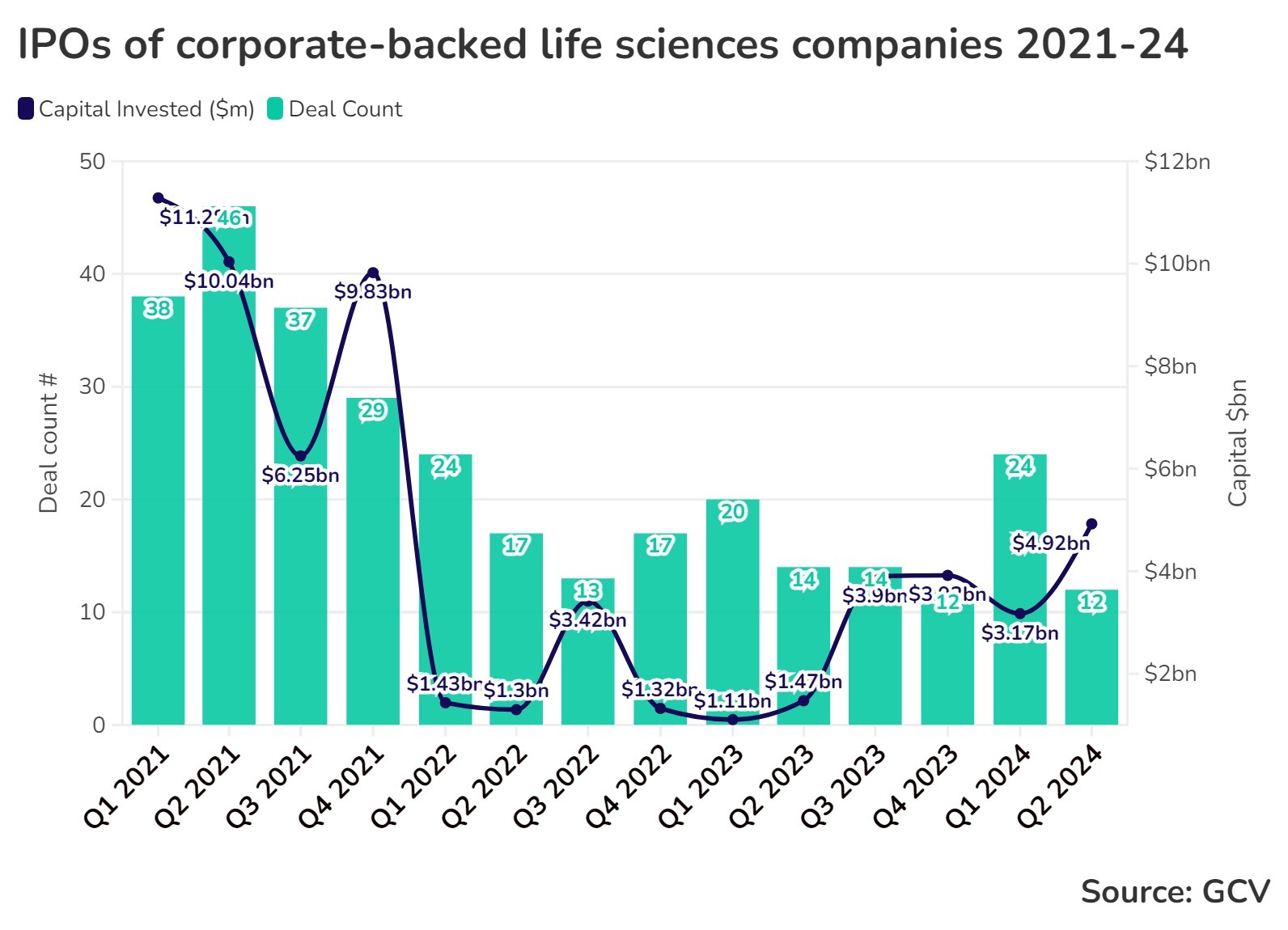

The life sciences sector has seen an uptick in exits in the first half of 2024, with more than 36 stock market listings, starting with the $380m listing of CG Oncology at the start of January. While we’ve not returned to the peak of 2021 when we saw 150 IPOs raising more than $37bn, there has been a recent uptick in activity.

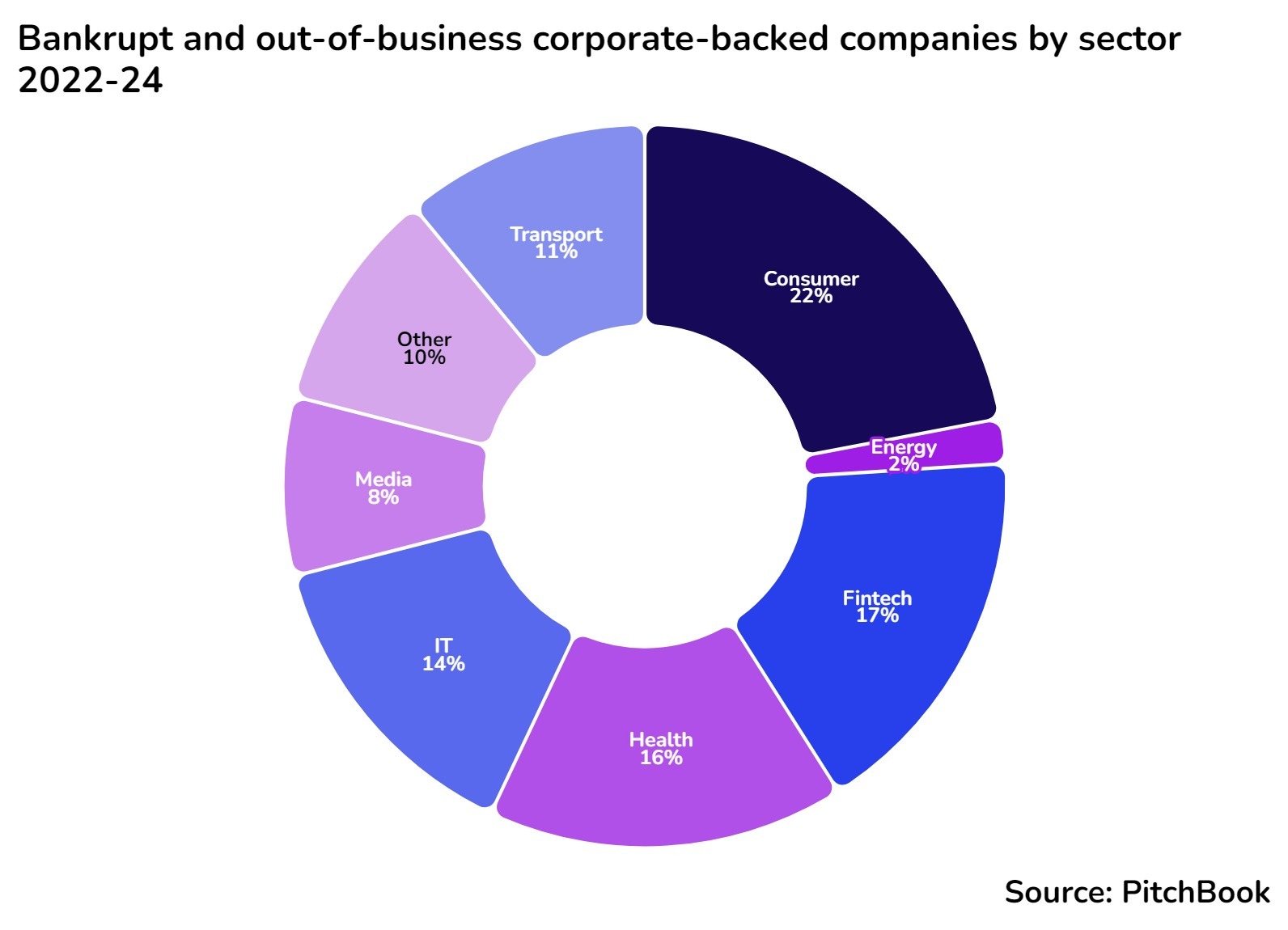

But, at the same time, it is worth noting that corporate investors in the healthcare, life sciences and pharmaceuticals sector have taken a heavy toll over the last two years in terms of companies going out of business. Alongside fintech and consumer startups, this sector has seen the most corporate-backed startups go into administration since 2022.

We’ve counted some 19 corporate-backed startups that have gone out of business in what we broadly term the healthcare sector, encompassing life sciences and pharmaceuticals. While the involvement of a corporate backer often correlates with higher survival rates for startups, it is clear that not every portfolio company can be a winner.

Here were some of the reasons these healthcare startups ended up not making it:

1. Competition: Escape Bio

San Francisco-based precision molecule therapies developer Escape Bio had become insolvent by the beginning of 2023. According to PitchBook, the company had raised $167m from a veritable who’s who of corporate investors, including AbbVie Ventures, Johnson & Johnson Innovation – JJDC, Lilly Asia Ventures, Novartis Venture Fund and Novo Holdings. Its orally administered therapies were designed to treat genetically defined subpopulations in neurodegenerative diseases, including Parkinson’s disease.

However, the company was competing against Denali, which had secured $1bn from Biogen for its Parkinson’s drug and is now a publicly-listed company.

2. Excess debt: Tarveda Therapeutics

Massachusetts-based solid tumour drug developer Tarveda Therapetics was liquidated in April 2022. The company was developing pentarin miniature drug conjugate medicines for treatment of patients with solid tumour malignancies. The miniature drug conjugate aimed to extend the lives of patients with hard-to-treat cancers while minimising potential toxicities. Tarveda had raised a total of nearly $130m before going bust, according to PitchBook. The company had been reportedly burdened with an unmanageable load of debt, leading to its liquidation. It counted Mass General Brigham Innovation, Novo Holdings, SciClone Pharmaceuticals and TaiAn Technologies Corporation among its backers.

3. Expansion exceeds funding: Fluidic Analytics

It is not entirely clear what led to Fluidic Analytics, a startup spun out of Cambridge University, to shut its doors in December 2023, but reading between the lines the company may have over-expanded and then found itself unable to raise a sufficiently large follow-on round to fund this. The analytic tools developer had raised a total of $93m from investors including Cambridge Enterprise, Innovate UK and Parkwalk Advisors.

The startup created instrumentation to measure protein-protein interaction in solution, an is understood to have had some 30 to 40 customers. A US-based company called Fluidic Sciences acquired its technology in May 2024, also bringing on board some of the scientific team.

4. Licensing legal issues: VHsquared

UK-based bowel diseases treatment maker VHsquared had raised more than $50m from investors including SR One Capital Management, Takeda Ventures and Unilever Ventures.

Founded in 2010, the London-based company was working on novel antibodies to target inflammatory bowel diseases such as Crohn’s Disease.

However, it became embroiled in a lengthly court dispute with biotech company Ablynx NV over a licence to use immunuglobulins derived from camelids (the camel family). Ablynx has an exclusive licence for medical uses of the technology while VHSquared had a licence for use in foods. The dividing line between food and medicine became something the courts needed to untangle.

As the case went through the courts VHSquared reported heavy losses and became unable to operate as a going concern without a further cash injection. The company was liquidated and ceased operations in January 2022.

5. Fraud: Curonix (Stimwave)

In every herd of companies has at least one black sheep. US-based neurostimulation tech developer Curonix — previously known as Stimwave — was developing a micro-sized injectable medical device, supposedly providing low-cost alternatives to surgery.

However, founder and CEO Laura Tyler Perryman was found guilty of creating and selling a fake component that was implanted into patients. The SEC also charged her with defrauding investors by making false and misleading statements.

Original investors in the company included Asahi Kasei Corporate Venture Capital and Xandex Ventures.

Curonix filed for Chapter 11 in October 2022. It received $40m debtor-in-possession financing from Kennedy Lewis Investment Management, which later acquired it through an LBO, according to PitchBook.