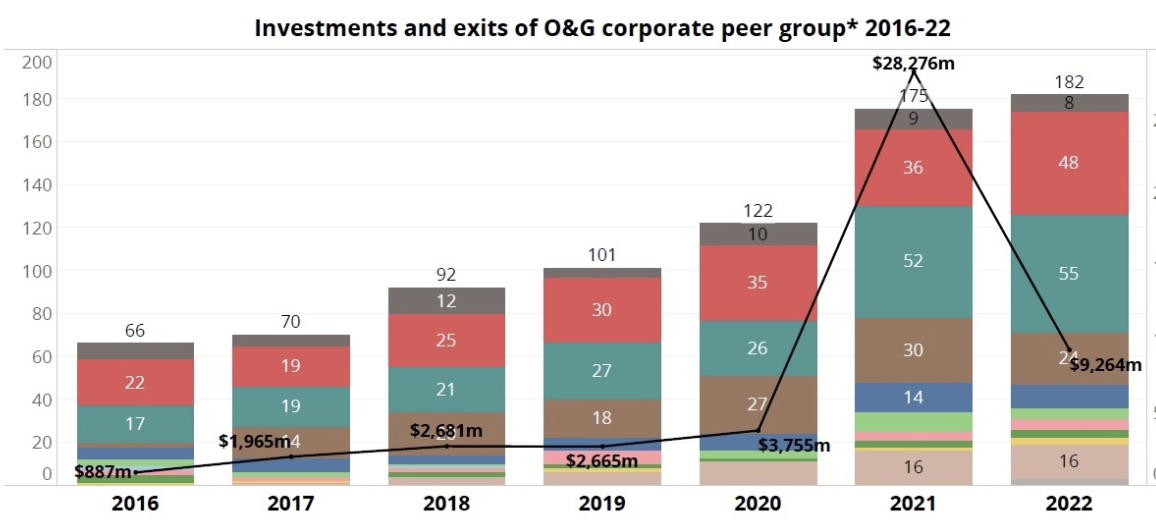

Oil and gas corporate venturers backed 182 startup rounds last year, up from 175 in 2021. However, the total estimated dollar value of those deals stood at $9.26bn, a fraction of the estimated $28.28bn bumper deal value of 2021, when a flood of liquidity and accommodative monetary policy elevated valuations, amid buoyant public equity and M&A markets.

We only saw a few exits, reflecting a lack of appetite and overall bearishness in public equity and M&A markets.

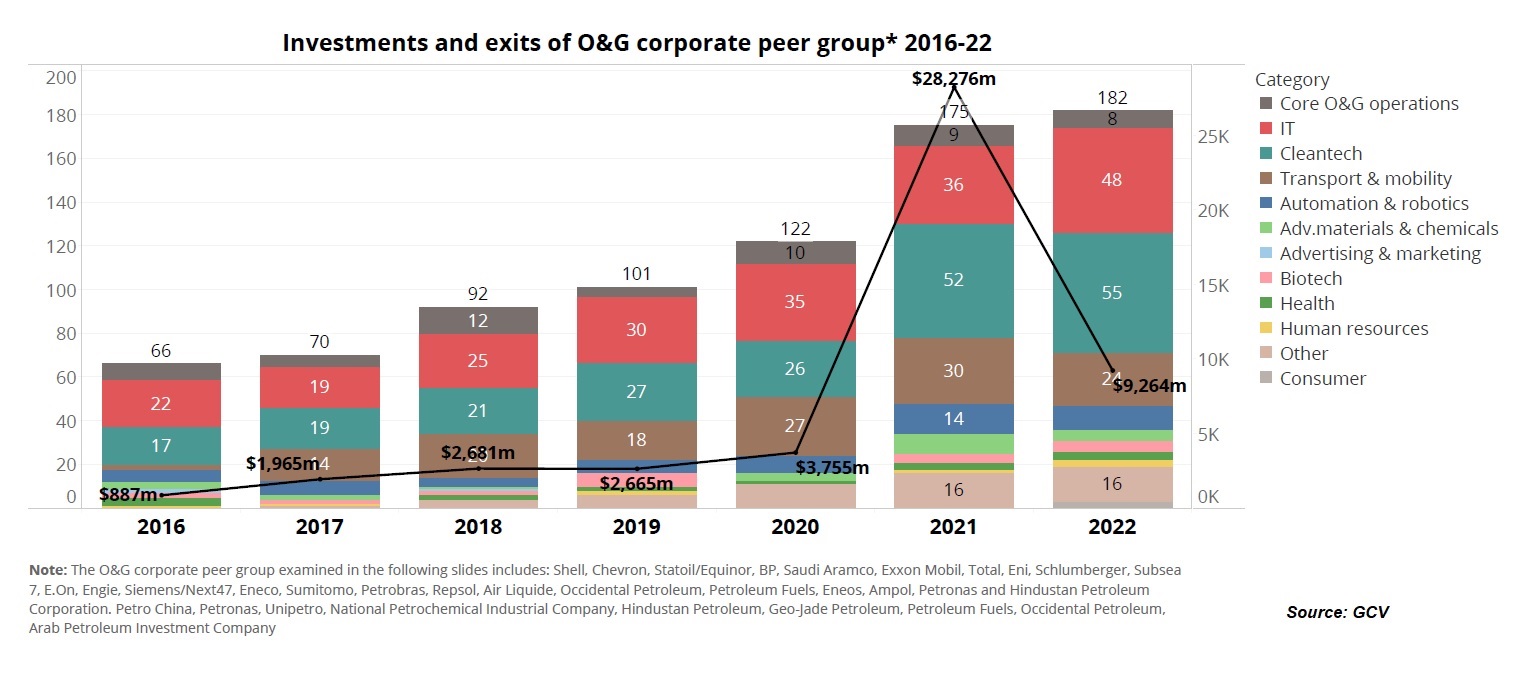

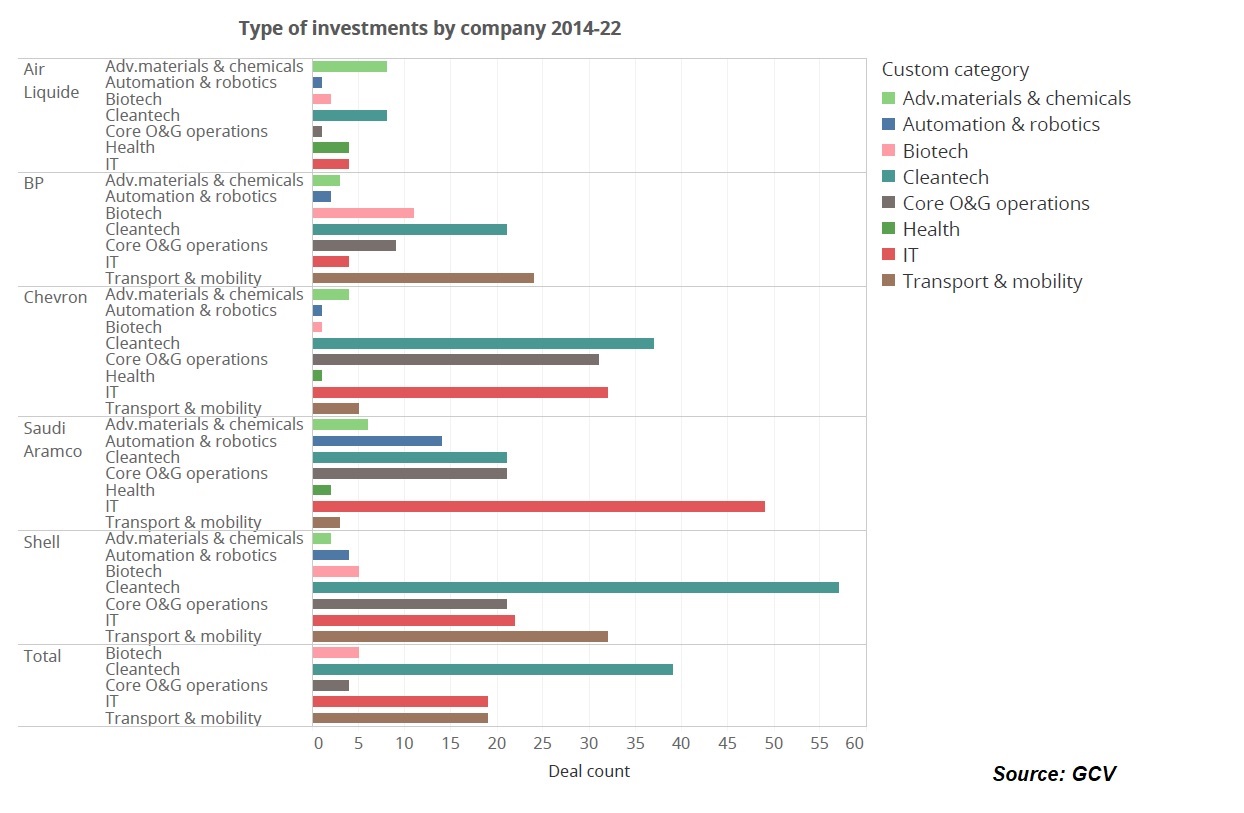

On sector-by-sector basis, the number of deals in cleantech and IT increased in 2022 but fell in areas like core oil and gas operations as well as transport and mobility.

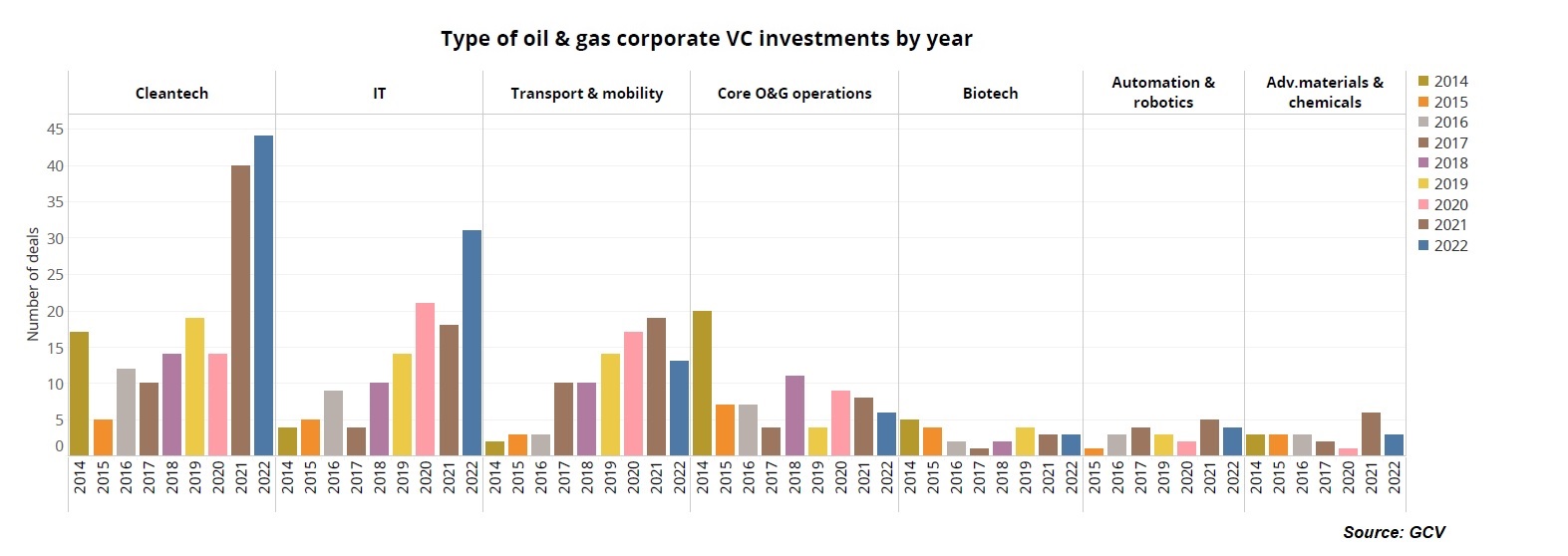

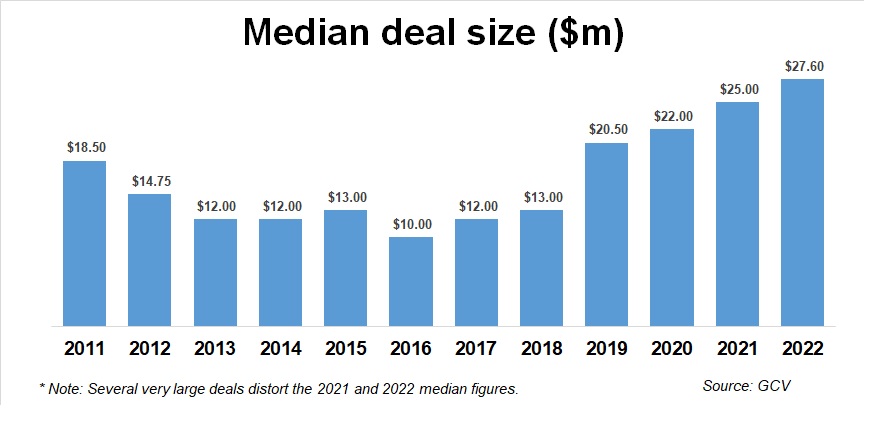

The median size of deals oil and gas (O&G) corporate venturing peers participated, amounted to $27.60m in 2022, slightly higher than in 2021 ($25.00m). Both of these figures have been distorted by the presence of some very large deals in both 2021 and 2022. Both represent a surge from previous years, which implies that valuations in areas of investment interest have been generally hot.

Shell and Chevron have been taking the lead in cleantech investments since 2014. Saudi Aramco and Chevron lead on investments in IT technologies, whereas Total, Shell and BP have had most investments in transport and mobility startups.

Over the years we have consistently observed the focus of O&G corporate venture investors shifting to non-core areas, primarily into IT and cleantech, as well as transport and mobility.

Such non-core businesses possess the most disruptive potential to the core of oil and gas companies. Media, governments and society overall reinforce the notion of the necessity and inevitability of a low-carbon world and, ultimately, the complete phaseout of fossil fuels in the future.

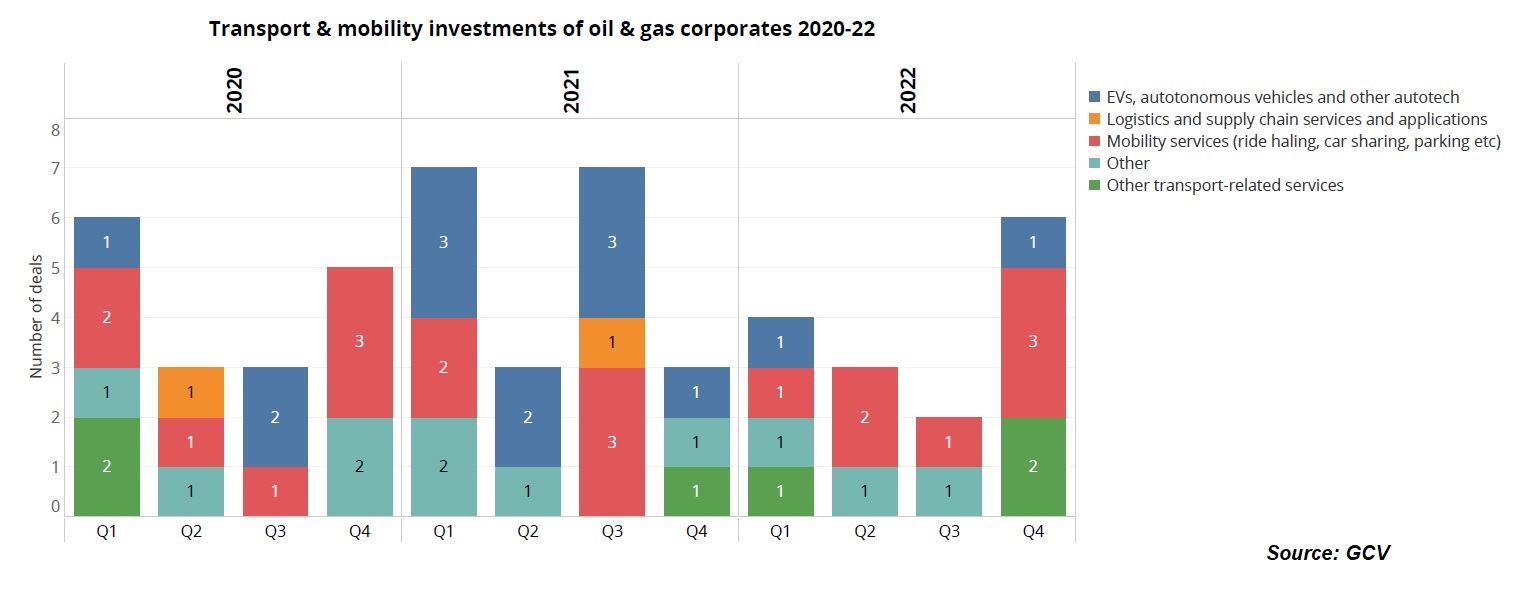

The increasing adoption of electric vehicles may affect a considerable part of the customer base of O&G companies, though how quickly or slowly still remains a matter of debate. There has also been a growing digitisation of industrial activities, which exerts a tangible impact on production and efficiency.

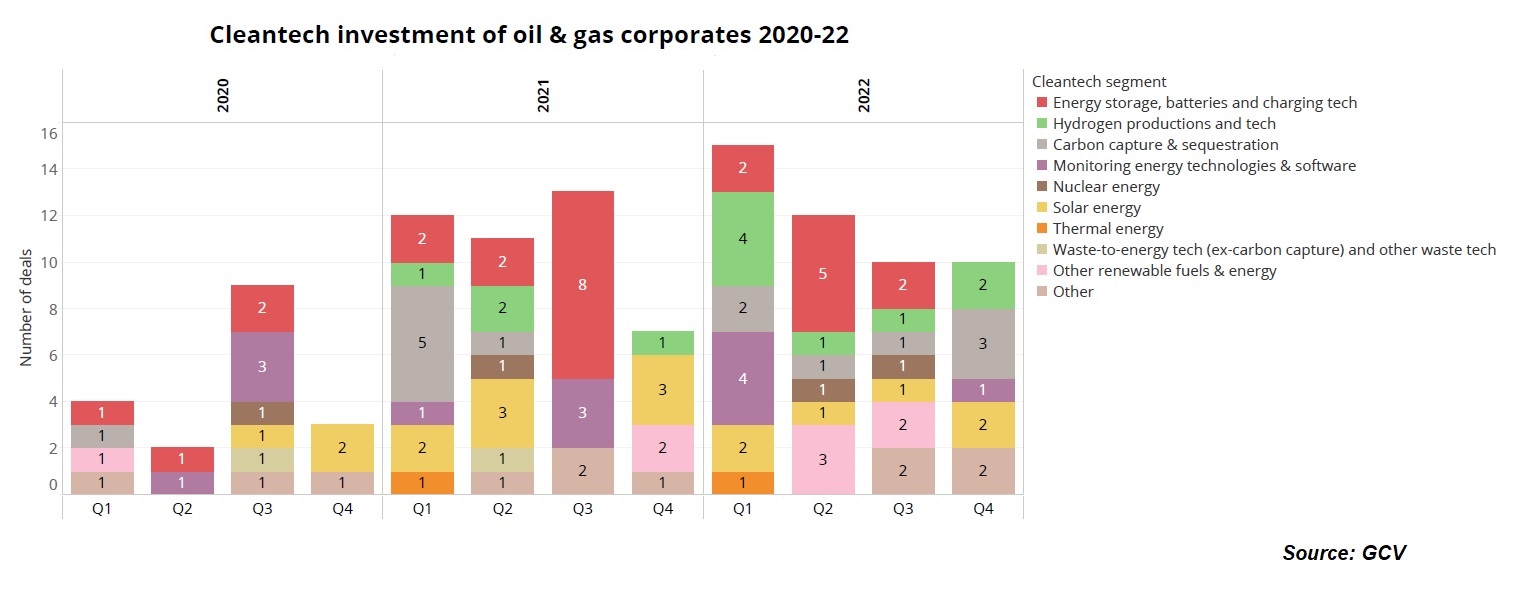

Energy storage powers on

Looking more closely at cleantech, energy storage, carbon capture, monitoring energy tech and software as well as hydrogen-related technologies were among of the most popular investments in 2022.

In the mobility sector, automotive technology (especially related to electric vehicles), and various mobility-related services were the most popular investments in 2022.

Commodity prices still wielding power

The oil and gas sector has increased spending fairly steadily, despite the wild swings in commodity prices over the past few years.

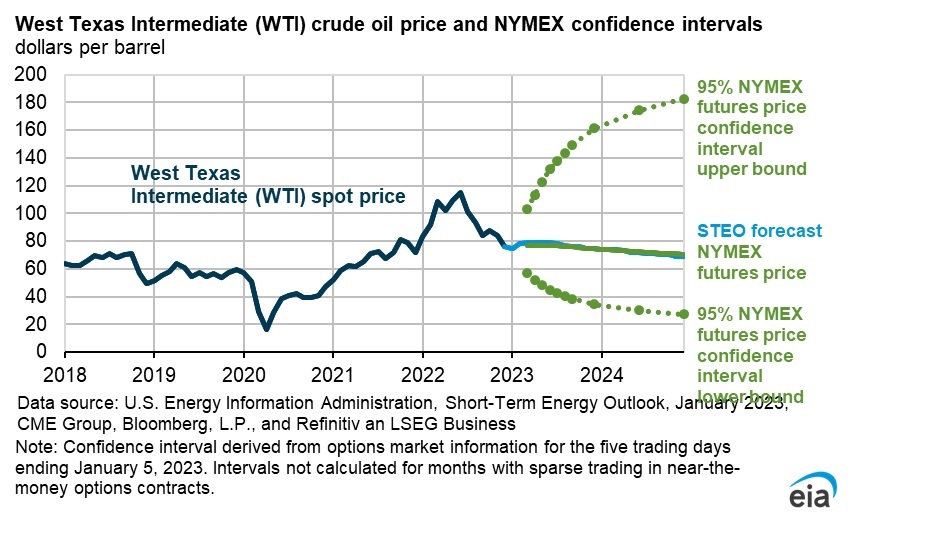

West Texas Intermediate prices have gone from being in negative territory in April 2020 to a high of $125-130 a barrel in 2022, ending the year at around $76-$77 a barrel.

Given the possibility of a recession this year, a correction or more volatility may be on the cards for crude prices. If futures contracts are to be taken as guidance and “wisdom of the crowd”, then markets are largely expecting the WTI price to average around its current levels or somewhere near throughout 2023, as shown on the chart below. The confidence intervals around it, however, are much wider, given the wild swings to which crude has been susceptible in the past.

The latest US Energy Information Agency’s Short Term Energy Outlook report (from early January 2023) expects the WTI benchmark to average around $70-$71 per barrel during this year. The authors of the report justify this forecast on grounds of build-up in global oil inventories “putting downward pressure on crude oil prices.”

The report also forecasts that wholesale gasoline prices will decline by 29% in 2023 and subsequently a further 14% in 2024, driving retail prices to average around $3.30 per gallon (gal) in 2023 and $3.10/gal in 2024. This prediction is based on an expectation of a fall in refining margins. If this should materialise, it would ease some ongoing inflationary pressures.

Optimism for Europe´s energy crisis?

The other important commodity is natural gas, and the provision of this in Europe has been disrupted by Russia’s war on Ukraine. A so far mild winter, however, has helped ease pressure on natural gas prices.

Military conflict, the closure of the Northstream pipeline and the overall weaponisation of gas supplies have forced the EU to look for solutions. It hastened to fill gas storage facilities that, according to Reuters were 91% filled by the beginning of October 2022, having reached a November target of 80% well ahead of time.

The EIA´s Short Term Energy Outlook expects natural gas prices that have seen pullback at the end of 2022 to rise back “above $5.00/MMBtu in late-January and stay above that in February.” This prediction has much to do with cooler temperatures and, consequently, an increasing demand for liquefied natural gas (LNG) exports. The report also notes that “extreme weather events can cause price spikes and volatility.”

Increased imports of LNG into Europe have helped it replenish reserves throughout last year. Additionally, higher nuclear power generation in France has also helped with electricity supply across the continent.

Recent sanctions and price caps on Russian products, designed to thwart the country’s war machine, appear to be having an economic impact on Russia . According to the Helsinki-based Centre for Research on Energy and Clean Air recent report, the price cap on Russian oil costs the Kremlin €160m ($172m) in losses per day. These losses, according to the report, could increase considerably if further sanctions are to be implemented. It is, however, unclear that any resolution of the war is close yet.