Japan is the world’s third-largest economy, with a gross domestic of nearly $5 trillion, the country has been home to some of the most successful electronics and automotive businesses, such as Canon, Casio, Nikon, Sony, Panasonic, Nintendo, Hitachi and Fujitsu for electronics, and Yamaha, Toyota, Nissan, Mitsubishi, Honda, Suzuki and Mazda for automotive, to name just a few.

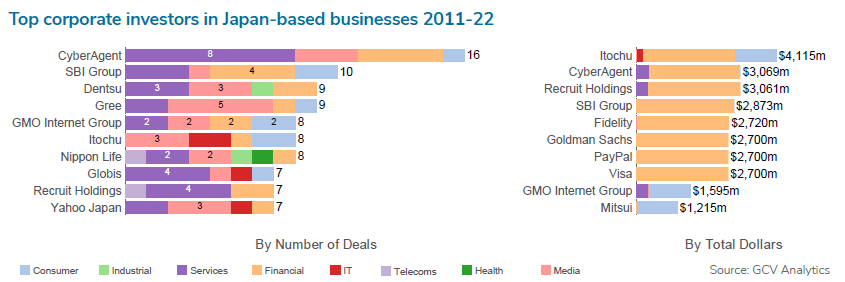

Many of these have conducted strategic investments, and some have their own specialised corporate venture capital (CVC) vehicles. Japan Venture Capital Association (JVCA) has some 90 CVC members, most of whose publicly disclosed deals have been tracked by Global Corporate Venturing Analytics.

Regarding the Japanese innovation ecosystem, Gen Tsuchikawa, chief executive and chief investment officer for Sony Ventures Corporation, the newly formed subsidiary of electronics manufacturer Sony that oversees various vehicles including Sony Innovation Fund and Innovation Growth Ventures, told GCV: “We can attribute the recent significant growth of Japan’s venture capital market, to the size gap of the VC market compared to the whole economy and infrastructure of large companies.”

Yuko Sasahara-Watanabe, president and chief executive of NTT Docomo Ventures, NTT Docomo Ventures, the corporate venturing unit operated by telecommunication firm NTT Group’s mobile network subsidiary, NTT Docomo, identified two challenges within the Japanese CVC industry.

She said: “First, a lack of open innovation culture on the part of large corporations. It is culturally difficult for startups to collaborate with them. I think that because Japanese companies have mainly employed people for life so far and there is little diversity of people within the company, communication with a diverse range of people outside the company has not been developed well.

“Second, by thinking about synergies from a relatively short-term perspective, it is possible to collaborate in the immediate future, but it is not likely to result in innovative business creation or trigger a major societal change a little further down the line.

“This is because corporate top management team often changes in a short time and the policies also change as a result, and there is also a lot of turnover on the CVC side in terms of management and investment teams.

“I believe it is necessary for business companies, startups and CVCs to consider business concepts and stories of social change from a long-term perspective and walk hand-in-hand to create a meaningful social impact.”

Naoki Kamimaeda, UK-based partner and Europe office representative for Global Brain, a Japan-headquartered VC firm that oversees multiple corporate venturing vehicles, pointed out three unique points to the Japanese ecosystem when compared with the US, Europe and other parts of the world.

He said: “First of all, there are not yet so many foreign investors active in Japan, especially in early stages. Therefore, most investment rounds are led by Japanese investors and the syndicate also consists of Japanese investors and corporations. At later stages, we are seeing much more foreign investors recently, though. Hopefully, more foreign investors will invest in Japanese startups and also more in earlier stage deals in 2022.

“Secondly, angels or family offices are less active. There are some very famous angel investors. However, it is not yet common for wealthy people to invest in startups in Japan. Lastly, we have fewer series A and B-focused pure VC funds than in the US, the UK or the EU. Only a handful of VCs have big funds sufficient to lead series A and B. Therefore, syndication is more common and more CVCs are involved in early-stage deals. There are more chances for corporations to be involved in early-stage deals if they wish. I believe this unique environment also leads more corporations to form their CVC funds. We are seeing this trend continue in Japan – covid even has accelerated this trend because of a lack of international travel and investors being a bit conservative and focusing more on local markets.

“Southeast Asia has more similar characteristics with that of Japan. However, Southeast Asia still has more international and global investor bases and more angels.”

Japan ranked 13th most innovative economy in 2021 in the Global Innovation Index compiled by Cornell University’s SC Johnson College of Business, Insead and the World Intellectual Property Organisation. It came after Switzerland, Sweden, the US, the UK, South Korea, the Netherlands, Finland, Singapore, Denmark, Germany, France and China, and was ahead of Hong Kong, Israel, Canada and Iceland.

Notably, the country has some of the top science and technology clusters with Tokyo-Yokohama being named first in the top 100 list, while Osaka-Kobe-Kyoto came sixth. Other Japanese cities – Nagoya (12th), Hamamatsu (83rd) and Kanazawa (84th) – featured the roster.

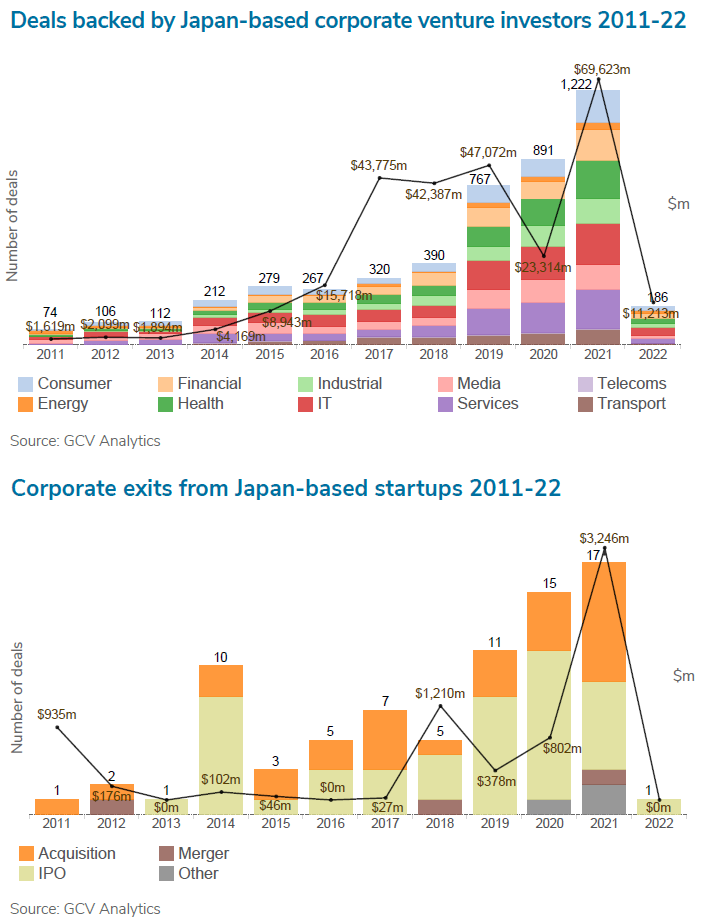

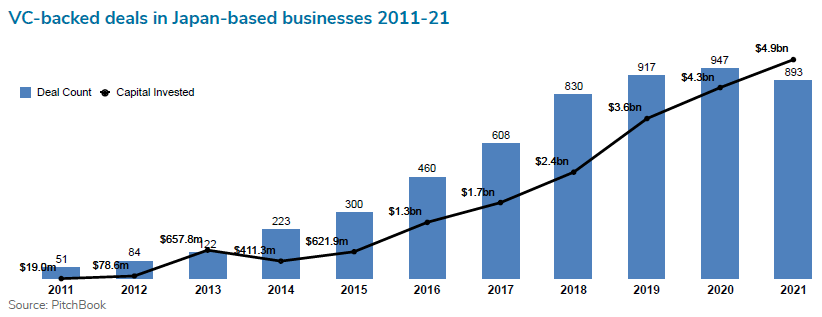

Kazuhiko Chuman, head of KDDI Open Innovation Fund and KDDI Mugen Labo, which were formed by telecommunications firm KDDI, pointed out that in Japan, the total amount of funding raised in 2021 by Japanese startups was ¥780bn (about $6.8bn), representing a year-on-year increase of 46%.

He continued: “The amount of funding per startup is increasing – six startups raised over ¥10bn (approximately $87m) in 2021 which was significant growth.

“The number of startup IPOs in Japan in 2021 was 66, which is the highest number in the last decade. However, we have still seen a few IPO yet in 2022 since the market condition has been declining.

“The sector that has raised the largest amount of funding in 2021 was software-as-a-service (SaaS), followed by financial technology and artificial intelligence. In addition, web3 and biotech sectors are expected to become the next trend of funding in Japan this year.” Chuman also highlighted that nearly 40% of the funding was coming from capital outside of Japan.

NTT Docomo’s Sasahara said: “For the consumers-oriented space, we feel the world is changing rapidly and increasingly requires well-being in both the real and virtual worlds while for businesses, the covid-19 pandemic has created a need for support for advanced efficiency and sustainability initiatives. Sectors include healthcare and medical, mixed reality, fintech, the internet of things, AI and areas related to carbon neutrality.”

Sony’s Tsuchikawa agreed with the observation and said: “When we started Sony Innovation Fund in 2016, we did not expect to invest much in Japan. But as we progressed, we were pleasantly surprised with the quality of the startups here and now have 30% or more invested in Japan. It is a rapidly expanding and very open community.”

Sony Innovation Fund has team members across Europe, India, Israel and the US in addition to its home country, and has made some 120 portfolio companies including local companies like emergency medical support system developer Smart119, know-your-customer technology provider TrustDock and food delivery service Chompy.

Global Brain’s Kamimaeda cited the findings in a report prepared by the Japan Venture Capital Association for the Japanese Cabinet Office’s Innovation Ecosystem Expert Committee in February this year, saying that the amount of startup investment in 2021 was much larger than the year before.

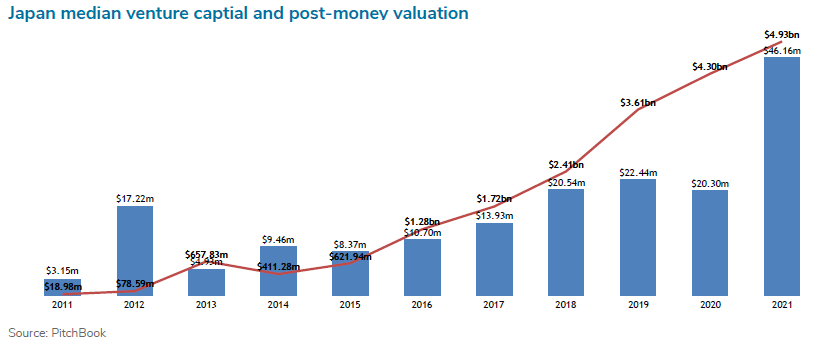

Kamimaeda clarified: “However, the number of startups getting investments decreased between 2020 and 2021. This indicates later-stage companies are securing bigger amounts of funding. In contrast, the number of startup investments is decreasing.

“We can see this kind of trend in other regions like the US and Europe, probably due to covid restricting international travel and investors being more conservative. Also, as in other startup ecosystems like the US and the EU, the size of the fundraising round is increasing and the valuation is also being more expensive.

“We have kept our investment approach the same as pre-covid and during the pandemic, as we still think now is the chance to find and invest in greater companies. We strongly believe the potential of the Japanese startup ecosystem stays huge and the underlined trend of people shifting more towards startups and corporates shifting more towards startup investments has not changed and will continue. We can expect more corporations to establish CVC funds and start collaborating with startups. I must say we need to be more careful on valuations and need to be more selective.”

Chuman said while KDDI Open Innovation Fund shares deal flow with other CVC units, it also co-invests with large enterprises that do not have a dedicated vehicle or venture investment subsidiary. In addition, KDDI’s accelerator scheme, Mugen Labo, aims for business co-creation by combining the ideas and technologies of startups with a wide range of assets from enterprise partners.

“Furthermore, we have partnered with Tokyo University to offer entrepreneurship education for master’s degree since October 2021.”

As Global Brain manages 10 CVC funds alongside its mothership pure VC fund, the firm works with its CVC corporate partners daily, said Kamiameda. In addition to co-managing KDDI Open Innovation Fund, the firm also helps run property developer Mitsui Fudosan’s 31Ventures funds, inkjet printer and electronics producer Seiko Epson subsidiary Epson X Investment, brewery group Kirin Holdings’ vehicle Kirin Health Innovation Fund, Norinchukin Bank unit Norinchukin Innovation Fund, logistics group Yamato Holdings’ Kuroneko Innovation Fund and Sony Financial Ventures, which is part of Sony Financial Holdings, consumer electronics provider Sony’s financial services subsidiary.

Global Brain’s Kamimaeda noted: “We strongly believe collaborating with corporations is a key to stimulate the Japanese startup ecosystem, help startups to grow and bring the ecosystem to the next level. For that purpose, Global Brain has established Alpha Trackers, Japan’s next-generation CVC labs, in late 2018. Alpha Trackers has been attracting and inviting more corporations and has become one of the major CVC consortia in Japan now.

“We also collaborate with other CVC peers, VCs, incubators, accelerators, universities and the government deeply. As collaborating with other players in the ecosystem is a key to growing and strengthening the ecosystem, we actively work with them, mentor their portfolio startups, and co-invest together.

“As one of the largest VCs in Japan, we at Global Brain are committed to the Japanese startup ecosystem. To bring the ecosystem to the next level and to make it more competitive to the world’s top startup ecosystems in other countries, we reckon we need to stimulate and improve the Japanese ecosystem further and incubate more global companies from Japan as well. To realise this vision, we also believe Global Brain needs to become more global to help our startups to go global. Therefore, we have been also actively expanding our footprints in new markets and aiming to become a global top-tier VC. Establishing our European headquarters in the UK in 2019 was one of the steps for us to achieve this goal.”

Sasahara attributes the success of NTT Docomo Ventures over the years to its synergistic investment approach. “Our CVC group has been investing in startups that sought growth opportunities by leveraging Docomo and NTT group companies’ core businesses. We believe this reputation has led to new investment and collaboration opportunities.

“We would like to provide support in the short to medium to long term to the [parent] business units by providing collaborative support to their current businesses of focus, and to the executives by providing input on new signs obtained through investment in and support of startups, so that they can use them as hints for the direction of future businesses.”

“While balancing the objectives of an operating company – business creation – and the objectives of a CVC managing a fund – financial return – I would like to consider how I intend to make society better and more interesting in the end, and draw up a concept, co-create and implement it to the point where it changes the social landscape.

“With this in mind, we have newly established a vision, mission and action guidelines as an organisation, as we did not have them before. Our vision states: ‘With all the talents and enthusiasms necessary to change the world, we get together and unite at our dynamic, global corporate venture capital group.’

“We at NTT Docomo Ventures aim to be a CVC group that gathers the diverse strengths and aspirations of startups from around the world, uniting our strengths and aspirations to continue to change the global landscape.”

“I would like to achieve the vision we set out so that NTT Docomo Ventures become a place where everyone remembers and gathers when they want to change the world. To my peers I tell them, let us work hard together.“

GCV joined JVCA in 2018 to conduct a Japan-focused CVC survey released by the country’s Ministry of Economy, Trade and Industry, comparing local and international perspectives, before teaming up again, along with Japan Research Institute (JRI) and Sony, to co-host the GCV Asia Congress in Tokyo the year after. GCV is partnering JRI, JVCA, Sony, electronics group TDK and its TDK Ventures subsidiary, carmaker Toyota’s Woven Planet unit, internet company Tencent, VC group Mach49, law firm Orrick, among others, to hold a new edition of the conference in November 2022.