle royale game Fortnite and first-person shooter series Gears of War. The company is looking to build a ‘Metaverse’ of games, having acquired multiplayer sports title Rocket League by buying its developer, Psyonix, in mid-2019 and Tonic Games, the creator of battle royale platformer Fall Guys.

Online food ordering service Delivery Hero led a $950m series C round for Germany-based grocery delivery service Gorillas. The round also featured Tencent, investment management firm Coatue Management, investment firm DST Global and venture capital firm A-Star Partners, and reportedly valued the company at $3bn. Delivery Hero reportedly contributed nearly $200m of the total. Founded in 2020, Gorillas offers groceries to customers in 57 cities across eight European countries for delivery within 10 minutes of an order, selling items at retail price. The cash will go to European growth and comes as the company has moved into the United States having begun deliveries in New York.

US-based logistics services platform developer Flexport raised $935m in a series E round featuring e-commerce software provider Shopify and SoftBank at a valuation of $8bn post-money. Andreessen Horowitz and MSD Partners co-led the round with additional backing from DST Global, Founders Fund, private investor Kevin Kwok and undisclosed others, while SoftBank invested through its Vision Fund 1. Flexport operates a cloud-based logistics system allowing customers to book shipments by air, sea, land or rail globally, offering end-to-end cargo insurance, real-time tracking and all-inclusive billing. It claims the platform was responsible for moving almost $19bn in merchandise across 112 countries in 2021 as its revenue more than doubled.

Alibaba and investment firm DST Global co-led a $750m series D round for China-based grocery platform Nice Tuan. Anatole Investment, CDH Investments, Cygnus Equity and DE Shaw took part in the round, as did Dragoneer, Franchise Capital, GGV Capital, Jeneration Capital and Kunlun Capital. Founded in 2018 and also known as Shihuituan in Chinese, Nice Tuan runs an online community marketplace that helps users bulk-buy grocery items such as fruit and vegetables, meat and packaged goods at discount rates. The cash went to improving its shipping operations and expanding its fresh produce business.

US-based autonomous driving software developer Cruise added $750m from big-box retailer Walmart and unnamed institutional investors to its latest round, boosting it to $2.75bn. The capital was raised at a valuation of about $30bn and followed a $2bn first close in January 2021 featuring software provider Microsoft and carmakers Honda and General Motors (GM) as well as unnamed additional investors. Cruise is developing autonomous driving software in addition to robotics and hardware such as cameras and sensors. The company is also working on a ride hailing app intended to serve as the basis for a robotaxi service and is trialling its technology in driverless vehicles in San Francisco. GM bought Cruise for $1bn in 2016 and spun it back off two years later with a pledge of up to $2.25bn of funding from SoftBank’s Vision Fund.

US-headquartered battery supply chain developer Redwood Materials raised over $700m from investors including Amazon’s Climate Pledge Fund. The round was led by funds and accounts advised by investment management firm T Rowe Price, and it reportedly valued the company at $3.7bn post-money. Redwood is building a closed loop supply chain for electric vehicle batteries that will involve it partnering large companies to recycle used batteries and feed the useful materials back into the supply chain, reducing the industry’s environmental impact. The company has recycling partnerships in place with businesses including Amazon and it plans to triple the size of its Carson City, Nevada facility while constructing a new plant elsewhere in the state.

There were other interesting deals in emerging consumer-focused businesses that received financial backing from corporate investors in the same and other sectors.

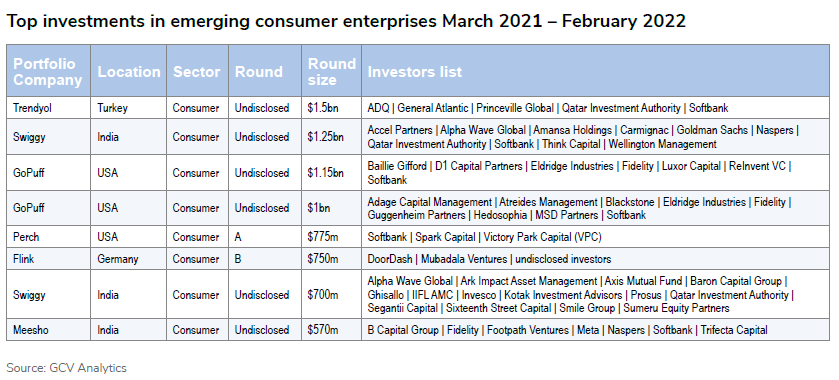

SoftBank’s Vision Fund 2 co-led a $1.5bn funding round for Turkey-headquartered e-commerce marketplace Trendyol at a valuation of $16.5bn. The round was co-led with growth equity firm General Atlantic, investment firm Princeville Capital and sovereign wealth funds ADQ and Qatar Investment Authority. Citi was financial adviser and placement agent on the deal. Trendyol operates a diversified online retail platform which incorporates on-demand grocery delivery and a peer-to-peer e-commerce marketplace. It has also built its own courier and last-mile delivery infrastructure in addition to a mobile wallet.

SoftBank’s Vision Fund 2 and internet group Prosus co-led a $1.25bn series J round for India-based food delivery service provider Swiggy at a $5.5bn valuation. The round also featured sovereign wealth fund Qatar Investment Authority as well as Accel, Wellington Management, Falcon Edge Capital, Amansa Capital, Goldman Sachs, Think Capital and Carmignac. The round reportedly included an $800m tranche led by Prosus’ corporate venturing arm, Prosus Ventures, while SoftBank provided a reported $450m for that close. Founded in 2014, Swiggy provides food and grocery delivery services, and its online platform facilitates access to more than 150,000 restaurants and stores located in over 500 Indian cities.

GoPuff, the US-based operator of a personal services app, received $1.15bn from investors including SoftBank’s Vision Fund 1 at an $8.9bn valuation in March 2021. Investment and financial services group Fidelity Management and Research also took part in the round, as did hedge fund managers Luxor Capital and D1 Capital Partners, investment manager Baillie Gifford and investment firms Eldridge and Reinvent Capital. Founded in 2013, GoPuff runs an online platform that allows users to order products such as food and drink, cleaning, baby and pet products, over-the-counter medications and, in some places, alcohol, for delivery.

Subsequently, in August last year, GoPuff picked up $1bn in additional funding from SoftBank’s Vision Fund 1. Blackstone’s Horizon platform, Guggenheim Investments, Hedosophia, MSD Partners, Adage Capital, Fidelity Management and Research Company, Atreides Management and Eldridge filled out the investor line-up. The round reportedly valued GoPuff at $15bn.

US-headquartered e-commerce holding company Perch completed a $775m series A round led by SoftBank’s Vision Fund 2. The round also featured venture capital firm Spark Capital and alternative investment manager Victory Park Capital. Founded in November 2019, Perch is acquiring direct-to-consumer e-commerce brands, particularly third-party merchants on Amazon, in a bid to build a diversified online retail offering. Several emerging companies are ploughing similar ground but Perch is among the first to raise corporate funding. It has bought more than 70 brands and targets category leaders with the potential to scale their businesses.

Food delivery service DoorDash led a $750m series B round for Germany-based grocery ordering app operator Flink. Abu Dhabi state-owned investment vehicle Mubadala Capital and unnamed new and returning backers also took part in the round, which valued Flink at $2.85bn post-money. It also included debt financing from unnamed entities. Founded in late 2020, Flink has built an online platform that allows users to buy grocery items for delivery within 10 minutes. It operates in some 60 cities across its home country, Austria, the Netherlands and France.

In early 2022, Swiggy raised another notable round, securing $700m in a series K round featuring internet groups Prosus and Smile Group. Prosus and India Infoline were represented by Prosus Ventures and IIFL AMC Late Stake Tech Fund respectively, and the round valued the company at $10.7bn. Investment firm Invesco led the round, participating alongside financial services firms India Infoline and Kotak as well as Baron Capital Group, Sumeru Venture, Axis Growth, Sixteenth Street Capital, Ghisallo, Segantii Capital, Alpha Wave Global, Qatar Investment Authority and Ark Impact.

India-based online reselling platform Meesho raised a $570m in funding round, featuring social network operator Meta, SoftBank and Prosus, at a $4.9bn valuation. The round was co-led by investment and financial services group Fidelity and investment firm B Capital Group, featuring Footpath Ventures and Trifecta Capital within the syndicate as well. SoftBank participated through its Vision Fund 2, while Prosus via its corporate venturing unit, Prosus Ventures. Founded in 2015, Meesho has developed and runs an e-commerce platform that lets small businesses and entrepreneurs sell products to consumers through social media. The platform handles the administrative side of selling through services including supply chain management, payment processing and logistics. Meesho claims to have helped more than 15 million entrepreneurs start their own online businesses in India.

Exits

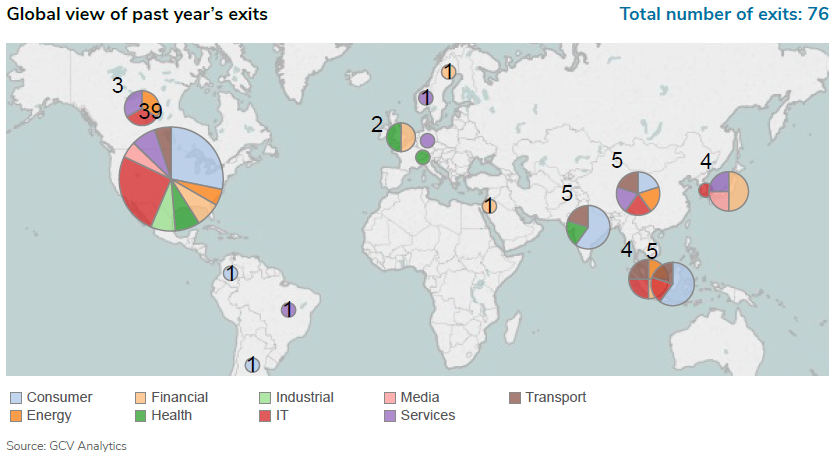

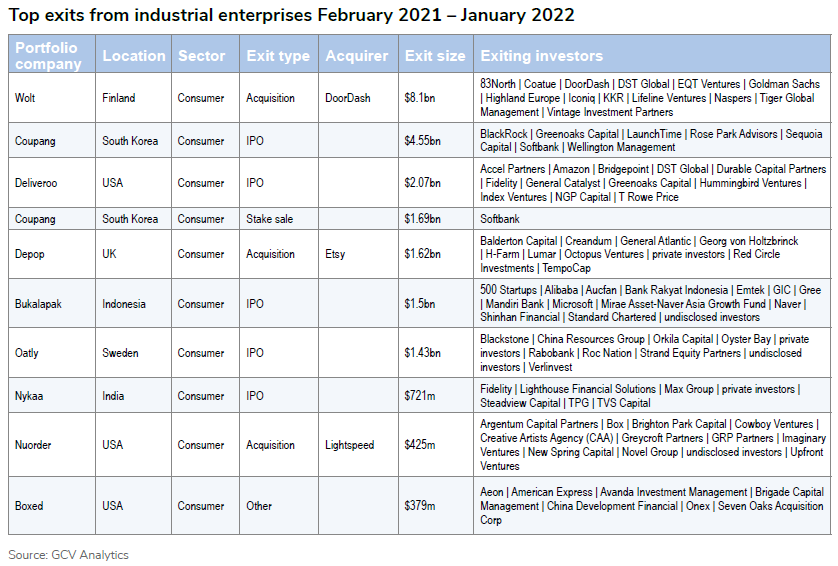

Corporate venturers from the consumer sector completed 76 exits between March 2021 and February 2022 – 43 acquisitions and 16 initial public offerings (IPOs), 13 other transactions (mostly reverse mergers), two mergers of equals and two stake sales. As for year-on-year, both the transaction volume and the estimated dollar value spiked significantly compared to 2020 levels – the number of exits went up 90% from 42 to 80 and the total estimated dollars in them more than doubled from $19.05bn to $39.82bn.

US-based electric jeep developer Rivian went public in an $11.9bn IPO that scored exits for corporates Amazon, Ford, Cox Enterprises, Sumitomo and Abdul Latif Jameel. The company increased the number of shares in the offering from 135 million to 153 million and priced them at $78.00 each, above the $72 to $74 range it had set. It floated on the Nasdaq Global Select Market. Rivian began deliveries of its all-electric pickup truck, the R1T, and its sports utility vehicle, the R1S. It was largely pre-revenue company at the time of its listing. The offering followed about $10.5bn in funding for the company since it was founded in 2009.

China-headquartered ride hailing service provider Didi Global went public in a $4.44bn IPO on the New York Stock Exchange. The company counts multiple corporates among its backers, including Alibaba, SoftBank, Tencent, insurance firms China Life and Ping An, electronics producer Apple, online travel agency Booking Holdings, car rental service eHi and social media company Sina Weibo. Didi increased the number of shares in the offering from 288 million to approximately 317 million American Depositary Shares (ADSs), with four ADSs equalling one class A share. Formed after the merger of peers Didi Dache and Kuaidi Dache in 2015 and formerly known as Didi Chuxing, Didi operates an on-demand ride service spanning its home country of China but has presence in Russia, Africa, Latin America, Central Asia and the Asia Pacific regions as well. It also offers food and package delivery in addition to automotive and financial services. Subsequently, the company was delisted from New York Stock Exchange due to pressure from China’s regulatory authorities.

JD Logistics, the logistics offshoot of China-headquartered e-commerce group JD.com, floated on the Hong Kong Stock Exchange in a HK$24.6bn ($3.2bn) IPO. The offering consisted of approximately 609 million shares priced at HK$40.36 each, towards the lower end of the IPO’s HK$39.36 to HK$43.36 range. Formed by JD.com as its delivery services arm, JD Logistics combines artificial intelligence technology with a China-wide network of warehouses to deliver e-commerce products to customers within 24 hours. The IPO proceeds went to strengthening its logistics infrastructure.

Financial management software producer Bill.com agreed to purchase payment management platform developer Divvy in a $2.5bn transaction enabling digital payment processor PayPal and electronics wholesaler Hanaco to exit. Divvy’s software platform allows businesses to efficiently track spending on expenses and corporate cards in real time while setting flexible limits. The deal allowed Bill.com to offer business customers accounts payable, accounts receivable and corporate card spend management options from a single place.

UK-based online food delivery service Deliveroo floated on the London Stock Exchange in a £1.5bn ($2.07bn) IPO, scoring an exit for Amazon. The company issued about 256 million shares while its shareholders sold a further 128 million. Deliveroo runs an app-based online platform that allows users to order food from nearby restaurants and eateries that is delivered by its riders. It has added a subscription service called Deliveroo Plus to its offering as well as its own kitchens under the Editions brand and delivery software platform Signature.

Aurora, a US-based self-driving technology developer backed by multiple corporate investors, agreed a reverse merger with special purpose acquisition company Reinvent Technology Partners Y. The combined company was to have a $13bn pro forma implied market capitalisation and take on Reinvent’s listing on the Nasdaq Capital Market, which was secured through an $850m IPO. The transaction included a $1bn private investment in public equity (PIPE) financing featuring truck manufacturer Paccar, ride hailing service provider Uber and commercial vehicle producer Volvo Group, among many other investors. Formed in 2017, Aurora is working on an autonomous driving system initially aimed at the trucking market. It expects to launch its first product by 2023 and expand the application of its technology to the last-mile delivery and ride hailing sectors.

Bukalapak, the Indonesia-based online marketplace backed by multiple corporate investors, priced its initial public offering at the top of its range, raising $1.5bn. Former corporate backers of the company include Ant Financial, part of the Alibaba Group, media group Emtek, software provider Microsoft, digital media group Gree’s Strive unit (then Gree Ventures) as well as price comparison platform Aucfan. The transaction reportedly valued the company at about $6bn. Founded in 2010, Bukalapak operates an e-commerce platform with 6.5 million online sellers and 100 million users, and also runs a business-to-business procurement platform as well as a digital financial services subsidiary called Buka Investasi Bersama.

Grab, a Singapore-headquartered ride hailing service backed by range of corporate investors, agreed a reverse takeover with special purpose acquisition company Altimeter Growth Corp at an initial pro-forma equity value of $39.6bn. The combined business was to take the position secured by Altimeter Growth Corp, an affiliate of technology investment firm Altimeter Capital Management, when it floated in a $450m IPO in October 2020. Funds managed by Altimeter Capital also put up $750m for a $4bn PIPE financing deal supporting the transaction that includes conglomerate Sinar Mas, clove cigarette producer Djarum and investment and financial services group Fidelity. Formerly known as GrabTaxi, Grab’s core business is its on-demand ride service but it has diversified into food and package delivery as well as financial services, through an offshoot that raised more than $300m in January 2021.

SenseTime, a China-based provider of computer vision technology developed at Chinese University of Hong Kong’s Media Lab, floated in Hong Kong in a HK$6.64bn ($851m) IPO. The company sold 1.5 billion shares priced at the foot of the HK$3.85 to HK$3.99 range it had set for the offering and an extra 225 million through an over-allotment option. Founded in 2014, SenseTime produces artificial intelligence-equipped chips, sensors and software for use in image, facial and vehicle recognition. It generated approximately $520m in revenue in 2020. SenseTime had planned to price its shares previously but the IPO was delayed after the US government added the company to a blacklist due to its technology being used to aid human rights abuses directed towards China’s minority Uyghur population.

Power generator manufacturer Generac Holdings agreed to acquire Ecobee, a Canada-based smart thermostat producer backed by corporates Amazon, Carrier, AGL Energy and Just Energy, for up to $770m. Generac was to pay $200m in cash along with $450m in common stock to the current equity holders of Ecobee. Founded in 2007, Ecobee has developed a smart thermostat equipped with voice control capabilities that can measure room temperature and detect how many people are in a room, as well as a wider suite of home monitoring products including smart sensors and cameras.

Global Corporate Venturing also reported several exits of emerging consumer-related enterprises that involved corporate investors for the same as well as other sectors.

Online food ordering service DoorDash agreed to acquire Wolt, a Finland-based food and consumer delivery service that counts Prosus as an investor, in a €7bn ($8.1bn) all-share deal. The transaction included a retention pool sized at about €500m for Wolt’s 4,000 employees and its management team. The company had raised approximately $856m in funding. Founded in 2014, Wolt operates an online platform which allows customers in 23 countries to order food, groceries and other consumer goods from local shops to be delivered to them at home. The purchase was meant to allow DoorDash to expand its reach to a host of new markets.

Coupang, the South Korea-headquartered online marketplace backed by SoftBank, floated on the New York Stock Exchange in an upsized $4.55bn IPO. The company priced 130 million shares at $35.00 each. It had set a price range of $32 to $34 for 120 million shares, 100 million of which were set to be issued by the company and 20 million sold by its investors. Founded in 2010, Coupang runs an e-commerce platform that offers a wide range of consumer goods through a same-day delivery service. It had reportedly increased revenue 91% year on year to almost $12bn in 2020 and cut its net loss from $699m to $475m.

SoftBank later sold 57 million shares in South Korea-based e-commerce platform operator Coupang for approximately $1.69bn in total. The sale valued the shares at about $29.69 each, below the IPO price of $35.00. SoftBank was hold approximately 568 million shares in the company after the transaction.

E-commerce marketplace Etsy agreed to acquire Depop, the UK-headquartered social commerce platform developer backed by consultancy group Lumar, for over $1.62bn. Depop operates a mobile platform with 30 million registered users – 90% of whom are under 26 years of age – who can buy and sell second-hand and new fashion items in addition to offering styling services. The company claims to have generated $70m in revenue in 2020.

Oatly, the Sweden-based oat milk producer backed by talent and entertainment agency Roc Nation and agriculture-focused banking group Rabobank, floated on the Nasdaq Global Select Market in a $1.43bn IPO. The company issued almost 84.4 million shares priced at $17 each, at the top of the IPO’s $15 to $17 range. Founded in 1994 to advance research at Lund University, Oatly provides oat milk and other oat-derived food products traditionally made from cow’s milk, including ice cream, coffee, yoghurt, cream, spread and custard.

FSN E-Commerce Ventures, the India-based, corporate-backed operator of fashion e-commerce platform Nykaa, went public, securing over $721m in its IPO. The company counts conglomerates Max Group and TVS among backers. Nykaa’s shares rose 89% to Rs 2,129 ($28.67) on the BSE while those listed on the National Stock Exchange (NSE) reached Rs 2,018 ($27.17) apiece in the opening, representing a 79% rise from the issue price. The listing gave company a market capitalisation of about $13.5bn at the time. Founded in 2012, Nykaa has built an online marketplace for beauty, personal and pet care products which also offers its goods through more than 80 brick-and-mortar retail partners across India. The company intends to use the IPO proceeds to increase its offline presence through new stores.

E-commerce software producer Lightspeed agreed to buy US-based business-to-business e-commerce platform operator NuOrder for $425m, enabling telecoms firm Novel Group and talent agency Creative Artists Agency (CAA) to exit. Half the transaction consisted of cash and the other half was made up of subordinate voting shares. NuOrder was founded in 2011 and has built an online platform that lets retailers buy stock from more than 3,000 brands. The company generated over $20m of revenue for the year ending March 2021, processing $11.5bn of orders through its platform.

Boxed, a US-based online grocery platform developer backed by corporates American Express and Aeon, agreed to a reverse merger with special purpose acquisition company Seven Oaks Acquisition Corp. The merged company retained the Boxed brand and assumed Seven Oaks’ listing on the Nasdaq Capital Market, which it acquired through a $259m IPO in December 2020. The deal was supported by a $120m private placement comprised of common stock and convertible notes that is backed by Brigade Capital Management, Avanda Investment Management and Onex Credit. Founded in 2013, Boxed operates an e-commerce platform that enables consumers and businesses to buy consumable products such as toiletries and cleaning products in bulk.

Funds

For the period between March 2021 and February 2022, corporate venturers and corporate-backed VC firms investing in the consumer sector secured $9.65bn in capital via 68 funding initiatives, which included 40 VC funds, 17 newly-launched or refunded venturing units, seven accelerators and four other initiatives.

On a calendar year-to-year basis, the number of funding initiatives in the consumer sector went up from 53 in 2020 to 64 registered by the end of last year. Total estimated capital also surged from $4.53bn in 2020 up to $9.69bn in 2021.

Legend Capital, the China-based venture capital firm formed by diversified conglomerate Legend Holdings, launched a RMB10bn ($1.54bn) sixth renminbi-denominated fund. Formed in 2001 with a $35m commitment from Legend Holdings, Legend Capital operates as an independent venture capital firm but retains the backing of its former parent. The firm has not revealed how much capital it has secured for Legend Capital Comprehensive Growth Fund VI, but the fund has a RMB10bn target for its close. The state-owned Xiangcheng Financial Holdings is among its limited partners so far. The vehicle will invest in developers of technology in areas such as semiconductors and integrated circuits, consumer electronics and new energy vehicles.

Singapore-based e-commerce and video game group Sea Group committed $1bn to a corporate venture capital unit called Sea Capital, as it revealed in its annual financial results for 2020 in early 2021. Founded in 2009 as Garena, Sea offers online games through a platform also dubbed Garena, as well as running an e-commerce marketplace called Shopee and a digital financial services offering under the Sea Money brand. It floated in an $884m initial public offering in 2017. Sea Capital was launched to build a broader ecosystem around the company’s offering and will target developers of consumer and enterprise technology. The $1bn will be deployed over the next few years. The unit will be overseen by chief investment officer David Ma, founder and head of Composite Capital Management, an investment management firm recently acquired by Sea.

United Arab Emirates (UAE)-based industrial conglomerate Crescent Enterprises announced plans to double its corporate venture capital investments to Dh1bn ($272m) by 2022. Founded in 2017 with a $150m commitment, Crescent’s corporate venturing unit, CE-Ventures, already invested more than $136m in 32 startups and VC funds around the world, including Tarabut Gateway, Hippo Insurance, China Union Pay, Nerdwallet and Turtlemint. CE-Ventures said it would invest more in the food, financial, energy and software sectors.

Line Ventures and YJ Capital, the respective corporate venturing subsidiaries of messaging platform developer Line and internet company Yahoo Japan, officially merged with ¥30bn ($271m) of capital. Japan-headquartered Yahoo Japan and Line, the messaging platform formed by South Korea-headquartered internet group Naver, closed their merger earlier this month and will operate under Z Holdings, a publicly-listed holding company backed by Naver and SoftBank. The newly formed corporate venture capital vehicle, Z Venture Capital, will invest in developers of technology related to Z Holdings’ group businesses, such as consumer services, e-commerce, healthcare, cybersecurity, financial technology and enterprise software. Z Venture Capital will target portfolio companies in Japan and South Korea as well as in the United States, China and Southeast Asia. It also intends to help US-based developers of edge technologies like artificial intelligence, robotics and blockchain to expand in East Asia.

India-based fantasy sports game operator Dream Sports launched a corporate venture capital arm called Dream Capital with $250m in cash. Dream Sports runs Dream11, an online fantasy sports game that allows users to assemble teams for individual rounds of league games in sports such as cricket or football in order to win money. The newly formed fund will invest in early-stage companies across areas such as gaming, sports and fitness technology, and the deals are expected to support Dream Sports’ expansion into adjacent areas to fantasy sports. The capital has come from its balance sheet. The vehicle will provide between $1m and $100m per deal and is open to strategic acquisitions in addition to minority investments. The company intends to invest in about 20 startups over the first two years of its operations.

The founders of Australia-based payment technology provider Airwallex raised $200m for a venture capital fund to back companies utilising its payment infrastructure. Airwallex operates a cross-border payment platform which enables businesses to trade internationally by managing payments, expenses and budgets globally across a range of markets and currencies. The fund, dubbed Capital 49, will raise capital from Airwallex’s founders as well as external backers, and will invest in areas such as e-commerce, software-as-a-service, digital technology, business services and financial technology. It has so far backed two undisclosed companies. The move came after Airwallex expanded its series D round to $300m at a $2.6bn valuation. The company had raised a total of just over $500m and by the time counted corporates Tencent, Salesforce, Mastercard, Bank Central Asia and ANZ Bank among its investors.

Australia-based venture capital firm Main Sequence Ventures secured A$250m ($194m) of capital commitments for its second fund , from investors including aerospace and defence manufacturer Lockheed Martin. The fund’s other limited partners (LPs) included Singaporean state-owned investment firm Temasek, superannuation fund HostPlus, venture capital firm Horizons Ventures and unspecified family offices and individual investors represented by Morgan Stanley Wealth Management and Mutual Trust. The firm will use its sophomore fund to invest in technology companies operating in sectors such as food, healthcare, space and industrial productivity technology. It also looking to increase its focus on technology companies addressing decarbonisation. Main Sequence was founded in 2017 to manage Csiro Innovation Fund 1, an investment vehicle established by research institute Commonwealth Scientific Research Organisation (Csiro) and the Australian federal government.

Netherlands-based venture capital firm Anterra Capital pulled in $175m for an initial close of its second food and agriculture technology fund with commitments from pharmaceutical firm Novo and agriculture focused-bank Rabobank. Anterra F&A Ventures II’s other limited partners include investment and financial services group Fidelity’s Eight Roads Ventures unit, investment group Tattarang and unspecified family offices, sovereign wealth funds and state-owned investment vehicles. Rabobank committed capital to the fund through corporate venture capital unit, Rabo Investments. The VC firm expects to hold a final close for the fund in the third quarter of 2021. Anterra is focused on early-stage technology companies operating in sectors such as agriculture, food production and animal health.

China-based roasted seed and nut provider Qiaqia Food and domestic snack food producer Juewei Food formed a RMB1.1bn ($170m) industry investment fund. Sichuan Chengdu Xinjin Siyiwu Investment was equipped with almost $100m from Juewei Food’s Wangju Capital vehicle, which will take a 58.6% share, while Qiaqia Food is set to provide $9m in return for a 5.45% stake. The vehicle will invest in companies operating in areas like restaurant chains, snack and condiment brands, pet food producers and developers of technology which can enhance the supply chain. Linzhi Yongchuang Information Technology and Zhejiang Jiyuan Network Technology also agreed to commit capital to the fund.

China-based venture capital firm Qingsong Fund raised RMB1bn ($153m) to close its fourth renminbi-denominated fund, which was backed by publishing firm Time Publishing and Media. The fund’s other limited partners include the Chinese-state managed Qianhai Inno-Tech Investment fund as well as undisclosed corporate backers, government-backed funds, funds of funds, family offices and individual investors. Qingsong was founded in 2012 and focuses on areas such as education, consumer brands and technology. It manages six renminbi-denominated investment funds and has roughly $460m of assets under management. The firm will use the fund to invest in early and growth-stage companies having already backed electronic component manufacturer JustFit, automotive logistics services provider Zhaochi Supply Chain and beauty and personal care brand PolyVoly.

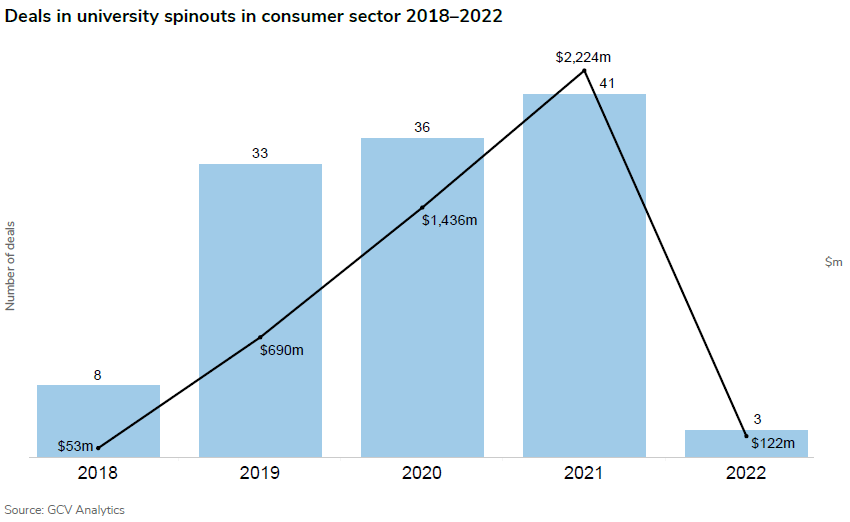

University and government backing for consumer companies

Over the past few years, we reported various commitments to university spinouts in the consumer sector through our sister publication, Global University Venturing. By the end of 2021, there were 41 rounds raised by university spinouts, up from the 36 and 33 registered in the previous two years. The level of estimated total capital deployed last year stood at $2.22bn, more than three times over the estimated $690m in 2019.

SoftBank’s Vision Fund 2 led a $350m series C round for US-based alternative protein developer Nature’s. Food producer Danone’s corporate venturing arm, Danone Manifesto Ventures, also participated in the round, as did agribusiness Archer Daniels Midland (ADM) and conglomerate SK. The participants were completed by Blackstone Strategic Partners, Balyasny Asset Management, Hillhouse Capital, EDBI, Hongkou Capital, Breakthrough Energy Ventures, Generation Investment Management and 1955 Capital. Formerly known as Sustainable Bioproducts, Nature’s Fynd grows a fungi protein named Fy, which is used as the basis for meat and dairy products which do not require animals. Fy is obtained from a microbe with origins in the geothermal springs of Yellowstone National Park and is grown with a fermentation technology that uses a fraction of the land, water and energy required by traditional agriculture.The funding will be used to accelerate the company’s growth as it looks to boost its production capacity, expand internationally and broaden its product portfolio.

Future Meat Technologies, an Israel-based cultured meat producer spun out of Hebrew University of Jerusalem, secured $26.8m in convertible debt financing from investors including food producers Archer-Daniels-Midland (ADM), Rich Products Corporation, Theo Müller Group and Tyson Foods. Multicorporate-backed investment firm Emerald Technology Ventures also took part in the round, as did venture capital firms Bits x Bites, S2G Ventures and Manta Ray Ventures in addition to ADM Capital, a private equity firm unrelated to its corporate namesake. Future Meat develops meat products made from animal cells, without involving animal husbandry or genetically modified organisms. The technology was licensed from Hebrew University of Jerusalem, and Future Meat said its cultured chicken breast costs $7.50 to produce. It will use the cash to boost its production and research and development efforts.

Motif FoodWorks, a US-based food ingredient developer spun off by microbe engineering services provider Ginkgo Bioworks, received $226m in a series B round backed by food and transport conglomerate Louis Dreyfus. The Teachers’ Innovation Platform formed by Ontario Teachers’ Pension Plan Board co-led the round with unnamed funds and accounts managed by investment management firm BlackRock. Motif is working on plant-based food ingredients created through precision fermentation and advancements in material science. It was spun off by Gingko Bioworks, itself a spinout of Massachusetts Institute of Technology, in 2019 and since also licensed research from University of Guelph and margarine producer Coasun. The company will look to increase its research and development capabilities, scale and commercialise its technologies, bolster headcount and expand its facilities using the series B proceeds.

People

We reported people moves in the consumer sector over the past year.

Rachel Weiss, vice-president for strategy and growth at France-headquartered cosmetics brand L’Oreal’s US operations, was appointed partner at its corporate venturing unit, Bold Ventures. Weiss has spent almost 15 years at L’Oreal and said she would be an early-stage investor at Bold, which has been run by Laurent Schmitt, head of corporate finance, since 2018. Bold invests in new business models in marketing, digital, retail, communication, supply chain and packaging. Its portfolio companies include Sillages Paris, and others, including Carbios, Global Bioenergies, Functionalab Group, Slick, Replica Software and Gjosa.

Christina Bechhold Russ, former director of South Korea-headquartered electronics prodcuer Samsung’s Next corporate venturing unit, joined US-based financial services firm Truist. As senior vice-president and head of strategic initiatives at Truist’s venture capital arm, Truist Ventures, Bechhold Russ will be based in London, UK, where she had been working for Samsung since the start of 2018. Under Vanessa Indriolo Vreeland, head of Truist Ventures since the start of 2020, the Ohio-based corporate venturing unit has backed companies including Greenwood, Veem and Greenlight.

Planning to raise C$50m ($39.5m) for a cleantech corporate venturing fund called NPC Ventures, Canada-based biotechnology product maker Natural Products Canada hired Kristi Miller, founder and former national managing director of business finance provider First West Capital, to run the fund as managing director. Miller said: “NPC Ventures has tapped into something very compelling. There is tremendous opportunity for Canadian companies to meet this exponential demand for ‘natural’. I am honoured to bring my experience and network to an area with such meaningful potential for growth.” The fund will target 16 to 20 investments ranging from C$500,000 to C$2.5m.

Jaytiya Ngam-maykin, a GCV Rising Stars award winner in 2020, joined Singapore-based internet and e-commerce group Sea as head of corporate development. Ngam-maykin had previously spent about five years in corporate venturing at Thailand-based financial services firm Siam Commercial Bank (SCB). SCB hired Ngam-maykin as an accelerator programme manager in 2016 before she moved two years later to lead strategic investments in China for SCB Digital Ventures. She was appointed to a principal position at the firm’s SCB10X unit in March 2020.

Tao Liu moved to the strategic investment group at Alibaba. Liu will back cloud software technology developers having spent the past seven months at sister company Alibaba Cloud making undisclosed technology investments in semiconductors and silicon, sensing, artificial intelligence (AI) and virtual reality. Alibaba’s cloud services subsidiary, Alibaba Cloud, pledged $1bn in 2021 to an initiative to support tech startups and developers. The Project AsiaForward initiative is intended to support some 100,000 recipients over the next three years while also providing training for prospective software developers and linking entrepreneurs to venture capital investors.

US stock exchange provider Nasdaq hired Selena Singleton from Alibaba as head of strategic development. Before her two years running business-to-business globalisation for Alibaba, Singleton had been a director at insurer New York Life’s corporate venturing unit. It was an important hire for Nasdaq, which in January appointed Jeremy Skule as chief strategy officer in a newly expanded role overseeing mergers and acquisitions, venture investments, and data and analytics.

Adiari Vazquez joined US-listed online retailer Amazon’s sustainability-focused corporate venturing unit as an investment manager. At Amazon’s $2bn Climate Pledge Fund, Adiari said in her LinkedIn profile she was “investing to bend Amazon’s carbon emissions curve”. She had previously spent a year as a UK-based associate at Next47, a corporate venture capital vehicle owned by Germany-headquartered industrial equipment and appliance producer Siemens, before leaving in 2020 to set up Braver Ventures. Vazquez had earlier been a Portugal-based investment manager at Caixa Capital, the corporate venturing fund operated by financial services firm Caixa Geral de Depósitos, for more than three years having joined in late 2015, and oversaw early-stage deals in smart energy and materials.

Calidad Pascual, a Spain-based dairy business, set up its corporate venturing unit and hired Sejal Ravji to head the unit dubbed Pascual Innoventures. It will work with and invest in startups doing business in areas including the circular economy, personalisation and health. Ravji, a former GBFoods and Nestlé who joined the dairy business in 2018 as director of open innovation, leads the new unit with Gabriel Torres Pascual, Calidad Pascual’s director of innovation, the news provider added.

David ‘Dede’ Goldschmidt was appointed head of Samsung Catalyst Fund (SCF), an evergreen vehicle for South Korea-headquartered consumer electronics manufacturer Samsung Electronics, to lead the unit’s global activities. Goldschmidt had been in the venture capital ecosystem for two decades. SCF hired him in 2015 as an Israel-based managing director to oversee investments in the country and in Europe, covering areas including 5G, artificial intelligence, automotive, cloud, healthcare, quantum and robotics technologies.

Jeffrey Housenbold, formerly a managing partner at SoftBank Investment Advisers (SBIA), the fund management arm of SoftBank, joined US-based home improvement service Leaf Home. Founded in 2019, Leaf Home provides direct-to-consumer home safety and enhancement products including gutter guards and accessibility equipment such as stairlifts, as well as water filtration systems. It appointed Housenbold president and CEO, and he will help the company’s leadership team support its growth plans. Housenbold had joined SBIA in 2017 and helped launch and manage the unit’s investment activities through its SoftBank Vision Funds 1 and 2. He ranked fifth on Global Corporate Venturing’s Rising Stars roster in 2019.

General Mills, a US-based food maker, promoted Doug Martin to run its corporate venture unit. The CVC unit, 301 INC, will move into a newly-formed “disruptive growth” team led by Martin, who has been president of the company’s dairy operating division for nearly two years. The team will combine 301 INC; Gworks, General Mills’ internal innovation incubator; and Isquad, the company’s innovation and core growth strategy consulting team. 301 INC had previously invested a reported $100m in companies like Epic Provision, Beyond Meat, Purely Elizabeth, Good Catch, and No Cow.

US-based investment firm ICV Partners hired Bill Ford, a former executive at beverage producer Coca-Cola Company, as a managing director in its portfolio operations group. Ford had previously spent more than three years as director of venturing and portfolio management at Coca-Cola. He had previously been at food processor Treehouse Foods between 2013 to 2017, most recently as general manager of its coffee business unit. Ford joined Mary Rachide and Everett Hill as the third managing director of portfolio operations group at ICV.

Safi Keshvargar joined Walmart, the US-listed retailer, to become ecosystem head for Store No. 8 – Walmart’s incubation unit. He had previously lead the expansion into New York City of Brand Capital, the strategic investment arm of the Times Group – India’s largest media conglomerate – whose portfolio consists of more than 900 investments, including AirBnB, Uber, Coursera, Headspace, Square Panda and Oddup. Kesvargar remains an investor at angel network GoingVC Partners, which backs early-stage health tech, consumer marketplaces and consumer product brands.

Rohit Giri joined US-based big data software developer Splunk as director of corporate development and its corporate venturing unit, Splunk Ventures, having left e-commerce software provider BigCommerce after three years. Between 2018 and October 2021, Giri was director of corporate development for BigCommerce, prior to which he had served a seven-year stint as corporate finance and financial strategy lead at website building software provider Squarespace. Giri’s previous experience also includes associate or analyst roles at Bryant Park Capital, Worldwide Capital Group, Merriman Curhan Ford & Co and Rutberg & Company.

Japan-based venture capital firm Nextblue raised about ¥1.5bn ($13.7m) for its debut fund, from LPs including local department store retailer Marui Group, system integrator Q’sfix and rewards platform Giftee. The figure represented the first close of the fund, which has a ¥3bn target for its close. It will make seed-stage investments in companies focusing on the future of work, health and lifestyle, in Japan and Europe. Nextblue was formed by Yuichi Kori, founder of Reality Accelerator, with Kanako Inoue and Vincent Tan (based in Germany), who both have experience at consulting firm Boston Consulting Group and VC firm D4V.

Peter Na left South Korea-listed internet group Naver and joined venture capital firm Atinum Investment as regional head of its Singaporean office. Naver had hired Na as Singapore-based director of Southeast Asia investments in 2017 to help it expand into the region. Its portfolio companies there include ride hailing service Grab and consumer credit provider FinAccel – both of which conducted reverse mergers in 2021 – as well as e-commerce platform Bukalapak, which is now listed on the Indonesia Stock Exchange. Na’s new role will involve him leading Southeast Asia investments on behalf of Atinum Investment, which was founded in South Korea in 1988 and which has $12bn under management across 26 vehicles. The firm targets growth-stage IT, biotechnology and healthcare technology developers, and has a portfolio of more than 400 companies.