Venture capital is becoming a larger part of the toolkit companies’ spending on innovation. As some companies decrease the relative amount they spend on research and development and acquisitions, they are increasing their corporate venture capital activity, according to research by GCV.

Venture capital was once effectively a rounding error on the big innovation tools used by corporations to help drive their productivity, margins and revenue growth. The winds of change, however, are starting to blow.

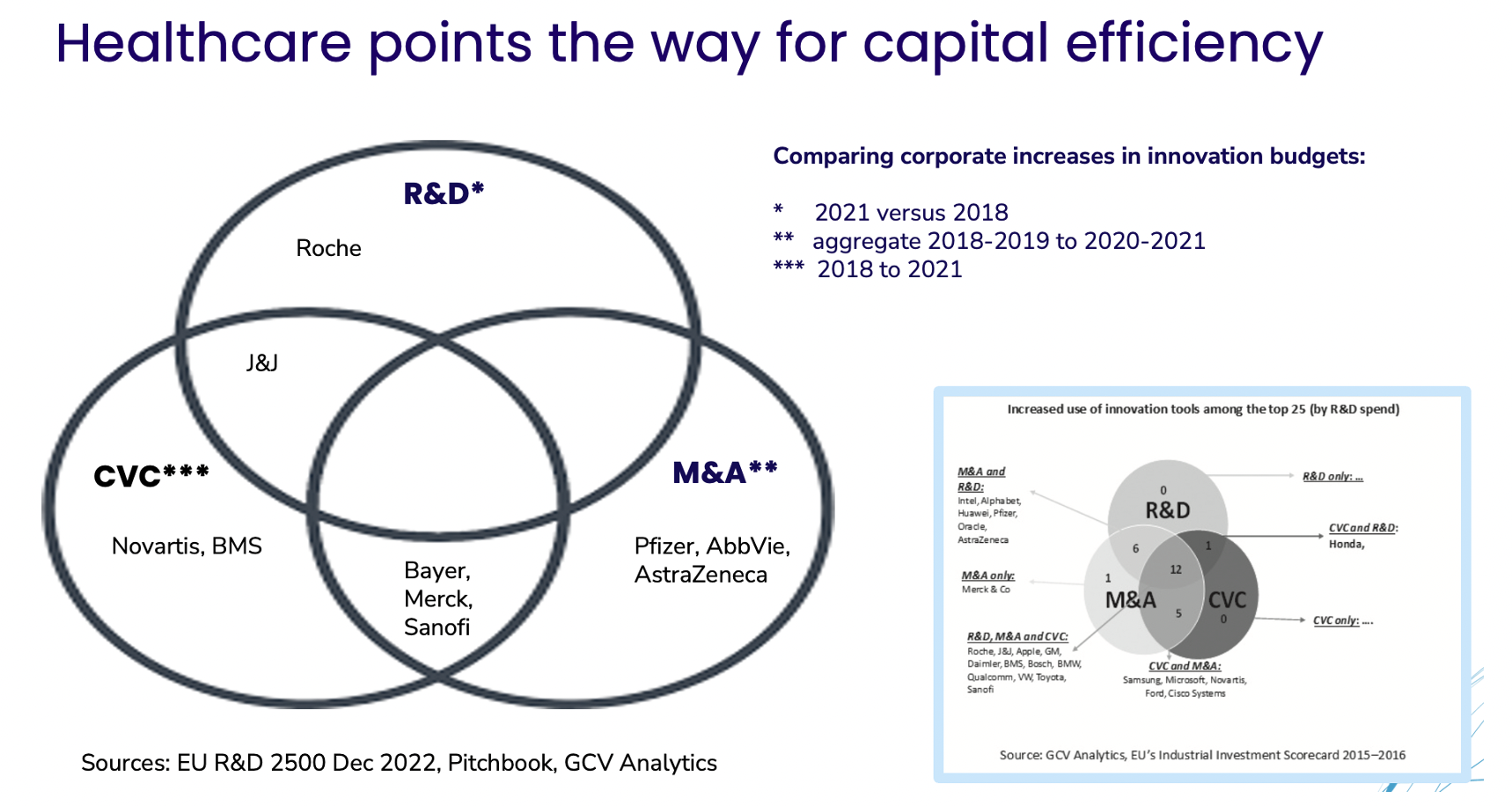

Healthcare – probably the oldest and most established of the corporate venturing industries – is showing the way to a more advanced and sophisticated allocation of capital to those innovators who can use the capital and support best.

More than 2,000 corporate venturing units (CVCs) were involved in deals worth at least $292bn in aggregate last year, according to GCV Analytics in the World of Corporate Venturing 2023 report published this week at the GCVI Summit. This is about 10 times the level of activity CVCs had a decade ago, but still a relatively small. Although it is hard to get precise numbers, it is assumed about a fifth of the dollars in a venture round involving a corporate comes from the CVC unit. So global corporate venture spending is still only in the tens of millions of dollars annually.

Venture capital spending accounts for around 1% of total corporate innovation budgets. What would it take to get nearer 10%?

Contrast that with the amount spent by the corporations on research and development (R&D) and mergers and acquisitions (M&A). The latest analysis of the top 2,500 global corporations by R&D spending, published in December by the European Commission (EC), found they invested more than $1 trillion ($1,094bn) in the latest period (2021). Meanwhile, Pitchbook tracked M&A worth in aggregate $1.44 trillion last year.

Venture capital spending accounts for around 1% of total corporate innovation budgets. What would it take to get nearer 10%?

In the book, Corporate Venturing: A Survival Guide, published in 2019 the authors showed the interrelation between CVC, R&D and M&A as the largest corporations allocated their budgets between these innovation tools. The six-year trend in data back then was the largest companies by R&D were effectively increasing their CVC spend along with usually one other of the two main tools.

Updating this data set for the latest period from 2018 to end-2021 and narrowing down to the top 10 largest healthcare companies by R&D spend, GCV Analytics has found while the overall aggregate amounts invested has increased the R&D intensity has usually started to fall. R&D intensity is the percentage of sales invested in internal research and development and all bar Johnson & Jonson (J&J) and Roche saw their intensity levels fell between 2018 and 2021, according to the EC data.

By contrast, in this same period more than half of the same healthcare corporations increased their CVC activity by deal volume and value, according to GCV Analytics. And the same number, six, although not always the same ones, increased their M&A activity, Pitchbook found.

This M&A trend may well continue, given that very few of the 91 recently listed tech groups that have reported results so far this year are reporting net profits. Many of these could be looking for suitors if they run out of money ,according to the Financial Times.

This targeting of increased money towards corporate venturing makes sense if corporations regard CVC as both a strategic and financial contributor to its balance sheet and profit and loss accounts.

J&J, the world’s largest healthcare company, set up the world’s longest-established CVC unit more than 50 years ago. About half of its pharmaceutical innovation is now sourced from outside the company, CEO Joaquin Duato said last summer.

Pfizer, the second-biggest drugs maker by annual sales, said it could add $25bn of risk-adjusted revenues to its 2030 top line through dealmaking, CEO Albert Bourla told investors during a conference call in February.

Venture investing helps access the best external entrepreneurs and thus sharpens internal decisions about which areas R&D efforts should target. It can also improve generally abysmal M&A success rates of 20% to 50% by better targeting of entrepreneurs that have a cultural as well as strategic fit to the purchaser.

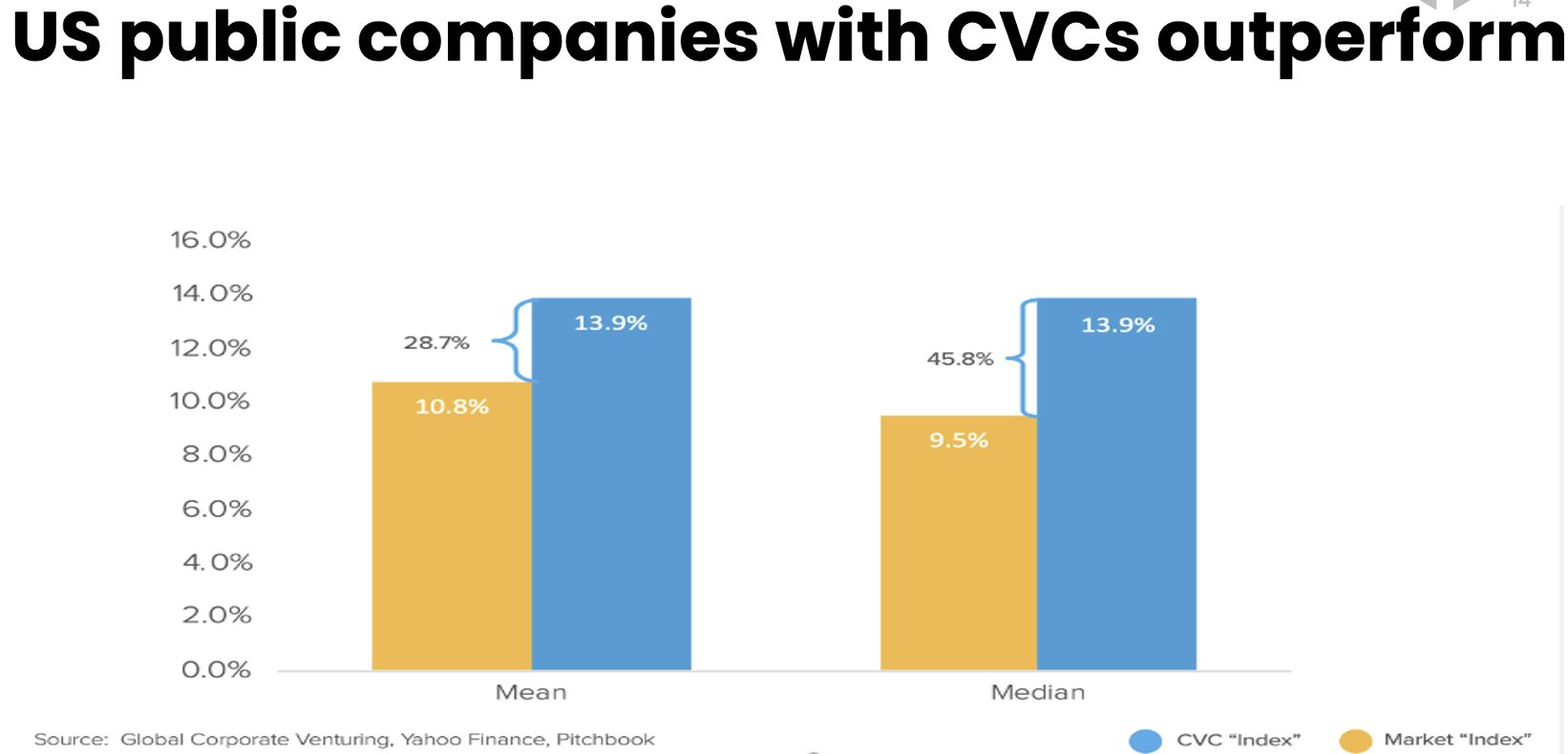

All of this makes CVC an aid to share price outperformance compared to their peers.

The Global Corporate Venturing 2020 index by stock performance analysis prepared by Touchdown Ventures showed a more than three percentage point outperformance of corporations with a CVC unit compared to the mean and median equity in their index.

Almost three-quarters (71) of the top 100 US companies in the Fortune 500 list by market capitalisation have active CVC units, according to GCV Analytics published in last year’s book, Transformative Innovation. This was substantial growth from less than a third in 2010 and about 10 at the turn of the millennium and the height of the dot.com boom.

Almost three-quarters (71) of the top 100 US companies in the Fortune 500 list have active CVC units.

Around half (47) of the US companies that featured in the top 100 ranking in 2000 had left the list by 2020. Almost all of the 2000 vintage that remained in the ranking (46) have had an active CVC unit whereas most that dropped out did not.

Similarly, almost all the entrants in the 2020 Fortune 100 list compared with the 2000-era cohort have had a corporate venturing unit. They have learned from the successful and a reason why last year saw a record 101 CVC units formed worldwide, according to GCV Analytics.

Having a CVC unit has switched from being a rare strategic advantage to being basic “table stakes” for a corporation. Now, corporations without a CVC unit are at a strategic and competitive disadvantage to their better-resourced peers.

But for the industry to scale up another 10-fold in the coming decade will require greater sophistication in its asset management strategies and to be run on more professional lines using training, benchmarking and reports and data to help better land the value of corporate venturing around the world.