In most circumstances, L4 cars do not require human intervention but the driver can still do so, according to SAE International, a global standardisation body.

Currently, most autonomous driving technology in use is either classified as L2 or L2+, under which sensors are used to give a vehicle “environment detection” capabilities to help it monitor other road users and help with parking.

But with about two dozen startups particularly in the US and China fighting for dominance in the technology there is a surge of investment in new mobility, including electric vehicles, autonomous driving, micromobility and space.

In this battle, “capital is the most important powder needed by all car makers,” according to Cao Hua, a partner at private equity firm Unity Asset Management.

Capital buys resources, particularly advanced chips, such as US-listed Nvidia’s Drive Orin SoC chip, which enables continuous upgrades through over-the-air software updates and can process 254 trillion operations per second.

But the heart of autonomous remains its algorithms and software. UK-based Wayve’s AV2.0 technology for example uses a camera-first sensing suite with a deep learning system fed from petabyte-scale driving data provided by Wayve’s partner fleets, including Ocado Group, Asda, and DPD, and hosted in the Azure cloud by one of its investors, Microsoft.

By using machine learning, Wayve wants to use its $200m series B round closed in January to build a more scalable autonomous vehicle (AV) platform applicable to new cities, different use-cases and vehicle types rather than traditional approaches using maps and rules-based control strategies, it said.

Electric vehicle and other mobility tech startups raised $23.4bn in VC funding in the final three months of last year, up 81.9% year-over-year, according to Pitchbook.

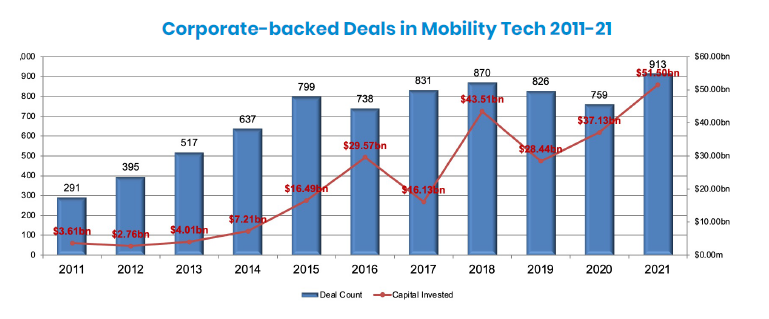

Corporate venture-backed mobility deals in total have more than trebled in volume over the past decade, according to Pitchbook data, reaching 913 deals worth an aggregate $51.5bn last year.

And most of the active CVCs in mobility have come from outside the traditional vehicle makers and tier one suppliers – only one, BMW, is the top 10 investors, according to Pitchbook. BMW last summer raised $300m for its second i Ventures corporate venturing fund, compared to €500m for its first fund in late 2016.

Corporate-backed Deals in Mobility Tech 2011-21

| Investors | Investments in the last 5 years |

| Tencent Investment | 114 |

| Qualcomm Ventures | 73 |

| GV | 70 |

| Salesforce | 61 |

| Intel Capital | 57 |

| Endeavor Catalyst | 56 |

| EIT InnoEnergy | 51 |

| SAP.IO | 47 |

| BMW i Venture | 42 |

| Samsung Venture Investments | 42 |

| Baidu Ventures | 41 |

| Wayra UK | 40 |

| Toyota Ventures | 39 |

| Omidyar Network | 37 |

| Shell Ventures | 35 |

| Ben Franklin Technology Partner Group | 34 |

| Bertelsmann Asia Investments | 32 |

| Legend Star | 30 |

| Softbank Ventures Asia | 30 |

| Lenovo Capital and Incubator Group | 29 |

While the biggest investments in mobility have gone to platform providers, such as Didi, Uber, Gojek and Grab, that have raised billions of dollars the L4 AV providers are raising hundreds of millions or using well-capitalised parents, such as Alphabet with its Waymo autonomous unit, to cover substantial losses.

Beyond the core AV units below, the ecosystem has a thriving supplier network, such as Superpedestrian, a US-based company that tracks vehicles such as bikes and scooters to prevent unsafe driving that raised $125m in equity and debt funding from Sony’s corporate venturing unit and bank Citi’s impact fund, and Algolux, a Canada-based computer vision software company, which in July received $18.4m in its B round from CVCs such as Nikon-SBI Innovation Fund and GM Ventures.

But all are effectively trying to catch US-listed Tesla, which is regarded as the front-runner in smart electric vehicles in China and the US even if it has missed some of its AV expectations for autonomous driving.

Last year, Tesla delivered 321,000 Model 3 and Model Y vehicles with some autonomous capabilities to customers in mainland China, 117% higher than 2020, and nearly one million in all markets. Tesla’s market capitalisation was more than $1tn at the start of this year – higher than practically all car peers put together – before falling back in recent weeks.

Given the level of funding and advances in technology and business models, therefore, it is only a question of time before autonomous vehicles are driving or flying around.

Mini profiles on L4/5 autonomous driving companies

Beyond traditional car parts suppliers, such as Valeo, Denso and Magna, and car makers, like Toyota and Volkswagen, developing AV services are a host of corporate-backed startups and spinouts. Highlights from selected corporate-backed companies:

AImotive

In 2018, AImotive, a Hungary-based autonomous vehicle technology company, raised $38m in its series C round with participation from Cisco Investments, Samsung Catalyst Fund, and Robert Bosch Venture Capital.

With relatively little capital, therefore, AImotive has this year released its automated driving full software stack, aiDrive 3.0, to use neural networks to see how the environment around the vehicle is perceived and interpreted.

Argo AI

Argo AI, a US-based self-driving startup backed by car makers Ford and Volkswagen with more than $3.5bn, had been expected to float last year with a reported valuation expected to top $7bn.

“Our focus right now is on securing a round of private investment which is part of our plan to go public,” Alan Hall, a company spokesman, said in a statement to Bloomberg last July.

While no further investment has been made public, the company was picked by Walmart for the retailer’s first autonomous delivery service. Rival retailer Amazon, however, in 2020 acquired Zoox, the Silicon Valley-based autonomous driving company with an in-house-designed electric L5 passenger-hauler.

Aurora

Aurora Innovation has been part of a rapid acceleration of consolidation in AV companies.

In its first earnings report since the initial public offering (IPO), Aurora this month said it would start selling autonomous truck and robotaxi services next year. Aurora has robotic truck partnerships with Paccar and Volvo, as well as working with Uber and Toyota on robotaxi projects.

Aurora listed on Nasdaq stock exchange in November after completing a reverse merger with special purpose acquisition company Reinvent Technology Partners Y to raise $1.8bn last year.

Aurora acquired the Uber unit and formed its investment partnership with the ride-hailing group in December 2020, while Toyota, Paccar and Volvo are shareholders.

Previously, Toyota had invested $500m in Uber in 2018, as both companies worked on autonomous vehicle development.

In April, Lyft sold its self-driving division, Level 5, to Woven Planet, a subsidiary of Japan-listed car maker Toyota Motor, for $550m. Woven Planet said it would pay $200m up front and $350m over five years.

AutoX

AutoX, a China-based provider of level 4 fully autonomous robotaxis backed by local online retailer Alibaba, opened its production factory in July.

Honda provides its Accord and Inspire vehicles with AutoX’s autonomous vehicle technology for use in road tests on China’s public roads, AutoX said in a statement emailed to Caixin last year.

The company raised tens of millions of dollars in early 2020 from Alibaba and Dongfeng Motor.

Cruise

Cruise, the autonomous vehicle division of US-listed car maker General Motors, this month raised $1.35bn from previous backer SoftBank Vision Fund and became the first driverless robotaxi service to the public to operate in San Francisco, California, according to TechCrunch.

SoftBank had initially invested $900m in Cruise and said the $1.35bn would follow when the service commercialised.

Cruise’s move to open the service to the public follows the departure in December of its CEO, Dan Ammann. Kyle Vogt, who co-founded Cruise, is interim CEO, as well as chief technology officer.

DeepRoute.ai

In December, DeepRoute.ai, a China-based autonomous vehicle startup, offered its production-ready, level 4 system for $10,000. TechCrunch said the price tag was “incredible given the hardware used: five solid-state lidar sensors, eight cameras, a proprietary computing system and an optional millimetre-wave radar”.

In 2019, Zhou Guang founded DeepRoute after he was forced out of his last company, Roadstar.ai. In September, DeepRoute raised $300m in its series B round from a syndicate including online retailer Alibaba and Chinese automaker Geely, among others.

Didi Woya

China-listed ridehailing service provider Didi’s autonomous driving spin-off last summer reportedly raised $300m, two-thirds of which came from car maker GAC Group.

GAC Group split its investment half from its Guangzhou Automobile Group balance sheet and the other $100m from the GAC Capital fund. According to information from Tianyancha, since the spin-off of Didi Woya unit as an independent company in 2019, it has received a total of over $1.1bn.

The year before and Didi Woya raised $500m in a deal led by SoftBank Vision Fund – its first round since a $600m funding from Toyota in July 2019’s separation.

Jidu Automotive

Jidu Automotive, the smart electric vehicle (EV) company majority-controlled by China-listed Baidu, raised about $400m from its two shareholders. As well as Baidu holding 55%, Jidu is owned by carmaker Zhejiang Geely Holding Group.

The latest round followed $300m in March when the smart EV builder was established by the two partners.

In early January, Baidu became the first mainland Chinese company to give a clear time frame to launch a mass production car with L4 automation. A prototype of the new car is expected to be unveiled at the Beijing Auto Show in April, with mass production and delivery to start in 2023.

In addition, Baidu, which has been granted 2,900 patents for intelligent driving, started a fully driverless robotaxi services to the public in Beijing from May. The Apollo Go Robotaxi service was launched in Beijing’s Shougang Park – one of the venues for the 2022 Beijing Winter Olympics – and was transporting visitors at the games.

Baidu’s cars have driven more than 10 million miles according to the company’s third quarter results published in November.

Haomo.ai

China-based autonomous driving startup Haomo.ai in December raised more than $150m in its series A round from a consortium including food delivery group Meituan, chip maker Qualcomm, local steel maker Shougang Group’s Shoucheng.

Founded by Great Wall Motor in 2015, Haomo spun out in 2019 to sell its level two system and develop an L4 self-driving logistics vehicle for Meituan among others.

Mobileye

In December, US-listed chip company Intel said it planned an initial public offering for its autonomous driving unit, Mobileye. A potential IPO could value Mobileye at $50bn, according to a report in the Wall Street Journal.

Intel acquired Israel-based Mobileye back in 2017 for about $15.3bn before buying and integrating its Intel Capital portfolio company, Israel-based Moovit, to offer a fuller suite of transport services.

However, with new CEO, Pat Gelsinger, focused on a $100bn investment in its core chips business, a flotation of Mobileye and driving would reduce capital expenditure in other areas.

Motional

In March 2020, car maker Hyundai and auto parts supplier Aptiv set up a $4bn joint venture, a L4/L5 autonomous vehicle developer called Motional that integrated the resources of NuTonomy.

US-based Motional this year said it would develop driverless cars based on the all-electric Hyundai Ioniq 5, in a written interview with The Korea Economic Daily. As the first step, the company forged a partnership with Uber Technologies last year to complement ones with ride-hailing peers Lyft and Via.

Momenta

In November, China-based autonomous driving startup Momenta closed a $200m top up from local car maker SAIC and a syndicate following $300m from Robert Bosch, General Motors and Toyota and others in September.

The new money took the total raised last year to about $1.2bn, according to Bloomberg.

The first production car built with Momenta’s assisted-driving system, SAIC’s electric Zhiji L7 sedan, is expected to start mass delivery this year, the newswire added.

Cao Xudong, CEO of Momenta, said in an interview with Bloomberg that having customers like GM and Toyota join as investors turned them into strategic partners who would back research and development and business planning.

Founded in 2016 by a team of AI engineers from Microsoft Research Asia, Momenta’s algorithm turns sensory information about a vehicle and its surroundings into actionable information in real time.

Pony.ai

In February 2021, China-based Pony.ai’s first robotaxis rolled off its standard production line.

This followed Pony.ai, also known as Xiaoma Zhixing, setting up its truck division for autonomous commercial vehicles in 2020.

However, the company is likely looking for funding after shelving plans to float in the US through a reverse merger with special purpose acquisition company VectoIQ Acquisition in October, according to Reuters. Pony.ai pulled its plans after regulators said the company might face investigations or sanctions that have been levied against other Chinese tech companies in recent months.

Japan-listed car maker Toyota had provided $400m of Pony.ai’s $462m series B round in February 2020.

Wayve

In January, Wayve, a UK-based autonomous mobility startup, raised $200m in its series B round to develop its artificial intelligence (AI)- led approach to autonomous vehicles (AVs).

These investors included Eclipse Ventures, which led the B round, Microsoft, Virgin, Ocado Group and a prominent list of angel investors that include AI and industrial leaders, such as Sir Richard Branson, Rosemary Leith, Linda Levinson, David Richter, Pieter Abbeel, and Yann LeCun.

The round followed mobility software peer FiveAI’s $41m round in 2020 from investors including Direct Line Insurance.

Uisee Technology

In January, Uisee Technology, a China-based autonomous driving technology startup, raised $154m from government-backed Guokai National Manufacturing Transformation and Upgrade Fund. Uisee said the funding would be used to accelerate the development of its full-stack autonomous driving technology.

Waymo

The operating loss for Alphabet’s Other Bets unit that includes self-driving technology company Waymo and other non-Google ventures, was $5.3bn in its most recent results. Waymo has been struggling to deliver on its promise and in April saw the departure of John Krafcik as CEO, followed a few weeks later by Ger Dwyer, chief financial officer, and chief automotive officer Adam Frost, who first began working for Google’s self-driving car project in 2013 before it spun out as Waymo.

Waymo’s L4 development model has been set back, analysts said. Its efforts to develop L4 with the model of “refitted vehicles-road test data collection-trial operation” hit a bottleneck.

But the team changes brought investors back in. In June, Alphabet led a $2.5bn funding round, following on from $3.2bn raised in early 2020, with hedge fund Tiger Global participating for the first time alongside all existing investors, including auto supplier Magna and car retailer AutoNation, according to the Financial Times.

WeRide

In January last year WeRide, a China-based L4 autonomous driving company, raised $310m from the country’s National Investment Fund and Alliance Ventures, the corporate venturing unit of Renault-Nissan-Mitsubishi.

“Nissan has been a key partner of ours,” said WeRide Founder and CEO Tony Han in a Medium post at the time of its round. “Throughout the past three years, they have been playing a critical role in supporting WeRide’s autonomous driving platform, hence, enabling us to establish a leading fleet of Robotaxis.”

WeRide had raised over $600m in this C round at a $3.3bn valuation, the company said, before raising an undisclosed-size strategic investment from Guangzhou Automobile Group, another of its partners on robotaxis.

WeRide, which has backed other startups, such as On Time, said last month its vehicles had covered more than 6.2 million miles on public roads, mostly in the Chinese city of Guangzhou and in San Jose in the US, and a quarter of which using fully driverless mode.

Chinese with US listings

The stocks of US-listed Chinese electric vehicle makers Nio, Li Auto, and Xpeng have fared well since the start of the year on solid sales.

Xpeng Motors was one of three China-based automakers to back Zvision Technologies, a local lidar sensors maker for self-driving cars, in January. State-owned automaker Dongfeng Motor, Shang Qi Capital, a private equity firm owned by Chinese automaker SAIC, and existing backer Intel Capital, US-listed chip maker Intel’s corporate venturing unit, also joined Zvision’s C round.

In September, Xpeng began delivering the P5, which it said could distinguish objects within a range of up to 150 metres and can run autonomously under a driver’s supervision on Chinese roads, the South China Morning Post reported.

XPeng’s Huitian division has made its fifth generation flying car prototype with autonomous capabilities with a foldable one planned for the sixth generation.

Li Auto has the one electric vehicle but last summer said it was investing heavily in L4 autonomous driving.

“Starting in 2022, all of our new models will come standard with the necessary hardware compatible with self-developed L4 autonomous driving, and we will continue to optimize our autonomous driving solutions using our self-developed full-stack software development capabilities,” the company said.

In 2020, Nio relaunched its in-house Level 4 self-driving technology research and development project and was planning to develop its own AV chips through a hardware unit, dubbed “Smart HW” as well as a partnership with Intel’s Mobileye.

Meanwhile other Chinese companies caught in the crosshairs of regulatory battles between the US and China have explored other options.

This month, Volkswagen was reportedly in talks with Huawei to acquire the latter’s nascent autonomous driving unit for billions of euros, Germany’s Manager Magazin said.

Space lifts off for investors

A solar storm might have wiped out most of Elon Musk’s Starlink low earth orbit satellite system this month, but it has yet to take the shine off investor appetite for similar space-focused startups.

Last month, the European Commission, European Investment Bank and European Investment Fund said they were committing at least €1bn ($1.1bn) over five years to Cassini, a early-stage fund for European space companies.

“European space entrepreneurs feel that there is a lack of private financing sources. They, therefore, tend to keep an eye on private capital outside of the EU [European Union], especially the United States,” Kris Peeters, vice-president of the EIB, said during a speech at the 14th European Space Conference where he and other officials announced the fund.

Guillaume de La Brosse, head of the innovations, startups and economics unit at the European Commission directorate responsible for space, said the European Investment Fund would partner with venture capital funds in Europe for Cassini.

Frank Salzgeber, head of innovation and ventures office at the European Space Agency, said it had been supporting startups with a special program for 16 years and hence welcomed the new fund.

There has been increased funding available to startups from the continent. ICeye, a Finland-based satellite imagery specialist, raised $136m from a consortium led by UK-listed fund Seraphim Space, and including the UK’s National Security Strategic Investment Fund and customer BAE Systems.

ICeye uses a special type of imagery, called synthetic aperture radar (or SAR), to capture images of the Earth’s surface at night and through clouds.

The company has deployed 16 satellites in orbit and plans to use the new funds to help launch as many as 10 additional ones this year.

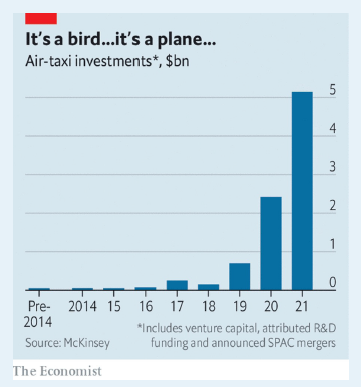

Air taxis take off

Japan-listed car maker Toyota has participated in at least 20 corporate venturing deals in mobility in the past few years and invested billions of dollars in leading autonomous driving and services providers, such as Uber, Momenta, Pony.ai and Didi Woya, and acquiring Lyft’s unit for Woven Planet.

However, one of its largest lead rounds was a $590m series C for electric aircraft maker Joby Aviation, which recently completed a reverse merger with a listed special purpose acquisition company (SPAC).

Electric vertical take-off and landing (evtol) aircraft are under development at 200 projects around the world, attracting $5.1bn in investment last year, according to management consultancy McKinsey.

Joby alone has raised $2bn, including $400m from Toyota and more money from ridehailing service Uber and plane operator JetBlue.

Most of these evtols are, like Joby, based on multiple drone-like rotors combining to provide lift and thrust. Some, however, are like Regent, a US-based startup making electric seagliders, having raised $18m from Mesa Air Group among others.

But to really take off requires a more efficient battery. Hence the excitement after researchers in Japan revealed a new battery technology that could offer double the energy density of the world’s leading battery found in car maker Tesla’s Model 3.

And, just like in the film Blade Runner 2049, to work will probably require the evtols to operate autonomously.

Laurie Garrow, a professor at the Georgia Institute of Technology, told the IEEE Spectrum newsletter: “For the large-scale vision, autonomy will be critical. In order to get to the vision that people have, where this is a ubiquitous mode of transportation with a high market share, the only way to get that is by… eliminating the pilot.

“We are going to have to get the consumer used to thinking about flying in a small aircraft without a pilot on board. I have reservations about the general public’s willingness to accept that vision, especially early on.”

EHang, a China-based maker of evtols carrying two passengers and operated autonomously, is working with the local regulator on a test programme that has involved more than 20,000 trial flights.

Joby Aviation hopes next year to become the first to obtain type certification from the US regulator and is making a dozen or more aircraft at a new manufacturing plant in Marina, California.

Joby’s peer, Archer Aviation, backed by United Airlines, plans a commercial 14

ride-sharing service also using a four-passengers-plus-pilot design, to start the following year in 2024. This is a similar timescale to Volocopter, a Germany-based firm backed by Intel Capital, which is testing an evtol with autonomous capabilities.

But the incumbent aircraft makers are fighting back. Boeing has just invested $450m in Wisk Aero in a joint venture with Kittyhawk so it, too, can take off in the autonomous, evtol space, while Brazil-based Embraer’s spinoff, Eve Urban Air Mobility, was valued at $2.4bn in its reverse merger with listed SPAC (Zanite) in December.

Eve was the first company to go public from EmbraerX, the Brazilian company’s business incubator.

Evtols might have lift-off in funding and pilots completed but whether all the projects can stay afloat before passengers and cargo are allowed to be carried and successful business models to keep them going are found remains less certain.