Corporate venture-backed deals rose

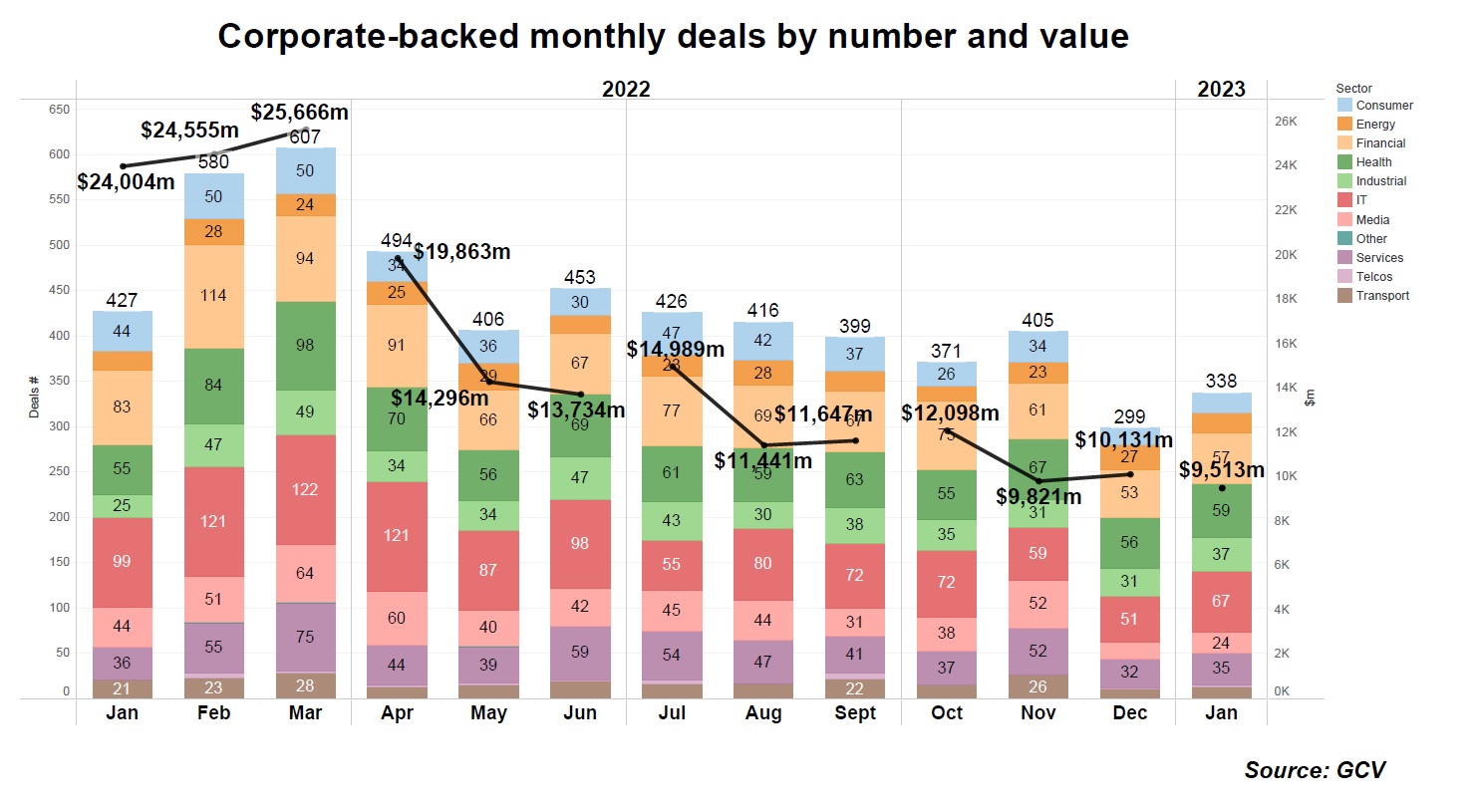

After surviving a down year relatively unscathed, corporate venture investors kicked off the new years with more deals in December. However, this was still considerably below the level of deals registered back in January 2022 across most sectors and verticals, with the notable exception of agtech. Corporate-backed funding initiatives exhibited a similar behaviour. Exits are still sluggish, overall.

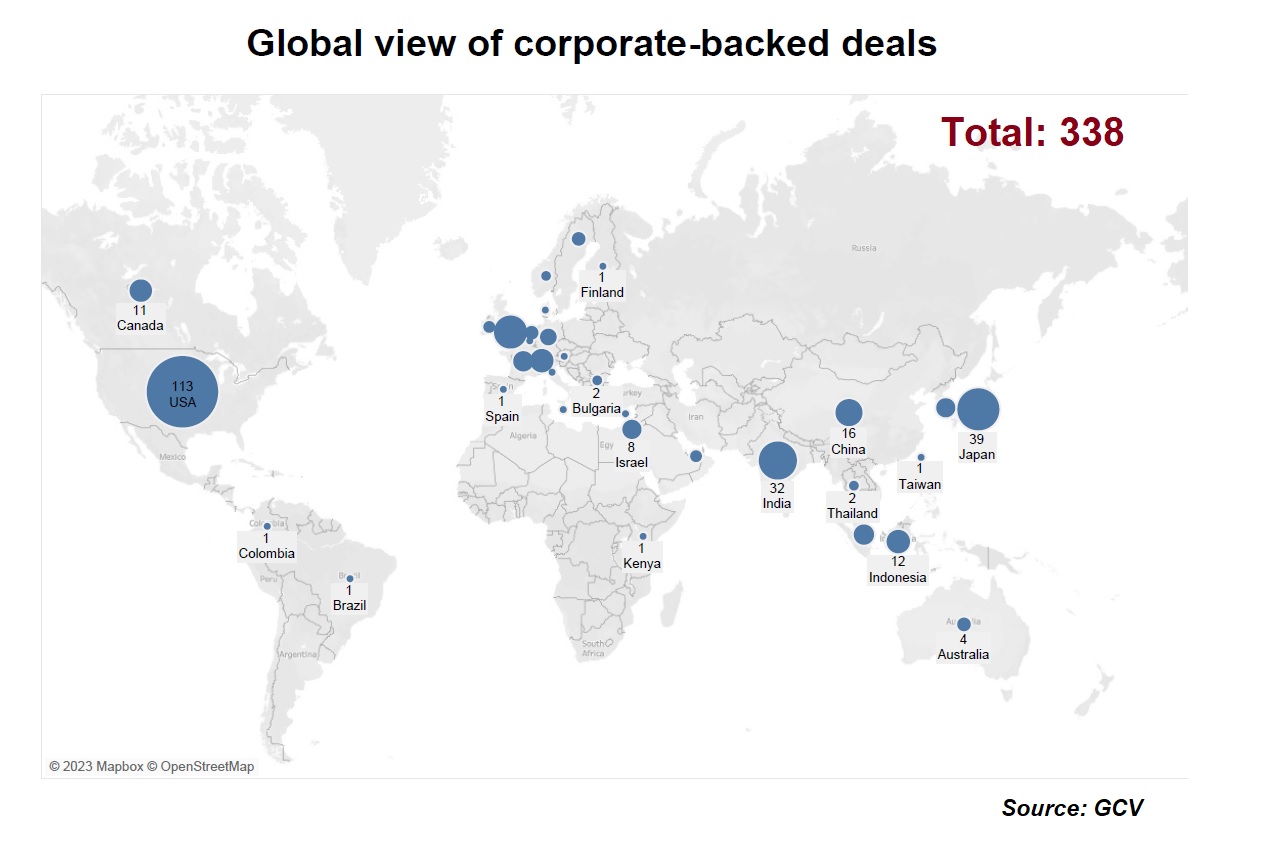

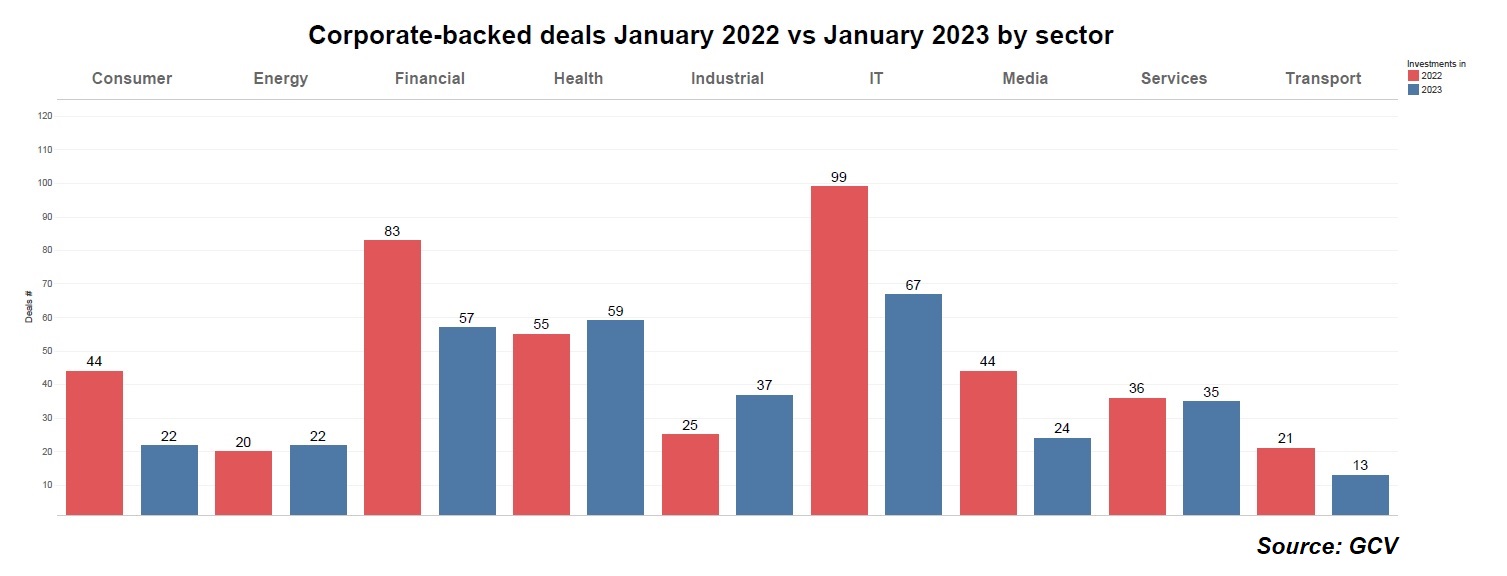

The number of corporate-backed deals from around the globe stood at 338 in January, down 20% from the 427 rounds registered in the same month last year. Investment value stood at $9.51bn in total estimated capital – little more than a third of the $24bn of the same period in 2022.

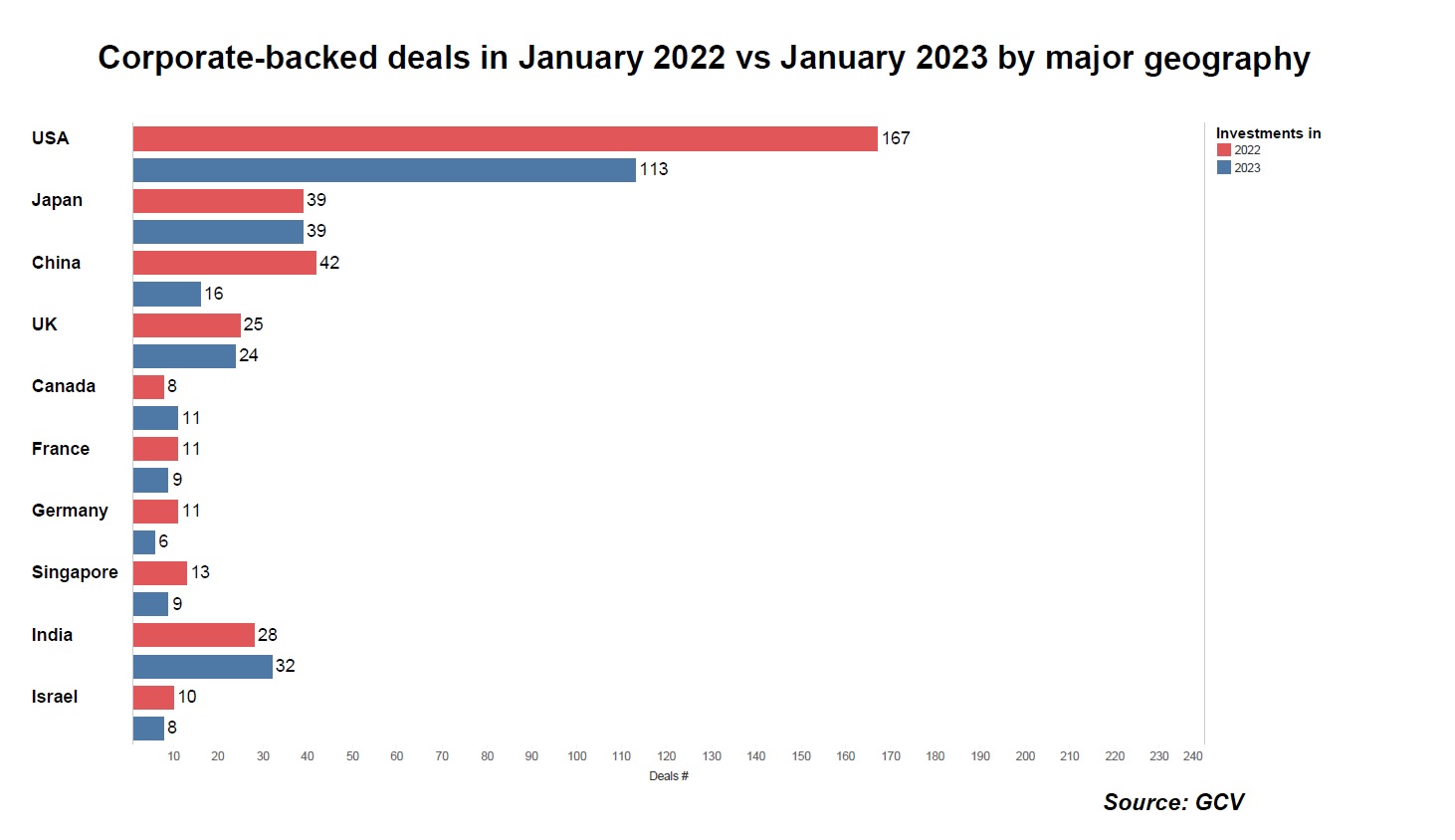

The US came first in the number of corporate-backed deals, hosting 160 rounds, while Japan was second with 39 and India third with 32.

In most of the major venture geographies, there were fewer deals this January than in the same month of the previous year, except for India (only marginally better with 32 vs 28 deals). This may potentially be hinting on some opportunistic investments in emerging innovation regions.

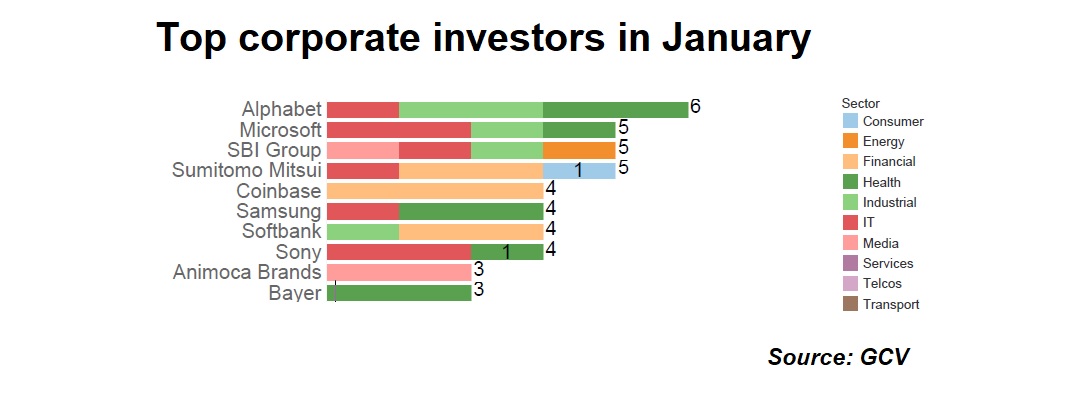

The leading corporate investors by number of deals were internet conglomerate Alphabet, software provider Microsoft and investment firm SBI.

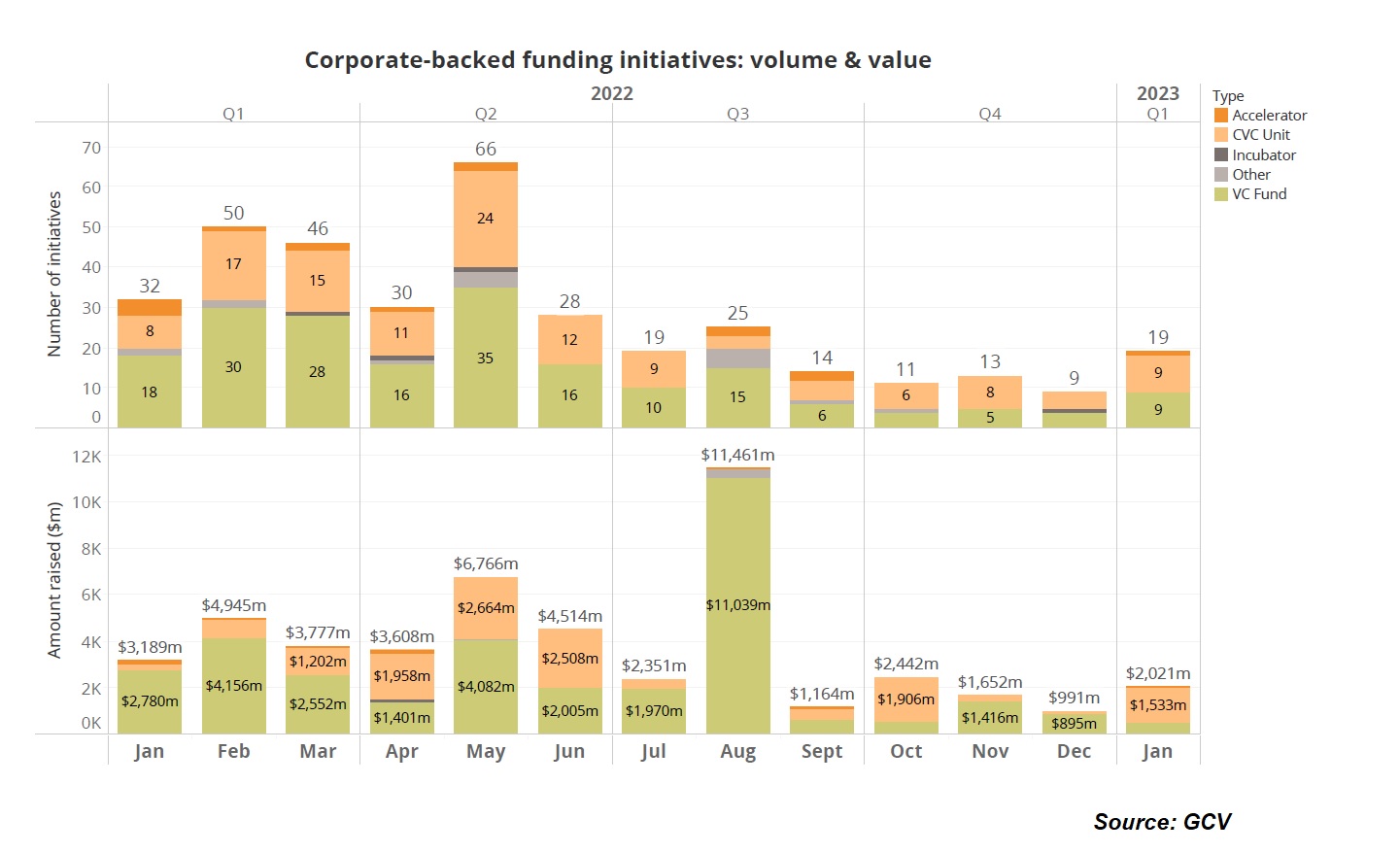

GCV reported 19 corporate-backed funding initiatives in January, including VC funds, new venturing units and incubators. This was a slightly higher number than in previous months but still much lower than the 32 initiatives recorded in January 2022 but higher than the seemingly anemic months of the last quarter of 2022.

Deals

Emerging businesses from every nearly sector raised fewer funding rounds in corporate-backed round this January than in the same month of last year. The notable exceptions were energy and health, which were marginally up and industrial, which was more significantly so (37 deals this January versus 25 last year).

Our definition of industrial includes agriculture and agtech, which is precisely the area that saw more deals during the first month of this year. There were some notable deals in this area, too. US-based soil sensor developer Earth Optics raised $27m series B round backed by a slew of corporates, including Continental Grain, Bayer and CNH Industrial. Indian sustainable perishable developer Ecozen Solutions raised $25m in a Series C round, backed by several banks – Axis Bank, Triodos, HDFC and EximBank.

Also in India, farm monitoring and management platform CropIn raised $13.8m in a round featuring Alphabet. Fresh produce B2B e-commerce platform EdenFarms from Indonesia also received $13.5m in its series A round, backed by Telkomsel.

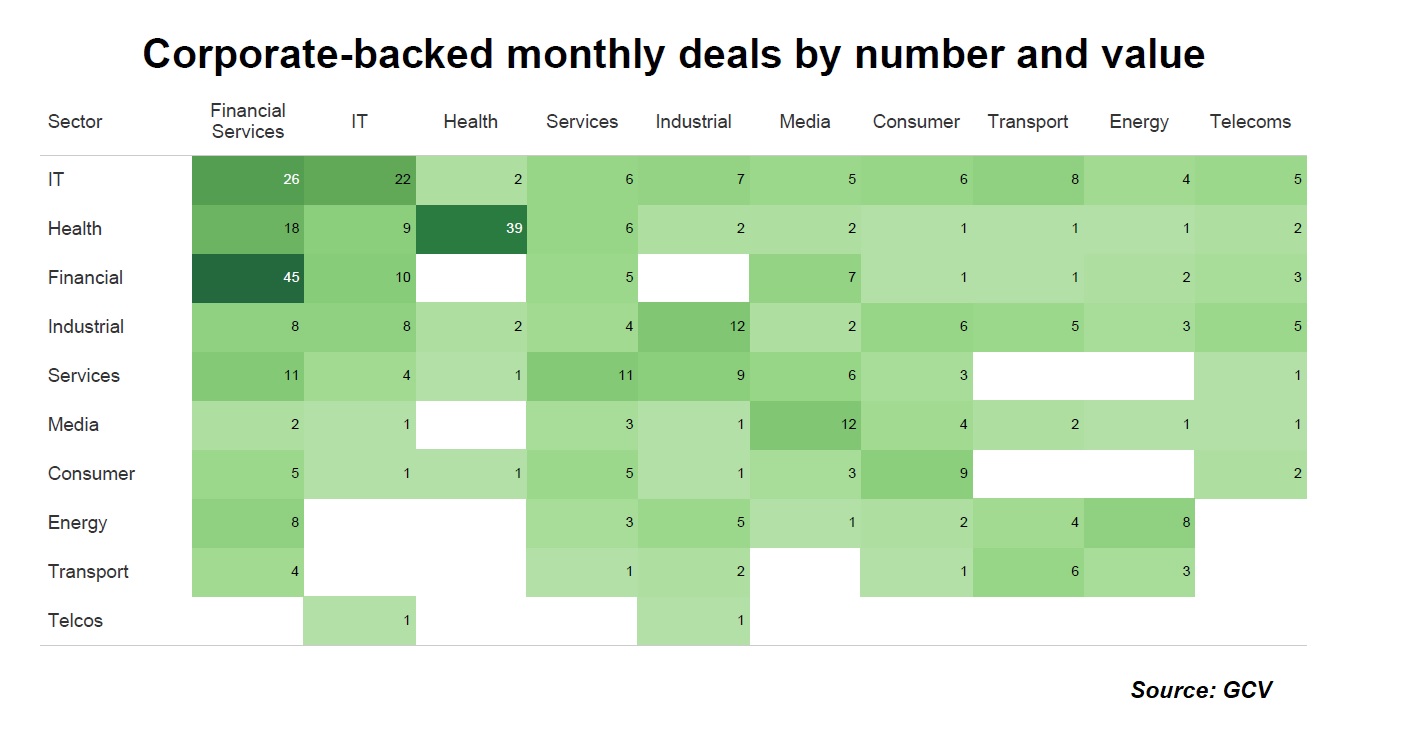

The most active corporate venturers came from the financial, IT, industrial and health sectors, as shown on the heatmap.

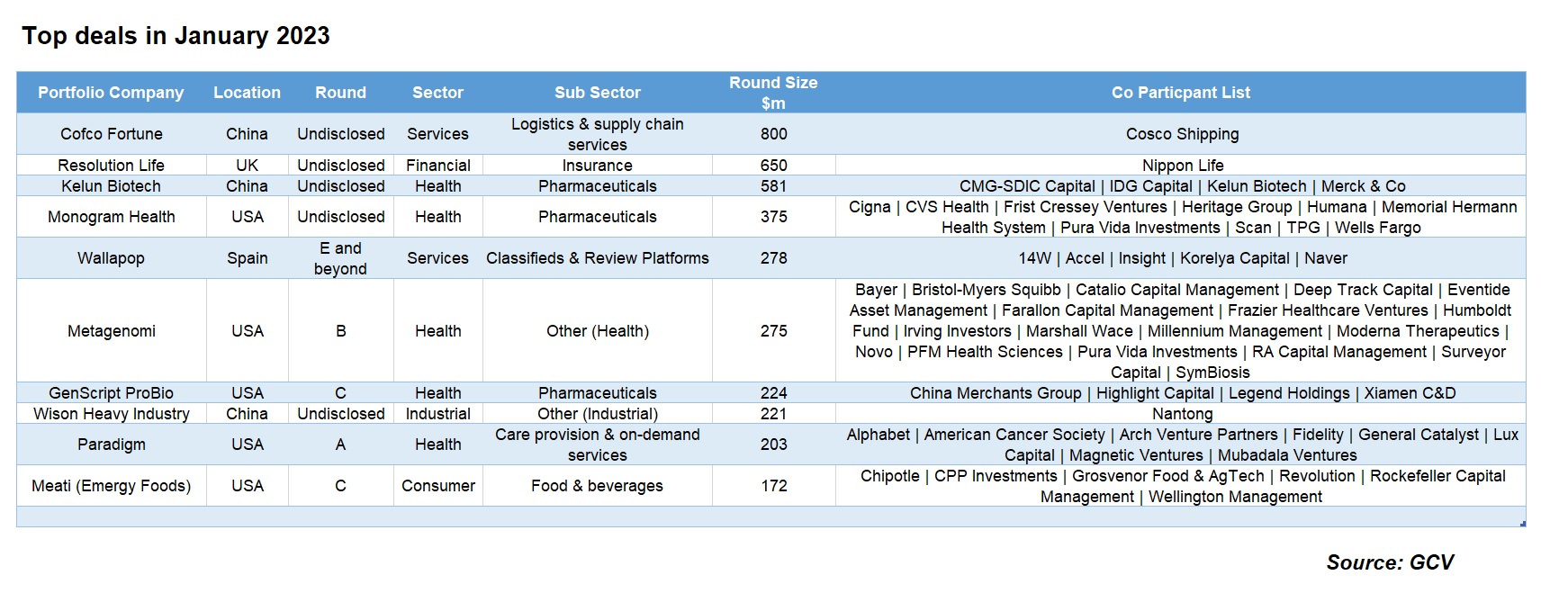

The top deals of January were concentrated in emerging businesses primarily from the life science sectors.

China-based Cosco Shipping agreed to pay 5.5bn yuan ($800m) to purchase a 5.8% stake in Cofco Fortune, a food processing and logistics unit of Chinese state agricultural conglomerate Cofco. The company will explore operations involving resources such as container yards, warehouses and terminal ports, according to Reuters. Other backers of Cofco Fortune include several state-linked entities as well as the asset management arm of insurance firm China Life Insurance.

Bermuda-based life and annuity insurance consolidation business Resolution Life received $650m from Japanese insurance firm Nippon Life, which is a returning investor, having reportedly committed $1.65bn to the company to date. The deal followed an announced strategic partnership between Resolution Life and Blackstone. Blackstone has become Resolution Life’s investment manager for certain areas, including directly originated assets across the private credit, real estate and asset-based-finance markets.

Also in China, small molecule-focused subsidiary of Kelun Pharmaceutical, Kelun Biotech raised $581m funding round featuring its parent Kelun as well as pharmaceutical firm Merck in addition to other investors. Founded in 2016, Kelun Biotech is developing biological therapeutics and small molecules, with a pipeline targeting a range of ailments including cancers, infectious diseases and autoimmune conditions, among other.

US-based home care management service provider for polychronic sufferers Monogram Health raised $375m in a funding round featuring a slew of corporates, including CVS Health, which led the round, Cigna though Cigna Ventures, Humana, Memorial Hermann Health System and Heritage Group. Monogram provides clinical managed services and renal care for kidney disease across 20 US states in addition to in-home nephrology clinical services that are informed by big data technology.

Spanish peer-to-peer e-commerce marketplace Wallapop finished raising its series G round, which reportedly topped at $278m. The round was reportedly led by South Korean search portal Naver, which reportedly participated indirectly through investment from its LP venture capital vehicle, Korelya Capital. Wallapop intends to grow its business with the additional capital.

Pharmaceutical firm Novo co-led the second tranche of Metagenomi’s $275m series B round as gene therapy developers continue to pull in big money. Corporate venture unit Novo Ventures joined peers Bayer (which took part through its Leaps by Bayer unit), Bristol Myers Squibb and Moderna in the round. University of California, Berkeley spinout Metagenomi recovers DNA samples from nature and, using Crispr gene editing technology, reconstructs those cellular systems to treat cancer, metabolic and genetic diseases.

US contract pharmaceutical researcher and manufacturer GenScript ProBio raised a $244m series C round, featuring Legend Holdings (Legend Capital) (lead), Xiamen C&D Corp (C&D No 7 Holdings), China Merchants Group (CTSII Fund); HighLight Capital. GenScript ProBio operates a bio-pharmaceutical contract development and manufacturing organisation, providing life science contract research organization (CRO) services to shorten the timeline for biological drugs and reduce the R&D costs.

China-based subsidiary of energy technology provider Wison Offshore & Marine, Wison Heavy Industry raised 1.5bn yuan ($221m) in a round led by Nantong Industry Investment fund. The fresh capital will be used to finance the upgrade of Liquified Natural Gas (LNG) equipment.

US-based cancer-focused clinical trial management platform Paradigm raised a $203m series A round, which featured internet conglomerate Alphabet through its GV venturing arm. The round was co-led by Arch Venture Partners and General Catalyst. Paradigm is a clinical trials data and patient-matching platform, which aims to open up access to research to boost patient recruitment and speed up drug development.

Mushroom root-derived meat substitute producer Meati raised $172m in a Series C round, led by Revolution/ROTR, putting the company’s pre-money valuation at $530m, featuring restaurant chain. Chipotle Mexican Grill, among other investors. Funds from the deal will be used to expand the production and accessibility of its products.

Exits

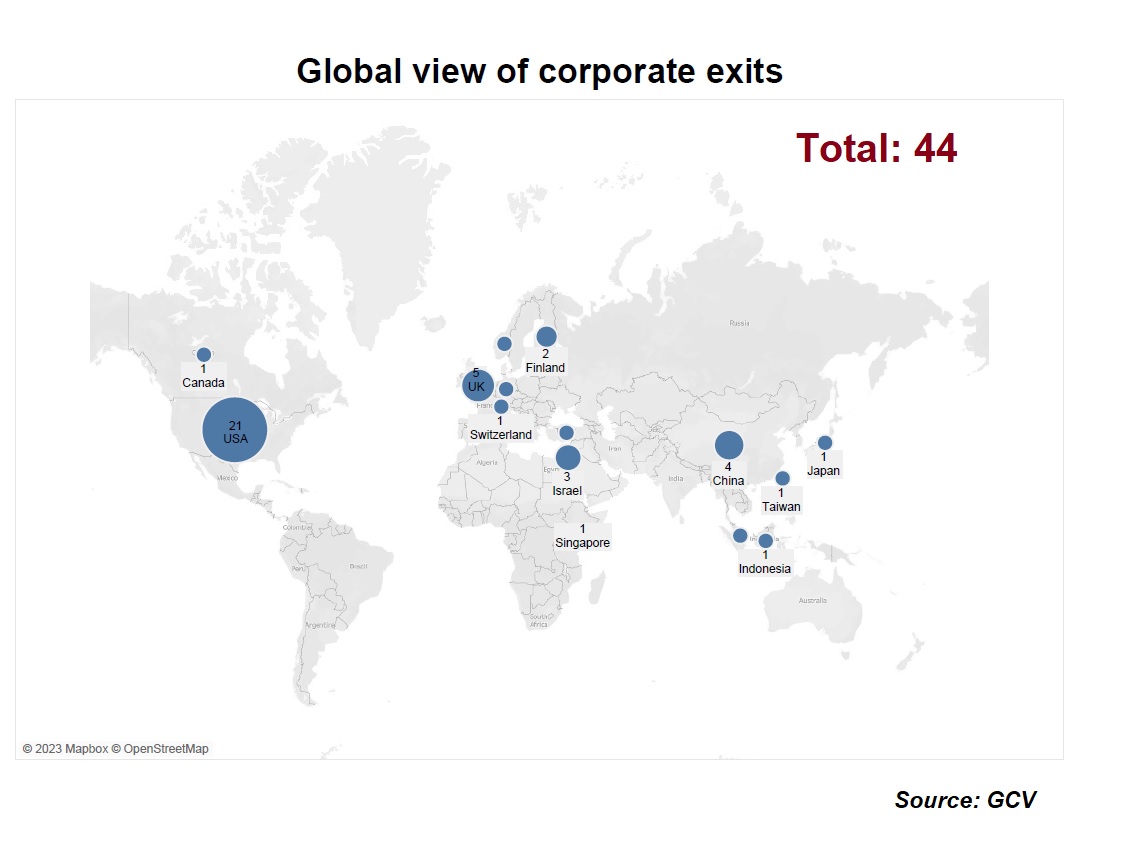

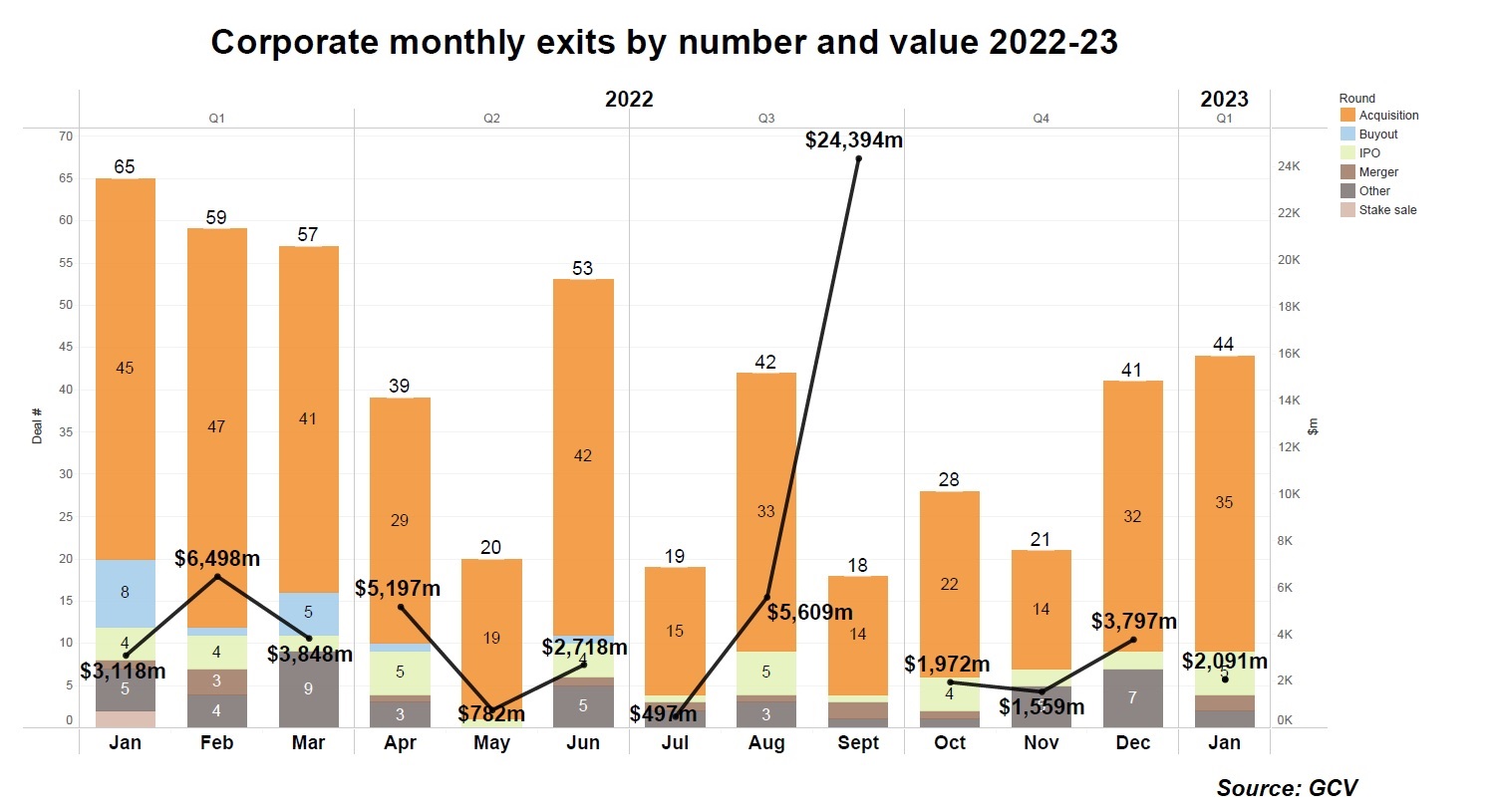

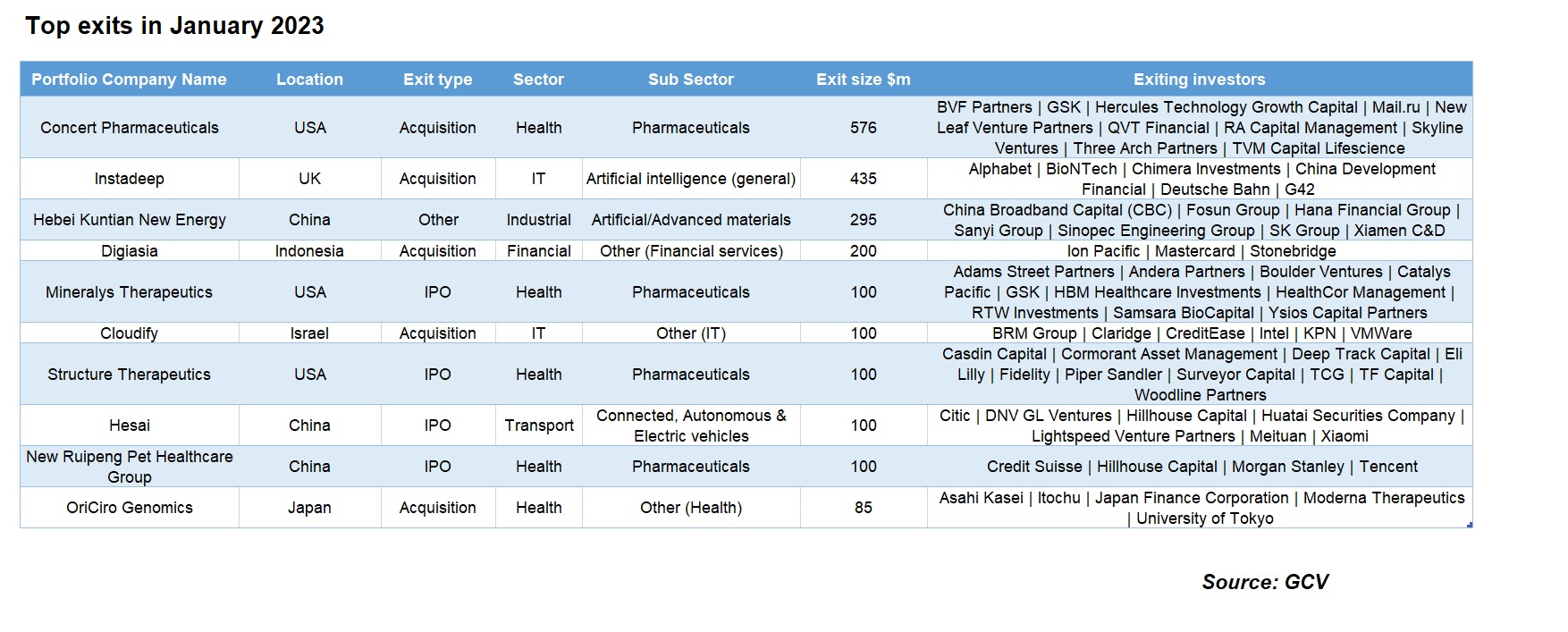

GCV Analytics tracked 44 exits involving corporate venturers as either acquirers or exiting investors in the first month of this year. The transactions included 35 acquisitions, five completed or announced initial public offerings (IPO), two mergers and two other transactions.

The exit count was significantly down from January 2022 figure this year (65) but relatively comparable to that of December last year (41). The total estimated exited capital stood at $2bn.

The figures still continue to suggest that public and M&A markets are not precisely buoyant. However, a good chunk of the top ten exits were concentrated in life sciences.

Sun Pharmaceutical Industries has agreed to acquire Concert Pharmaceuticals, a US-based alopecia areata treatment developer backed by another pharmaceutical group GlaxoSmithKline, for $576m. Concert Pharmaceuticals´ pipeline consists of small molecules designed for oral administration to cure cystic fibrosis, inflammation, narcolepsy, residual schizophrenia, major depressive disorder, and Alzheimer’s agitation.

Pharmaceutical firm BioNTech agreed to pay £362m ($440m) to buy portfolio company InstaDeep, a UK-headquartered developer of artificial intelligence software for decision making. It had raised at least $107m as of a $100m series B in January 2022 featuring internet technology producer Google, artificial intelligence technology provider Group 42 and Deutsche Bahn Digital Ventures, part of public transport operator Deutsche Bahn.

China-based anode materials manufacturer Hebei Kuntian New Energy a $295m pre-IPO round featuring as backers industrial conglomerates SK Group (via its SK China subsidiary), Fosun (Fosun Capital), heavy equipment maker Sanyi Group, Xiamen C&D Corporation in addition to oil and gas producer Sinopec Group and the Hana Financial Group. Hebei Kuntian New Energy makes anodes used in lithium-ion batteries.

DigiAsia Bios, an Indonesia-based embedded financial technology provider backed by payment services firm Mastercard, merged with Nasdaq-listed special purpose acquisition company StoneBridge Acquisition Corporation. Mastercard led a series B round of undisclosed size in 2020, and the latest transaction values the combined business at $500m pre-equity. Digiasia is developing a framework for financial technology providers located in the country.

Cox Enterprises acquired US-based plastics recycling technology developer Nexus Circular for $150m. Nexus had raised undisclosed amounts from sustainable packaging producer Printpack in January 2022 and polyolefin provider Braskem the following month.

Mineralys Therapeutics, a US-based hypertension therapy developer backed by pharmaceutical firm GlaxoSmithKline, filed a $100m IPO on Nasdaq. Mineralys develops novel therapy designed to focus on the field of hypertension and cardiovascular disease.

Computer manufacturer Dell has acquired Cloudify, an Israel-based IT automation software developer spun off by computing technology provider GigaSpaces and backed by corporates KPN, CreditEase, VMware and Intel, for up to $100m, a source familiar with the matter told TechCrunch. VMware, KPN Ventures and CreditEase Israel Innovation Fund were among the investors in a $7m round in 2018.

Biopharmaceutical company Structure Therapeutics, which counts Eli Lilly among its previous backers, filed to raise $100m in an IPO in the US. The company is headquartered in the US but runs R&D operations from China. It seeks to list its American Depositary Shares (ADS) on the Nasdaq stock exchange. Structure Therapeutics Inc is a clinical stage global biopharmaceutical company aiming to develop and deliver novel oral therapeutics to treat a wide range of chronic diseases with unmet medical need.

Hesai Technology, a China-based lidar technology developer backed by corporates Meituan, Xiaomi, ON Semiconductor, Robert Bosch and Baidu, also filed for a $100m initial public offering on the Nasdaq Stock Market. The company’s technology is a smart sensing laser radar for autonomous cars and natural gas leak detection systems, enabling car companies to monitor mixed gas composition.

China-based Ruipeng Pet Group, a pet clinic operator that count internet conglomerate Tencent among its backers, filed to raise $100m in an IPO in the US. Ruipeng runs a network of more than 1,900 pet hospitals across China.

Pharmaceutical firm Moderna has agreed to pay $85m to acquire OriCiro Genomics, a Japan-based developer of cell-free synthesis technology, allowing trading group Itochu and pharmaceutical company Asahi Kasei to exit. Coprorate venturing arm Itochu Technology Ventures had taken part in a $7.3m series B round in mid-2021 that increased the total raised by OriCiro to $10.9m, before Ashai Kahei added an undisclosed sum in June 2022.