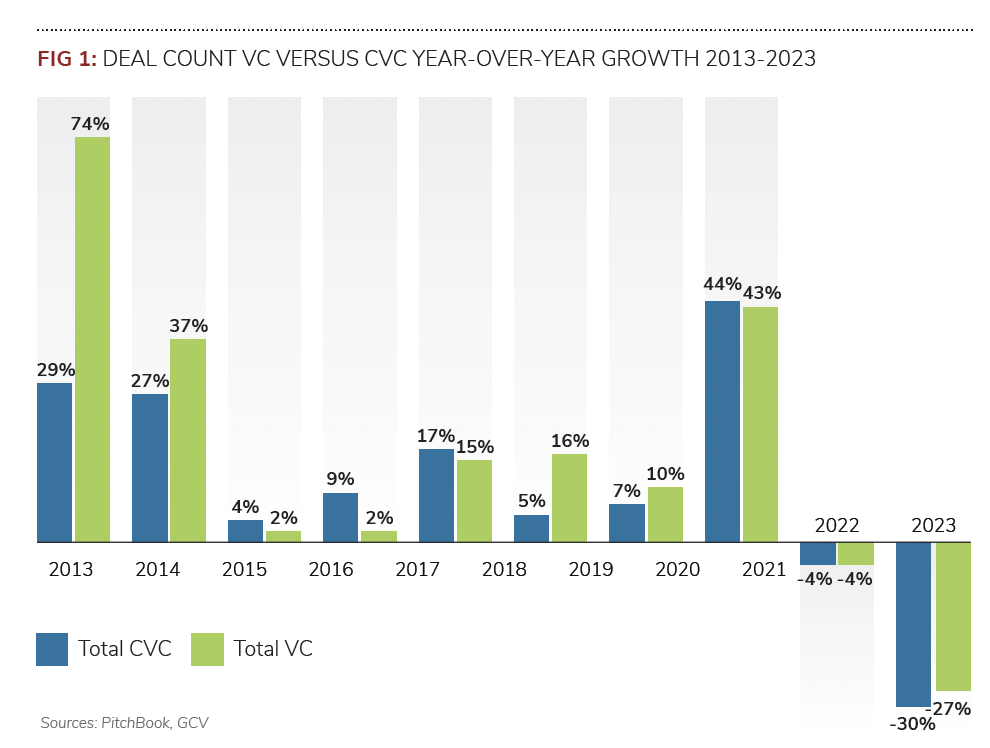

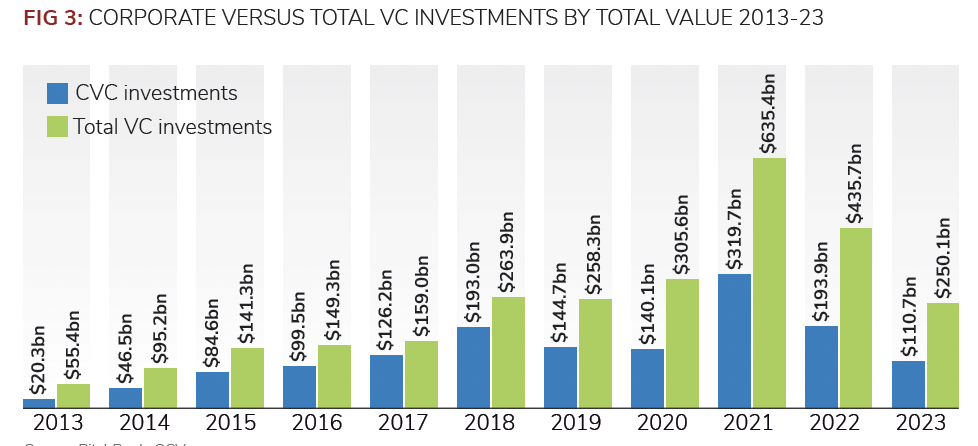

Corporate investors backed 27% fewer funding rounds in 2023, compared with the previous year, and the dollar amount spent on those deals dropped even more dramatically, down 43% to $110.7bn compared with $193.9bn the previous year.

This is broadly in line with the drop in the overall venture capital market. The number of VC funding rounds is down 30% year on year, and the dollar value of investments declined 43% to $250.1bn.

Events in 2023, from central banks raising interest rates to the collapse of Silicon Valley Bank, contributed to an uncertain market that kept corporate investment under strain. However, deal numbers have returned to 2019/2020 levels of startup investment. This is seen by many in the market as a normalisation rather than a crash, following the extreme bull markets of 2020 and 2021.

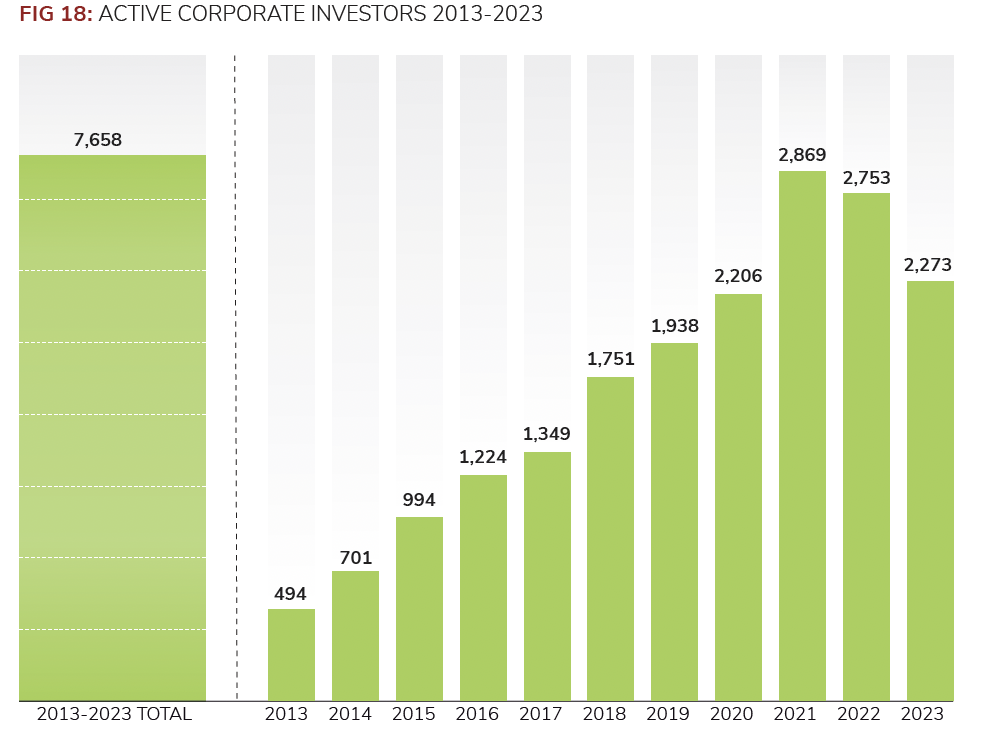

There was evidence of some corporate teams tactically sitting out 2023. Only 56% of investors who had backed a startup in 2022 came back to do so in 2023.

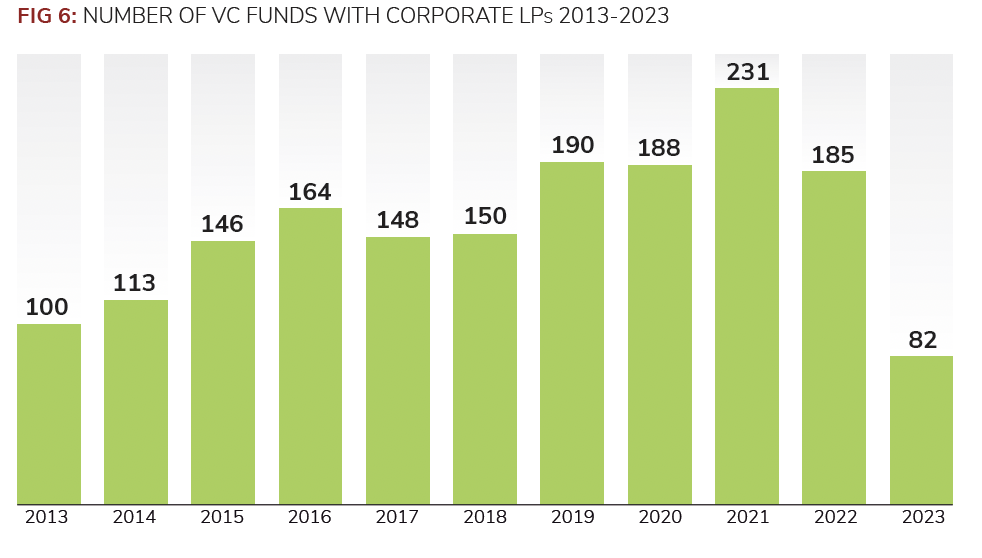

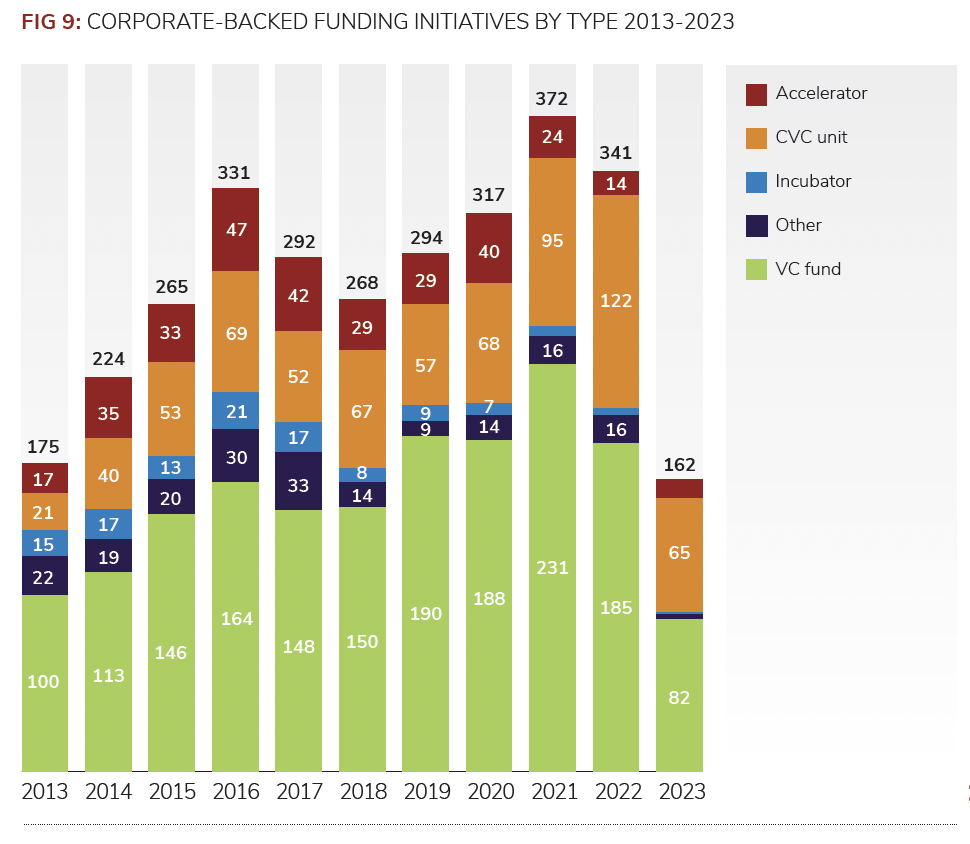

The rate at which corporate investors put money into other VC funds as LPs also fell. It had already slowed in 2022 but there was a further 54% decline in 2023, to the lowest level of activity in a decade we tracked just 82 new funds with corporate backing were raised in 2023, down from 185 the year before.

This partly reflects the general VC market, which has seen a steep decline in the number of new funds being created. Just 1,502 new VC funds were raised globally in 2023, down 47% from 2,817 the previous year.

We also saw a decrease in the number of active corporate investors, that is, those who participated in at least one minority stake deal during the year. We counted 2,273 active investors in 2023, 17% down from 2,753 the previous year.

But new CVC units are still being formed. Some 65 new units were created in 2023. While this is down from a record 122 the previous year, this is a similar level of CVC formation seen before 2020.

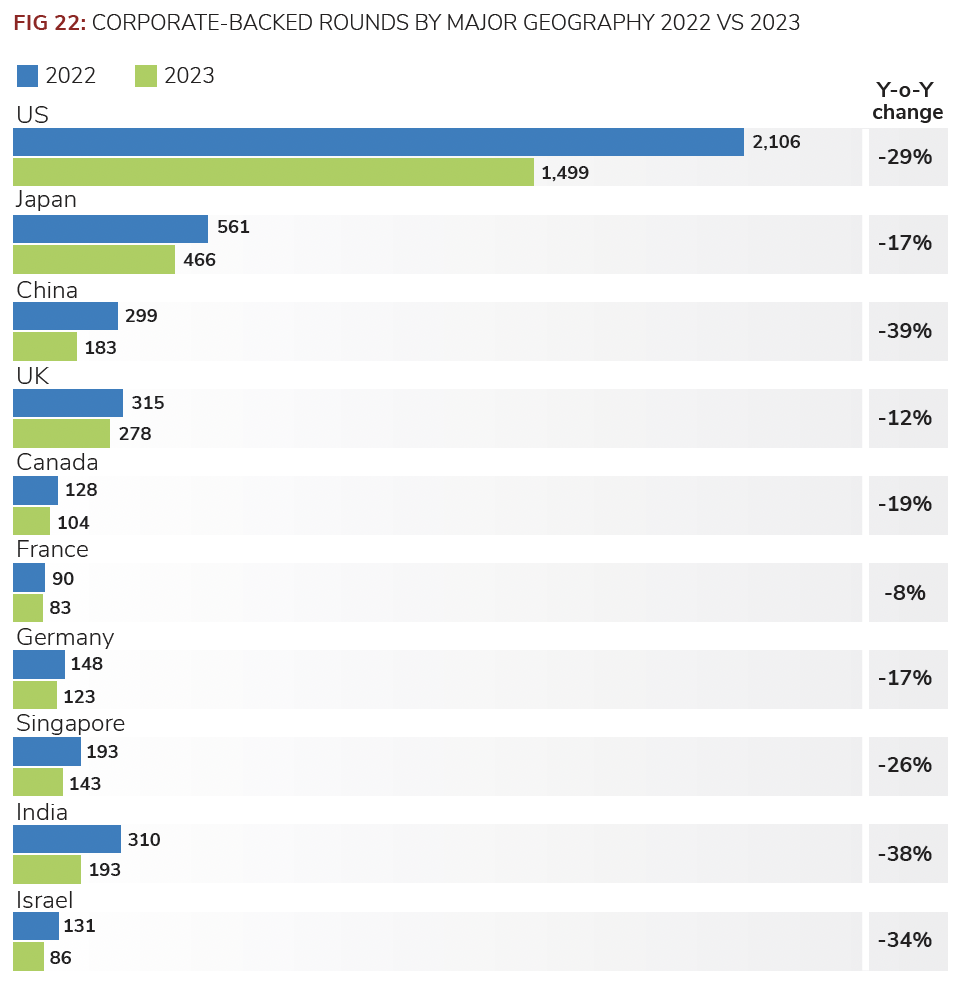

No region escaped a decline in corporate-backed startup deals, but the US, China and India saw the

sharpest declines.

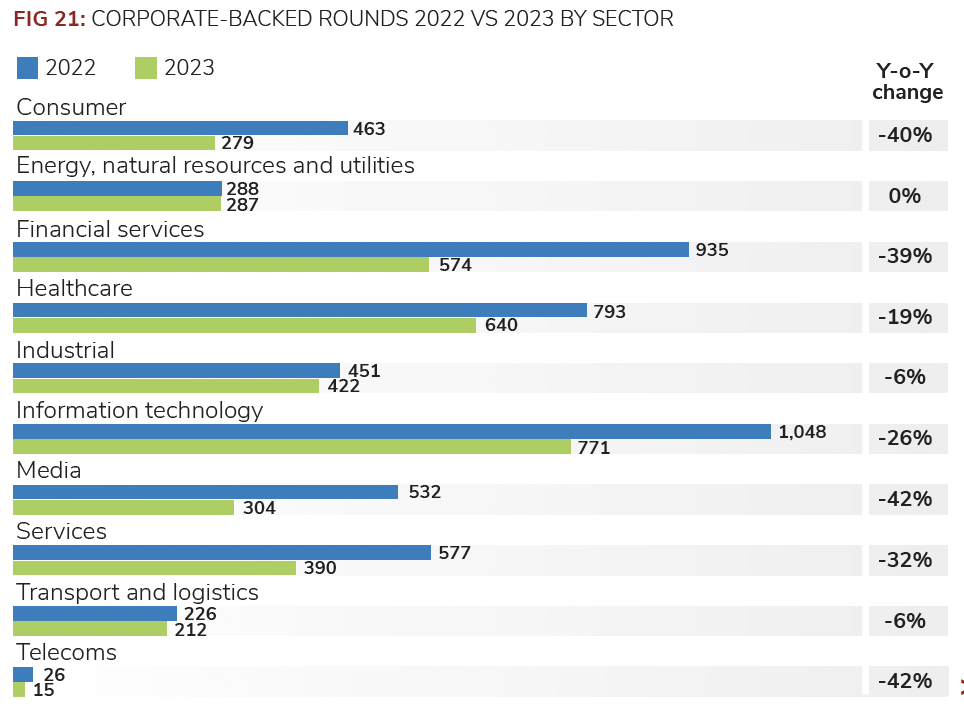

Fortunes also diverged across sectors, with energy deals remaining steady, while areas such as telecoms and media saw the sharpest decreases.

This article in an extract from the annual GCV World of Corporate Venturing. Subscribers can see the full data here.