In the Seattle suburbs in the US state of Washington, the team at nuclear fusion startup Zap Energy are on the cusp of what their VP of product calls a “Kitty Hawk moment”. Referring to the town of Kitty Hawk, in North Carolina, where the Wright brothers made history with their first powered aeroplane flight in 1903, the company is close to making its own breakthrough: getting more energy out of its fusion reaction chamber than it puts in.

The concept of fusion energy — creating a huge burst of energy by combining two atoms into a heavier one — has been around since the 1950s. Fusion held a promise of abundant, clean energy with less of the nuclear radiation risk that accompanies nuclear fission, which is currently used in power plants.

But it is only in the past few years that the technology is finally maturing to the point where scientists can say that soon – 2030s is a commonly cited timeframe – fusion energy can be turned into electricity for the grid.

Recent scientific breakthroughs include the success of researchers at Lawrence Livermore National Laboratory’s National Ignition Facility in the US creating a self-sustaining nuclear fusion reaction that kept burning rather than fizzling out.

Corporate investors are taking notice. Oil major Chevron is notable for its recent large investments in fusion energy startups. Chevron Technology Ventures, the oil company’s corporate venturing arm, invested in Zap Energy in 2020 for an undisclosed sum, the first investment made by an oil major in a fusion energy company.

Chevron cemented its commitment to fusion energy with its most recent investment in US startup TAE Technologies in July 2022. It invested alongside Google and Sumitomo Corporation of Japan in a $250m fundraising round for the latest iteration of TAE’s California fusion reactor.

Chevron is not the only investor committing capital. Private fusion companies have raised at least $2.8bn in the past year, bringing total private sector investment to $4.8bn, according to a recent report by the Fusion Industry Association, a trade body. This is a 139% funding increase since 2021.

Spoilt for choice

What makes the investment landscape compelling for corporates is the variety of fusion energy startups globally, which all have different approaches to developing the technology. The dozen or so corporate-backed startups, based in the US, China, UK and Japan, are pursuing their own unique paths towards commercialisation.

“It is a nice way to de-risk the chance of success because there is a portfolio of companies,” says Ryan Umstattd, vice president of product for Zap Energy. “We are starting to see that strategic investors are thinking that one fusion investment may not be enough. They might want to diversify and make a few fusion investments. That is a positive sign for the industry as a whole.”

Zap Energy, which includes Shell as a corporate investor, was launched by two University of Washington professors, Uri Shumlak and Brian Nelson, and entrepreneur Benj Conway, in 2018. The team plan to have a pilot nuclear fusion plant up and running by the early 2030s.

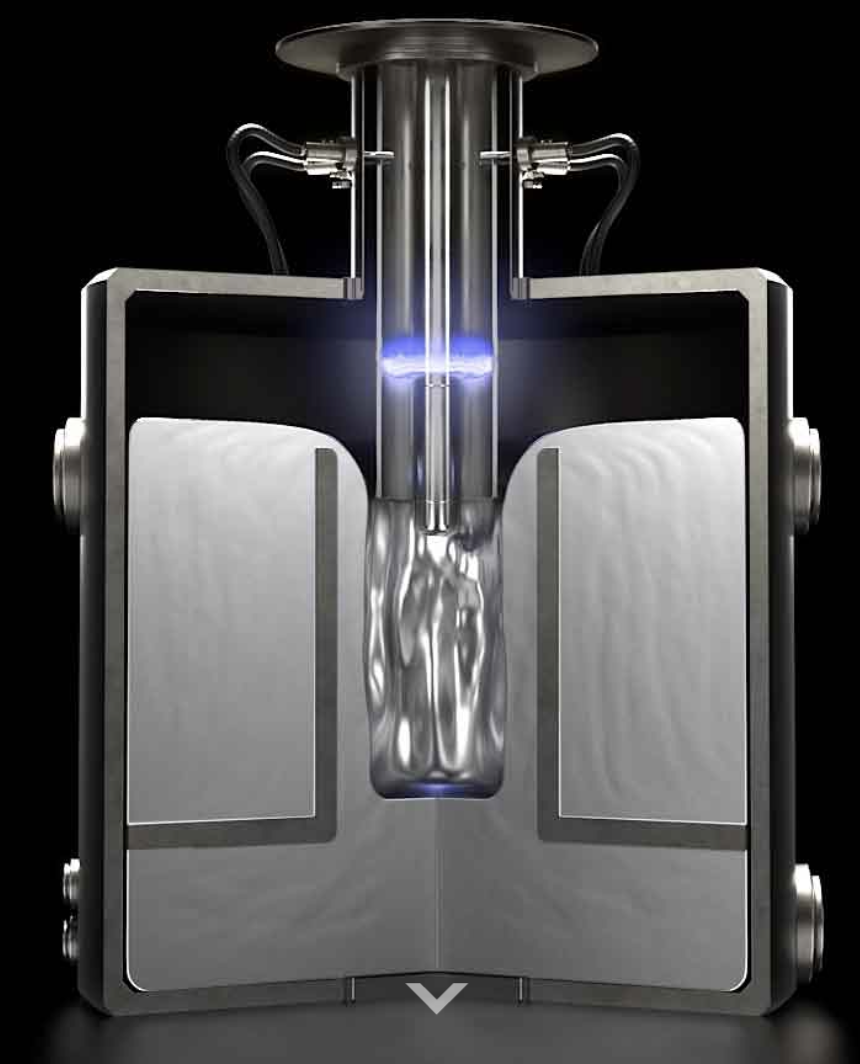

Zap Energy differentiates itself from other startups through its so-called z-pinch technology. Most other startups use large magnets or large lasers to confine and heat plasma – a hot, charged gas where nuclear fusion reactions take place. The z-pinch sends a large electrical current through plasma. The current generates a magnetic field that compresses and heats the gas. The energy from this reaction is what will eventually generate electricity. The company hopes to achieve breakeven – when it generates more electricity than it puts in – by 2023, says Umstattd.

The radiation issue

The process is carbon free, but it does produce low levels of radioactive waste. This comes from tritium, a hydrogen isotope, which is produced inside the fusion chamber. The radioactive waste takes months or years to decay compared with centuries that it takes for waste to decay from traditional nuclear fission plants.

The production of radioactive waste contrasts with TAE Technologies’ fusion process – the other technology Chevron recently invested in – which fuses a hydrogen proton with boron, which is not radioactive.

Despite the concept of nuclear fusion originating 70 years ago, it is only recently that advances in electronics – the capacitors, switches and semiconductors that provide energy to plasma – and advances in super-computing, which have made progress towards commercialisation possible.

Artificial intelligence and machine learning, for example, have allowed physicists to assess large amounts of data needed to understand how plasma should perform for fusion reactions to take place.

Zap Energy is targeting 50MW of energy output from each of its power plant modules, which could serve about 30,000 households. This is modest compared with traditional nuclear fission plants, which typically produce 1GW. The company’s small, compact modules would be a couple of metres square and are designed to be installed in small groups of three and four. They are ideal replacements for retiring coal or natural gas plants, says Umstattd.

They are also suitable for areas that have few fuel sources. “They could be used in regions where there are high population densities and scarce land resources. And remote applications where you don’t want to build large transmission infrastructure,” he says.

Zap Energy’s corporate investors are not yet actively involved in its development, says Umstattd. “We are early stage for them. They will want to see further progress before they engage more directly,” he says, adding that this strategy is “wise and helpful, because at this stage we need to de-risk our technology before we need corporate strategic advice on how to get into the energy markets.”

The drive to meet carbon reduction goals is a force that will continue to propel investments in low-carbon technologies like fusion energy. A Chevron spokesperson said the company sees fusion energy as a “promising low-carbon future heat and energy source”.

Corporates’ drive to meet climate goals has motivated startups to research their own technologies and bypass the ITER project, a collaboration of 35 countries that are building the world’s largest tokamak, a 500MW magnetic fusion device designed to prove the feasibility of fusion as a large-scale and carbon-free source of energy.

The ITER project, based in southern France, has been beset by delays because of technical challenges and the Covid-19 pandemic. The machine is scheduled to be powered on for the first time in December 2025, following decades of planning.

The delays have motivated private companies to launch their own fusion technologies to speed up commercialisation. One such company is Helical Fusion, a Japanese startup launched in 2021. The founders were motivated to start their own company, following 25 years of fusion study, after seeing several startups launching around the world.

Helical Fusion’s initial investors include Japanese conglomerate Sony and venture capital firm Plug and Play Ventures. It is seeking to raise between $3m and $4m in a second funding round in December this year. It hopes to attract overseas investors this time. “Many investors in Japan hesitate to invest much money in this area because fusion energy is still in the development stage,” says Takaya Taguchi, co-founder and CEO. “But US and European investors are starting to put a lot of money into this area.”

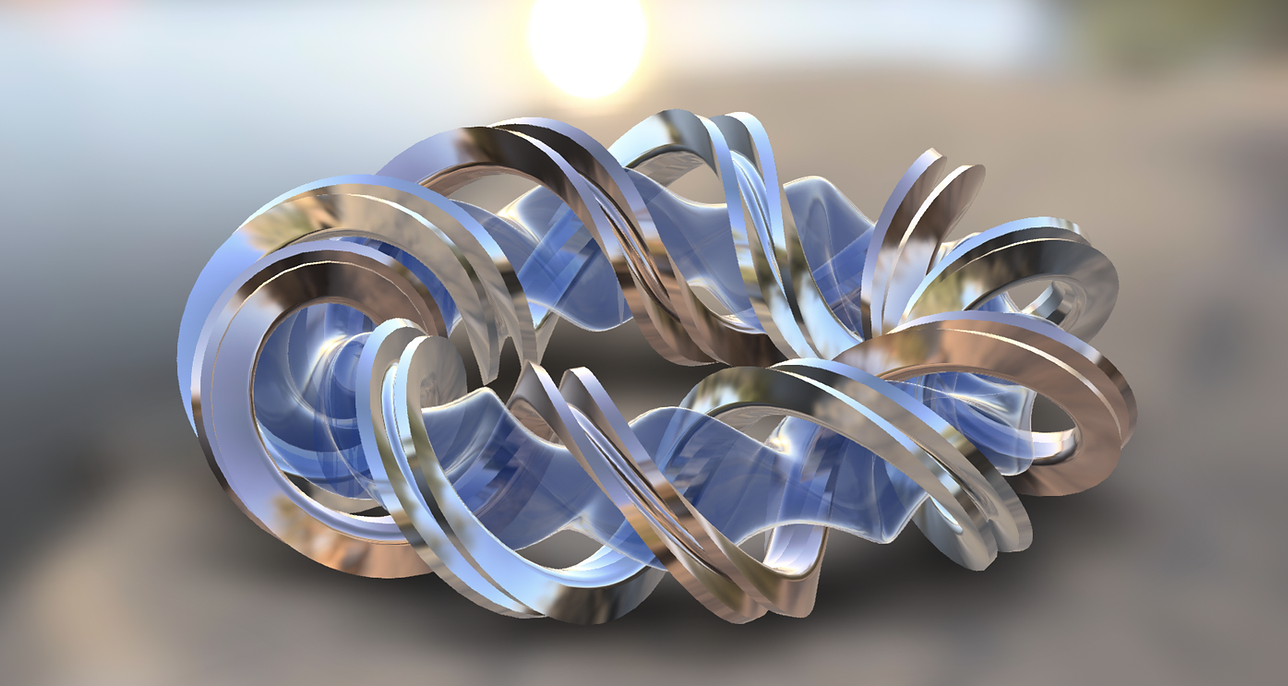

The startup is unique among its peers in that it researches helical reactors rather than the more traditional tokamaks. The main difference is that helical fusion reactors maintain the high temperature of plasma through external magnetic coils, whereas an electrical current as well as magnetic coils maintain high temperatures in tokamaks.

Helical fusion is more suitable for long-term operation, says Junichi Miyazawa, co-founder and president of Helical Fusion. “In helical devices, we don’t need current to sustain high-temperature plasmas. In future fusion reactors, we need to operate high-temperature plasma for one year. This is possible with a helical device,” says Miyazawa.

The company is seeking to build a commercial helical fusion reactor that would generate 100MW by 2040. It is a bit later than other startups to begin energy production, admits Nagato Yanagi, co-founder and board member. “We are being cautious about precision. We want to take a step-by-step approach,” he says.

Public aversion to nuclear reactors in Japan has grown since the Fukushima nuclear disaster in 2011, when an earthquake triggered a tsunami that damaged a nuclear power plant and led to radioactive contamination. For this reason, the Helical Fusion team has come up with a novel idea of siting its fusion reactors on land as well as on ships. The ships would be connected to land using super conducting DC power cables, which could also transport liquid hydrogen. “There are very difficult conditions for having nuclear power plants in Japan. There are lots of regulations and people are generally against them,” says Yanagi.

Fiction turned reality

For a technology once considered more like science fiction than reality, nuclear fusion looks increasingly part of the future carbon-free energy mix. Helical Fusion’s team point to recent developments in high-temperature superconductors and plasma physics, which have only emerged in the past decade, as drivers of progress towards nuclear fusion as a viable energy source.

With these advances, energy companies appear increasingly willing to invest in the sector. Says Zap Energy’s Umstattd: “Part of this is driven by progress they see, as well as the birth of the fusion industry with the couple of dozen startups that are working on their own approach.”