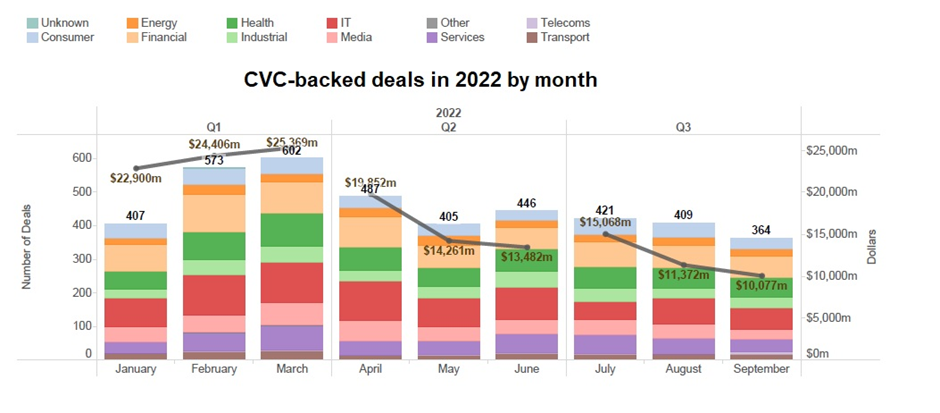

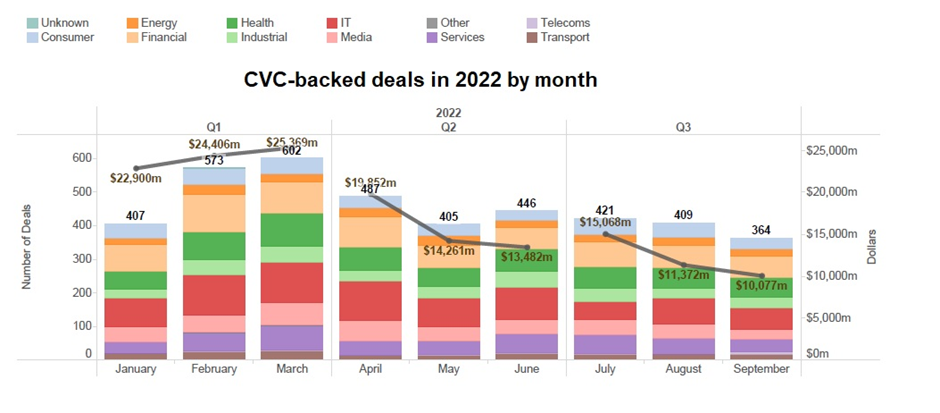

Corporate venture activity slumped noticeably across the board in the third quarter, with the number of rounds involving a corporate backers down 17% from the same period last year. The total value raised in those rounds was down 57% from the year-ago period. The same pattern was true also for exits and funding initiatives.

It wasn’t doom and gloom in all innovation geographies, however. Some, like Israel and UK, didn’t register a quarter-over-quarter drop in deals and there were several multi-billion dollar funding initiatives in geographies outside the US. The energy and telecoms sectors also saw increases in the number of deals, bucking the general trend.

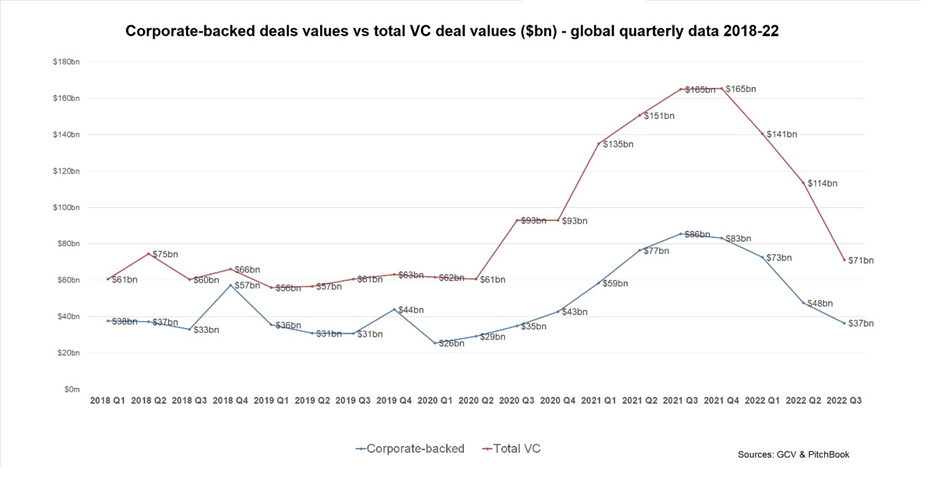

Overall, however, corporates appear to be catching up with the risk-off attitude already assumed by their traditional VC peers. The total dollar value drop for the entire VC space – from $165bn in Q3 last year down to $71bn this year – also amounted to 57% when compared to the same quarter last year. Corporates are moving in lock-step with their traditional peers in that respect and migrating to smaller deals and far lower deal values, on average.

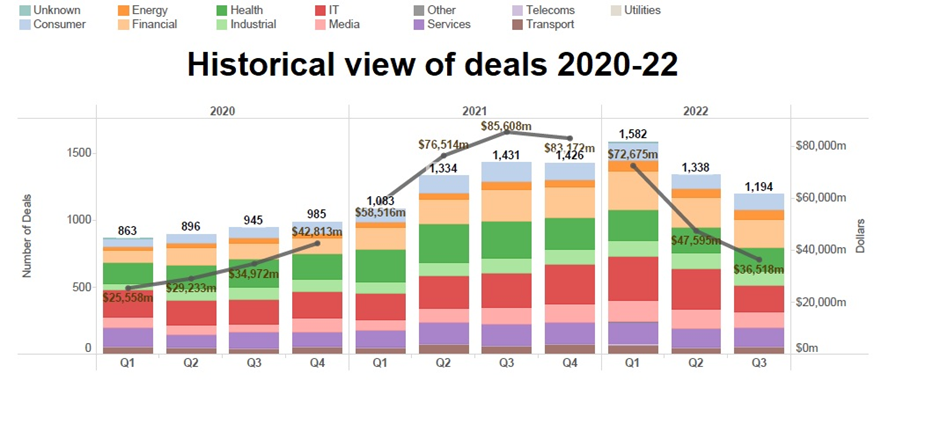

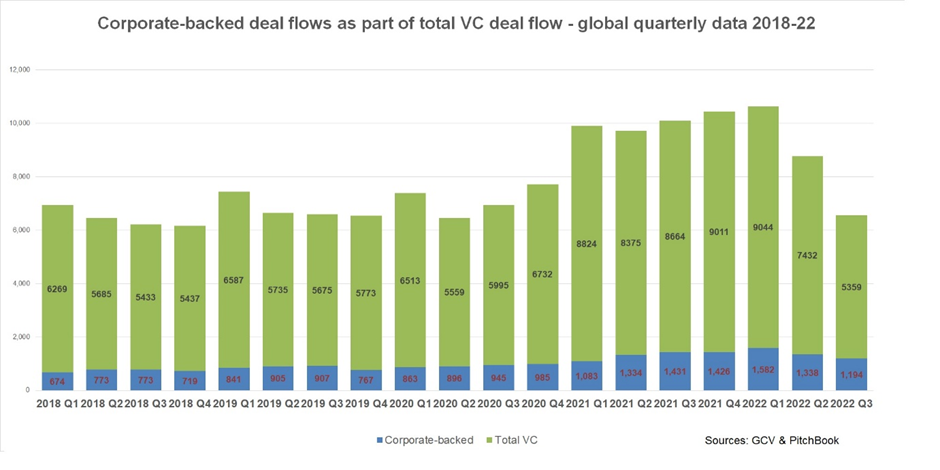

The near certainty of entering into a recession, still uncontrolled inflation rates, along with geopolitical tensions and hawkish monetary authorities have all damped investment activity in an ever more pronounced way. As the following PitchBook chart illustrates, by the third quarter of this year, the total estimated dollar value of VC deals has dropped 71% from the all-time high of $165bn it reached in Q4 last year. The same goes for corporate-backed deals, having gone down from $83bn in Q4 2021 to $37bn in Q3 2022. This has effectively brought the dollar value of deals roughly to the pre-pandemic period.

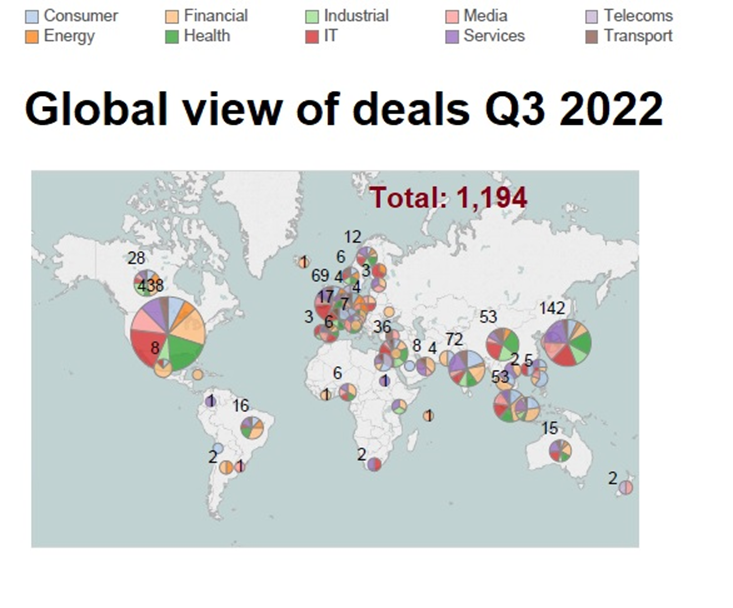

GCV recorded 1,194 funding rounds involving corporate venturers during the third quarter of this year, compared with 1,431 rounds recorded in same period last year. The estimated total investment dollars stood at $36.52bn, down 57% from the $85.6bn recorded during Q3 of 2021.

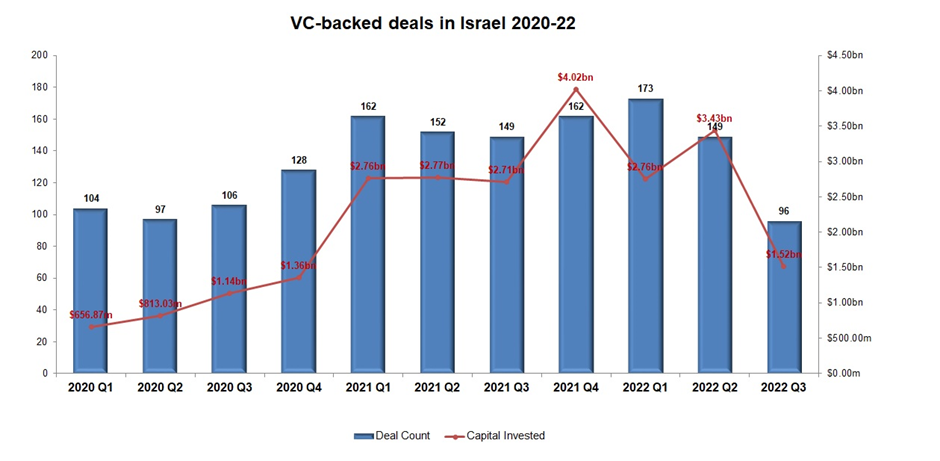

The number of deals has seen the most severe correction in the US, where deal numbers dropped to 438, from 540 in Q2 and 660 in Q1. The same was true for China, India, India, Germany, Canada and Switzerland – even if from a smaller baseline. Interestingly enough, the number of deals in other markets like the UK and Singapore remained stable vs the previous quarter and in Israel, they even increased (36 deals in Q3 vs 28 in Q2). This suggests that in some geographies corporate venturers have either not yet jumped on the risk-off bandwagon or that they may be increasingly opportunistic. It is still early to judge which of these two possibilities is true.

Israel appears to be one major innovation geography bucking the general downward trend. According to PitchBook’s data, however, it has not been completely immune to the slowdown. It may be that some corporates active in the country may have decided to take advantage of the ongoing slowdown and look for bargains.

There were other key trends we noted in the data through Q3.

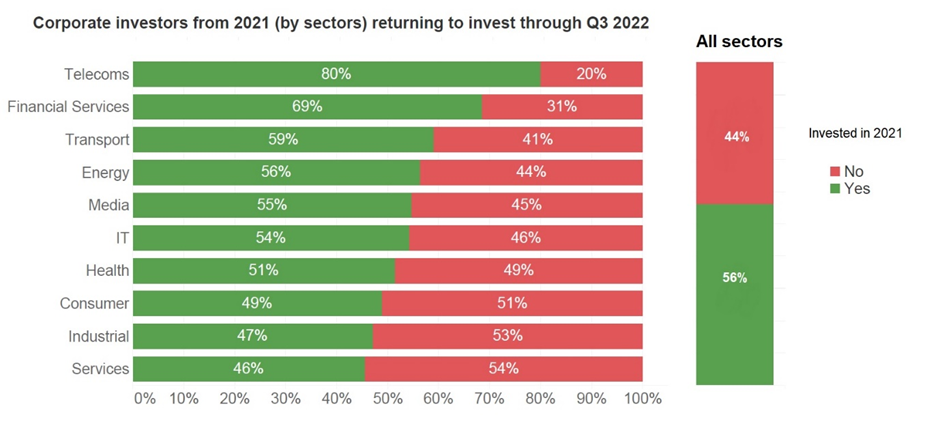

Relatively fewer corporate investors are coming back for more deals than before. Roughly 56% of those that participated in at least one minority stake round last year had returned as investors by Q3 of 2022. In comparison, the number we reported by the end of Q2 was 61%. While the percentage figures are fairly close, given the overall current context, this may be an early indication of corporates assuming a more conservative attitude.

In some sectors, notably, the proportion of returning investors is actually higher – telecoms (80%), financial services (69%) and transport (59%). This indicator is a reasonable proxy of the longer-term commitment of corporate investors to venture investing.

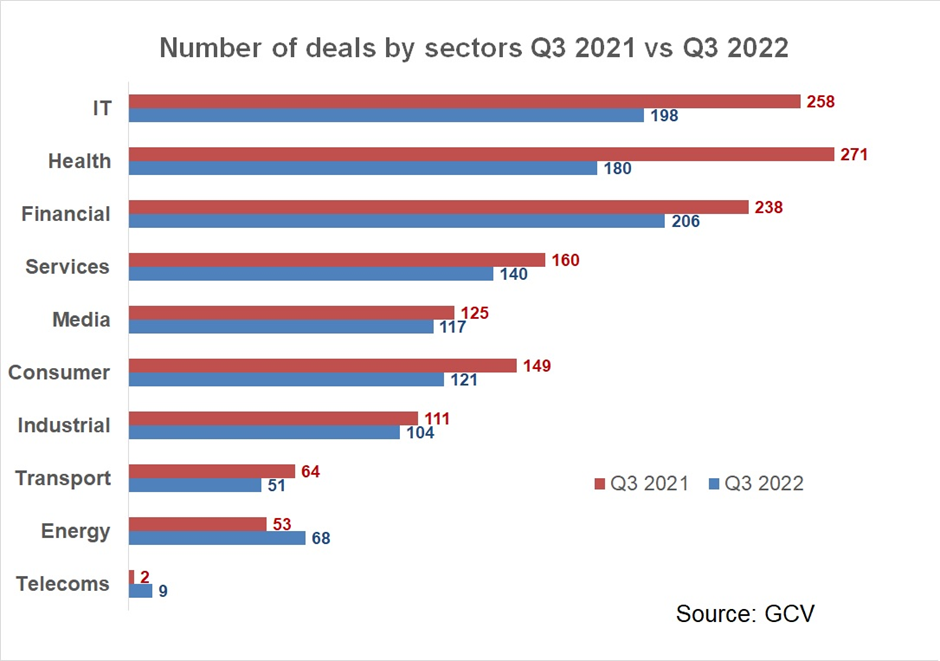

Sector-wise, deals in every sector but energy and telecoms declined in Q3 when compared to the same quarter last year. This is hardly surprising given the bull market taking place in the energy ecosystem and the relatively small number of pure-play telecoms startups.

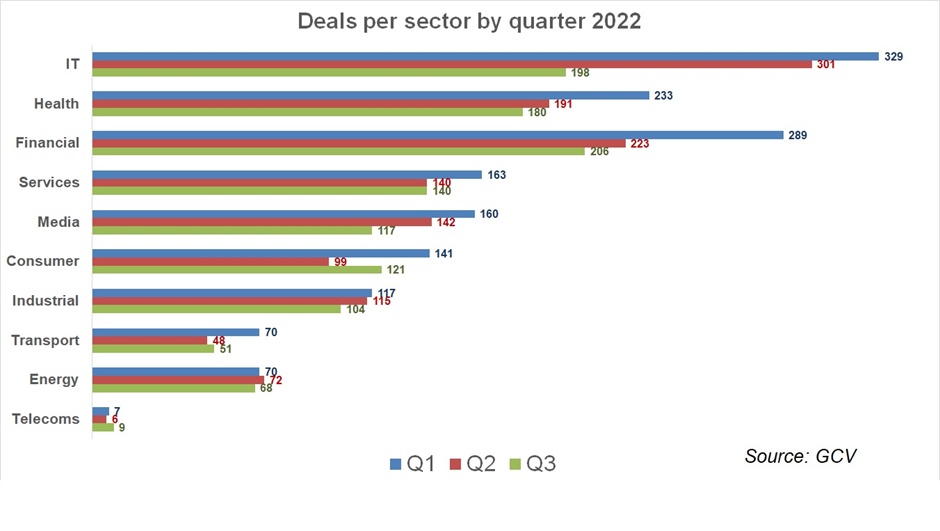

When juxtaposed with previous quarters from this year, however, the only sector that registered an increase in deals was consumer (121 round in Q3 versus 99 in Q2).

There was no shortage of interesting large deals from the consumer space across various geographies, in fact. Thailand-based food delivery service provider Line Man Wongnai raised a $265m series B round, featuring Taiwan Mobile and PTT Oil among its backers. LazaNG Digitalda Group and Touch ‘n Go provided $168m for online payment platform developer TNG Digital in neighboring Malaysia. In the US, live shopping platform operator Whatnot raised a $260m series D round, featuring internet conglomerate Alphabet. In India, online grocery shopping service BigBasket raised a $200m round backed by conglomerate Tata.

When comparing Q3 2022 with the previous quarter, there was an 11% decline in the deal count, down from the 1,338 in Q2, continuing on a downward path from the 1,582 in Q1. Estimated total investment also plummeted to $36.52bn, down 23% from $47.59bn in Q2.

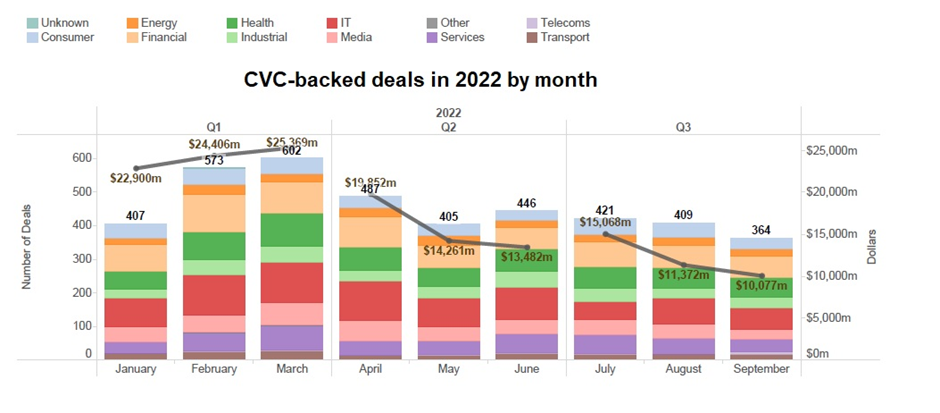

If we look at the Q3 data on a monthly basis, the decline is clearly becoming more evident during the third quarter, much like in Q2.

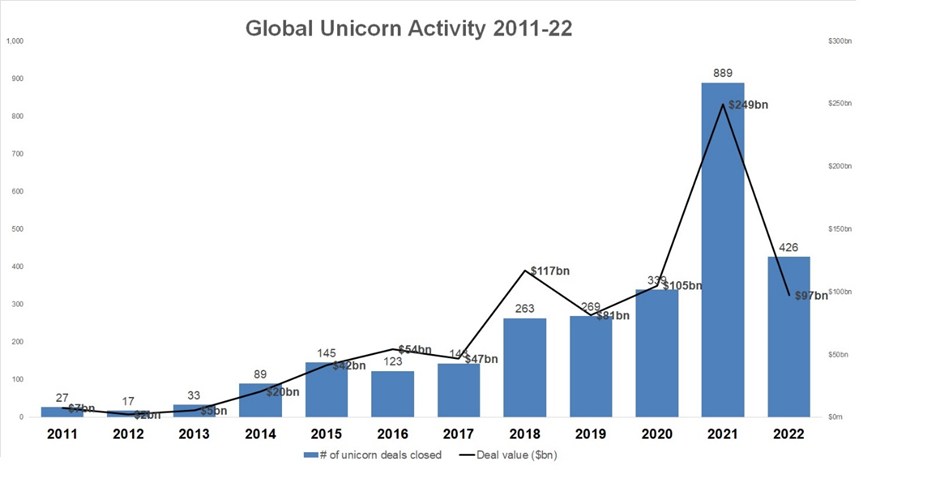

While there were deals and exits sized $1bn or higher, unicorn deal activity around the globe is cooling down significantly in 2022, according to PitchBook´s data.

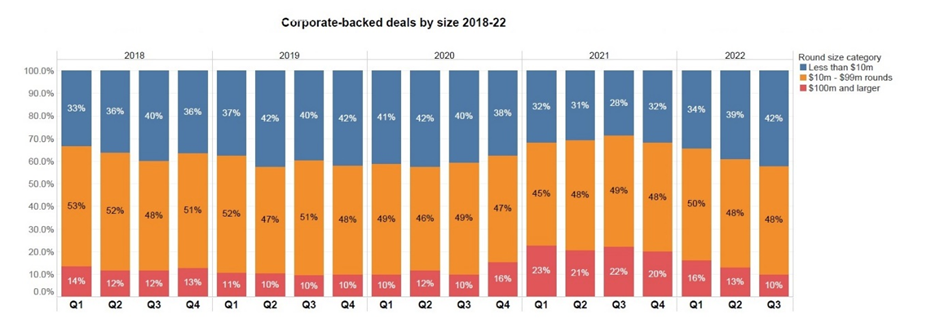

Another interesting indicator to look at are the relative proportions of small (>$10m), medium ($11–$99m) and large (>$100m) deals. Throughout 2021 the relative share of large deals, above $100m in size, went up significantly versus the previous years and stood between 20% and 23%. This was partly due to more corporate-backed companies reaching unicorn status. In Q3 of 2022, that figure was at 10%, down from 13% in Q2 and 16% in Q1. It is clear that a cooling off of the heated upward trend in valuations seen before is taking place.

The upsurge in valuations, which started in the last quarter of 2020 and accelerated through 2021, was concentrated in North America (though not limited to it), particularly in the US, which accounted for 50-60% of all large deals in 2021. This continues to be the case even by the end of Q3 2022.

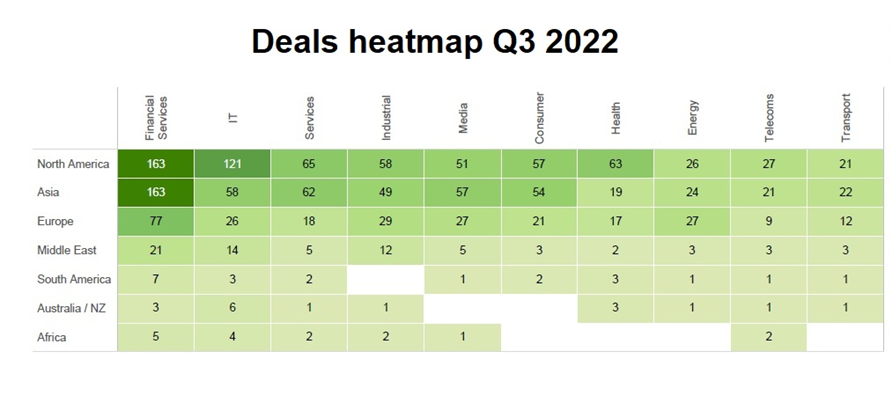

Emerging enterprises from the fintech, IT and health sectors proved to be the most alluring for corporate venturers, accounting for more than 180 deals each in Q3. The top funding rounds by size, however, were raised by companies from a variety of sectors.

The most active corporate investors, in turn, came from the financial, IT, services and industrial sectors, as shown on the deal heatmap.

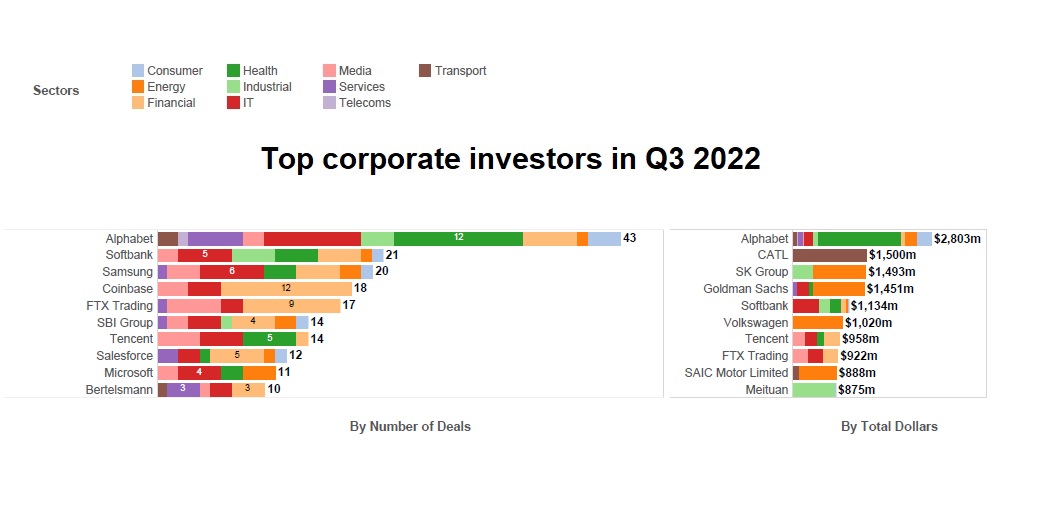

The leading investors by number of deals were internet conglomerate Alphabet, diversified telecoms and internet conglomerate SoftBank and semiconductors and electronics producer Samsung. The list of corporate venturers involved in the largest deals by size was headed also by Alphabet, battery maker CATL and conglomerate SK.

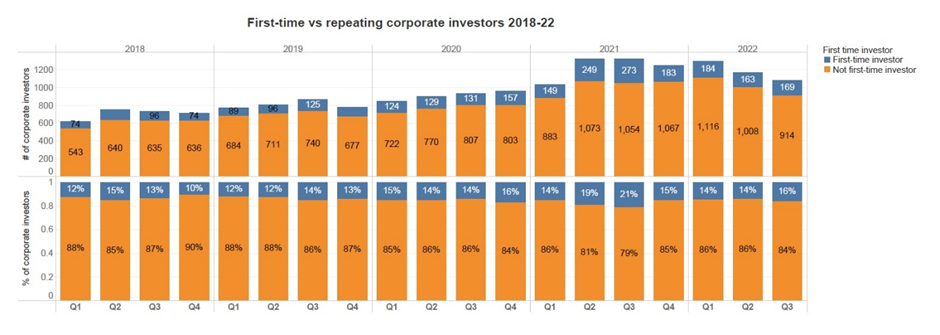

Most of the corporate investors taking minority stakes during the third quarter were investors that have done at least one deal before (84%). However, roughly two out of every 10 (16%) corporates were disclosing their first minority stake deal during this quarter. There appears to be a trend of newcomers to venturing – whether having a specific venturing unit or not – comprising roughly a fifth to a quarter of all corporate investors, from 2018 onwards. We are yet to see if this trend will be sustained and if the corporate venturing community will withstand headwinds.

It is also worth monitoring how corporate venture investors stand in comparison with their traditional VC peers. According to PitchBook, data provider on private capital market data, overall venture capital activity globally appears to be slowing down noticeably in Q3 (5,539 deals) when compared to the previous quarters or the same period in 2021 (8,664), implying a nearly 36% decrease.

Biggest deals

Most of the funding from the biggest rounds reported in the third quarter went to emerging enterprises from the energy, transport and financial services sectors. Only three of the top 15 rounds stood above the $1bn mark.

China-based electric car manufacturer Hozon was reported to have raised a total of $1.5bn in its series D round (and all of its extension and tranches). The round was backed by internet security company 360 Security Technology and CATL. Hozon develops and manufactures electric vehicles that it claims to be intelligent electric vehicles with high price-to-performance ratio.

Swedish EV-focused lithium-ion battery developer Northvolt raised $1.1bn of funding in the form of a convertible note, backed by carmaker Volkswagen and Goldman Sachs. Northvolth has developed lithium-ion battery for electric vehicles, which it claims to be eco-friendly, being manufactured with minimal carbon footprint and with recycling technology without compromising important eco-systems.

Alphabet led a $1bn round for Verily, the corporate’s US-based life sciences and precision health subsidiary, investing alongside unnamed other investors. This is one of the largest single corporate venturing deals of the year. Verily was incubated by Alphabet’s secretive research and development group, Google X unit (now rebranded as X Development). Alphabet has been investing in a number of therapeutics, diagnostics, medical device and healthtech companies through its Gradient Ventures investment unit.

China-based Sunwoda Electric Vehicle Battery, an EV battery subsidiary of Chinese battery producer Sunwoda Electronic, received RMB6bn ($875m) in a series A round from a number of investors including food delivery service provider Meituan. Launched in 2014, Sunwoda EVB develops EV battery cells and management systems, operating 11 production bases in China and India with technical and customer service centres in the US and Europe, according to Deal Street Asia.

US-based nuclear technology developer TerraPower raised $750m round led by industrial manufacturer Gates and SK Group, among other investors. Terra has developed a technology designed to provide an affordable, secure and environmentally-friendly form of nuclear energy. The company claims its technology improves the reliability of nuclear plants. It intends to use the funds to develop small-scale nuclear reactors.

Exits

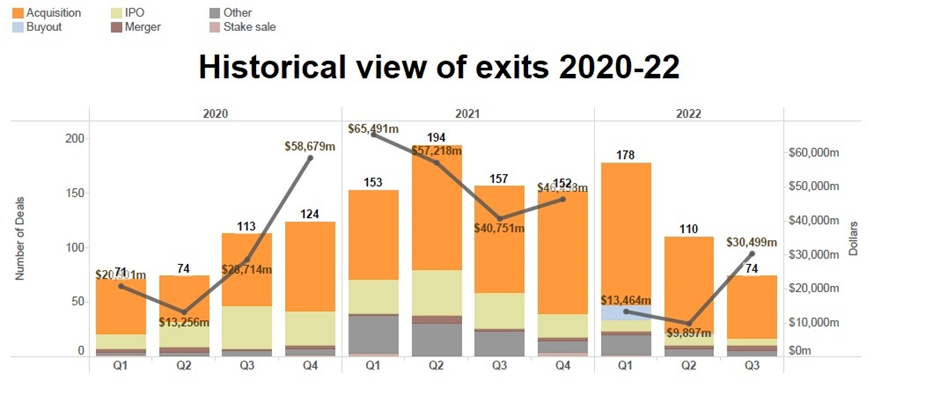

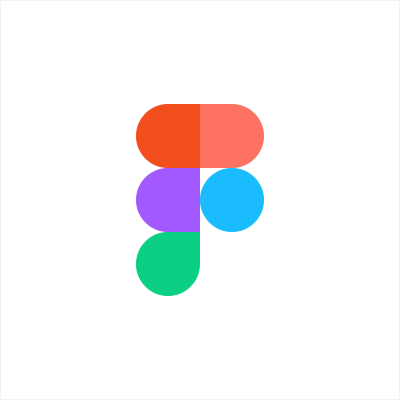

GCV tracked 74 corporate-related exits during the third quarter of 2022, including 57 acquisitions, seven initial public offerings (IPOs), six other transactions (including reverse mergers with Spacs) four mergers (of equals). Top exiting corporates this quarter included SoftBank, cloud enterprise software provider Salesforce and Legend Holdings.

The number of exits versus previous quarters suggested a continuing significant decline, as 74 transitions was a fraction of the 178 and 110 in Q1 and Q2 respectively. All this suggests a continuing slowdown in exits that is hardly surprising and unexpected at this point.

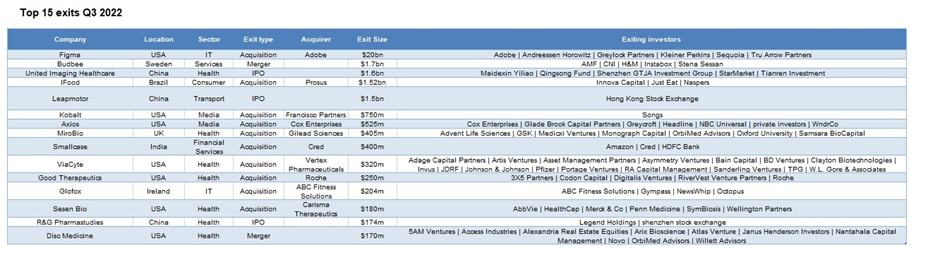

The total estimated amount of exited capital in Q3 2022 was $30.5bn, lower than the $40.75bn registered in Q3 of the previous year. Admittedly, the $20bn Figma acquisition (discussed further below) was the biggest exit scored and a somewhat unusual in size, given the overall bearish conditions in public and M&A markets. So much so, in fact, that the Financial Times even called it a “dumb deal”.

Beyond Figma, however, there were four other exits we reported which stood above the $1bn mark, including a successful IPO in China.

Graphic design software provider Adobe agreed to acquire Figma, a US-based interface design tool developer backed by media group O’Reilly, for $20bn. The company has been valued at $10bn as of a $200m series E round in June 2021. Founded in 2012, Figma provides an online platform that helps user interface engineers create projects together with their clients remotely and in real time. Airbnb, Alphabet, Google, Herman Miller and Kimberly-Clark are among its customers. The deal was the largest M&A for the year so far and much commented on the media. Read James Mawson’s take on it.

Last-mile delivery service Instabox merged with Budbee, a Sweden-based smart lock technology provider backed by fashion retailer H&M, in a SEK18bn ($1.7bn) deal. Budbee runs an app-based last-mile delivery service that enables users to control parameters such as delivery times and how they should be notified once the package arrives. It operates across Sweden, Denmark, Finland and the Netherlands.

China-based medical imaging company United Imaging Healthcare went public on the Shanghai Stock Exchange and its price soared in its first day of trading, with shares jumping 65%. The company reportedly raised $1.5bn in it. Previous backers of the company include investment firm Maidexin Yiliao and grocery stores chain StarMarket. United Imaging provides medical imaging equipment and radiotherapy products, among other solutions.

Internet group Prosus (Naspers) agreed to buy the 33.3% stake in Brazil-based portfolio company iFood it did not own, from fellow food delivery service Just Eat for €1.5bn ($1.5bn) in cash and an additional contingent consideration of up to €300m. iFood runs an online platform that allows customers to order food from a network of more than 50,000 restaurants.

Leapmotor, the China-based electric vehicle manufacturer backed by corporates Dahua Technology, Shanghai Electric and CRRC, raised a $1.5bn IPO on the Hong Kong Stock Exchange. The flotation attracted 15 cornerstone investors who agreed to purchase around $736m worth of stock. Leapmotor manufactures smart EVs including compact cars and sports utility vehicles, in addition to electronic parts, hardware and software that support intelligent power and self-driving systems.

Funding initiatives

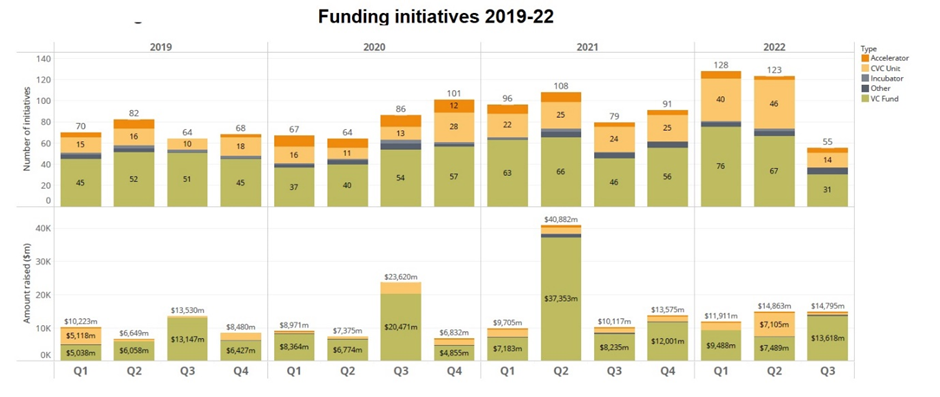

Corporate venturers supported a total of 55 fundraising initiatives in the third quarter of this year, less than half of those reported in Q1 and Q2 (128 and 123, respectively). The figures were also down from 79 such initiatives reported during the same period in 2021. The estimated total capital raised stood at $14.8bn, a comparable number to that of preceding quarters and the same quarter last year, though owed to an outlier in the dataset – a single fund raising $10bn, discussed below.

The 55 initiatives in question included 31 announced, open and closed VC funds with corporate limited partners (LPs) and 14 new or refunded (or rebranded) corporate venturing units, among other. These figures are negative sign that corporate LPs have adopted an increasingly risk-off attitude in the third quarter, as entering a recession is highly anticipated at the moment in many industrialised nations. If this trend continues, the implications are lower availability of innovation capital.

Despite the overall, there were notable corporate-backed funding initiatives. Four of the top five were in geographies outside the US and there was a particularly large one, among them.

United Arab Emirates-based artificial intelligence (AI) and cloud technology provider G42 launched a $10bn venture capital fund with the government-owned Abu Dhabi Growth Fund providing most of the cash. The fund will target computing, communications, mobility, cleantech, renewables, digital infrastructure, new materials, multiverse, financial and healthcare technology. It will run as a private equity investor, with a significant focus on high-growth regions.

Cathay Innovation, a subsidiary overseen by France-based investment firm Cathay Capital, has launched a third fund that is sized at $1bn, having secured multiple corporate limited partners. Those include Groupe ADP, Kering, L’Oreal, Michelin, Pernod Ricard, Sanofi, SEB Groupe, TotalEnergies, Unilever and Valeo.Cathay Innovation, a subsidiary overseen by France-based investment firm Cathay Capital, has launched a third fund that is sized at $1bn, having secured multiple corporate limited partners. Those include Groupe ADP, Kering, L’Oreal, Michelin, Pernod Ricard, Sanofi, SEB Groupe, TotalEnergies, Unilever and Valeo.

BAI Capital, the storied China-focused venture investment firm that was formerly known as Bertelsmann Asia Investments, raised $700s. BAI Capital (formerly Bertelsmann Asia Investments) specialises in private equity, venture capital, credit, public equity, impact investing, life sciences, and real estate. The firm will use the funds to back Chinese companies.

Energy Impact Partners, a US-headquartered VC firm focused on climate tech, launched in Europe with a €390m fund. The fund was backed by a large number of corporate unnamed energy suppliers. EIP’s European fund will back later-stage startups focused on the energy transition or advancing the net zero carbon economy. The firm will aim to help European companies move into the US market.

Indonesian government-formed, corporate-backed incubator and investment firm Merah Putih is to reach a $300m first close for its inaugural Dana Ventura Merah Putih Fund,. Its LPs will include BNI Ventures, BRI Ventures and Mandiri Capital Indonesia, on behalf of financial services firms Bank Negara Indonesia, Bank BRI and Bank Mandiri, as well as MDI Ventures and Telkomsel Mitra Inovasi, the investment arms of Telkom Indonesia and Telkomsel respectively.