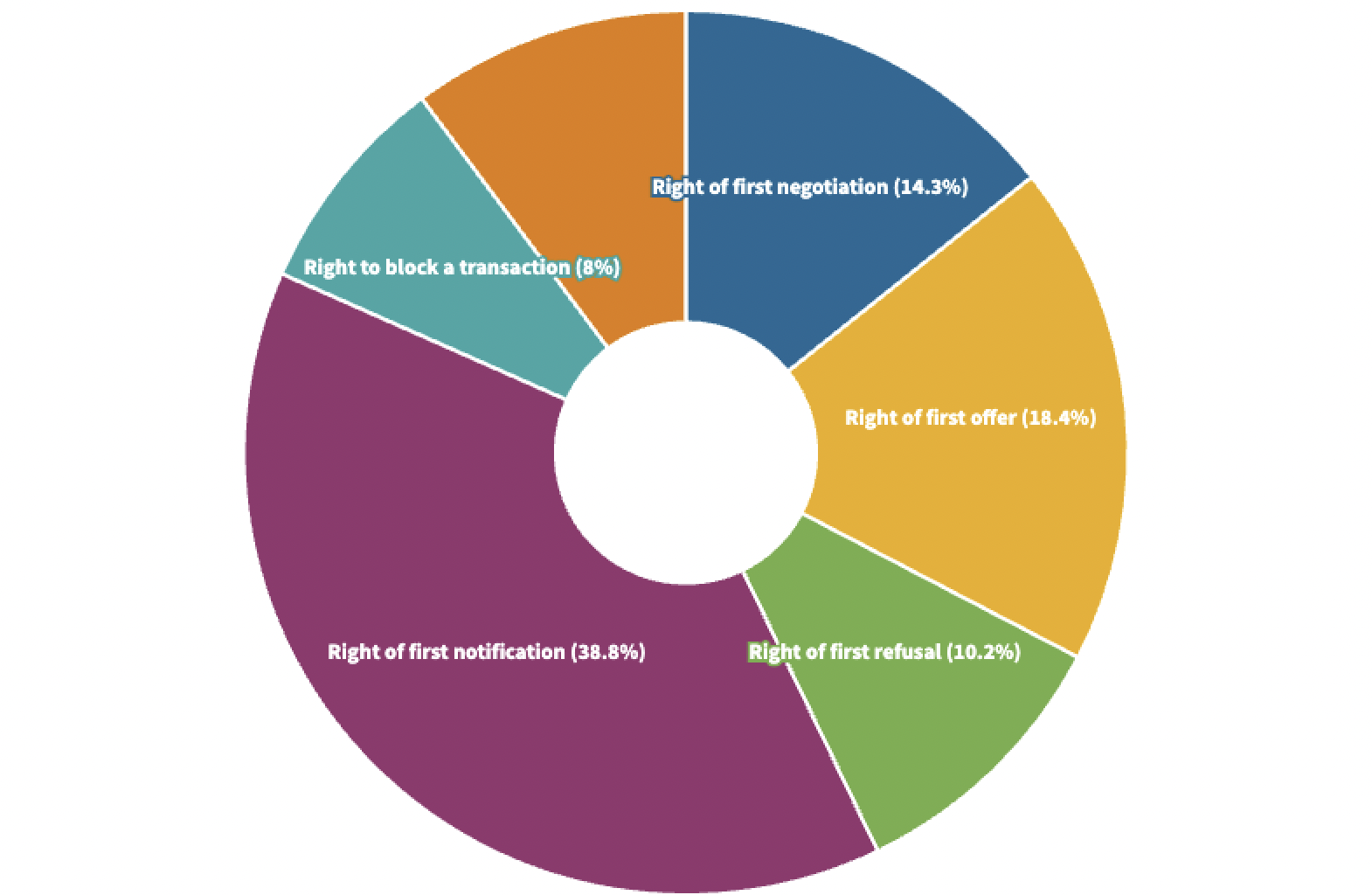

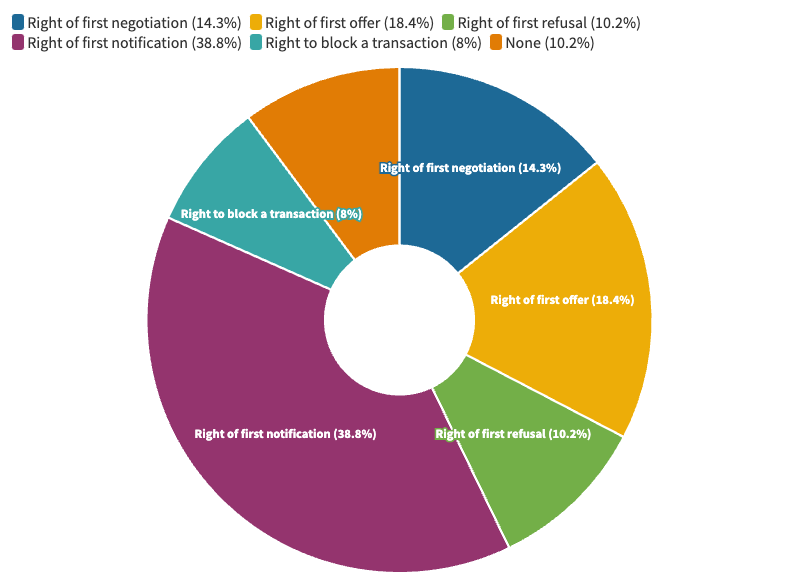

Almost all corporate investors — nearly 90% — say they negotiated some kind of special rights related to the sale of their portfolio companies, according to a GCV poll. Slightly more than half say they negotiated some kind of pre-emptive terms, either the right of first negotiation, the right to make the first offer or the right of first refusal — even the right to block a deal.

Conventional “founder-friendly” rhetoric often suggests that corporate backers shouldn’t negotiate any special rights at all. But when we polled the Global Corporate Venturing community on this, we found that the overwhelming majority do look for some privileges around the sale of the companies that they have backed.

The most popular rights to put in the term sheet are information rights — usually the right to be notified first if a transaction is being planned. As one respondent put it: “This is the ‘anti-embarrassment’ right. It is important to not be surprised if a company is to be acquired.”

Some 38.8% of respondents — corporate innovation professionals at the investment arms of large corporations — say they want these information rights.

The right to make the first offer was the next most popular — with 18.4% of respondents saying they put this into their deals.

The more restrictive rights, such as the right to block a deal or the right of first refusal were not particularly common. It is relatively rare for corporate investors to back startups explicitly with a view to acquiring them, so terms like these, which would make deals with other buyers harder for the startup, would not make sense. But one respondent told us they did put this in as one of the terms “mostly to review possible competitors’ entrance to the company”.

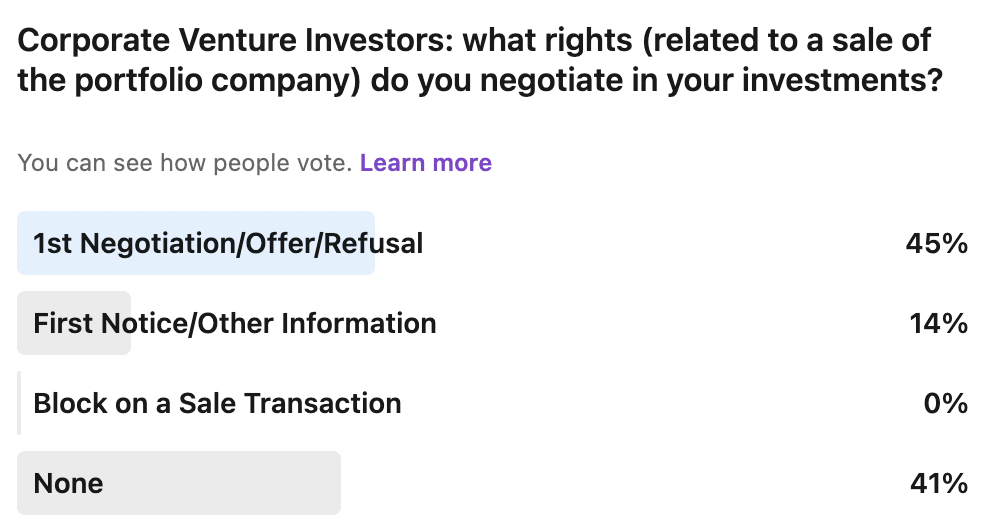

Interestingly, it seems there is still some secrecy over these rights deals. When we ran the same poll much more publicly on LinkedIn, we had a very different set of answers, with a much larger group of respondents saying they did not negotiate any special rights.

Is that just for show? I’d love to hear your thoughts on that.