Kenya was ranked second among the top three innovation economies in sub-Saharan Africa, ahead of another eastern African nation Tanzania and after South Africa, according to the Global Innovation Index (GII) 2021: Tracking Innovation through the covid-19 crisis, a report produced by the United Nations’ World Intellectual Property Organisation.

The report further noted that Kenya has held the record for overperforming on innovation relative to their level of development for 11 consecutive years, alongside India, Kenya, Moldova and Vietnam.

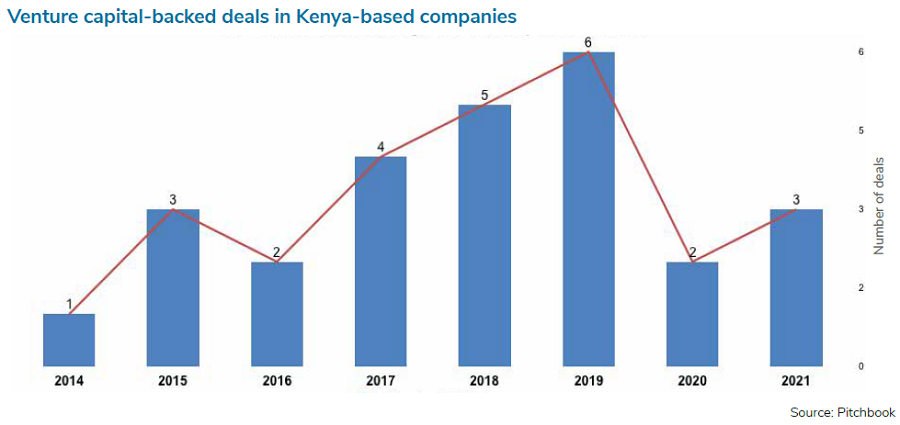

In addition to attracting a considerable number of expats, Kenya also had a $5.80 per capita in venture capital investment last year, representing the highest in Africa, according to The State of Tech in Africa 2021, a report produced by startup accelerator AfricArena and supported by Microsoft.

The report added that there are two main approaches Africa-based entrepreneurs take: the Nigerian way, where startups are incorporated outside of their countries of origin, and the Kenyan counterpart, which involves incorporation and fundraising in their own countries.

Telecommunications groups Vodafone and Safaricom-backed mobile payment service M-Pesa, which was founded in 2007 and is now part of Vodafone, is often credited for helping lift the rural and unbanked segments of the Kenyan population out of poverty. The platform has some 50 million users that send remittances from urban areas or abroad.

Besides financial technology, agriculture technology is also on the rise in the country. In 2020, Kenya hosted large agtech deals such as rounds raised by supply chain analytics software developer Gro Intelligence, perishable food logistics group Twiga Foods and farmers’ services platform Apollo Agriculture.

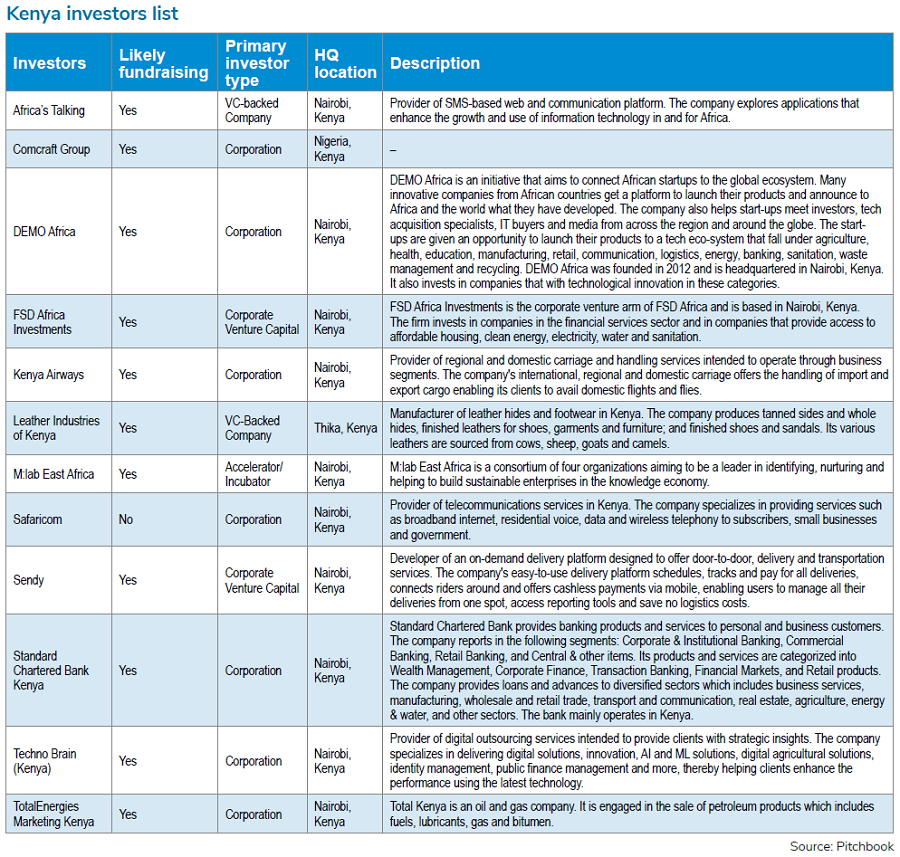

Some notable corporate investors in the Kenyan innovation ecosystem include enterprise software provider Africa’s Talking, conglomerate Comcraft Group, software producer Microsoft-sponsored startup competition Demo Africa and UK government-funded non-profit financial services group FSD Africa subsidiary FSD Africa Investments.

Airline operator Kenya Airways, leather producer Leather Industries of Kenya, communications technology producer Nokia-backed startup incubator scheme M:Lab East Africa and the aforementioned Safaricom are also among the active corporate venturers in the country.

On-demand delivery service Sendy, financial services firm Standard Chartered Bank Kenya, software development and management group Techno Brain and oil and gas supplier TotalEnergies filled out the top CVCs in Kenya, according to PitchBook data.

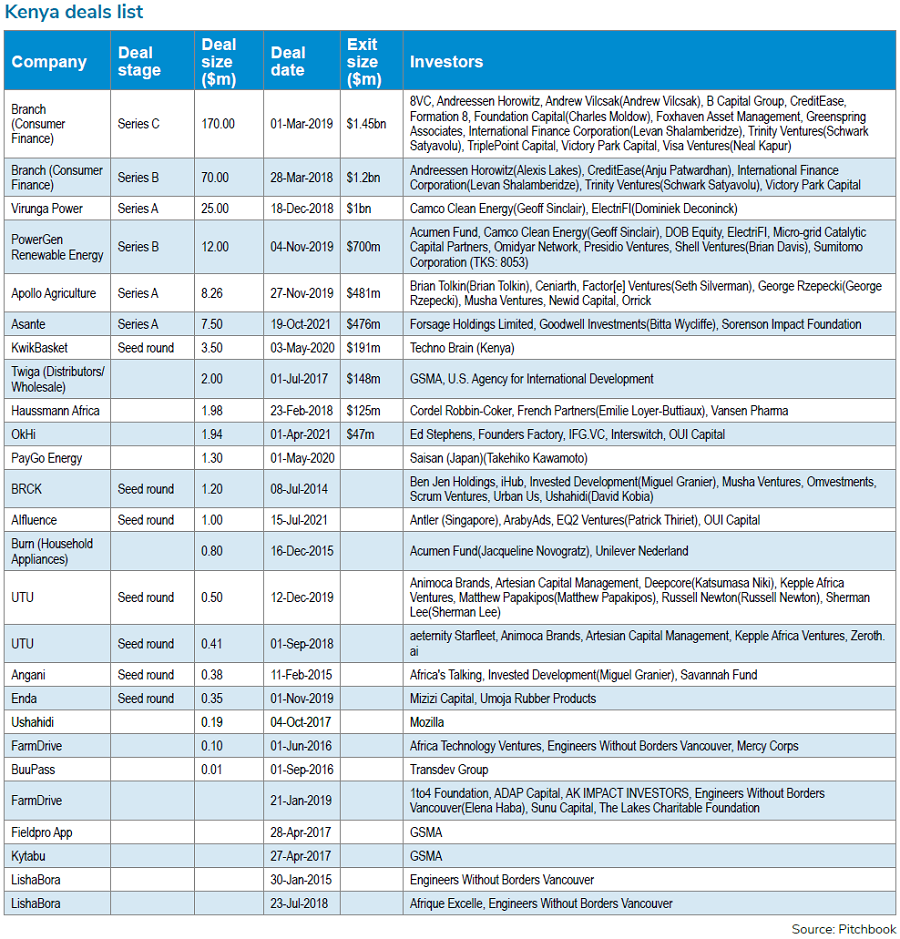

Top deals involving corporate VCs in Kenya include rounds raised by Branch, Virunga Power, PowerGen Renewable Energy, Apollo Agriculture, Asante, KwikBasket, Twiga, Haussmann Africa, OkHi, PayGo Energy, BRCK, AIfluence, Burn, Utu, Angani, Enda, Ushahidi, FarmDrive, BuuPass, Fieldpro App, Kytabu and LishaBora.

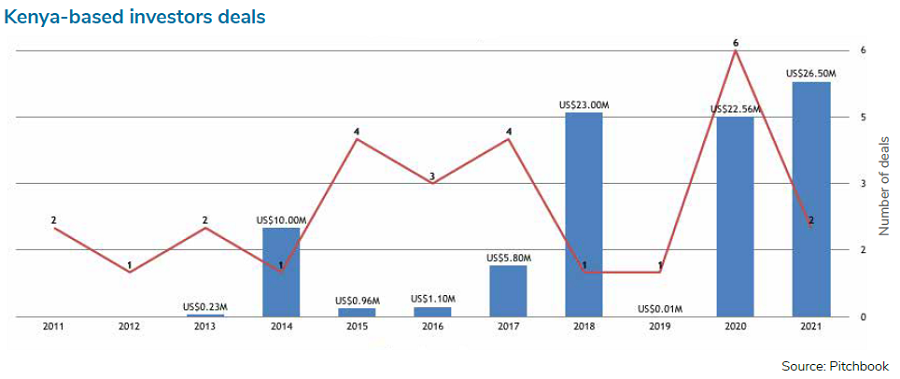

By November this year, PitchBook logged two deals in Kenya that were conducted by corporate venturers, aggregating to $26.5m in deal volume. The deal number has grown from the $22.56m figure recorded last year but across six transactions.

Netherlands-headquartered investment firm Goodwell Investments told the AfricArena report that compared with other African economies such as Nigeria, not only is it more straightforward to set up a business in Kenya, but it is also easier for foreign VC investors to inject their capital there.

The statement further added: “So it is easier to get talent [in Kenya], it is easier to settle here, the government has ensured that foreign investment is not interrupted and capital can flow in the country quite easily – so that is very, very attractive for many people in comparison to Nigeria where the business environment is different. In Nigeria, you will find more local entrepreneurs as opposed to East Africa and that creates a difference in how people allocate capital.

“For example in logistics in Kenya, in comparison to a similar logistics business in Nigeria, you find that Nigerian businesses might have better traction, and have grown in all areas better than the Kenyan business, but a Kenyan business has higher valuation. It has also been driven mostly by American VCs, so they kind of look at this environment from a Silicon Valley perspective.”