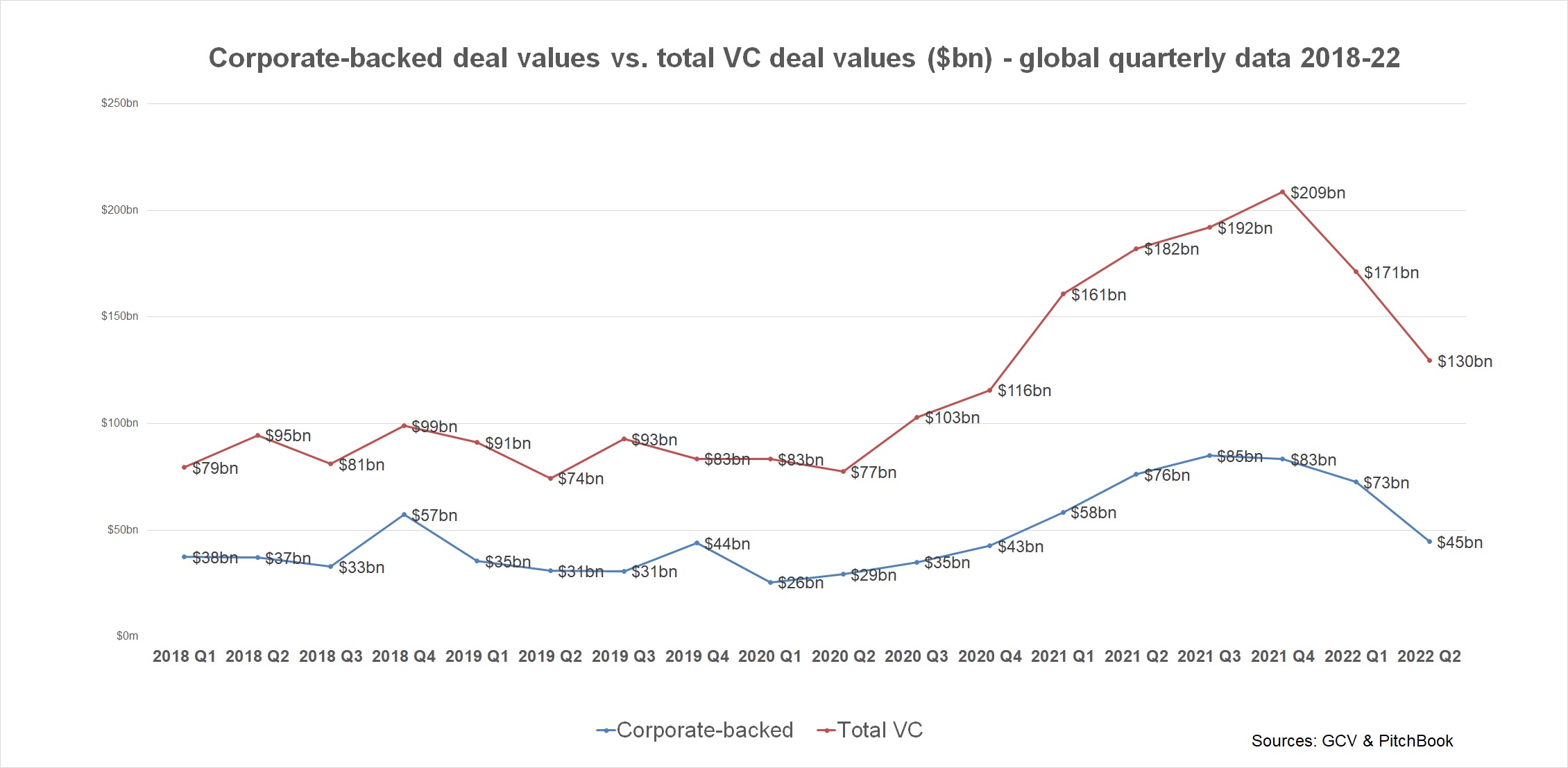

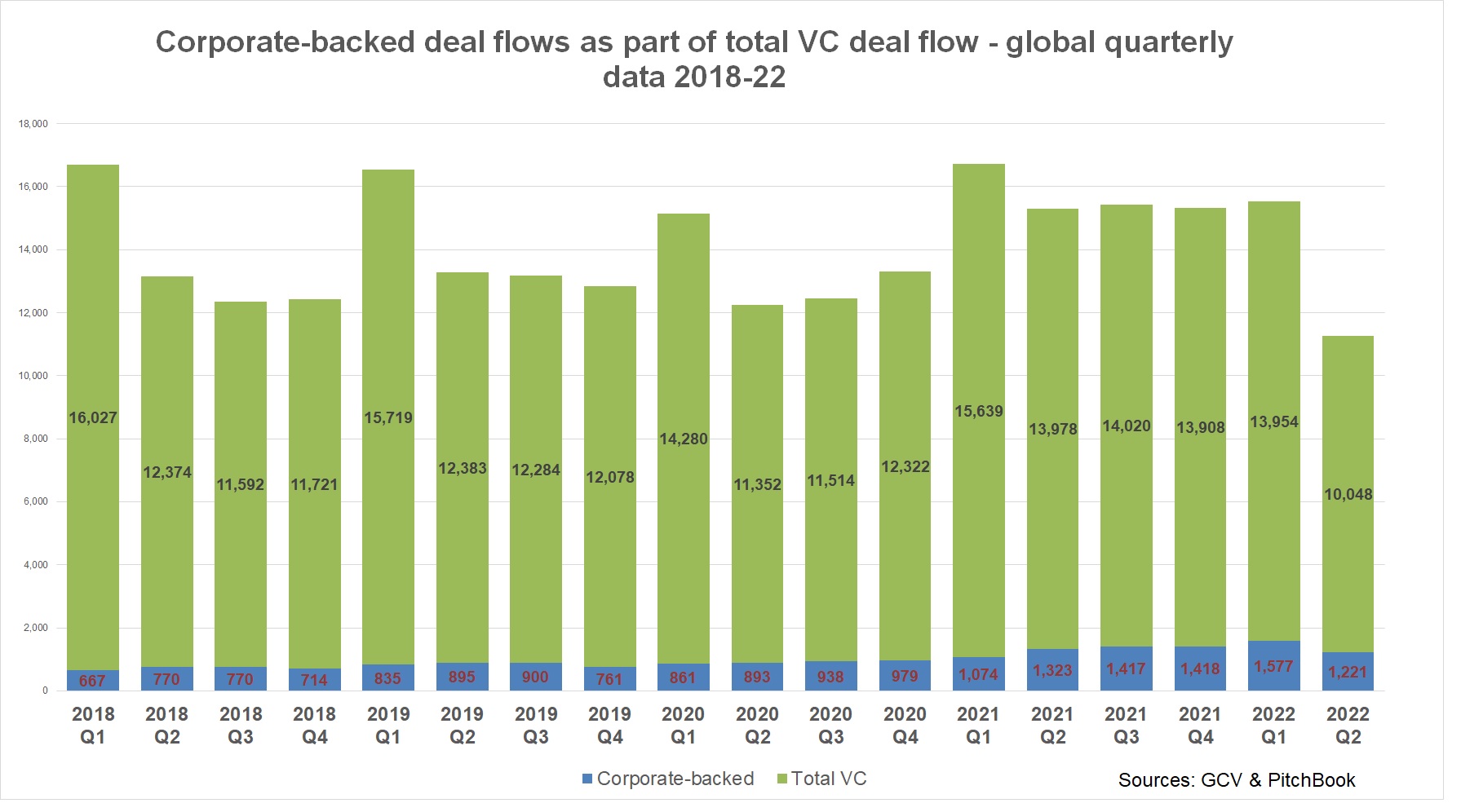

Corporate venture activity dropped noticeably in the second quarter, with the number of rounds involving a corporate backer down 8% from the same period last year. The total value raised in those rounds was down 42% from the year-ago period.

The drop in the number of deals is much smaller, however, than for the overall VC industry, which has seen a 30% decline in the number of rounds in the second quarter. The overall value of VC investments, however, fell just 28.5% in Q2.

In short: corporates appear to be much more constant investors as the downturn begins to hit, but they are migrating to smaller deals and far lower deal values.

Rising inflation, a commodities crunch, war in Ukraine and geopolitical tensions, mounting fears of a recession and monetary authorities around the globe continuing to switch course – have cooled investment activity, with numbers starting to show at the end of Q1 and now clearly visible in the April to June period.

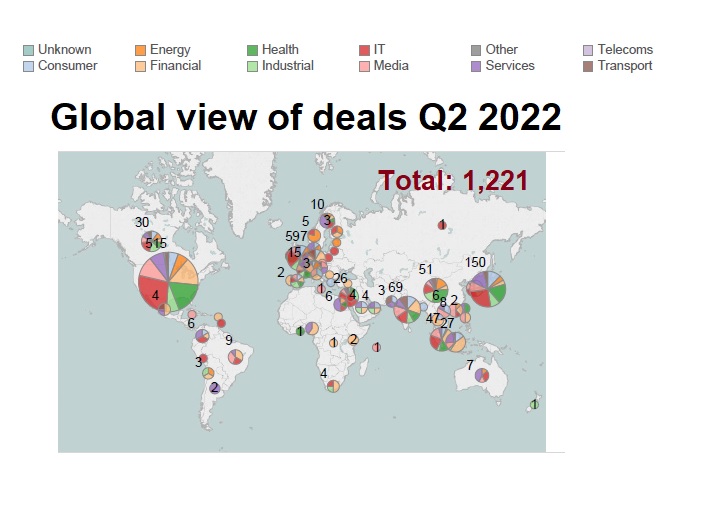

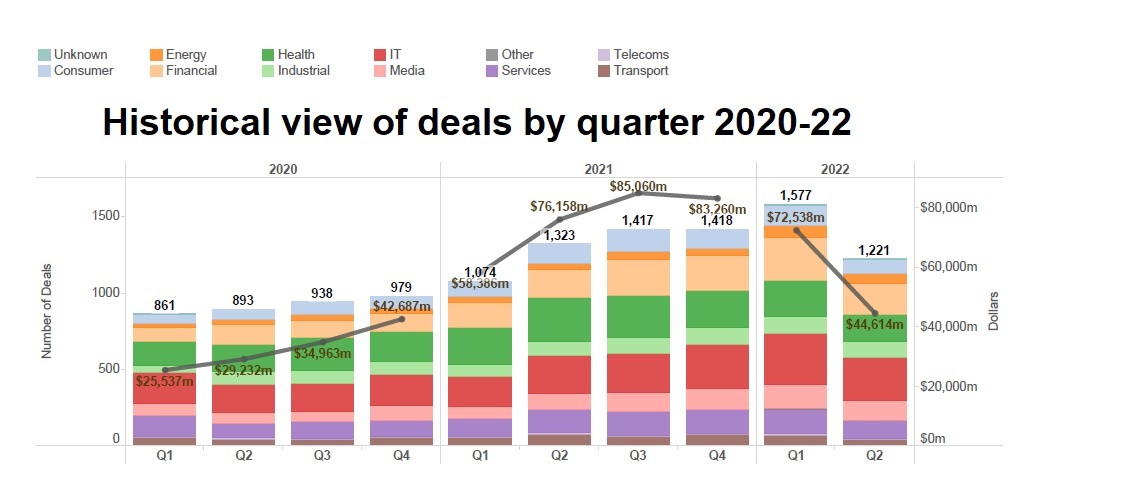

GCV reported 1,221 funding rounds involving corporate venturers during the second quarter of this year, compared with 1,323 rounds recorded in Q2 2021. The estimated total investment dollars stood at $44.61bn, down 42% from the $78.16bn recorded during the same period last year.

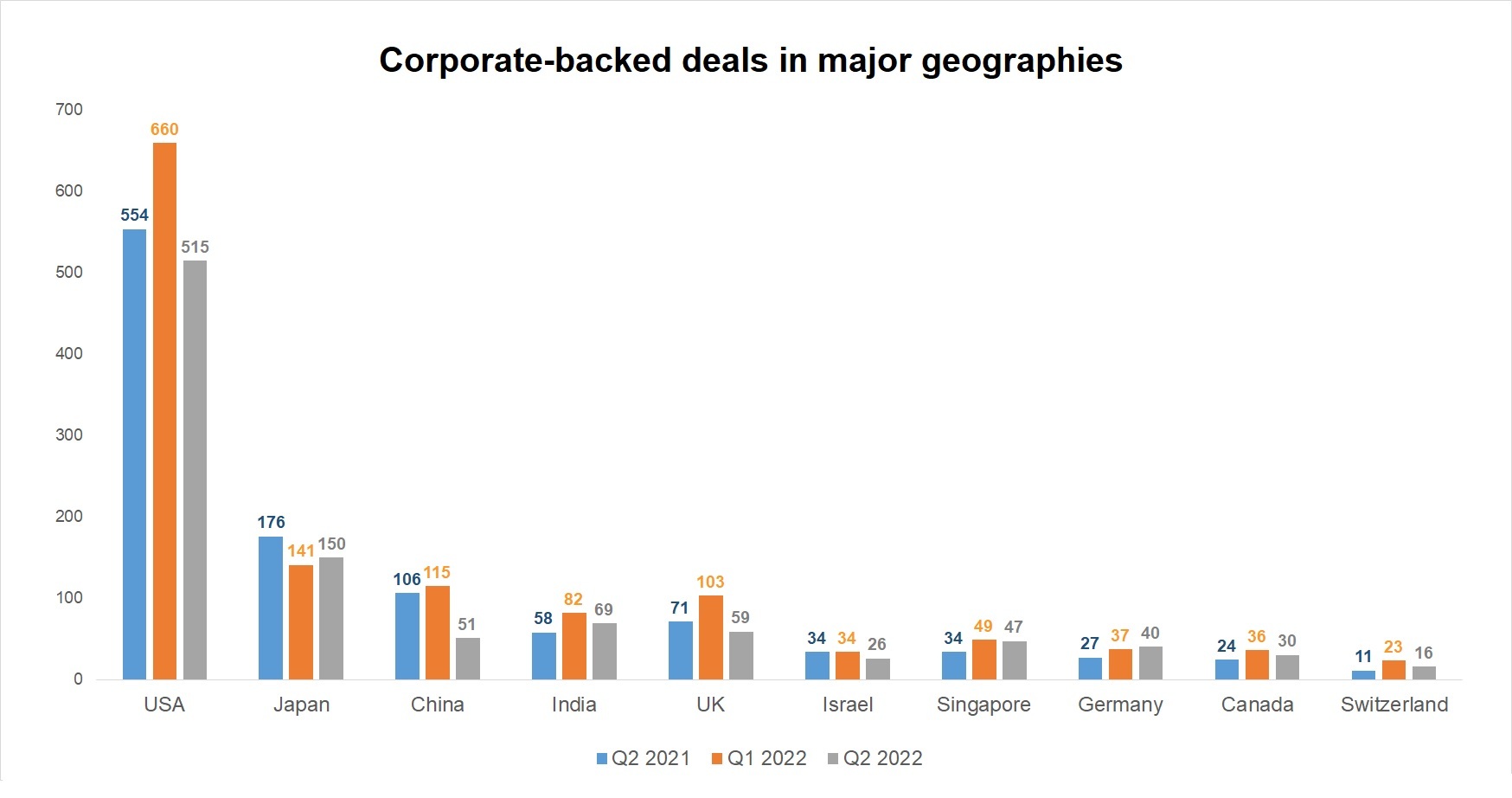

The number of deals in China halved, from 106 in the second quarter of 2021 to just 51 in the latest three-month period. The number of deals in markets like the US, UK and Japan have also fallen but by a smaller percentage. Deal numbers up, albeit from a smaller baseline, in Germany, Singapore and Canada.

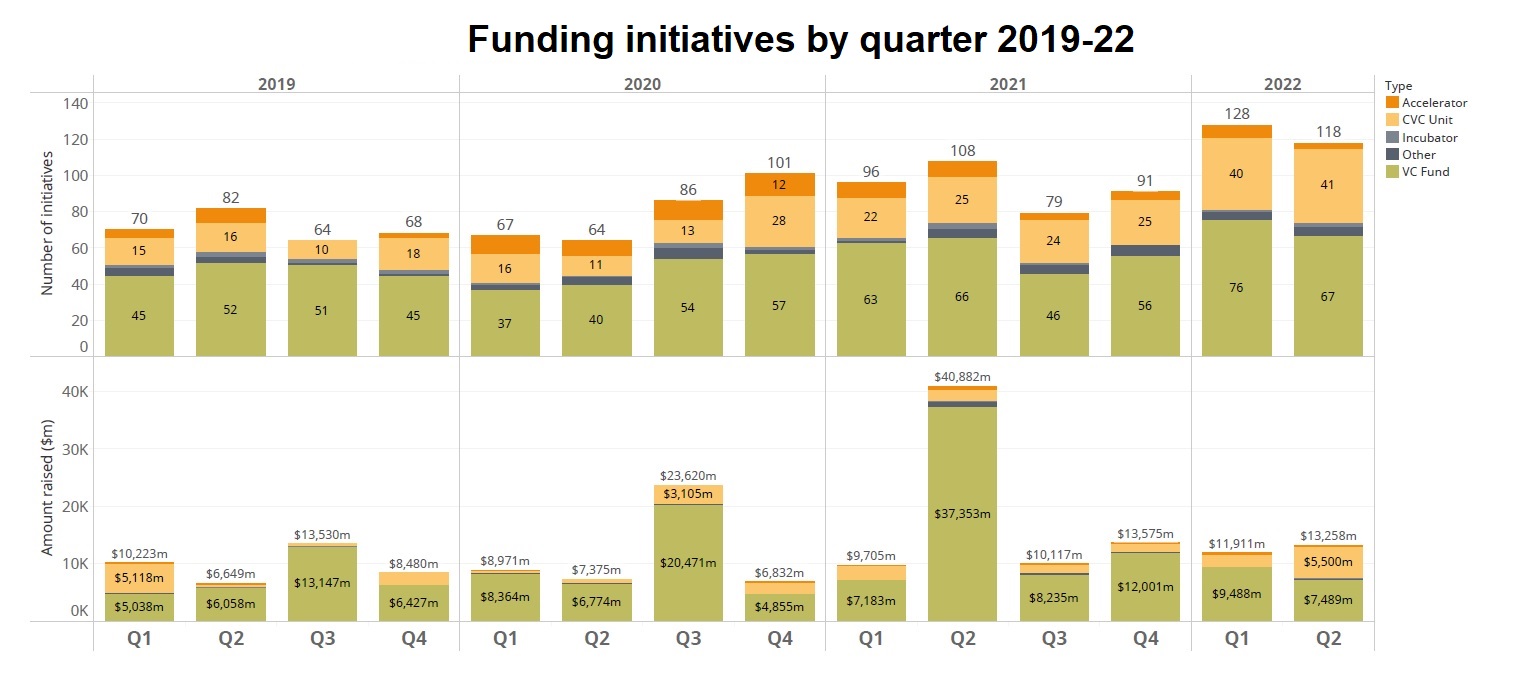

One positive is that investment units are continuing to raise new funds. This is far from being a boom and there are no outsized multi-billion initiatives, but activity has remained relatively stable (at least for the moment). Investors, both corporate and non-corporate VCs, which have reaped profits during the bull market of 2020-21 may be redeploying these in new funds — putting the industry in an enviable position to ride along the next cycle.

The other key trends we noted:

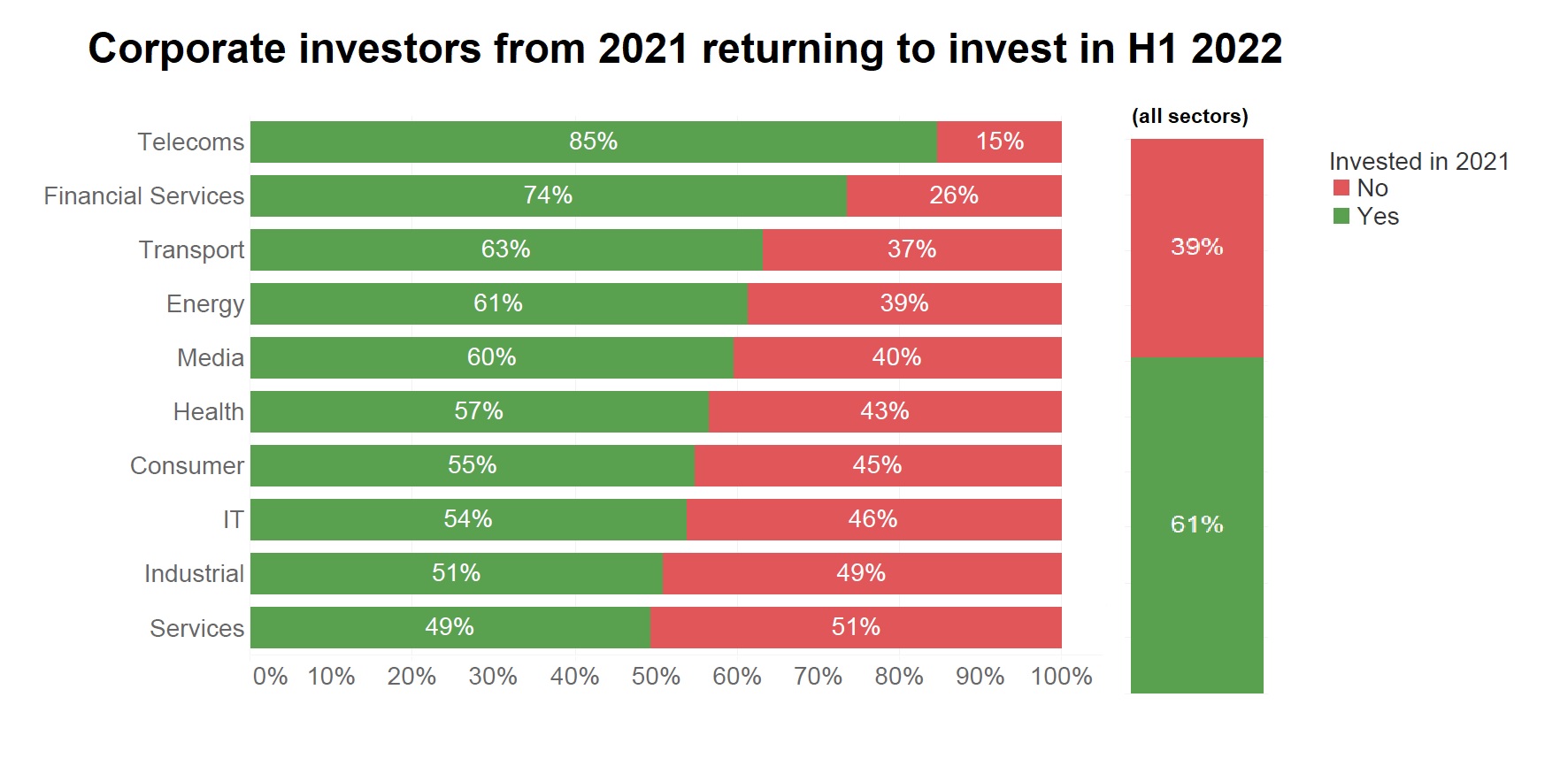

- Corporate investors are coming back for more deals. Roughly six out of every 10 corporate investors (61%) that had participated in at least one minority stake round last year returned as investors during the first half of 2022.

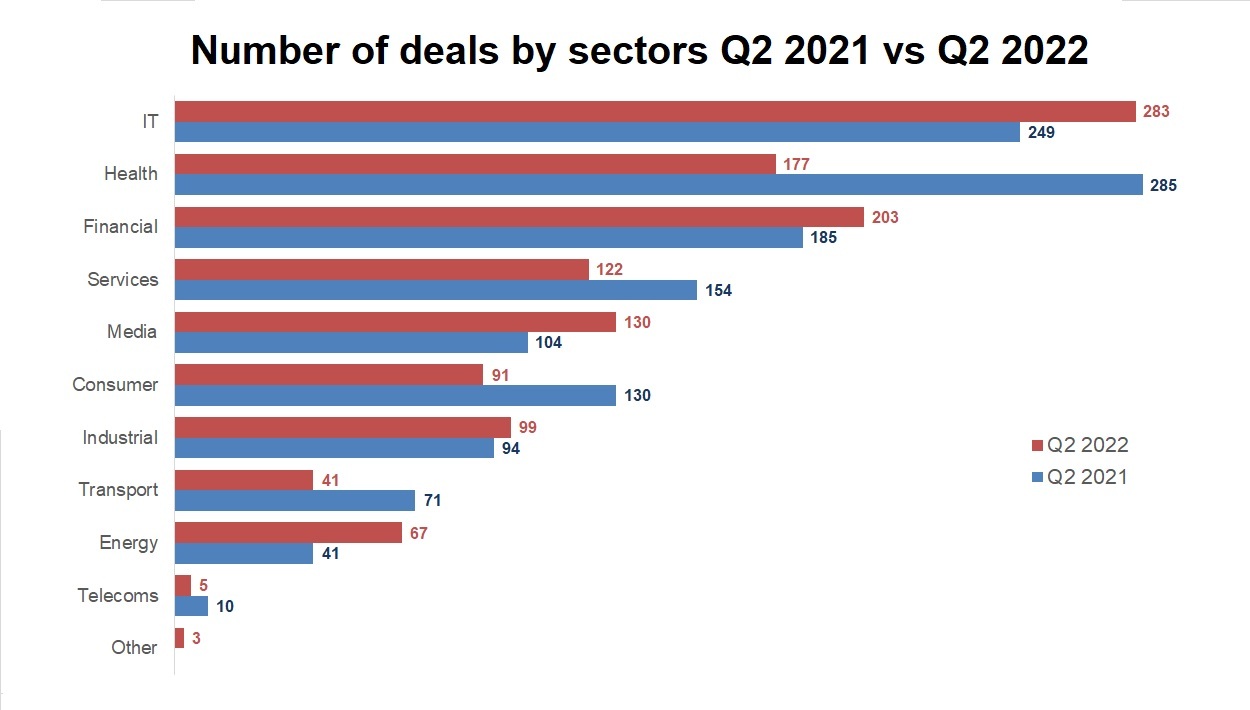

- The number of deals grew in sectors like IT and financial services. But there was a 28% drop in the number of healthcare deals compared to 2021.

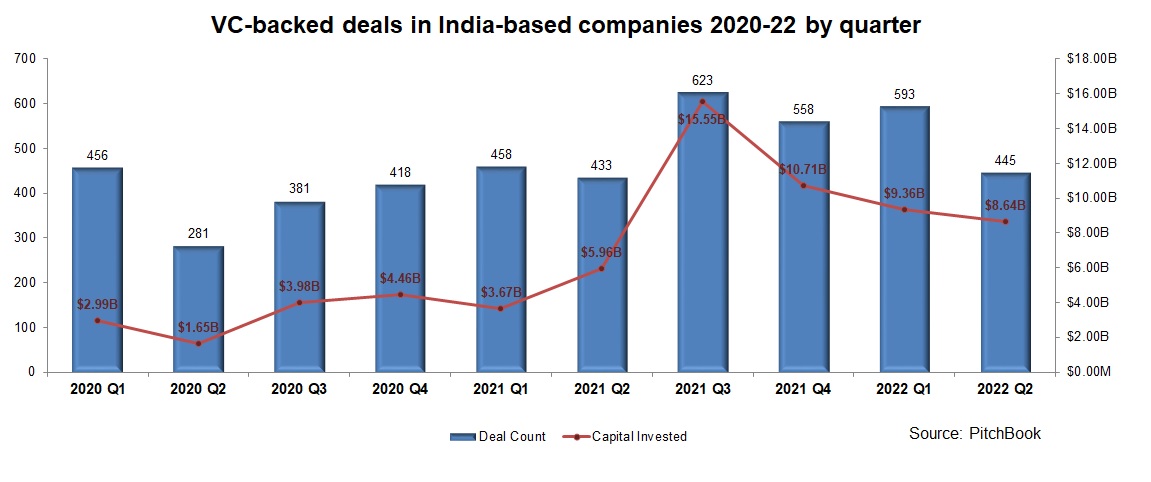

- The Indian ecosystem is one of the more stable amid the general slowdown. Two of the most notable exits in June were for Indian companies – the acquisition of grocery delivery service provider Blinkit (outlined below) and the $70m buyout of API fintech infrastructure company Setu. Investors are also committing more funds to India. One example is Bertelsmann India launching a new $500m fund to invest in early-stage startups in the country over the next five years.

A big drop in deals from Q1

When comparing Q2 2021 with the previous quarter, there was a drastic 23% drop in the deal count, down from the 1,577 in Q1. Estimated total investment also plummeted to $44.61bn, down 39% from $72.54bn.

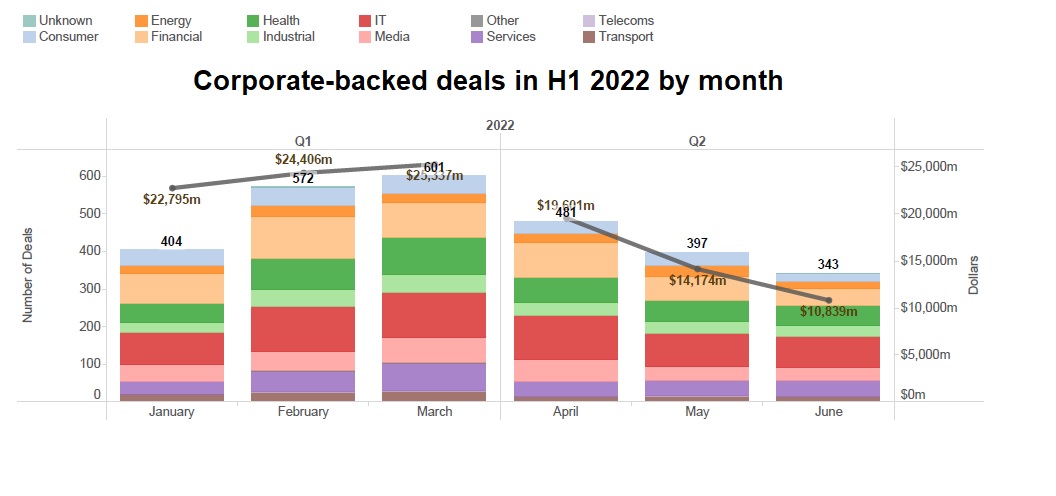

If we look at the H1 data on a monthly basis, the decline is clearly becoming more evident during the second quarter, with a particularly pronounced slowdown in June. In fact, there were no deals or exits sized $1bn or higher. This is a clear indication of the slowdown, as the world – not merely the US as being the most developed and active VC market – has been seeing a boom of unicorns and decacorns, especially in the past few years.

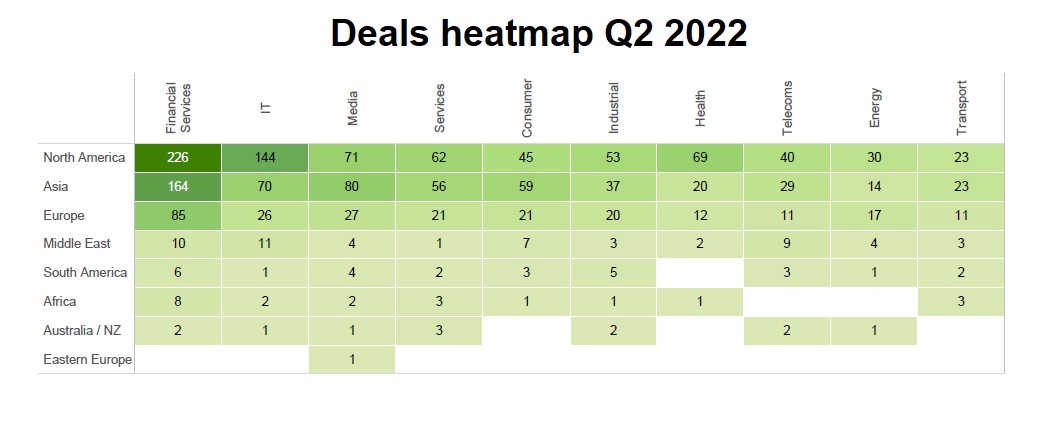

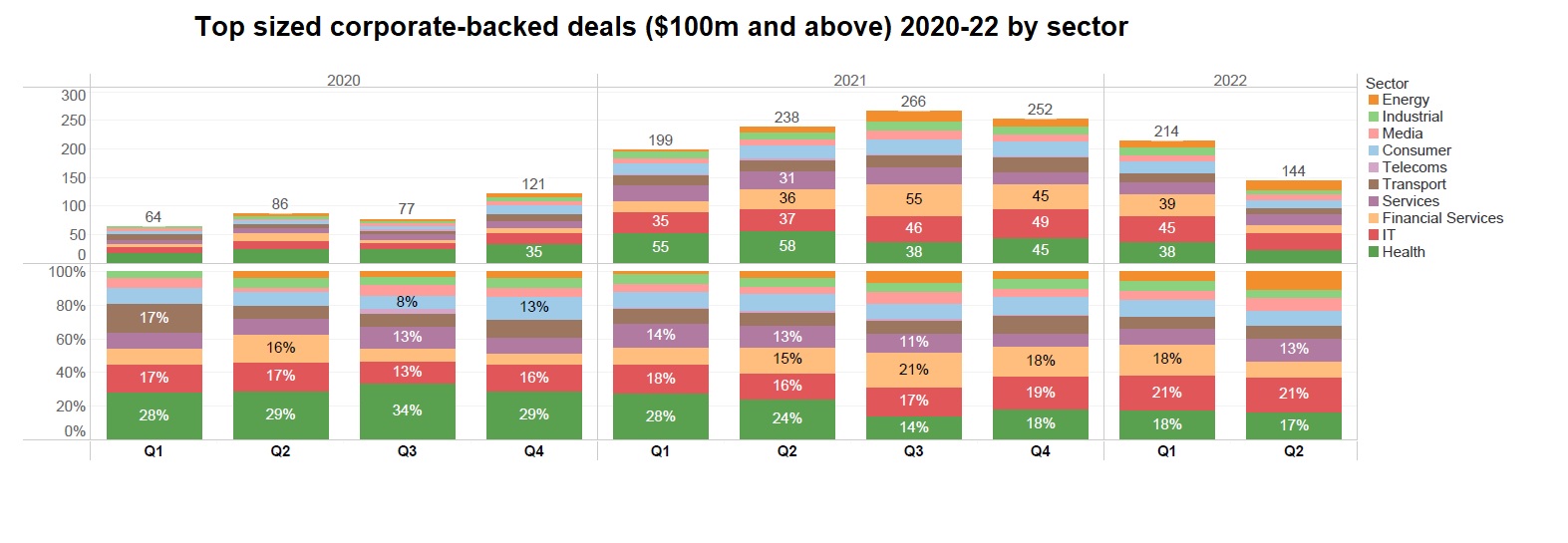

Emerging enterprises from the IT, fintech and health sectors proved to be the most attractive for corporate venturers, accounting for more than 170 deals each. The top funding rounds by size, however, were raised by companies from a variety of sectors.

The most active corporate investors, in turn, came from the financial, IT, media and financial services sectors, as shown on the deal heatmap.

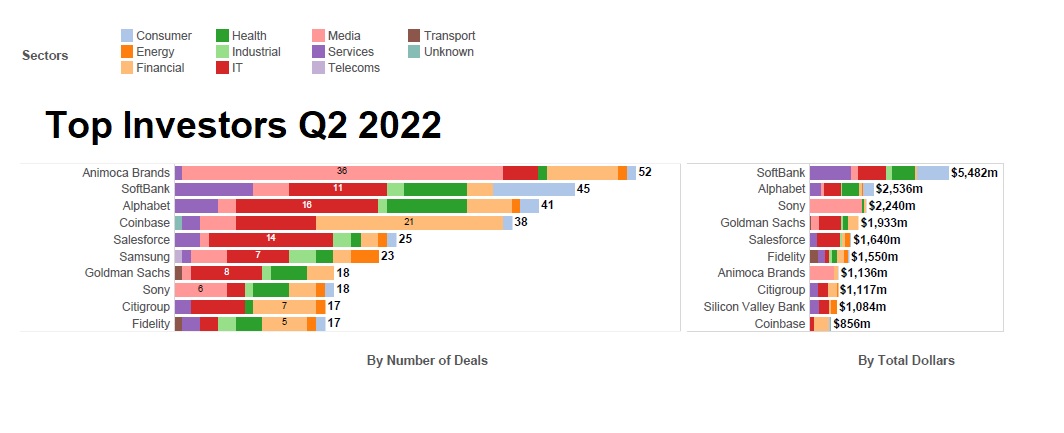

The leading investors by number of deals were gaming and blockchain technology group Animoca Brands, diversified telecoms and internet conglomerate SoftBank and internet conglomerate Alphabet. The list of corporate venturers involved in the largest deals by size was headed also by SoftBank, Alphabet and electronics producer Sony.

Our data also suggest that, overall, roughly six out of every 10 corporate investors (61%) that had participated in at least one minority stake round last year returned as investors during the first half of 2022. In some sectors, notably, the proportion of returning investors is actually higher – telecoms (85%), financial services (74%) and transport (63%). This indicator is a decent proxy of the longer-term commitment of corporate investors to venture investing and their portfolio companies.

Previous downturns have seen corporate venture units pull back from investment activity, earning them a poor reputation among startups. However, this pattern of behaviour does not seem to be happening this time — or at least it is not apparent in the second quarter numbers.

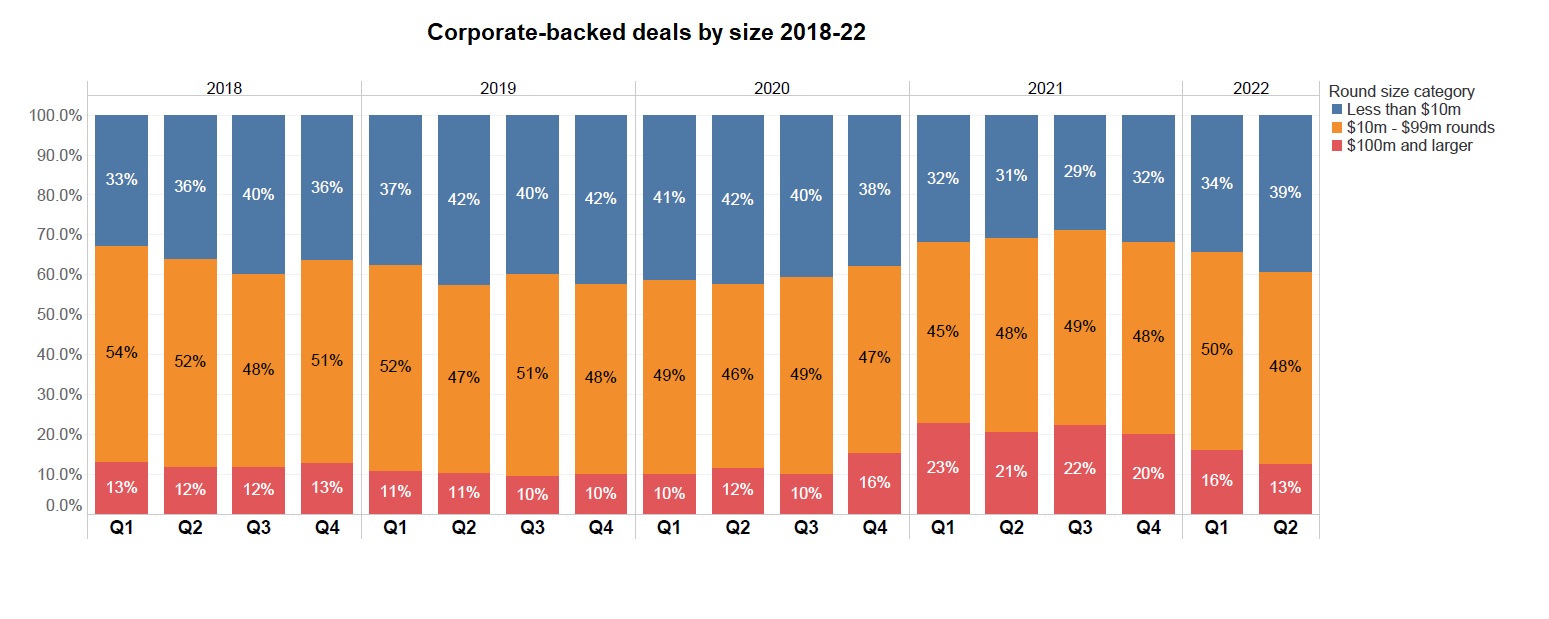

Another interesting indicator to look at are the relative proportions of small (>$10m), medium ($11–$99m) and large (>$100m) deals. As the following graph illustrates, in all quarters of 2021, the relative share of large deals, above $100m in size, increased significantly versus the previous years and stood between 20% and 23%. This was a clear hint that valuations of more corporate-backed companies had surged significantly, reaching unicorn status. In Q2 of 2022, that figure stood at 13%, down from 16% in Q1, which makes it reasonable to suppose with more certainty that there is a cooling off of the heated upward trend in valuations seen before.

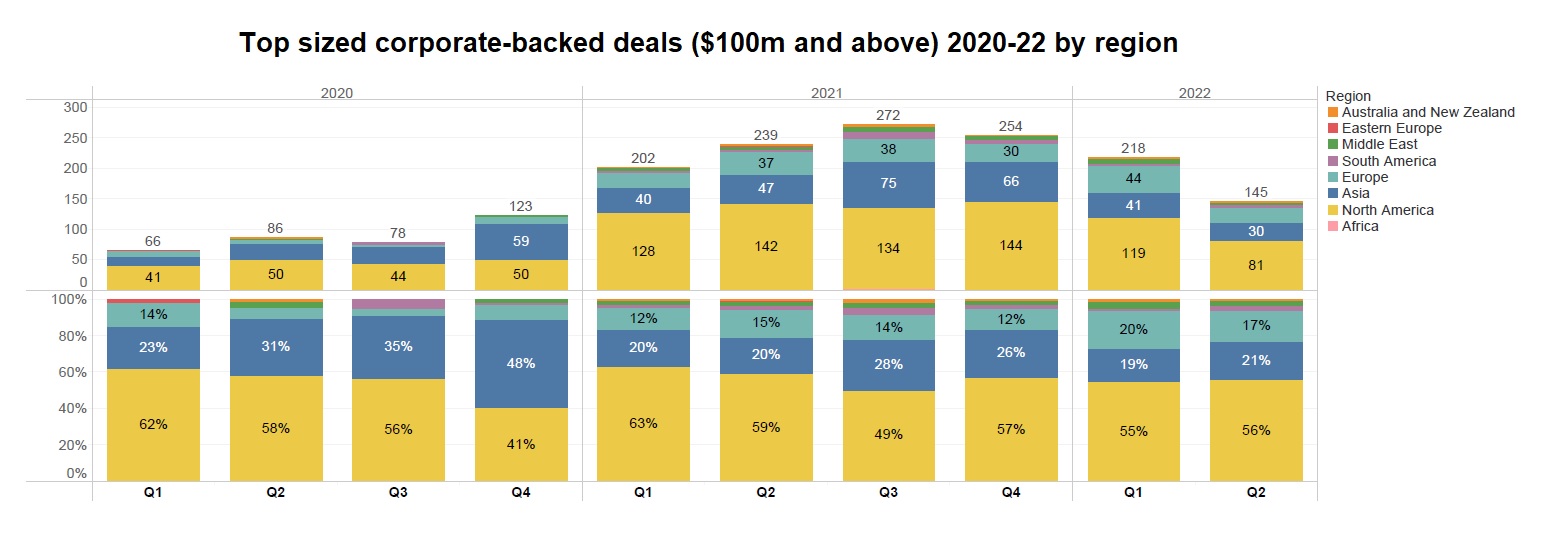

The upsurge in valuations, which started in the last quarter of 2020 and accelerated through 2021, was concentrated in North America (though not limited to it), particularly in the US, which accounted for 50-60% of all large deals in 2021. This continues to be case even through the correction of 2022.

There is no a specific concentration of such large deals in a particular sector, as most sectors have been broadly retaining their relative share over time. All these observations continue to apply during the first half of this year, even though the number of large rounds within the corporate deal flow is ostensibly decreasing in comparison with previous quarters.

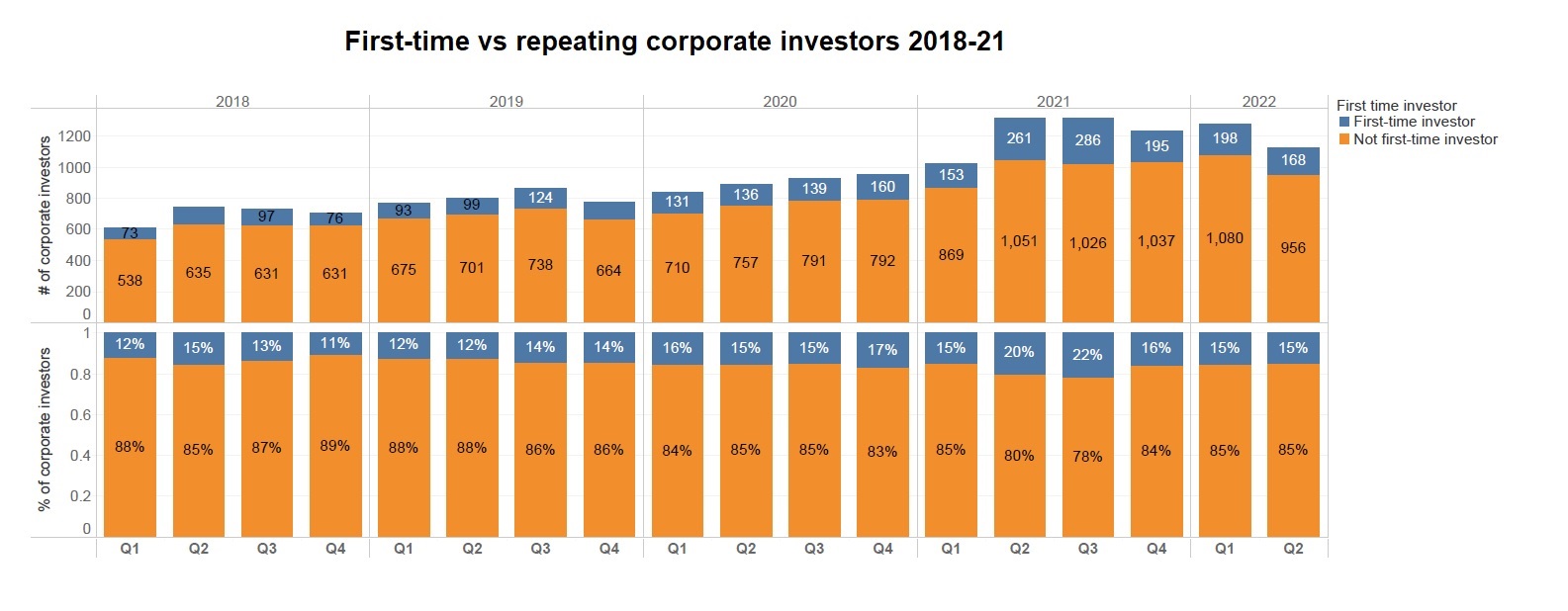

Most of the corporate investors taking minority stakes during the first quarter were investors that have done at least one deal before (85%). However, roughly two out of every 10 (15%) corporates were disclosing their first minority stake deal during this quarter. There appears to be a trend of newcomers to venturing – whether having a specific venturing unit or not – comprising roughly a fifth to a quarter of all corporate investors, from 2018 onwards. We are yet to see if this trend will be sustained and if the corporate venturing community withstands headwinds it is likely to find ahead.

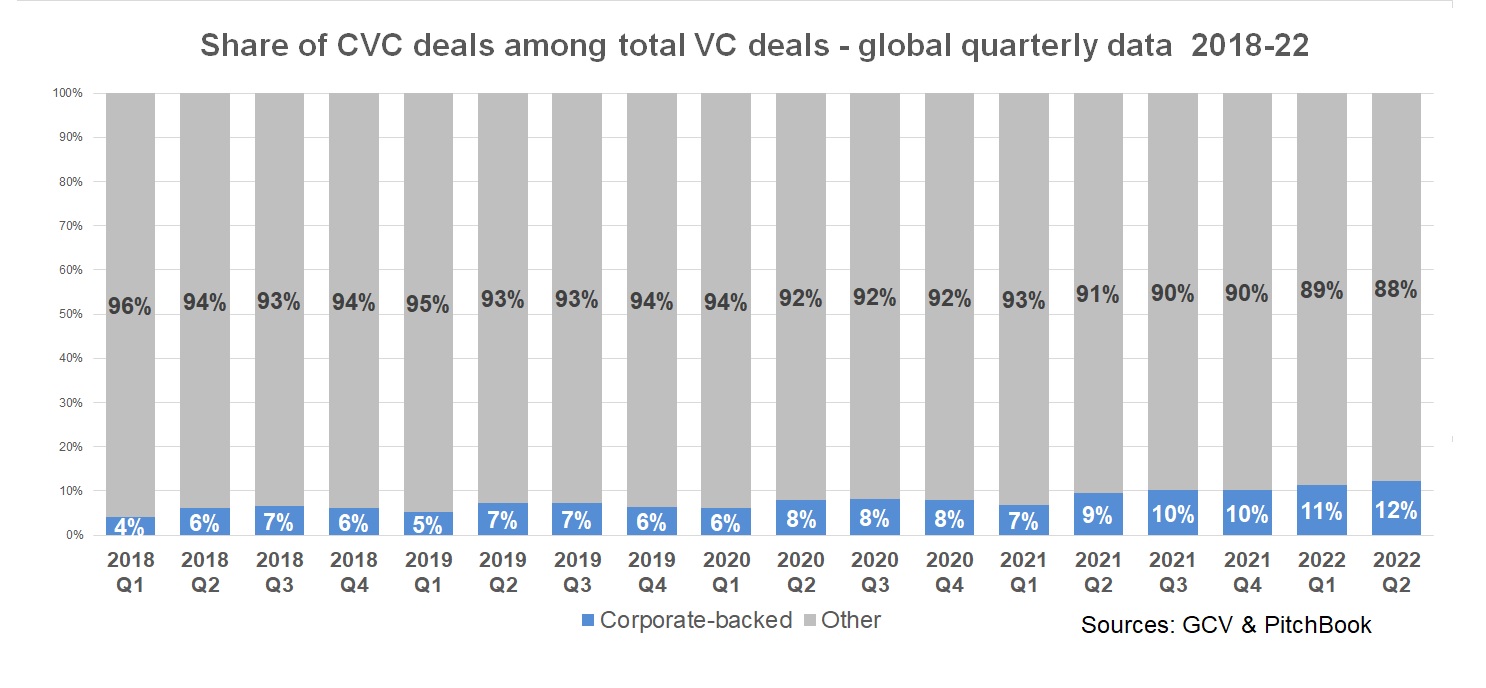

It is also worth monitoring how corporate venture investors stand in comparison with their traditional VC peers. According to PitchBook, data provider on private capital market data, overall venture capital activity globally appears to be slowing down noticeably in Q2 (10,048 deals) when compared to the previous quarters or the same period in 2021 (13,978), implying a nearly 30% decrease.

Similarly, data from both PitchBook and GCV suggest that total capital deployed (and valuations respectively) dropped significantly during Q2 in both corporate-backed rounds and all VC rounds.

One major innovation geography that is of particular interest and undergoing interesting developments is India. Two of the most notable exits in June in fact were in India-based companies – the acquisition of grocery delivery service provider Blinkit (outlined below) and the $70m buyout of API fintech infrastructure company Setu.

How has the overall VC space in India fared most recently, though? According to PitchBook’s data, it has not been immune to the slowdown seen in the second quarter, as the graph below illustrates. Even so, the deal flow has remained fairly stable and heightened since the outbreak of the covid pandemic. While it may not be correction-proof, it is not unreasonable to suppose it will likely continue to be one of the most interesting innovation geographies to corporate venturers going forward. Particularly, when we have seen an outside corporation ready to invest half a billion into this geography (see the note on the Bertelsmann India Fund below).

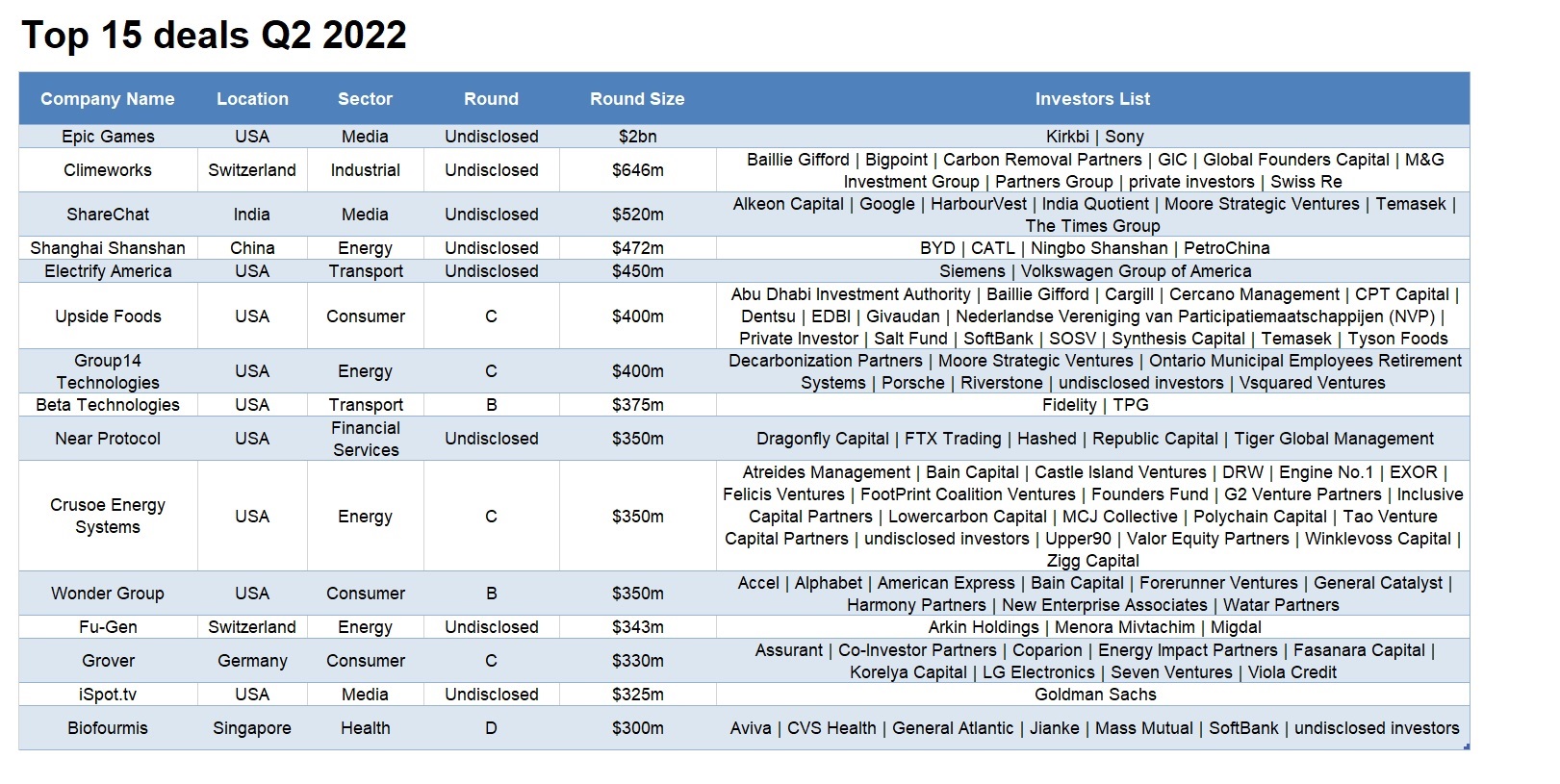

Biggest deals

Most of the funding from the biggest rounds reported in the second quarter went to emerging enterprises from the media, energy, transport and consumer sectors. However, only one of the top 15 rounds stood above the $1bn mark.

- Consumer electronics group Sony joined Kirkbi, the parent company of toy brand Lego, to each invest $1bn in US-headquartered video game producer Epic Games at a $31.5bn valuation. Epic is the developer of game franchises including shoot-em-ups Gears of War, Unreal and Fortnite, the battle royale shooter, which had generated over $9bn in revenue in its first three years of release and added Marvel characters for its latest season. All the company’s games make use of Unreal Engine, a proprietary game engine it also licenses to other developers. The engine has been used in game series such as Mass Effect and Batman: Arkham Asylum.

- Climeworks, a Switzerland-based carbon capture technology provider spun out of ETH Zurich, agreed to raise CHF600m ($646m) of equity funding from investors including reinsurance firm Swiss Re. Partners Group and GIC are co-leading the round, which also features Baillie Gifford, Carbon Removal Partners, Global Founders Capital, M&G, BigPoint Holding and private investor John Doerr. Climeworks has developed technology designed to pull carbon from the air and has 15 such systems in use, having launched what it describes as the world’s largest direct air capture and storage facility in Iceland in September 2021.

- ShareChat raised a $300m funding round, backed by Alphabet, media company Times Group and Singaporean state-backed investor Temasek. The transaction valued the Indian social media platform at $5bn. This was Google’s second investment in Indian short video platforms, having taken part in a $100m round for Josh, which competes with ShareChat’s sister company Moj. Following India’s permanent ban of video platform TikTok and 58 other Chinese apps after a deadly confrontation at the countries’ Himalayan border, domestic rivals like Moj and Josh have gained popularity. ShareChat operates a social media platform available in 15 local languages and dialects, currently boasting 180 million monthly active users.

- China-listed lithium battery provider Ningbo Shanshan was among the investors that provided RMB3.05bn ($472m) in funding for its Shanghai Shanshan Lithium Battery Material Technology subsidiary. Electric vehicle manufacturer BYD and battery producer Contemporary Amperex Technology (CATL) also took part in the round, along with oil and gas supplier PetroChina’s Kunlun Capital unit and CATL-backed vehicle Wending Investment, at a valuation of $1.5bn. Formed in 2014, Shanghai Shanshan develops and manufactures lithium-ion battery anodes and carbon materials. Ningbo Shanshan itself began life as an apparel vendor in 1992 before eventually pivoting to energy transition.

- US-based charging station maker Electrify America, a subsidiary of carmaker Volkswagen, raised $450m in a deal that included its first external investor, industrial conglomerate Siemens. The transaction valued the company and its EV charging network at $2.45bn. Siemens provided more than $100m of the capital, with the remainder coming from Volkswagen. Founded in 2016, Electrify America has developed electric vehicle chargers intended to promote electric vehicle adoption. The company is building infrastructure and energy management solutions for such vehicles and the fresh funding will help it double its footprint to 10,000 ultra-fast chargers across 1,800 charging stations throughout the US and Canada by 2026.

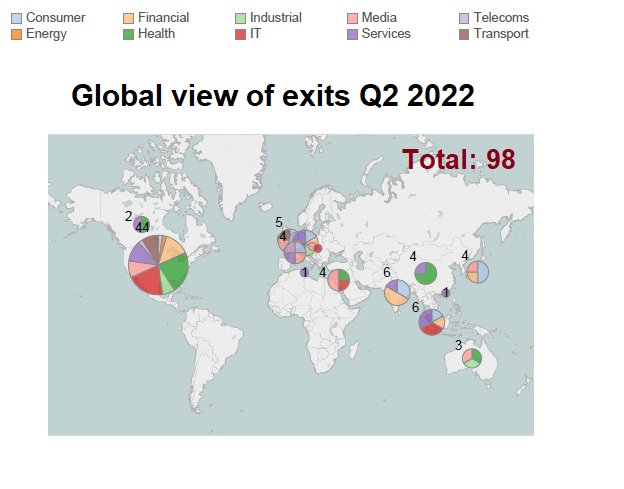

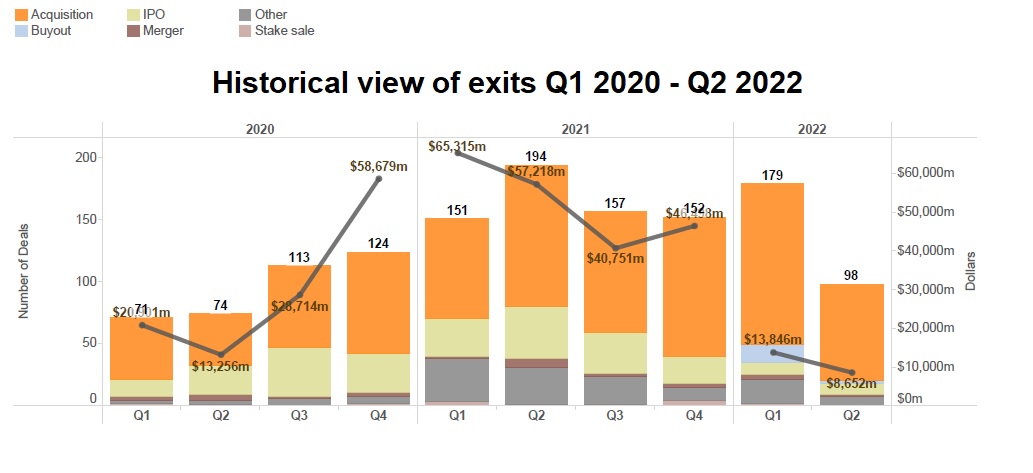

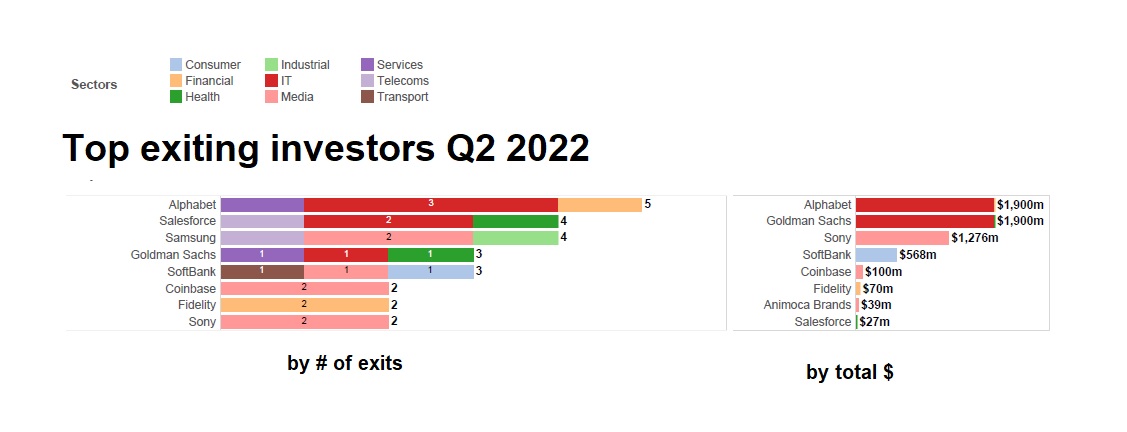

Exits

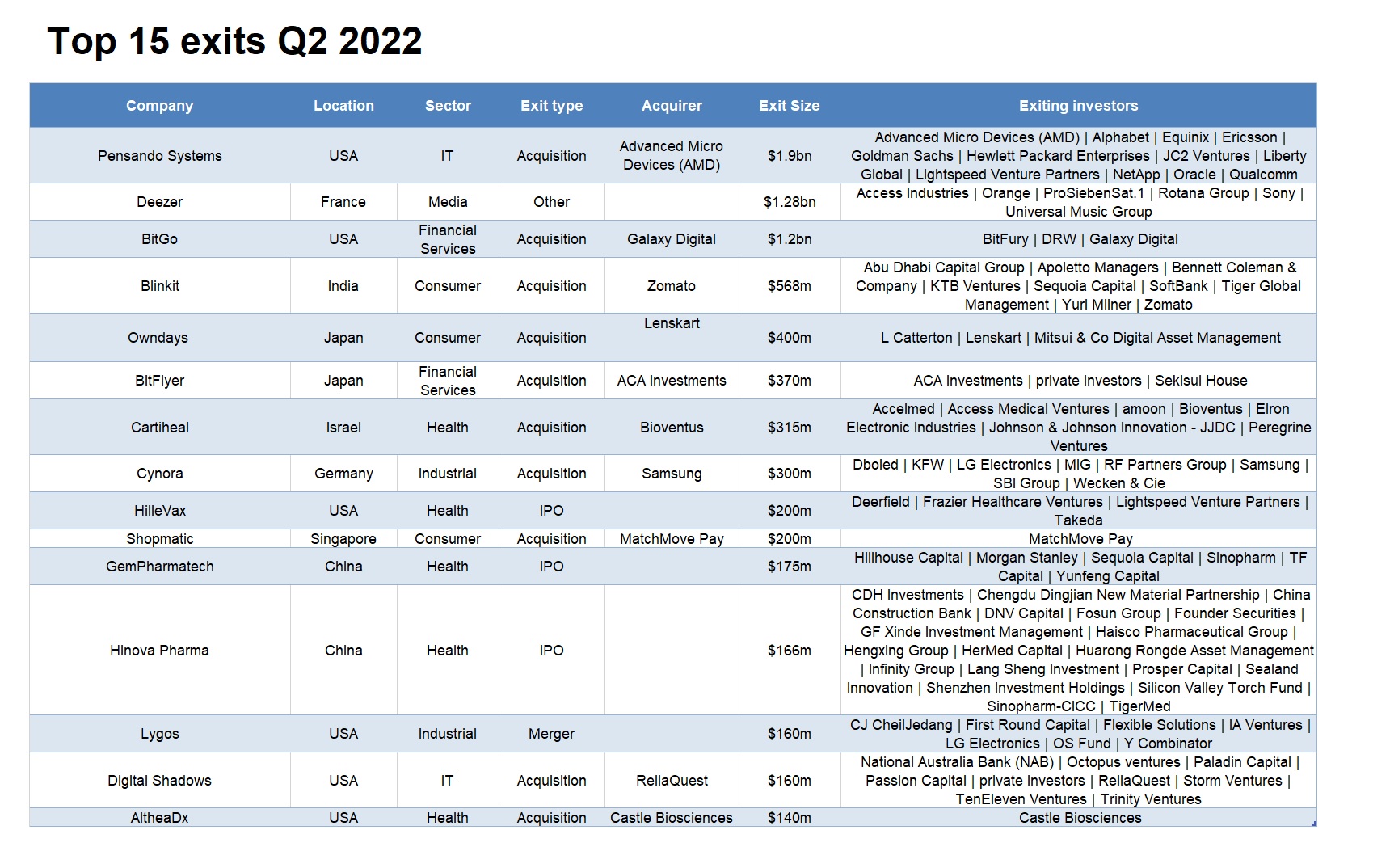

GCV Analytics tracked 98 corporate-related exits during the second quarter of 2022, including 78 acquisitions, eight other transactions (mostly reverse mergers with Spacs), nine initial public offerings (IPOs), two buyouts and one merger (of equals). Top exiting corporates this quarter included Alphabet, cloud enterprise software provider Salesforce and electronics maker Samsung.

The total estimated amount of exited capital in Q2 2022 was $8.65bn, only a fraction of the $57.22bn registered in Q1 of the previous year. Only three out of the top 15 reported exits stood above the $1bn mark and one of the top acquisitions was a significant markdown (see comments on Blinkit below). All this suggests a continuing slowdown in exits, which is not entirely unexpected, as both public and M&A markets have been languishing due to non-accommodative monetary policy, with rate hikes to address high inflation rates.

- Semiconductor producer AMD agreed to acquire US-based edge computing technology provider Pensando in a $1.9bn deal allowing corporates Hewlett Packard Enterprise (HPE), Equinix, Alphabet, Ericsson, NetApp, Oracle, Liberty Global and Qualcomm to exit. Pensando has developed a distributed, programmable processor and software platform to help customers’ existing network architecture function more like cloud networks in order to support high-velocity applications. The company claims its technology yields eight to 13 times better performance than competitive products, and the purchase would help AMD compete with the likes of Nvidia and Intel’s data centre chip businesses.

- Deezer, the France-headquartered online audio streaming service backed by corporates Access Industries, Orange, Rotana, ProSiebenSat.1, Universal Music Group (UMG), Sony and EMI, agreed to list through a reverse takeover. The company is set to join forces with I2PO, a special purpose acquisition company that floated on the Euronext Paris market in July 2021, in a deal valuing it at €1.05bn ($1.13bn) pre-money. The transaction will be boosted by approximately $146m in private investment in public equity (PIPE) financing from investors including conglomerate Access Industries and its Warner Music subsidiary, fellow record company UMG, publisher Media Participations and telecoms firm Orange. Deezer runs an online platform which allows users to stream music and audio content such as podcasts through a freemium model. It had 9.6 million paying subscribers as of the end of 2021.

- Digital currency-focused financial services provider Galaxy Digital Holdings agreed to purchase US-based cryptocurrency wallet developer BitGo, which has been backed by bitcoin mining technology producer BitFury, for about $1.2bn in cash and stock – $265m in cash and 38.8 million Galaxy Digital shares. BitGo is a digital custodian for crypto assets, providing a technology currently responsible for safeguarding some $40bn of assets. It has also added crypto asset-based products like trading, prime lending, portfolio management and tax services to its offering.

- Restaurant listings and food delivery service Zomato agreed to acquire one of its portfolio companies, India-based rapid delivery service Blinkit, in an all-stock deal valued at $568m. The valuation suffered a significant markdown. When the two firms agreed to an acquisition earlier, they had reportedly negotiated a deal sized between $700m and $750m. Founded in 2013 as Grofers, Blinkit operates an online platform where shoppers have access to a range of food, household and personal care products available for delivery in under 15 minutes. Amid intensifying competition with rival food delivery services such as Swiggy, Blinkit has scaled back its activity in some Indian cities to ensure a greater proportion of 10-minute delivery markets.

- Eyewear chain operator Lenskart acquired a majority share of Owndays, a Japan-based peer backed by conglomerate Mitsui, for $400m, according to Bloomberg, citing a person familiar with the matter. Mitsui and its Principal Investments vehicle were among the selling shareholders, as was private equity firm L Catterton. Founded in 1989, Owndays is a Tokyo-based manufacturer of eyeglasses and sunglasses, providing fashion and lifestyle-oriented eyewear products by introducing private brands.

Funding initiatives

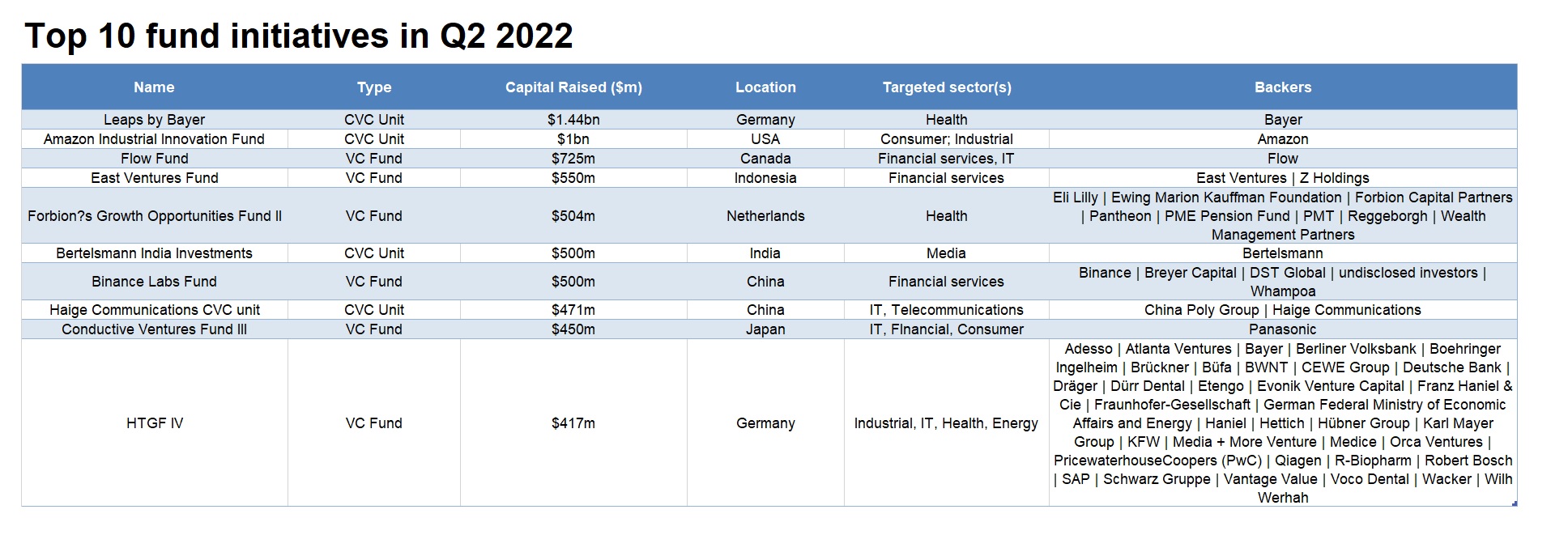

Corporate venturers supported a total of 118 fundraising initiatives in the second quarter of this year, just slightly fewer than during the first quarter and 9% more than the 108 such initiatives reported during the same period in 2021. The estimated total capital raised stood at $13.26bn, considerably down from the $40.88bn during the same period last year (though, the latter due to an outlier in the dataset) and more than the $11.91bn in the first quarter of this year.

The 118 initiatives in question included 67 announced, open and closed VC funds with corporate limited partners (LPs), 41 new or refunded corporate venturing units, among other initiatives. Though far from looking like a boom in fundraising, these figures are a refreshingly good sign that corporates may be doubling down on innovation investing in a time marked by economic uncertainty. If this trend is to continue, it may mean that the corporate venturers are well capitalised and poised to take part in the next upcycle.

- Leaps by Bayer, the corporate venturing unit of Germany-based drugs and crops company Bayer, committed a further €1.3bn ($1.44bn) over the next three years to more than double the pace of spending to date. The new investment plan has a focus on cell and gene therapy (CGT) and precision health for consumers and innovations enable farmers to ensure food security and decarbonize agriculture. Bayer has previously invested about €1.3bn in more than 50 companies in the past seven years. In addition, over the past three years, Bayer has invested more than €2.5bn to build up a CGT platform, including the acquisitions of BlueRock Therapeutics and Asklepios BioPharmaceutical and strategic collaborations with partners such as Mammoth Biosciences.

- US-headquartered e-commerce and cloud services group Amazon announced $1bn investment vehicle that will back customer fulfilment, logistics and supply chain technology developers. The move came the day after the corporate’s cloud services subsidiary, Amazon Web Services (AWS), launched an accelerator with over $30m in capital that will concentrate on founders from underrepresented communities. Amazon Industrial Innovation Fund will invest at early and late stage, targeting technologies capable of improving the speed and efficiency of product delivery. Robotics, artificial intelligence, machine learning and autonomous systems are among its areas of interest.

- Canada-based blockchain technology platform Flow, a Web3 platform started by NBA Top Shot maker Dapper Labs, formed a $725m vehicle to support entrepreneurs working on Web3-driven apps, games and digital assets. Flow is layer-1 blockchain which powers non-fungible token (NFT) applications including games, apps and digital assets including NBA Top Shot and NFL All Day, developed by Dapper Labs. Investors in the fund included Andreessen Horowitz, AppWorks, Cadenza Ventures, Coatue, Coinfund, Digital Currency Group (DCG), Fabric Ventures, Greenfield One, HashKey, L1 Digital, Mirana Ventures and BitDAO, OP Crypto, SkyVision Capital, Spartan Group, Union Square Ventures, and Dapper Ventures.

- Internet group Z Holdings Corp was among the returning investors that backed Indonesia-based VC firm East Ventures’ Southeast Asia-focused $550m fund. The company did not reveal the other limited partners but said it saw “a re-up rate of 120%” from existing backers. The firm plans to allocate $150m for early-stage deals, and $400m for growth-stage deals.

- Pharmaceutical producer Eli Lilly was among the limited partners that contributed to the €470m ($504m) first close of life sciences-focused venture capital firm Forbion’s Growth Opportunities Fund II. The fund has outstripped its €450m target and is also backed by PME, PMT, Ewing Marion Kauffman Foundation, Reggeborgh, Pantheon and Wealth Management Partners. The second Forbion Growth Opportunities Fund will continue to invest primarily in European, later-stage biopharmaceutical companies, developing therapies for areas of high medical need. It will aim to build a portfolio of 15 such investments in promising late-stage European life sciences companies.

- Germany-based media company Bertelsmann committed roughly $500m to its Bertelsmann India Investments (BII) subsidiary as it steps up its activity in the country. The move could see the Germany-headquartered media group investing more in early-stage Indian startups. The $500m is set to be deployed in the next five years and channelled into both new investments and follow-ons, with BII targeting six to eight deals per year. Although the unit has traditionally been a growth-stage investor, it will now look to expand to series A rounds. BII said it will invest in companies developing technologies for sectors like health, finance and agriculture, as well as in enterprise technology startups, including those focused on the future of work. It will also consider deals in more innovative areas like the Web3 space.

- China-based crypto exchange Binance’s unit Binance Labs closed a new $500m investment fund with support from various institutional investors, including DST Global Partners, Breyer Capital, unnamed private equity funds, family offices, and corporations. The new fund will aim to invest in projects that can expand cryptocurrency use cases and drive the adoption of Web 3 and blockchain technologies. The fund will be focused on companies across incubation, early-stage and late-stage growth.

- Guangzhou Haige Communications Group, which provides communications and navigation equipment to the Chinese military, agreed to partner with China Poly Group and other entities to set up a RMB3bn ($471m) corporate venture capital fund. Haige Communications’ predecessor was a military ordnance factory, while Poly Technologies is a subsidiary of China Poly, the largest state-owned supplier of military equipment, missile technologies and drones to the Chinese military. The planned fund is expected to serve as a platform for the Chinese military to enhance its technology competition with the US. Many of the US’s largest military suppliers, such as Lockheed Martin, Airbus and Raytheon, already have developed CVC and open innovation strategies, while NATO, the joint defence alliance covering western Europe and North America is preparing its $1bn venture fund strategy.

- Japan-headquartered consumer electronics manufacturer Panasonic provided $200m in capital for US-based venture capital partner Conductive Ventures’ third fund. Founded in 2017 by managing directors Carey Lai and Paul Yeh, Conductive targets developers of hardware, software, technology-enabled services and blockchain products at growth stage, and has cited startups led by non-traditional founders as a key area of interest. The firm has achieved seven exits so far, including additive manufacturing technology provider Desktop Metal, which listed on the New York Stock Exchange in an August 2020 reverse takeover valuing it at $2.5bn post-transaction, and electric bus producer Proterra, which secured a $1.6bn enterprise valuation in its own reverse merger, in February 2021.

- Germany-based public-private venture capital investment firm High-Tech Gründerfonds (HTGF) launched its fourth fund, having already secured a total of more than €400m ($417m) in commitments at first closing. More than €130m of the total were provided by private investors, investing in HTGF IV alongside the German Federal Ministry for Economic Affairs and Climate Action, and KfW Capital. The fund was also backed by a number of corporates from across many sectors and industries including Robert Bosch, Evonik Industries, Büfa, Boehringer Ingelheim, Dürr Dental, Qiagen, Schwartz Groupe, Hübner Group, Etengo, Brückner, Adesso, Deutsche Bank, Berliner Volksbank, Bayer, SAP, Fraunhofer-Gesellschaft and others. The new fund will provide early-stage financing to support young companies active in the areas of digital tech, industrial tech, life sciences and chemicals. The analysis and selection methods employed will be geared even more strongly towards the aspect of sustainability.