The first quarter of 2023, and especially the month of March, were marked by general bank turmoil in financial markets. This was particularly the case for the VC community because of the collapse of Silicon Valley Bank (SVB), which had served it for 40 years.

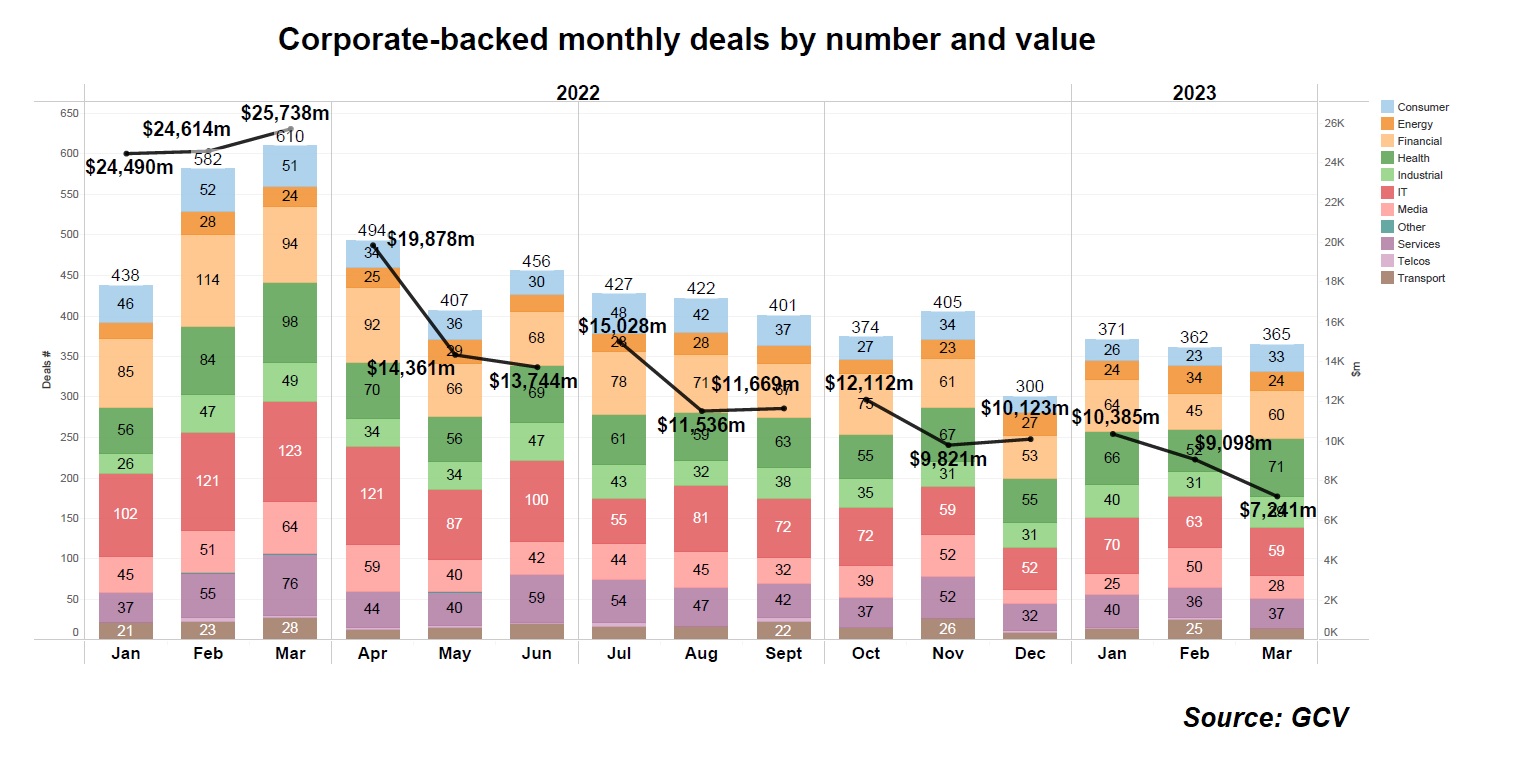

Corporate venture activity continued to slump in total dollar terms across the board in the first quarter, while the number of rounds remained relatively stable on a month-over-month basis. The same was roughly the case also for exits and funding initiatives. Decreases were more pronounced on a year-on-year basis in the first quarter than when compared with the previous and most recent quarters.

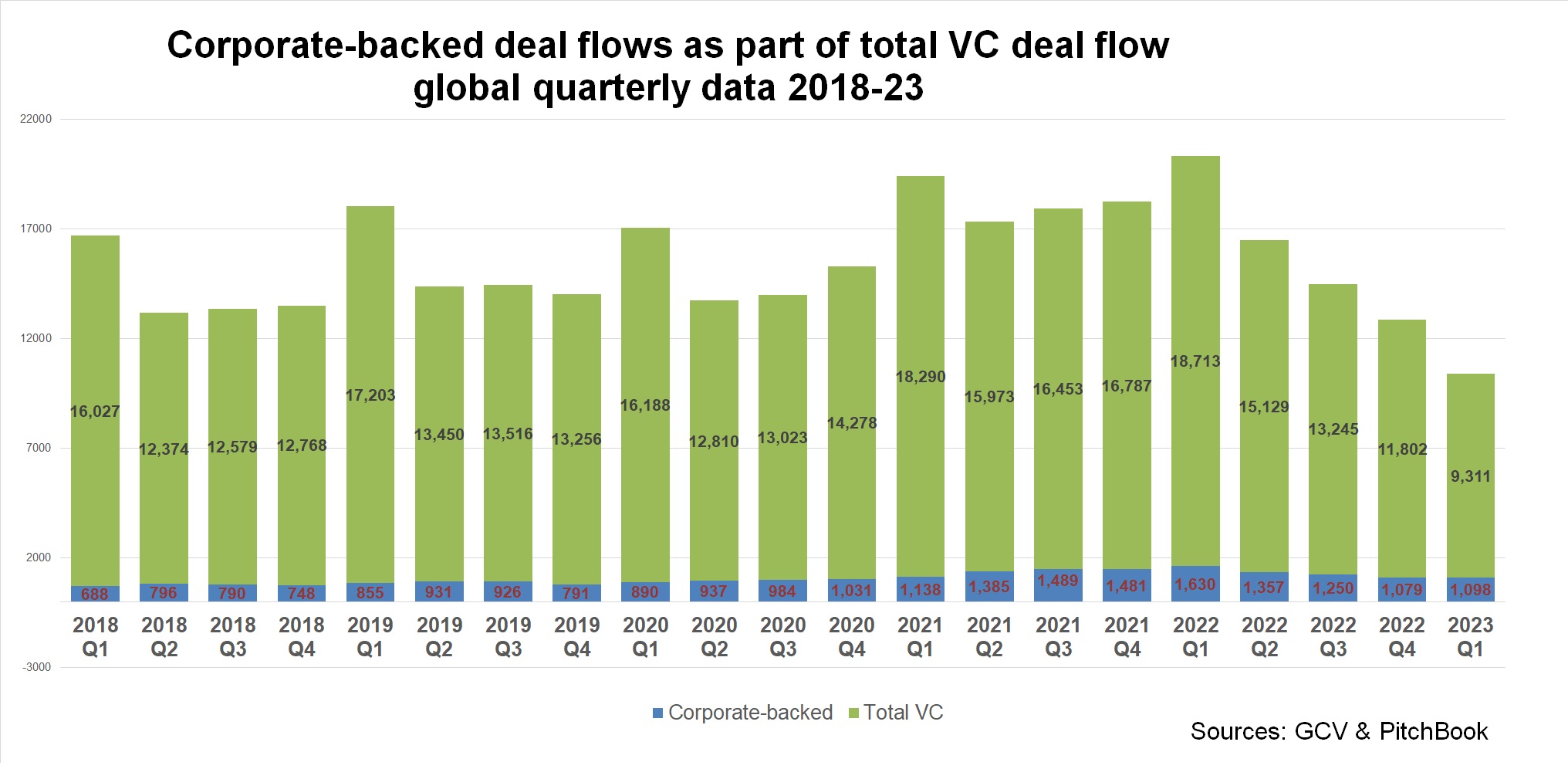

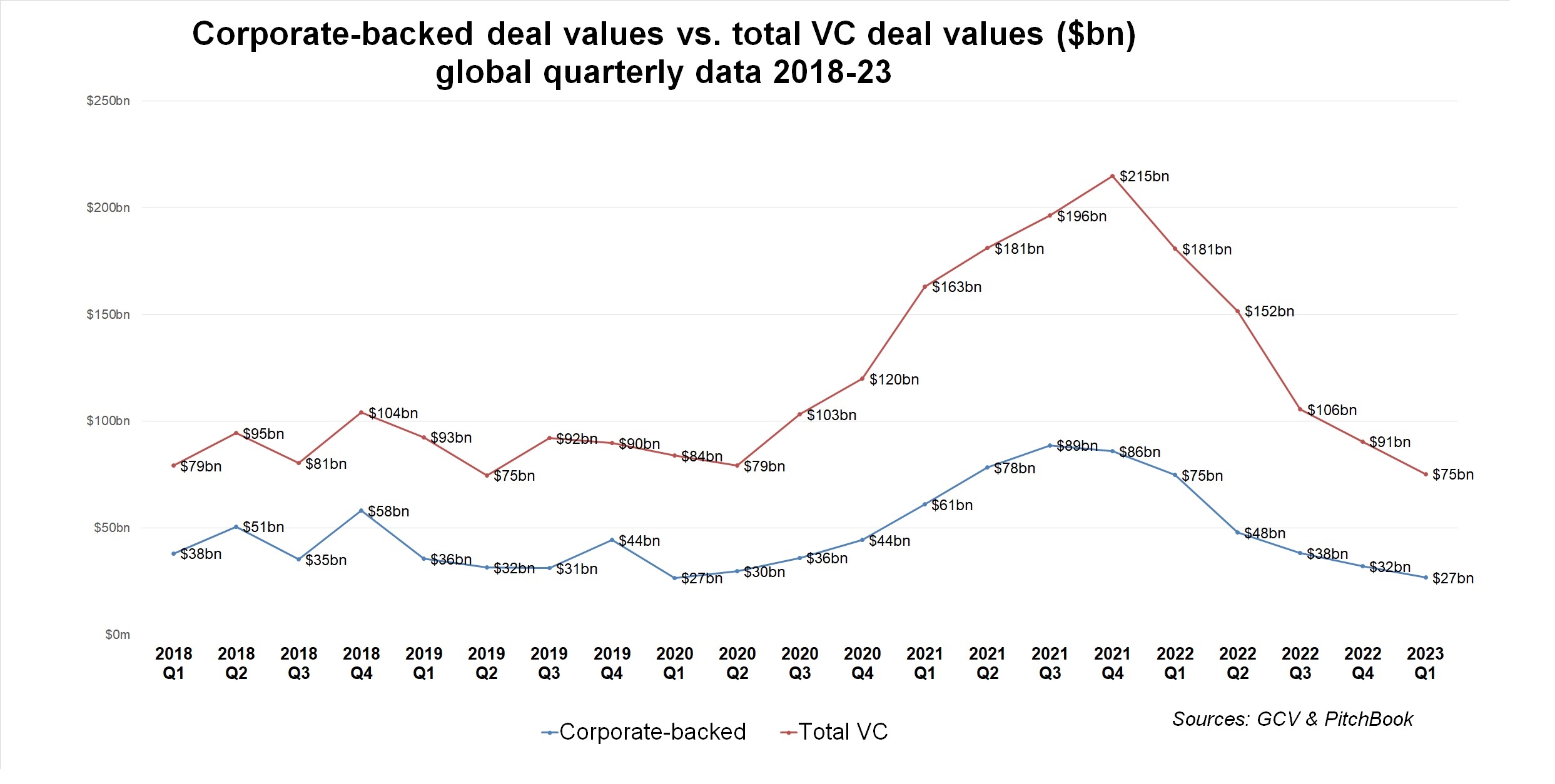

The overall VC market dropped in terms of deal count by 50% year-on-year during Q1, whereas total dollars invested dropped by 59%. The CVC-backed space, in comparison, fell 33% compared with the same period last year. The estimated total investment dollars were down 64% versus the Q1 of 2022.

All in all, we continue to see the divergence we noted in the annual data report where the CVC space seems to be moving differently from the total VC space, or dropping more slowly.

Corporate venture investors continue to switch focus and attention toward smaller size (and earlier stage) deals, a trend well supported by our data. This, in turn, suggests that, alongside traditional VC players, they are likely to be well capitalised and well positioned for the next upcycle.

CVC v VC

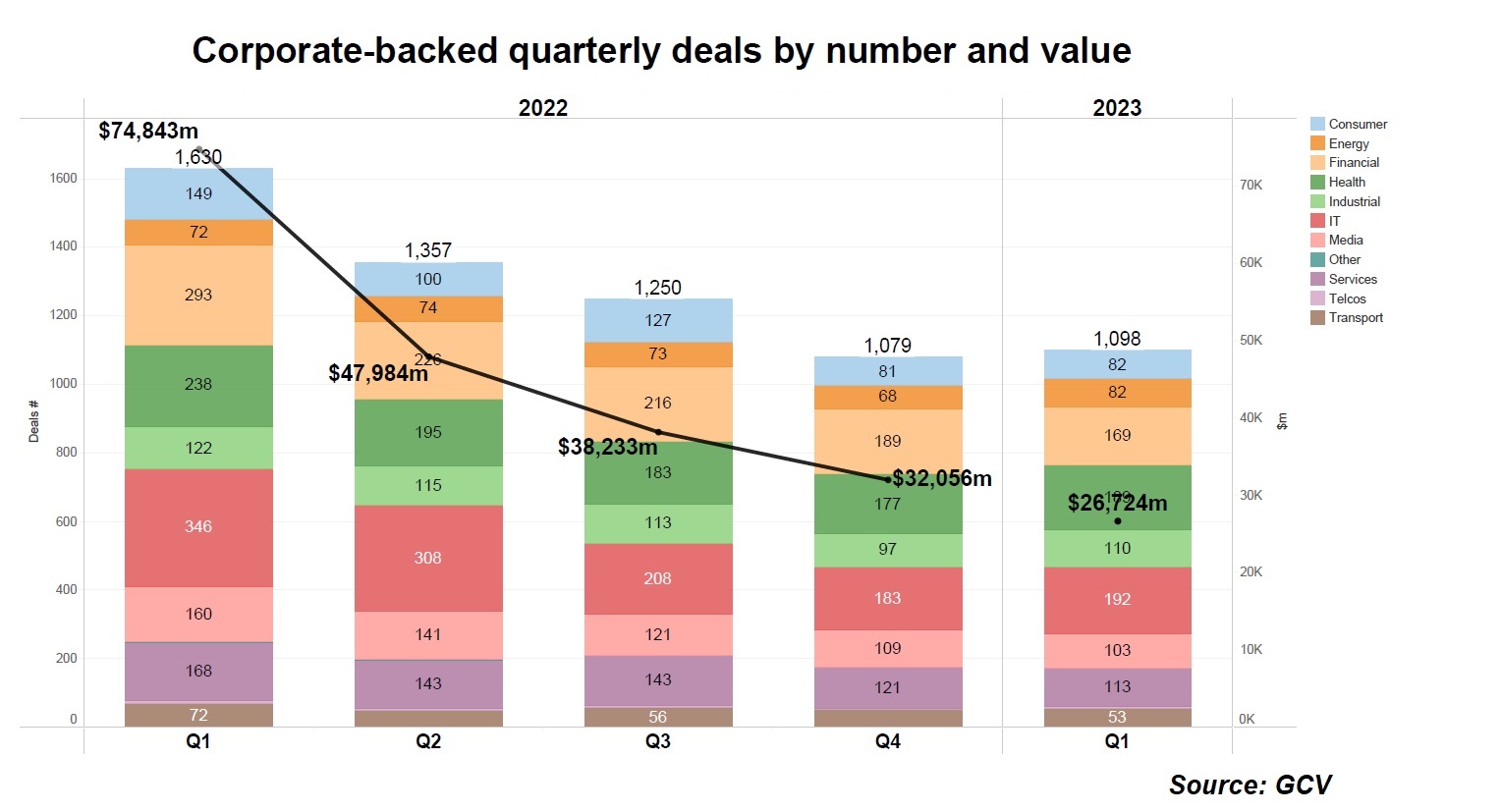

GCV reported 1,098 funding rounds involving corporate venturers in the first quarter of this year, down 33% from the 1,630 rounds recorded in the same period last year. The estimated total investment dollars stood at $26.72bn, down 64% from the $74.84bn recorded in Q1 of 2022.

When compared with the previous quarter (Q4 of 2022), the decrease seems somewhat less drastic. There was – in fact – a slight 2% increase in the deal count, up from the 1,079 in Q4, having gone down from 1,630 in Q1 2022. Total investment dollar value, however, dropped 17% to $26.72bn.

In comparison, total VC investments in Q1 (9,311 deals) dropped 50% compared with the same quarter last year (18,713), according to PitchBook data.

In total dollar terms, the overall global VC market in the first quarter ($75bn) dropped 59% versus the same period of 2022 ($181bn). The decrease was somewhat less pronounced when compared to Q4 of 2022 – down 18% from $91bn.

According to Crunchbase, cited by the Financial Times, VC firms had reached a record $580bn in estimated dry powder at the end of the first quarter.

This suggests that while the decline in total capital continues, the drop in number of rounds may potentially be bottoming. Or could this be a mere respite before it slides further if a recession takes hold?

Number of deals drop

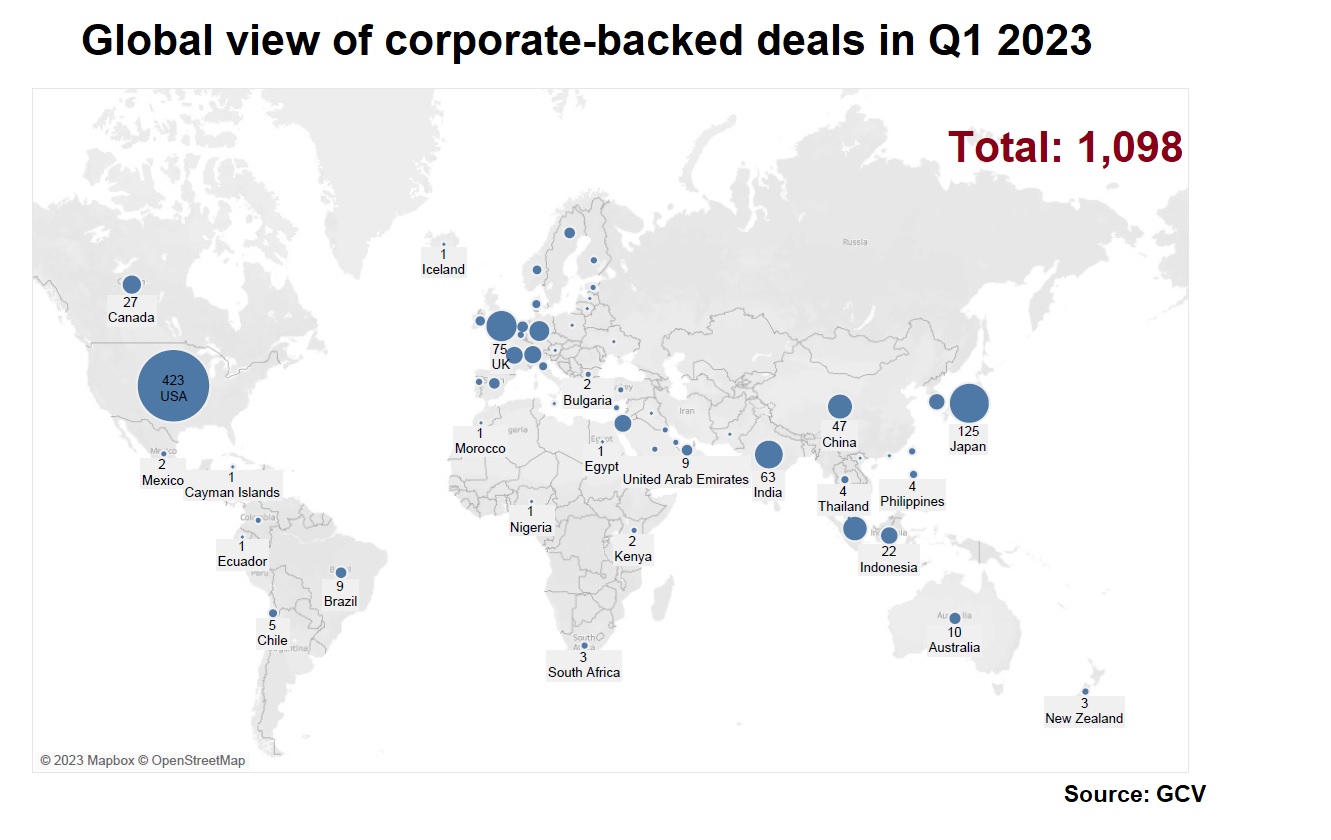

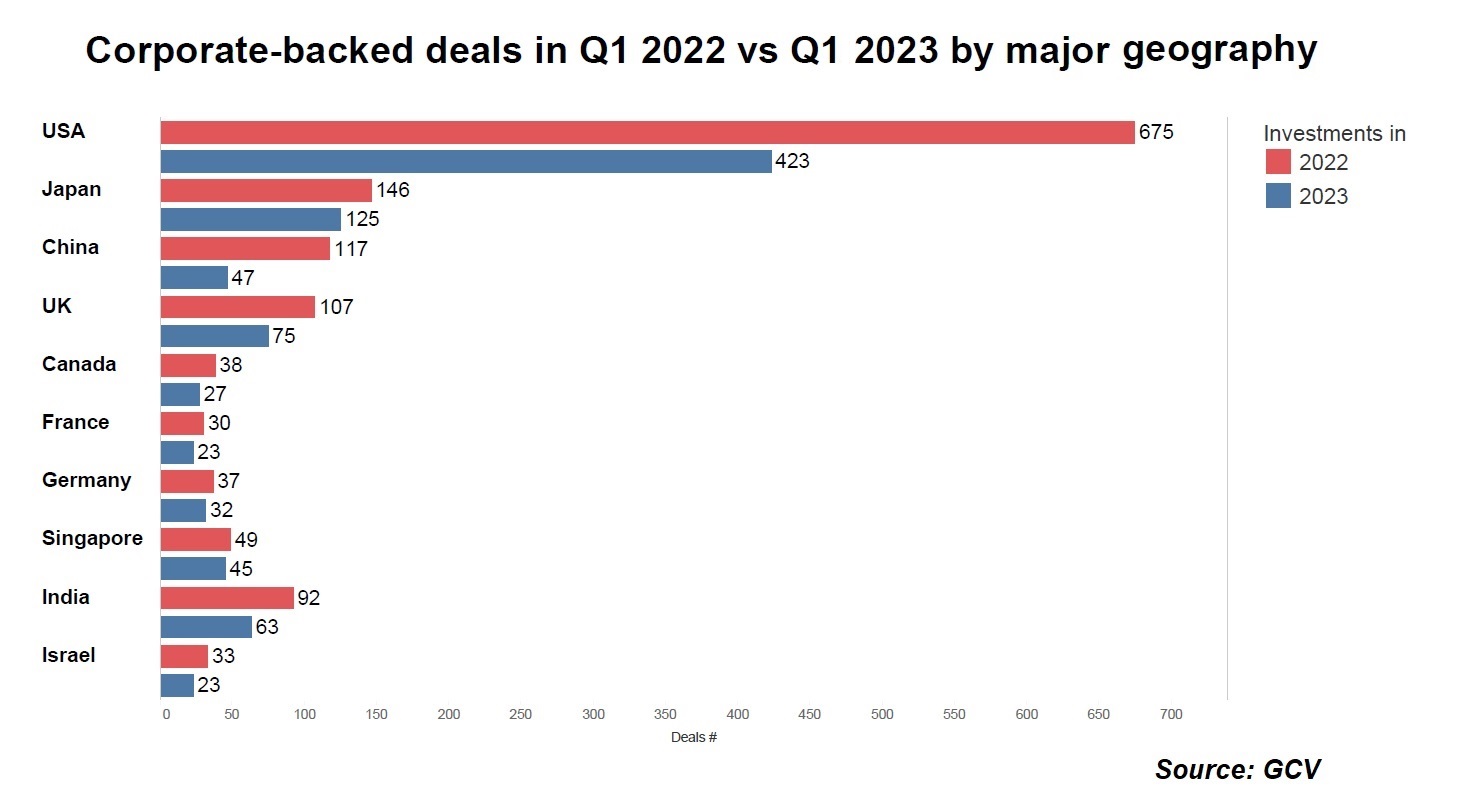

Across all major geographies we saw a drop in the number of deals. The number of deals in the US dropped to 423, from 540 in Q2 and 675 in Q1 of 2022, suggesting that corporate VC investments are still undergoing a severe correction compared with last year.

More importantly, however, the corporate VC community seems to have been able to weather the Silicon Valley Bank collapse largely unscathed (for now). It is not yet clear what the medium and longer term consequences of this event will be. However, it is reasonable to suppose there will be some fallout, especially for startups that relied on venture debt. There may also be some implications for venture funds that relied on SVB as a lender for their general partner commit.

Kemal Anbarci, general manager of venture capital at Chevron Technology Ventures, the venturing arm of oil and gas major Chevron, commented: “Deal making pace has not changed apart from a small window of a few days focused on solving short-term liquidity issues of portfolio companies.”

Similarly, Raj Singh, managing partner at JLL Spark, the venturing arm of commercial real estate firm Jones Lang LaSalle, said: “Deal making had already slowed down before SVB and we haven’t seen an impact either way (so far). The general issues around doing deals are still present and relate to the macro economy more than SVB, which was resolved (for now).”

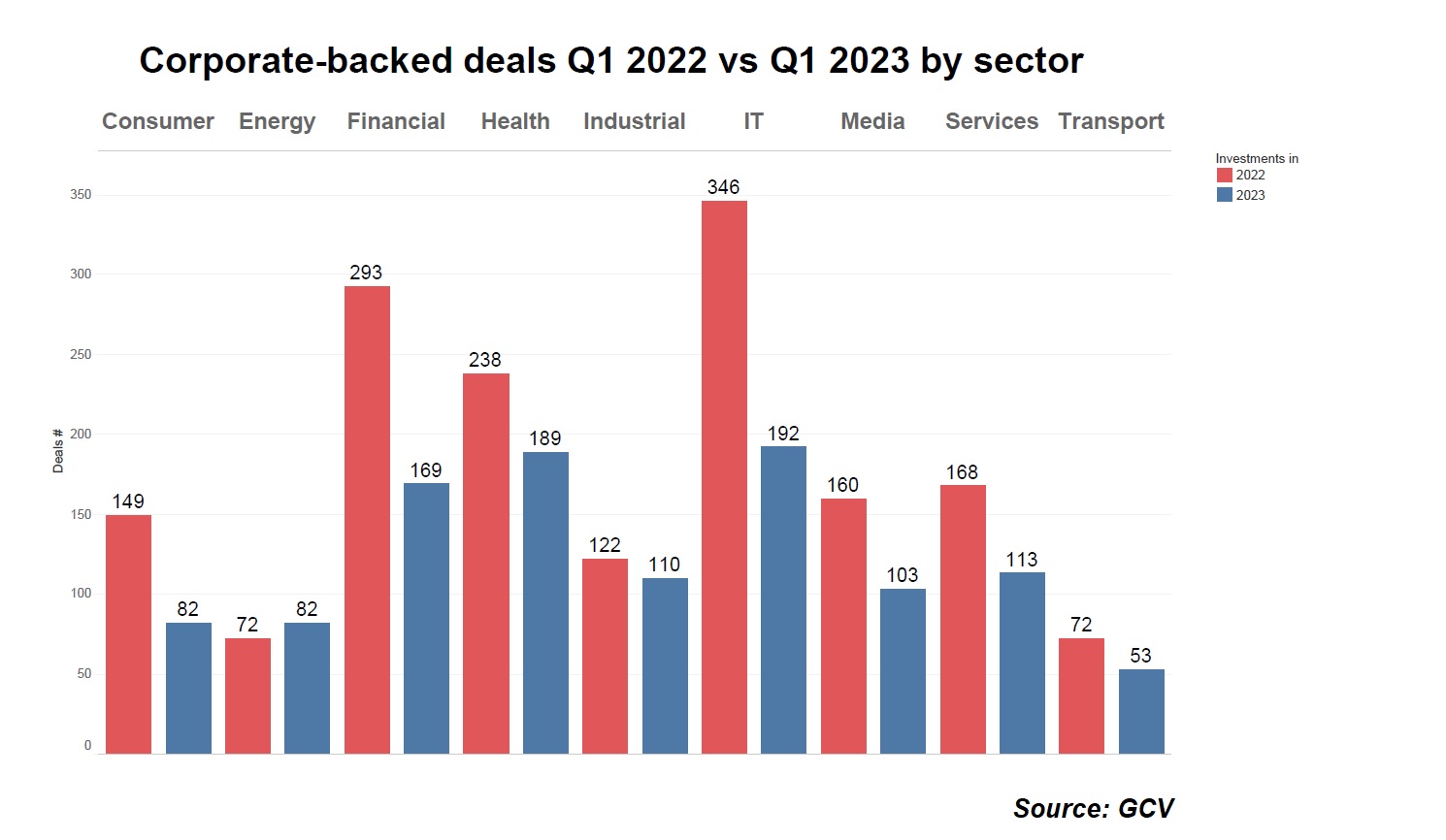

Deals in every sector but energy declined in Q1 when compared with the same quarter last year. This is hardly surprising given the bull market taking place in the energy ecosystem.

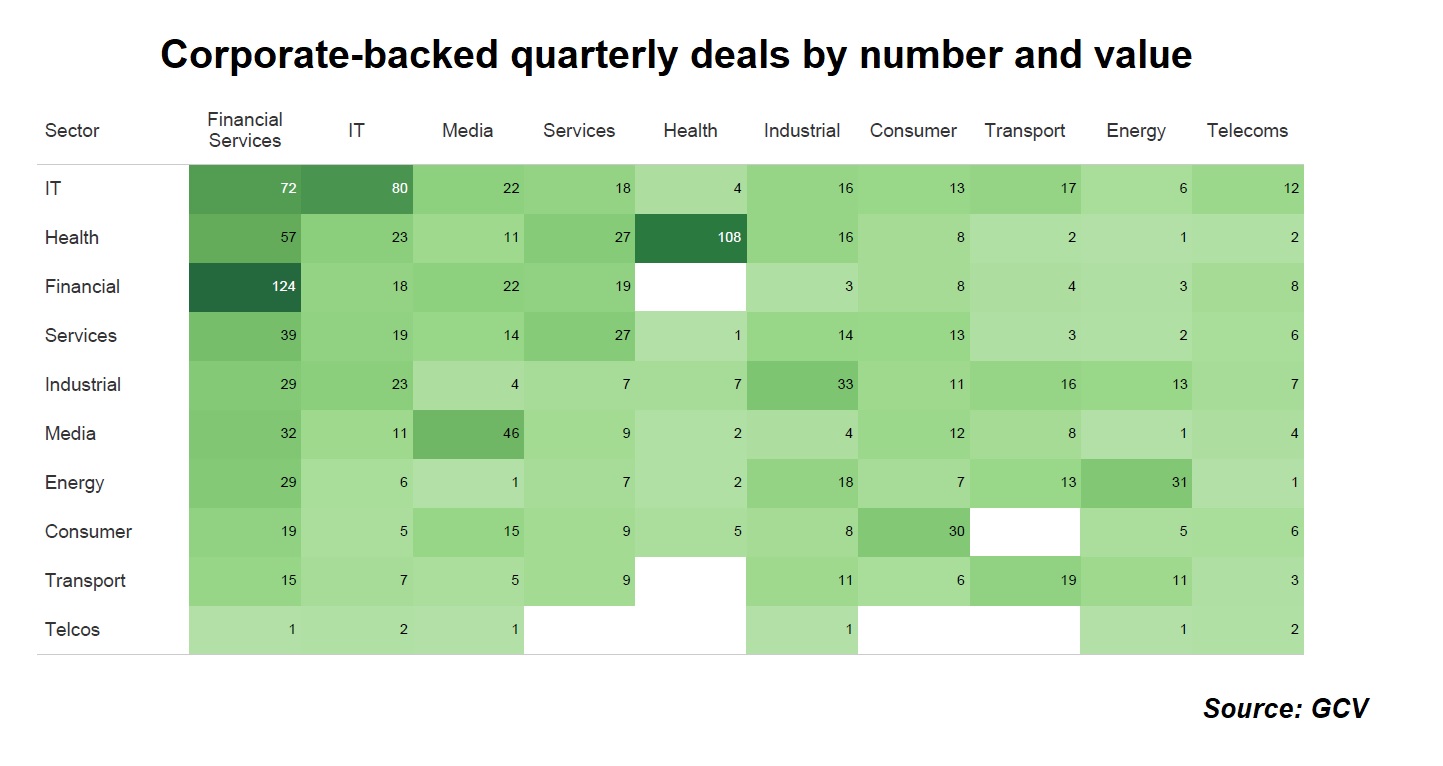

Emerging enterprises from the fintech, IT and health sectors proved to be the most attractive for corporate venturers, accounting for more than 180 deals each in Q1. The top funding rounds by size, however, were raised by companies from a variety of sectors.

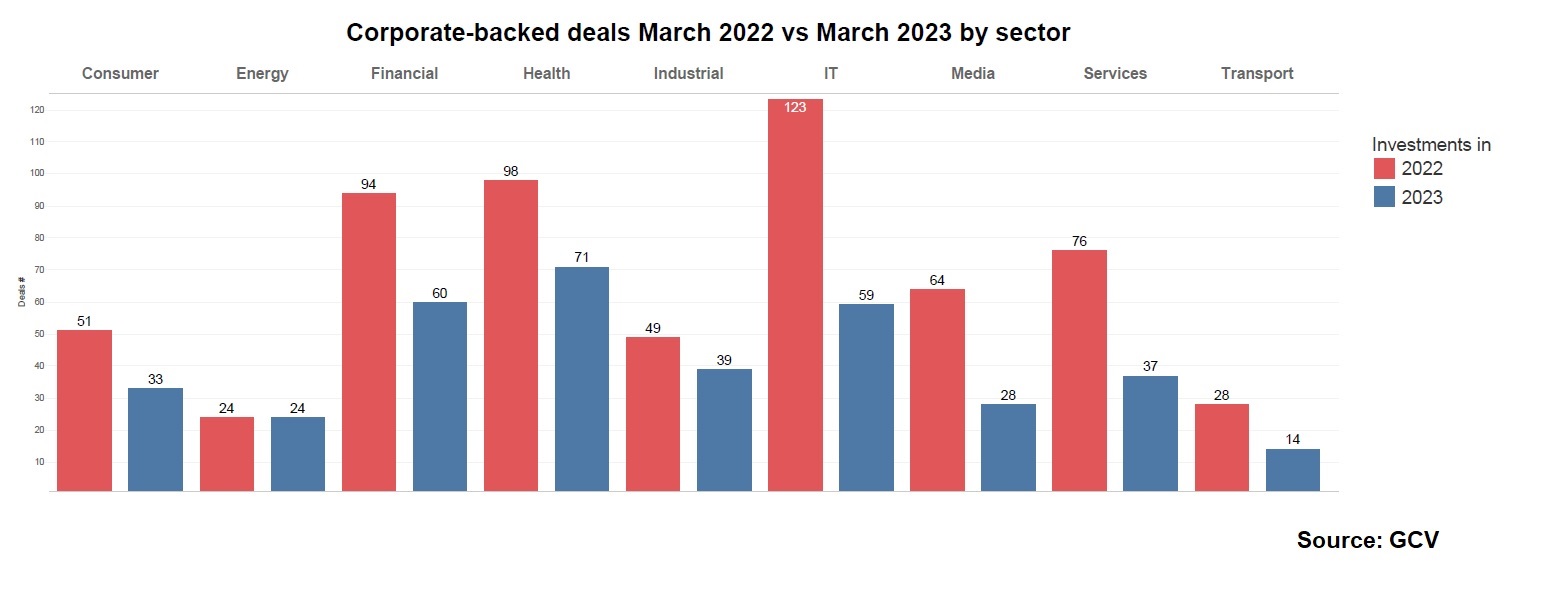

When we compare the last month of this first quarter (March), which is marked by the collapse of SVB, with the same month of last year, we see again that invariably there were fewer deals made in every sector, except for energy.

If we look at the Q1 data on a monthly basis, the decline is clearly becoming more evident during the first quarter by more on a total dollar basis than on total deal volume. On a monthly basis, the shock from the collapse of SVB was not noticeable globally. There may be a lag for a more pronounced medium and longer term impact to show up in the data.

The total number of deals we tracked for the first three months of 2023 remained largely stable month-over-month, while the total estimated capital continued the downward trend it has been on since last year. This clearly suggests a possible rotation to deals with lower valuations and smaller ticket size than previously.

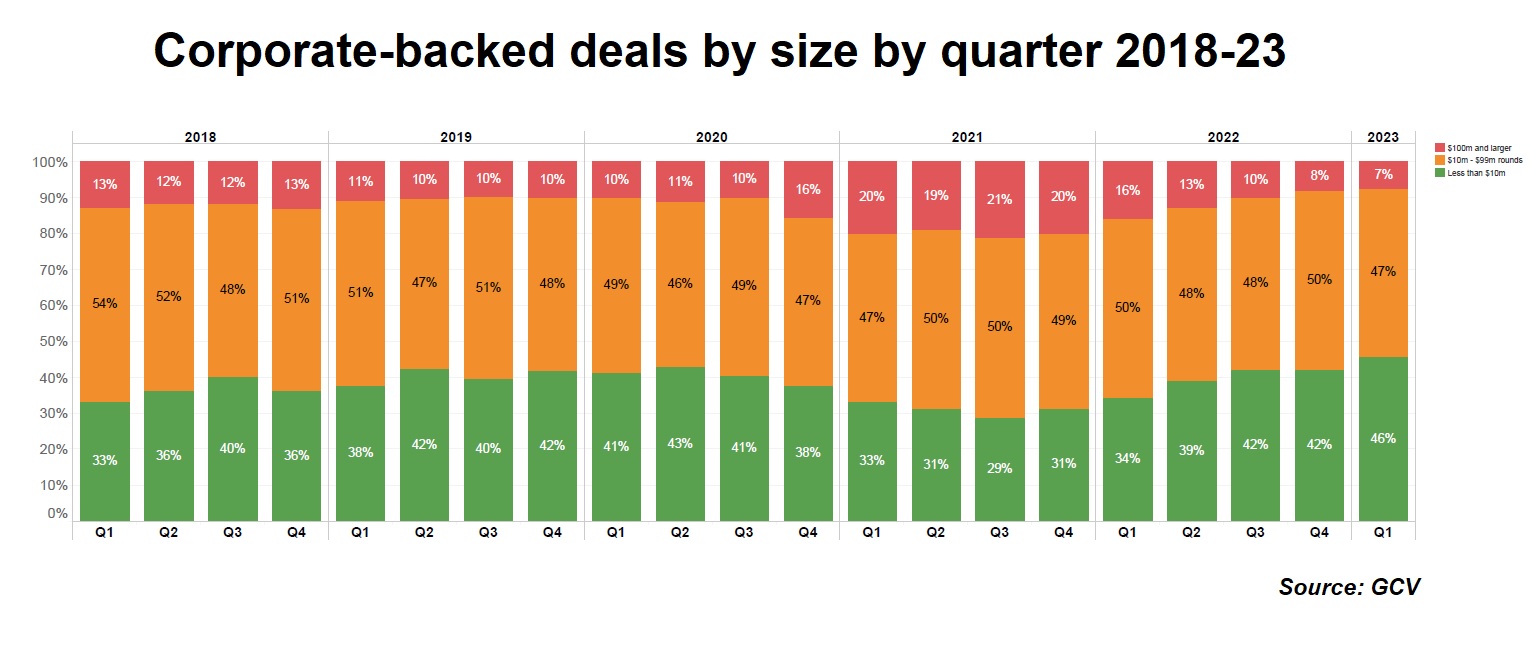

An interesting indicator to look at are the relative proportions of small (>$10m), medium ($11–$99m) and large (>$100m) deals. As the following graph illustrates, throughout 2022, the relative share of large deals, above $100m in size, was shrinking, and we continued to see that in the first quarter of 2023 as well, when respective figure stood at 7%.

The migration to smaller deals, which began in 2022, continues at a steady pace, with those making up already an estimated 46% of the total, or nearly half of all corporate deals with disclosed size.

This is consistent with what we have been hearing from professionals of the CVC community. Raj Singh, of JLL Spark, says: “Generally, it makes sense to look for slightly earlier stage companies that can weather the downturn with lower burn rates. CVCs are well positioned for this market.”

Singh adds: “The macro issues mean that if you have cash available and a long, multi-year time horizon, there are deals to be done. Distinguishing the companies that are worth investing in is as hard as ever.”

Anbarci, of Chevron Technology Ventures, concurs: “VC markets have been trending towards being more investor friendly. Tighter credit conditions will likely accentuate it. Given this trend, CVCs can and should be able to exercise more power in valuations in earlier rounds, which still have a way to go to match the trend in late stage and exit valuations. Independent of the trend or current dynamics, it’s important to emphasise continued vigilance on good governance by startups as well as the CVCs.”

CVC veteran Girish Nadkarni, who holds several advisory, board and consulting positions in the clean energy space, also finds today’s market conditions a net positive for CVC and the VC space as as whole. “Tighter credit conditions and higher interest rates will push away the non-traditional venture investors like mutual funds and hedge funds who made VC investments in search of higher yield.

“This is good for the industry as they typically are inexperienced and short term oriented, and their arrival is always a sign that the market has peaked. Their departure allows valuations to fall back to reasonable levels and only good companies will get funding. This is good for CVCs and VCs who have the skills and capital.”

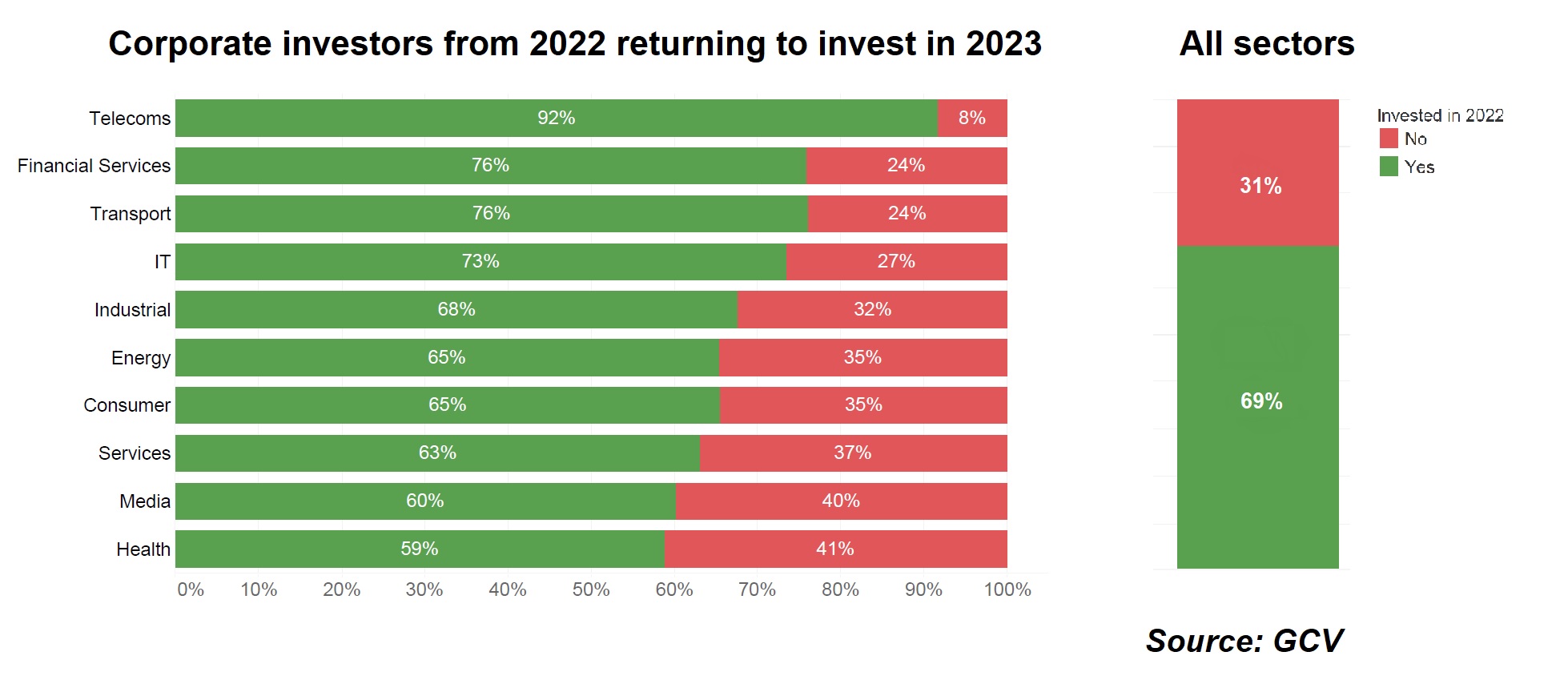

Overall, the idea that corporates are likely well positioned to look for opportunities at bargain prices seems to be supported by our data. Roughly seven out of every 10 (69%) of those that participated in at least one minority stake round last year returned as investors in Q1 of 2023 across all sectors.

In some sectors, the proportion of returning investors is actually higher – telecoms (92%), financial services (76%), transport (76%) and IT (73%). This indicator can be considered a reasonable proxy of the longer-term commitment of corporate investors to venture investing.

The most active corporate investors, in turn, came from the financial, IT, media and services and health sectors, as shown on the deal heatmap.

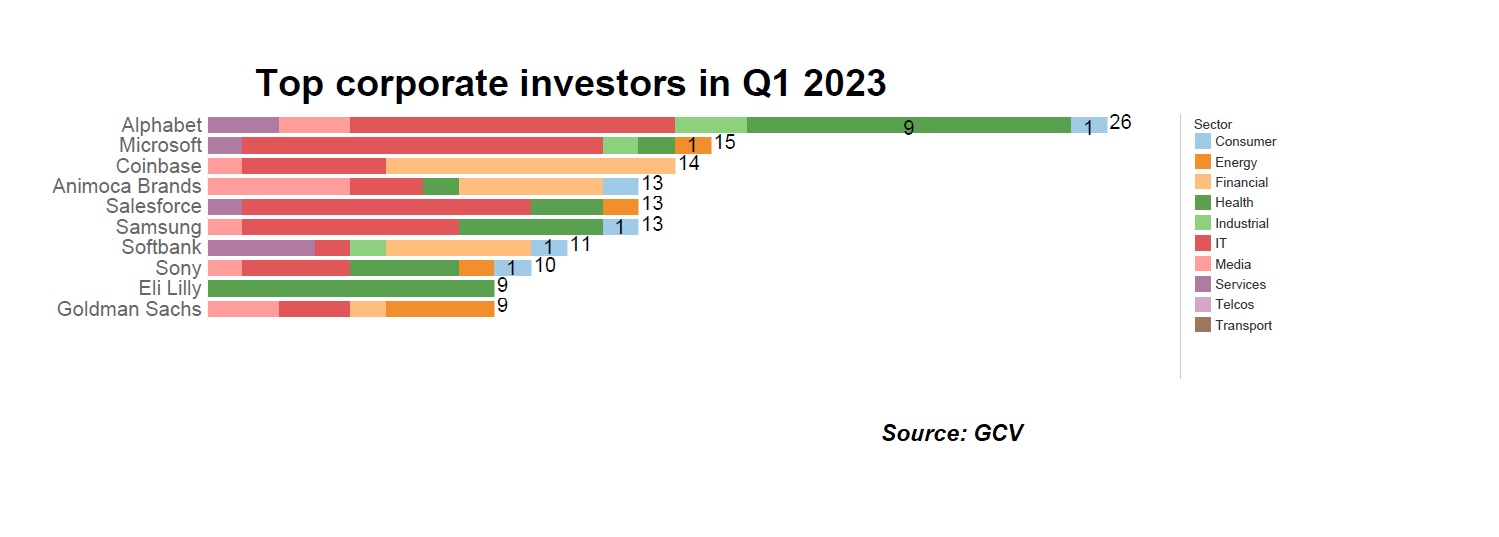

The leading investors by number of deals were internet conglomerate Alphabet, software provider Microsoft and crypto assets exchange Coinbase.

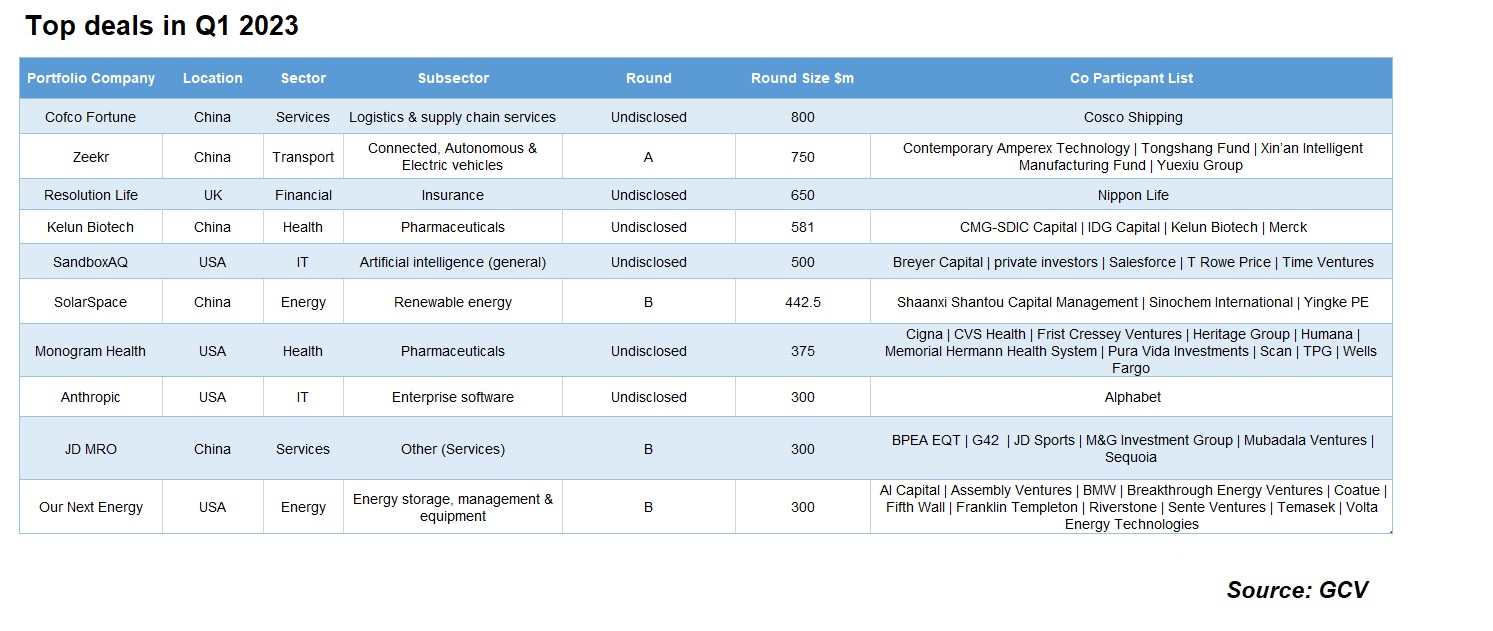

Biggest deals

Most of the funding from the biggest rounds reported in the first quarter went to emerging enterprises from a variety of sectors including energy, transport, IT and financial services. None of the top 10 rounds stood above the $1bn mark.

China’s Cosco Shipping agreed to pay 5.5bn yuan ($800m) for a 5.8% stake in Cofco Fortune, a food processing and logistics unit of Chinese state agricultural conglomerate Cofco. The company will explore operations involving resources such as container yards, warehouses and terminal ports, according to Reuters. Other backers of Cofco Fortune include several state-linked entities as well as the asset management arm of insurance firm China Life Insurance.

Zeekr, the luxury electric vehicle subsidiary of China-based carmaker Geely, raised $750m in a series A round featuring battery manufacturer Contemporary Amperex Technology. Yuexiu Industrial Fund, Tongshang Fund and Xin’an Intelligent Manufacturing Fund filled out the participants.

Bermuda-based life and annuity insurance consolidation business Resolution Life received $650m from Japanese insurance firm Nippon Life, which is a returning investor, having reportedly committed $1.65bn to the company to date. The deal followed an announced strategic partnership between Resolution Life and Blackstone. Blackstone has become Resolution Life’s investment manager for certain areas, including directly originated assets across the private credit, real estate and asset-based-finance markets.

China-based small molecule-focused subsidiary of Kelun Pharmaceutical, Kelun Biotech, raised $581m funding round featuring its parent Kelun as well as pharmaceutical firm Merck in addition to other investors. Founded in 2016, Kelun Biotech is developing biological therapeutics and small molecules, with a pipeline targeting a range of ailments including cancers, infectious diseases and autoimmune conditions.

SandboxAQ, a US provider of quantum computing simulation software which was spun off by internet and technology group Alphabet, raised $500m in funding. The cash came from investors including former Alphabet chairman Eric Schmidt as well as Time Ventures, Breyer Capital and T. Rowe Price. The company is developing AI quantum software designed to address business and scientific challenges.

Exits

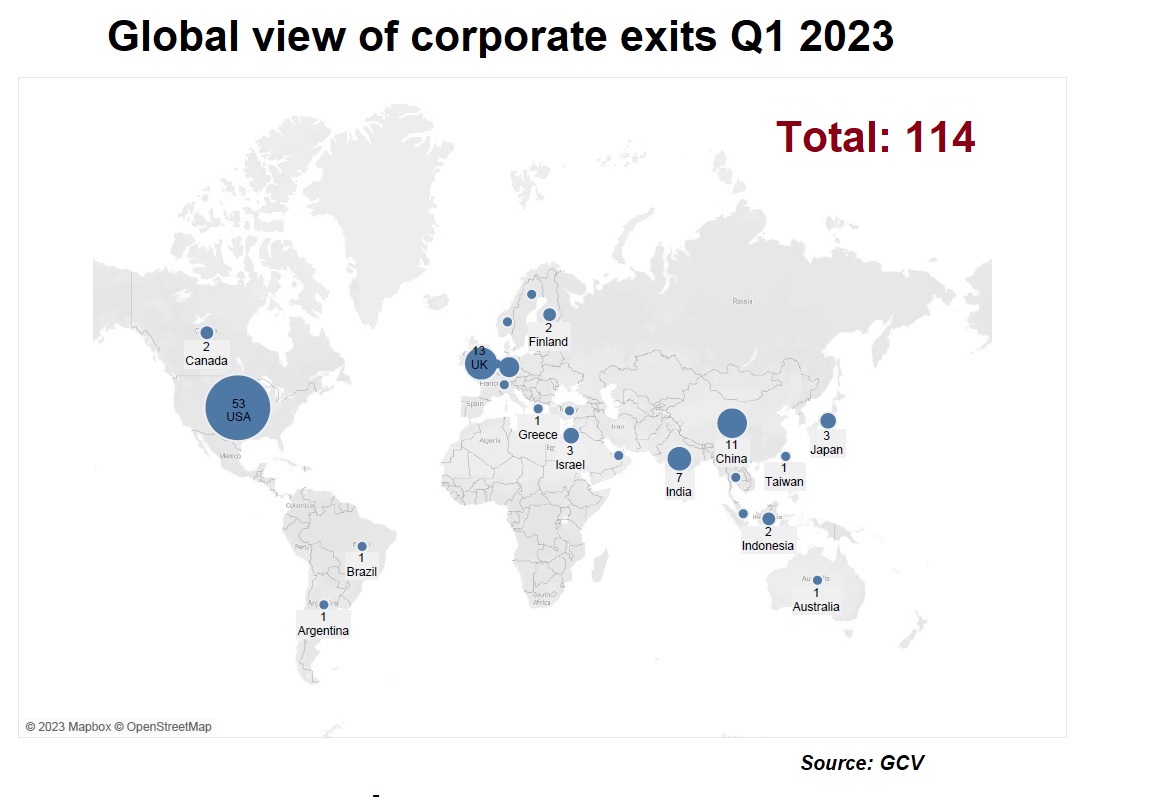

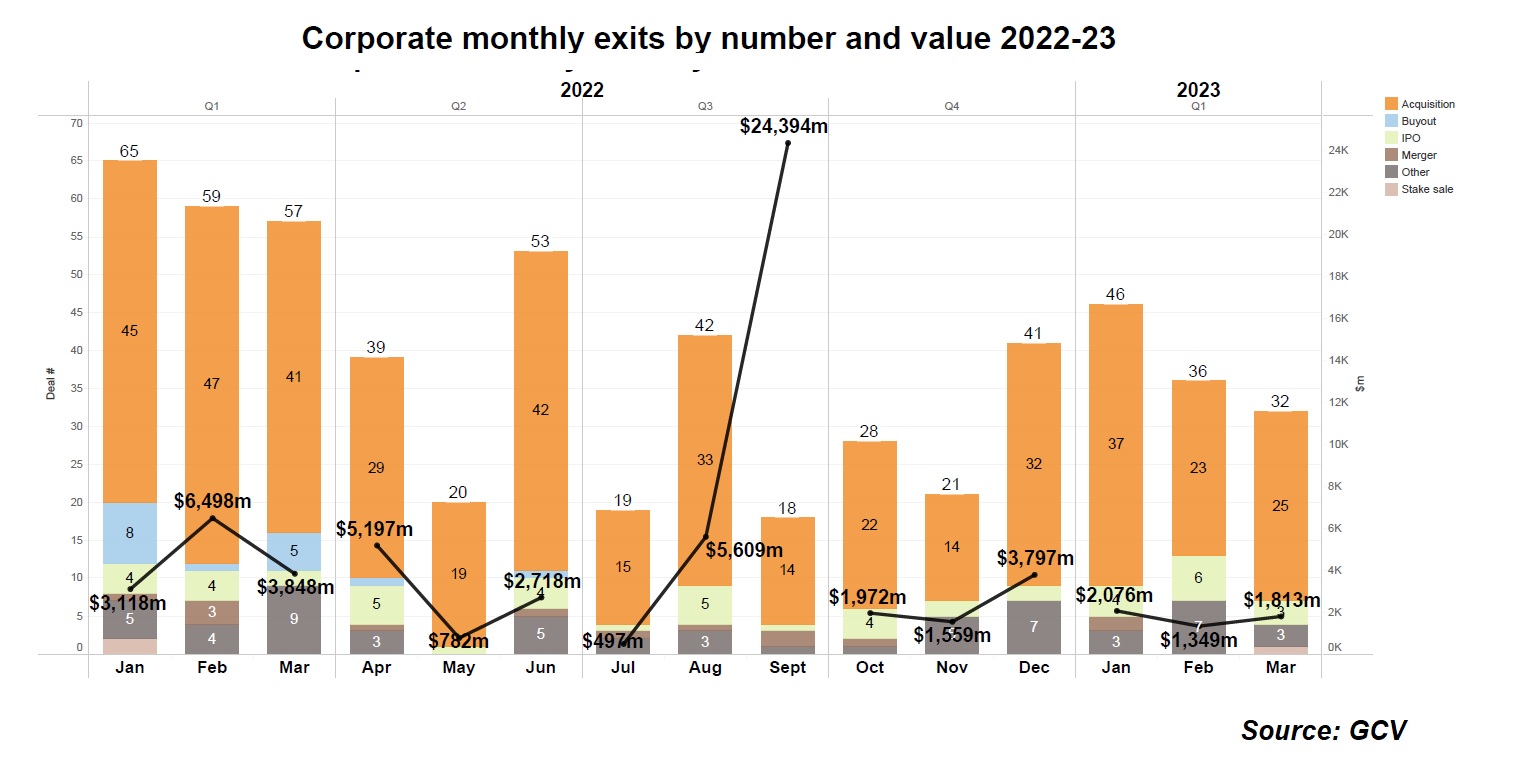

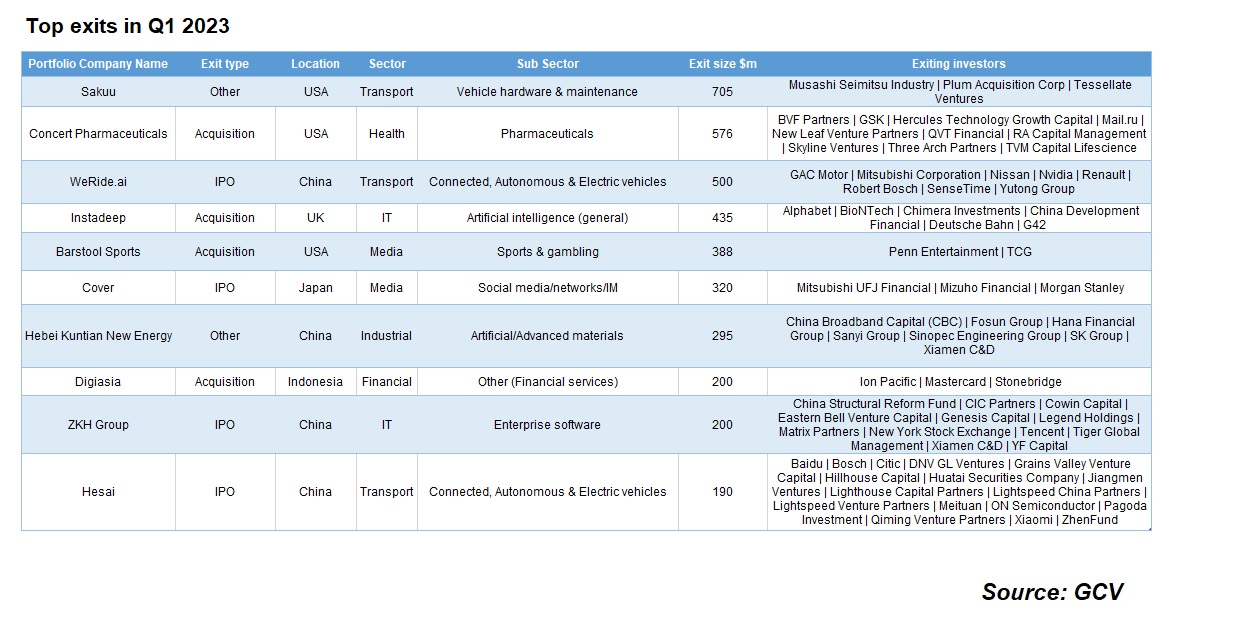

GCV Analytics tracked 114 corporate-related exits in the first quarter of 2023, including 85 acquisitions, 13 announced initial public offerings (IPOs) and 10 other transactions (including reverse mergers with Spacs), among other.

The number of exits compared with previous quarters continued to decline. The 114 exits were a fraction of the 181 in the Q1 last year.

The total estimated amount of exited capital in Q1 2023 was $5.24bn, lower than the $13.46bn registered in Q1 of the previous year.

No exits reported by GCV stood above the $1bn mark.

Sakuu, a US lithium-ion battery developer backed by transportation equipment manufacturer Musashi Seimitsu Industry, is reportedly set to go public through a reverse takeover with Nasdaq-listed blank cheque company Plum Acquisition Corp I, at a combined pro forma valuation of about $705m. Musahi Seimitsu led a $14m series A round for Sakuu in early 2021, when it was still known as KeraCel. This took its total funding to more than $16m.

Sun Pharmaceutical Industries agreed to acquire Concert Pharmaceuticals, a US alopecia areata treatment developer backed by another pharmaceutical group GlaxoSmithKline, for $576m. Concert Pharmaceuticals seeks to discover and develop small-molecule drugs by incorporating new elements into known molecules or by leveraging approved drugs to be used for new treatments. The pipeline consists of small molecules designed for oral administration to cure cystic fibrosis, inflammation, narcolepsy, residual schizophrenia, major depressive disorder and Alzheimer’s agitation.

WeRide, a Chinese autonomous driving technology developer backed by corporate investors GAC, Robert Bosch, SenseTime, Nvidia, Renault, Mitsubishi, Nissan and Yutong, has confidentially filed to raise up to $500m in an IPO in the US, people familiar with the matter told Bloomberg. The company was valued at $4.4bn when it closed a $400m round in March 2022.

Pharmaceutical firm BioNTech agreed to pay £362m ($440m) to buy portfolio company InstaDeep, a UK-headquartered developer of artificial intelligence software for decision making. It raised at least $107m as of a $100m series B in January 2022, featuring internet technology producer Google, artificial intelligence technology provider Group 42 and Deutsche Bahn Digital Ventures, part of public transport operator Deutsche Bahn.

Gambling and gaming group Penn Entertainment paid $388m for the remaining 64% of US online sports media platform Barstool Sports that it did not own, three years after having investing $163m for a 36% stake. At the time of the 2020 deal, investment adviser The Chernin Group held a 36% stake, with the rest of Barstool owned by its founders and employees. Barstool Sports runs a digital media company that produces content focused on sports, comedy and pop culture.

Japanese two-dimensional entertainment company Cover filed to go public on the Tokyo Stock Exchange under the ticker symbol of 5253. In the offering, the company will aim to sell 1.5 million new shares along with exiting shareholders intending to sell nearly 11 million shares at an estimated price of ¥710 per share. Cover Corp operates a platform for two-dimensional entertainment. It is engaged in developing businesses to accelerate 2D entertainment, such as distribution system development, VTuber office management and content development.

Funding initiatives

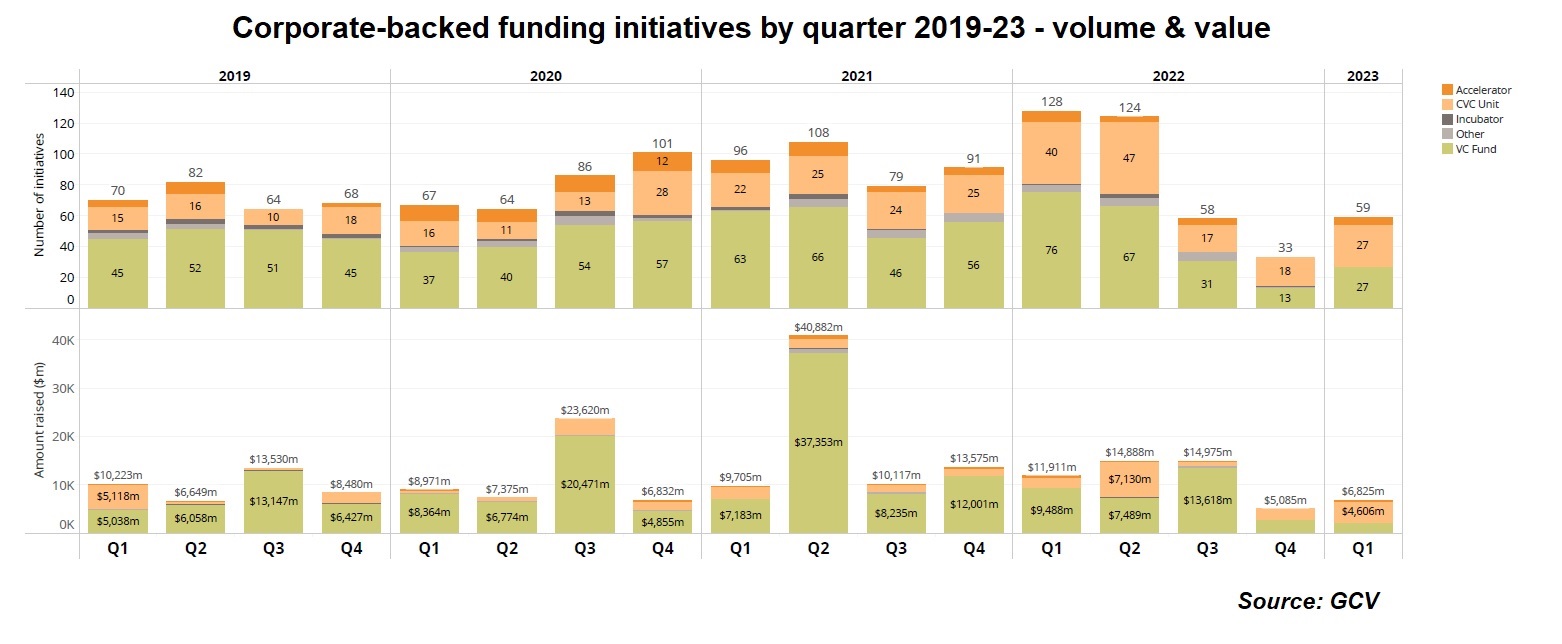

Corporate venturers supported 59 fundraising initiatives in the first quarter of this year, less than half of those reported in Q1 of 2022 (128). The figures were down from 96 such initiatives reported in the same period in 2022. The estimated total capital raised in Q1 this year stood at $6.82bn, 33% higher than that of the preceding quarter but still only about half of the amount from the same quarter last year.

The 59 initiatives included 27 announced, open and closed VC funds with corporate limited partners (LPs) and 27 new or refunded (or rebranded) corporate venturing units.

These figures suggest that corporate LPs are holding their risk-off attitude, as entering a recession continues to be highly anticipated in many industrialised nations. If this trend continues along with high inflation and interest rate hikes, the implication is lower availability of capital for innovation.

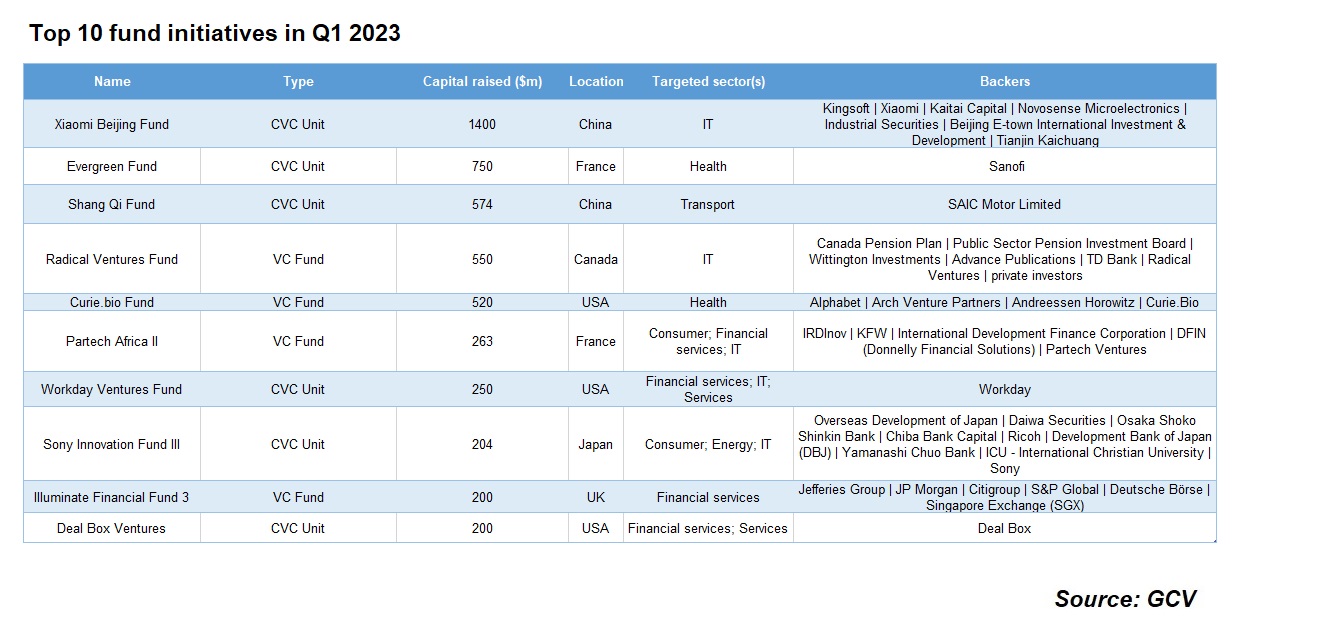

Despite the overall downward trend, there were notable corporate-backed funding initiatives. Most of the top ones came from geographies outside the US.

A subsidiary of diversified software producer Kingsoft teamed up with another Chinese corporate, consumer electronics manufacturer Xiaomi, to form a RMB10bn ($1.4bn) fund to back integrated circuit developers, according to a Hong Kong Stock Exchange filing cited by DealStreetAsia. Kingsoft Wuhan is providing approximately RMB500m as one of the limited partners while Xiaomi Wuhan will contribute RMB3bn. Xiaomi Beijing is supplying RMB30m as the fund’s general partner and its other limited partners include Hainan Huaying Kaitai and Nano Star Ventures, respective subsidiaries of IT services firm Kaitai Technology and semiconductor producer Novosense Microelectronics, as well as Industrial Securities Investment, Yizhuang International Investment, E-Town Capital, Tianjin Haichuang and Beijing Guiding Fund.

French pharmaceutical firm Sanofi expanded the size of corporate venture capital subsidiary Sanofi Ventures’ evergreen fund to $750m to increase the unit’s investment capacity. Sanofi Ventures targets immunology and inflammation, rare diseases, oncology, cell and gene therapy, and vaccine developers in addition to startups focusing on digital health and healthcare data. The extra cash allocation follows 10 investments in 2022 and came a day after Sanofi Ventures co-led a $80m series B round for NextPoint Therapeutics, a company working on precision immunotherapies for cancer. The size of the fund before the extra cash allocation was not disclosed.

China´s automaker SAIC Motor set up a 4bn RMB ($574m) fund, featuring a group of domestic corporate peers as backers including auto services provider Donghua Automotive Industrial, auto body structure makers Huayu Automotive Body Components. SAIC reportedly committed 980m RMB ($140m) to the vehicle, which is managed by private equity firm Shang QI Capital, according to Deal Streets Asia. The vehicle will be focused on autonomous driving, low-carbon transportation, automotive chips and vehicle cybersecurity technologies.

Canada-based venture capital firm Radical Ventures raised most of the capital for its C$550m ($373m) fund, from backers including media group Advance Publications. Financial services firm Toronto-Dominion Bank also contributed, as did Canada Pension Plan Investment Board and Public Sector Pension Investment Board, Temasek, Geoffrey Hinton and Fei-Fei Li. Radical focuses on investments in companies developing AI products or applying AI to create competitive advantages in massive markets.

Curie.Bio launched with $520m from investors including internet and technology group Alphabet’s GV unit, which looks to be leveraging its life science experience to participate in a new approach to healthcare startups. A first-time venture firm raising above $500m is extremely rare, but it was arguably a measure of both the expertise of its founders and a vision, which combines early-stage investment with close coaching, amplifying what traditional corporate VCs offer.