It was after his grandfather died of multi-organ failure, five days after being admitted to hospital for a heart attack, that Samyakh Tukra, a PhD student at Imperial College London, started wondering if there was anything he could do to improve outcomes in intensive care units (ICUs).

“There are more than 85 million patients admitted to the ICU annually for potential organ failure, yet only up to 50% of them survive,” Tukra told ConceptionX, an accelerator for PhD students wanting to set up a deeptech startup in the UK. “It was no longer just about my grandad.”

As Tukra started researching how clinical decisions in ICUs happen, he realised that doctors have to take into account multiple sets of data from different sources, both structured – such as live vitals from patient bedside monitors – and unstructured – such as patient notes, radiology reports and more.

Soon after, Tukra launched Third Eye Intelligence, an artificial intelligence (AI)-powered software platform that helps clinicians intervene early thanks to an automatic machine learning algorithm capable of processing both structured and unstructured data.

The tool can predict the onset of organ failure 48 hours in advance, with 91% accuracy. It also reduces false positives, improving alarm fatigue for clinicians and freeing up resources in the ICU.

Precision treatment

This is the power and promise of precision medicine, which data provider Pitchbook describes as “encompassing individualised treatments customised to a patient’s genes, environment and lifestyle.

“It uses complex algorithms to analyse an individual’s health and wellness profile, synthesise the various data points and transform datasets into personalised health plans. To recognise patterns that could help craft effective treatments, precision medicine can be derived only via computational techniques, given the complexity of analysing a person’s entire genome, metabolic profile, microbiome composition, food intake, exercise schedule, sleep regimen and so on.”

Kaia Colban, an analyst in emerging technology at Pitchbook, said in its outlook report at the start of the year: “Personalised medicine startups will receive a record level of VC investment in 2022.

“While precision medicine has been a talking point for several years now, gaps in technology and inefficiencies in harnessing big data have prevented it from becoming a reality. However, a confluence of technologies, including sensors, remote patient monitoring devices, the internet of things, electronic health records, genetic databases, ML [machine learning] and cloud computing is helping advance the state of precision medicine applications. While personalised medicine may yet take several years to become fully commercialised, we expect VC interest to ramp up in 2022 due to strong market drivers and the potential for a large addressable market.

“Caveat: Technical, ethical and legal concerns may delay the uptake of precision medicine, which requires AI- and ML-based big data platforms to transform data into actionable insights.”

The AI revolution

Venture capitalist Kai-Fu Lee, founder of China-based Sinovation, in a guest comment for TechCrunch as part of his AI 2041: Ten Visions For Our Future book said: “The next healthcare revolution will have AI at its centre.”

He added: “The global pandemic has heightened our understanding and sense of importance of our own health and the fragility of healthcare systems around the world. We have all come to realise how archaic many of our health processes are and that, if we really want to, we can move at lightning speed. This is already leading to a massive acceleration in both the investment and application of artificial intelligence in the health and medical ecosystems.”

The healthcare sector is seeing massive digitisation, which, says Lee: “will redefine healthcare as a data-driven industry and, when that happens, it will leverage the power of AI – its ability to continuously improve with more data.

“When there is enough data, AI can do a much more accurate job of diagnosis and treatment than human doctors by absorbing and checking billions of cases and outcomes. AI can take into account everyone’s data to personalise treatment accordingly, or keep up with a massive number of new drugs, treatments and studies.”

One big area of healthcare technology under rapid change is medical imaging, which is using AI and digitalisation to speed up diagnosis and improve accuracy rates. This is attracting significant CVC investment, including by Roche, Canon, Philips, GSK and so changing the landscape of early and more accurate diagnosis of disease, according to Karen Spink at Innovate UK.

Digital connectivity and AI are enabling remote diagnosis and monitoring, such as the pillcam that is proving an alternative to endoscopies and colonoscopies or Babyscripts, which provides at-home monitoring for pregnant women in partnership with Philips’s obstetrics-focused products.

The UK-based robot and laboratory automation developer Automata has raised $50m in its recent series B round including strategic investors In-Q-Tel and ABB Technology Ventures, to develop technology for diagnostics, drug discovery and biotech applications.

Automata Labs consists of modular pods containing robot arms that can operate lab equipment. Multiple pods can be integrated and automated simultaneously, using software and support to provide complete laboratory workflow automation systems.

Scipher Medicine, a US-based developer of blood tests to see how people will respond to specific drugs and drug classes, raised $110m from a consortium including Hitachi Ventures. Plexium, another US-based startup, is using cell-based screening to find therapies for cancers and other diseases and raised a $102m Series C round with participation from M Ventures, the corporate investment arm of Germany-based science and technology group Merck.

Beyond diagnosis, Lee said we could expect other aspects of healthcare to be transformed as sensors detect possible health crises and “trigger an alert to you, your next of kin or call for emergency assistance” and predict and warn about future pandemics, as well as recommend personalised changes in lifestyle, sleep, food, nutrients and medicines to keep every patient healthy.

Lee said: “Precision medicine stands to become increasingly feasible as more information becomes available. AI is suited to deliver this type of individualised optimisation and can be applied to longevity, where each person can be compared with others of different ages and be suggested ways to reduce the gap with younger people.”

Investments by corporate venture capitalists (CVCs) and other startup investors, therefore, are focusing on the data and technology side of startups, as well as clinical data to improve prevention, treatments and drugs for illnesses, disease and viruses, including heart attacks, cancer and neurological disorders.

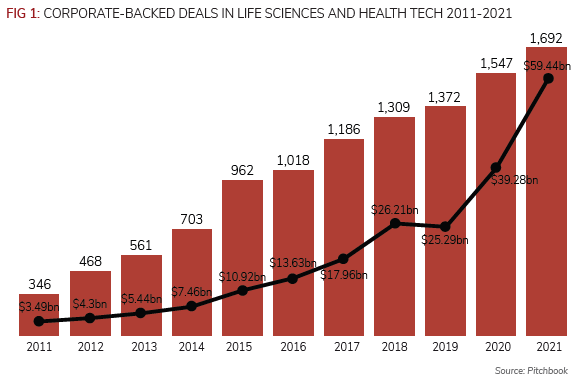

CVCs backed almost 1,700 deals worth an aggregate $59.4bn in 2021 in life sciences and healthcare, according to data provider Pitchbook (see Figure 1).

David Stevenson, managing director at US-listed drugs company Merck’s Global Health Innovation Fund focused on digital technology at the GCV webinar on personalised medicine and oncology in February. He said: “For us, the start is clinical data by regulated providers. But it will be a combination of technology and clinical in this age of integration between startup, healthcare provider and use of technology’s software engineers [that finds solutions to personalised medicine].”

Lizzie Lee, partner at McKesson Ventures, the corporate venturing unit of the US-based healthcare provider, told the same webinar digital health would provide better oncology care.

Caroline Cake, Entrepreneur in Residence at venture capital firm Oxford Science Enterprises, the Science Business Builder and preferred investment partner of the University of Oxford, and former CEO of Health Data Research UK, said personalised medicine offered a chance to both extend lives and improve quality of life. She said impact might vary by disease but offered especial promise in neurological areas, such as Alzheimer’s and Parkinson’s, that affected 60 million people globally and where so-far incurable but where early treatment makes an impact.

She said: “We can identify individuals earlier using different information, such as cognitive, biomarkers and blood and imaging sensors. This data on people and their risks can be measured for progression and responses can mean iteration and better stratification of trials and treatment.”

UK-based Mindstep uses the same technology that tracks eye movement to power Snapchat filters to diagnose and treat key indicators of conditions such as dementia, depression, anxiety and brain fog and recently raised £2.5m.

Cake added the greatest impact would come from embedded solutions but relied on public trust that the data would be secure and all would benefit. For this to happen she said it was important patients and the public were involved in decisions and governance (see box: Protecting the individual, page 8).

Issues and concerns

But rolling out AI, automation and robotics requires dealing with many major issues, according Sinovation’s Lee. “Some people will find it morally objectionable for machines to ever make decisions that affect human health and lives, even if AI-powered healthcare could save millions of lives over time.

“Today, when a human doctor or surgeon causes fatalities, they answer to judicial and regulatory processes that decide if they acted properly and, if not, determine the consequences. But what happens if AI causes the fatality? Who is held accountable? Is it the equipment manufacturer, the AI algorithm provider, the engineer who wrote the algorithm or the doctor providing supervision? We need laws and regulations that enshrine accountability and protect people from unsafe software, but we also need to ensure technological improvement does not stall due to excessive indemnities.”

These issues are increasingly relevant now. Gil Herrera, head of research at the US National Security Agency, has repeatedly raised the prospect of the directorate needing to develop greater capabilities in and understanding of rapidly advancing fields such as synthetic biology.

“Much of the competition in the world now is not military,” Herrera told MIT’s Technology Review. “Military competition is accelerating, but there is also dissemination of other technologies, such as synthetic biologies, that are frankly alarming.”

Palantir, the US-listed data analytics group, best known for its ties to the defence and security industries, was “rolling out software across the UK’s National Health Service (NHS) to help reduce the backlog of six million patients waiting for elective care”, according to the Financial Times. The rollout across 30 hospital trusts followed a pilot of Palantir’s Foundry system at the Chelsea and Westminster Hospital Trust that helped reduce the in-patient waiting list by 28% for all non-emergency surgeries, including for cancer treatments, the FT said.

Palantir’s technology works by bringing together disparate data into a dashboard that allows clinicians to see which patients needed to be prioritised at a glance.

Pitchbook said startup companies developing precision medicine technologies include Tempus Labs, Syapse and GNS Healthcare.

In December 2020, Tempus, which has built the world’s largest library of clinical and molecular data, raised $450m in its series G round, which Pitchbook said was the largest deal by a precision medicine startup.

Similar to Tempus, Syapse aims to aggregate fragmented clinical, molecular, treatment and health outcomes data, while GNS Healthcare leverages causal AI technology to exploit multiomics and clinical data to create virtual (in silico) patients in the fields of oncology, neurodegeneration and immunology to reveal hidden circuitry of disease.

GNS collaborated with Tempus to develop and launch an in-silico model for prostate cancer.

Other recent deals include Variantyx, a precision medicine company centred around genomic testing for rare genetic disorders, reproductive health and precision oncology markets, raised $41.5m in its series C round, including Robert Bosch Venture Capital.

In the UK, Microbiotica, which develops bacterial therapies and biomarkers using the human microbiome has raised $67m in its series B round co-led by China-based Tencent.

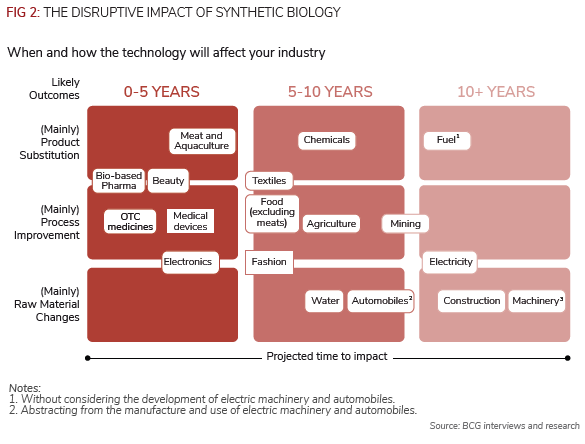

Science is getting better at re-engineering micro-organisms, so-called synthetic biology, for myriad uses, including better medicines and drugs initially, according to consultants Boston Consulting Group (BCG).

But none of synthetic biology can exist without one key piece of equipment: a bioreactor. Stämm Biotech, an Argentina-based startup founded in 2014, is developing a desktop-sized bioreactor with a $17m series A round.

Stämm uses a 3D printer to create a network of microchannels that pass cells through the nutrients and oxygen they need. In a global market, innovation and startups can come from anywhere, but the intellectual powerhouses remain consistent.

The UK is in second place behind the US in this field and this intellectual property (IP) is driving drug discovery

Better drug discovery

Today, it costs up to $2bn and takes many years to get a successful drug or vaccine through the development process.

Sinvation’s Lee said AI could be used to fold proteins and propose targets to attach a treatment molecule.

DeepMind, a UK-based AI subsidiary of US-listed Alphabet, has a programme for predicting protein folding announced towards the end of 2020. As MIT said in awarding DeepMind’s AlphaFold technology a top-10 breakthrough award this year: “Nearly everything your body does, it does with proteins. Understanding what individual proteins do is therefore crucial for most drug development and for understanding many diseases. What a protein does is determined by its three-dimensional shape.

“A protein is made up of a ribbon of amino acids, which folds into a knot of complex twists and twirls. Determining that shape – and thus the protein’s function – can take months in a lab. For years, scientists have tried computerised prediction methods to make the process easier. But no technique ever came close to matching the accuracy achieved by humans.

“That changed with DeepMind’s AlphaFold2. The software, which uses an AI technique called deep learning, can predict the shape of proteins to the nearest atom, the first time a computer has matched the slow but accurate techniques used in the lab.

“Scientific teams around the world have already started using it for research on cancer, antibiotic resistance, and covid-19, but the true impact of AlphaFold2 may take a year or two to be clear… It may ultimately transform the world of biology.”

Lee added: “AI models can narrow the search for a drug by identifying patterns within the data and proposing lead candidates. Scientists can use these tools to significantly reduce the cost of drug discovery.”

Last year, biotechnology company Insilico Medicine announced the first AI-discovered drug for idiopathic pulmonary fibrosis. Insilico’s AI saved 90% of the cost of two major steps in drug discovery. Lee said: “When such AI tools are made available to scientists, drugs will be invented at much lower costs, making it worthwhile for pharmaceuticals to pursue treatments for rare diseases and research multiple drugs for common diseases.

“Besides the above “in-silico” approach to drug discovery, “in-vitro” wet-lab experimentation, which involves testing the proposed drugs on human cells in petri dishes, can also expedite drug discovery. These experiments can now be conducted more efficiently with robotics than lab technicians to generate massive amounts of data. A scientist can programme these robots to iterate a series of experiments 24/7 without human intervention. This will accelerate the speed of drug discoveries greatly.”

It will combine with more precise techniques for manipulating people

Human genome

The deliberate alteration of selected DNA sequences in living human cells – human genome editing –has become one of the defining technologies of 21st century science and medicine, with parallel work on epigenome editing, which employs similar technology to make enduring changes to patterns of gene expression without making any changes to a DNA sequence.

RBVC, the corporate venturing unit of Germany-based industrials group Robert Bosch, took part in the $41m C round for US-based Variantyx, which helps clinicians develop personalised treatments for patients by getting more insights into their genetic makeup.

More capital is being pumped into startups working on precision genomics in order to achieve a clinical therapeutic effect, such as correcting disease-causing mutations, adding therapeutic genes to specific genome sites and removing deleterious genes or genome sequences that increase an individual’s susceptibility or predisposition to a certain disease. These deals include France-based startup SeqOne Genomics, which raised a $20m series A and Canada’s Deep Genomics, which raised $180m in a series C round.

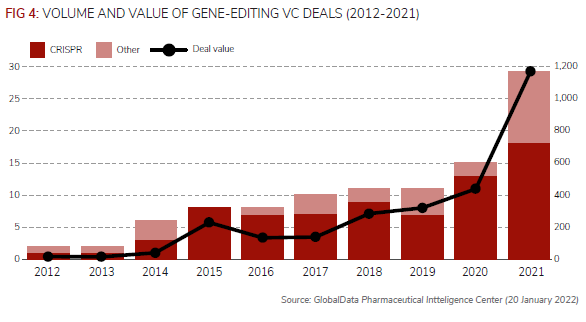

The Crispr-Cas9 system, which was first discovered around 10 years ago, has revolutionised gene editing, as it is a faster, more efficient, more accurate and more cost-effective technology, according to Pharmaceutical Technology’s review.

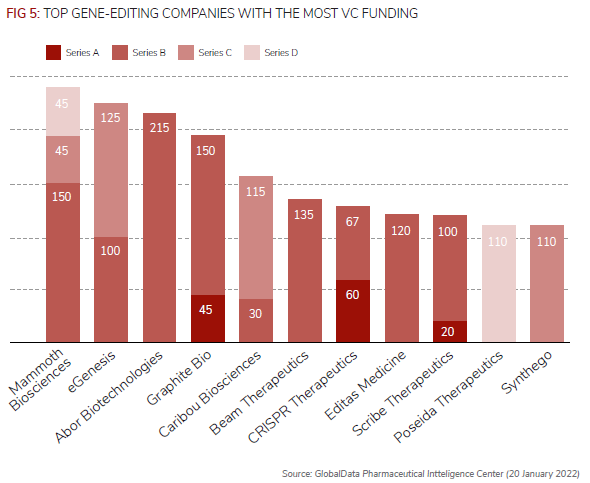

Since 2012, therefore, the number of VC deals for companies developing gene editing technologies has increased from just one in 2012 to 29 in 2021, according to the newsletter’s analysis of GlobalData’s Pharma Intelligence Center.

Of the 97 VC deals identified since 2012, 74 of these have involved Crispr technology.

According to GlobalData’s analysis, Mammoth Biosciences had received the most VC funding, $240m, from three financing rounds since 2020 for its gene-editing therapeutics.

In January, in a deal thought to be worth more than $1bn, Germany-based Bayer and Mammoth announced a strategic collaboration and option agreement for the use of the latter’s Crispr systems to strengthen Bayer’s cell and gene therapy platform initially targeting liver diseases.

Arbor Biotechnologies’ $215m series B round in November was the largest individual VC funding round in gene editing and is expected to advance its liver and central nervous system gene-editing technologies, according to the newsletter using GlobalData.

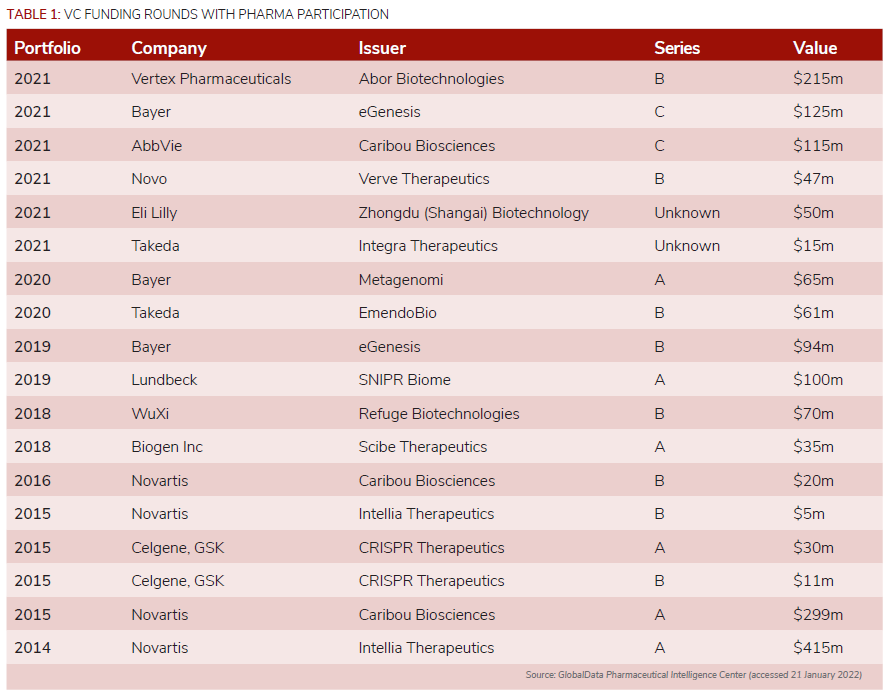

In terms of the number of corporate-backed deals, Bayer is just behind Switzerland-based peer Novartis. Novartis was an early investor in gene editing technology, with four VC deals between 2014 and 2016, while Bayer’s three deals are more recent, including eGenesis’ $125m series C round.

Other companies that have invested in gene editing companies include AbbVie, Novo Nordisk, Eli Lilly, Takeda, Lundbeck, WuXi AppTec, Biogen, Celgene, and GlaxoSmithKline.

Robots and materials

Intuitive Surgical remains the leader of robotic-assisted surgery (RAS) systems, Stryker’s Mako system continues to dominate robotic knee replacements, while Medtronic has gained a CE mark for its Hugo RAS system for use in urological and gynaecological procedures, according to GlobalData. But startups are forming, such as Neo Medical, a Switzerland-based startup working on solutions for spinal surgery, which closed a $20.6m round led by Swisscom Ventures.

Oliver Keown, managing director at Intuitive Surgical’s corporate venturing unit, said he was “super bullish” at the space where life sciences was meeting medical devices.

He added: “There are two trends: drug discovery via AI in parallel with a delivery platform and technology, such as mRNA; and personalised medicine for individuals.”

Traditionally, CVC units from medical device incumbents, such as Johnson & Johnson, Boston Scientific, Medtronic, Stryker and CMR, had been seen as effectively business development arms to identify acquisition targets, he said. But a series of mid-sized flotations for Acutis or Pulmanix opened exit options and technology companies were blurring the lines at an early stage between digital, life sciences and devices.

Keown said: “The shift is in devices enabling earlier detection and focal therapies that can zap tumours at this stage rather than large tumours that have been the focus of medical surgery in this area. Digital is transforming identification of target and means companies are not selling hardware to a hospital but outcomes.

“Startups are focused on a new technology plus big data. This device or platform could be in fertility, eyes, dental, tumour, liposuction, consumer, therapeutic treatments for organs, such as the heart of liver, or bioelectricals to reduce pain.”

However, he said the traditional challenges for startups remain the expense, regulation and sophisticated customers.”

Robot-assisted surgeries have increased from 1.8% of all surgeries in 2012 to 15.1% in 2018, and semi-autonomous surgical tasks, such as colonoscopy, suturing, intestinal anastomosis and teeth implants, are within reach for robots under doctor supervision.

Sinovation’s Lee said: “Extrapolating from this trend, we can expect all surgeries will see some amount of robotic participation in 20 years, with fully autonomous robotic surgeries accounting for the majority of procedures.

“Finally, the advent of medical nanobots will offer numerous capabilities that surpass human surgeons. These miniature (1 to 10 nanometer) bots could repair damaged cells, fight cancer, correct genetic deficiencies and replace DNA molecules to eradicate disease.”

All these advances, however, rely on developments in industrial or materials science. For example, UK-based Octopus Ventures led the £3.5m seed funding round for Scotland-based startup Touchlab, which develops electronic skin for robots.

SolidWorld, a spin-off of the University of Pisa in Italy, announced Electro Spider, a bio-printer that can recreate human organs and tissues.

Germany-based chemicals company Evonik, meanwhile, is developing its portfolio of 3D-printable biomaterials for medical technology, such as a polymer or filament that improves fusion between bone and implants.

“No other application field showcases more the classic advantages of 3D printing, such as individualisation or design freedom, than medical technology,” says Marc Knebel, head of medical systems at Evonik.

Semarion, a University of Cambridge spinout from the Cavendish Laboratory, raised more than £2m to combine materials engineering and cell biology to help drug screening. Its SemaCytes are a novel class of cell carrier materials, created using microchip fabrication technologies, nanomagnetism and smart materials to improve cell-based experiments typically used for in vitro drug screening work.

Feeling the pain

AndHealth, a US-based creator of “disease reversal programmes” focused on migraines and auto-immune diseases, has raised more than $57m in a round with participation from the American Medical Association’s corporate venture capital arm, Health 2047.

More than 36 million Americans had migraines in 2015, more than the number who have diabetes and asthma combined, according to the American Migraine Foundation. In 2020, 10 million people aged 15-69 in the UK suffered from migraines.

Heidi Mason, co-founder of consultancy Bell Mason Group, a partner of GCV on the Institute and, herself, a migraine sufferer, said there was hope through personalised medicine. “The CGRP Inhibitor class of new drugs are clearly breakthrough [in the past two to three years], and with lots of implications for previously intractable conditions – in this very personal case, for migraine prevention.”

CGRP Inhibitors (monoclonal antibodies) targeting certain neuro peptides shown to be causal in migraine, can be expensive but are invaluable, compared with lost sick days and suffering.

Protecting the individual

Wallife, an Italy-based insurance technology startup for the security and protection of the individual from biological change rather than accidents, raised $4.8m in its first round of funding. Founded in 2021 by Fabio Sbianchi, founder of Octo Telematics in 2002, Wallife is focused on protecting the individual from risks arising from innovations in the genetic field (preservation of biological material and genetic identity), biometrics (fingerprints and facial recognition) and biohacking (use of technologies inside the human body, such as prostheses and implantable medical devices).

As IEEE Spectrum noted in its tangled history of neural implants, Their Eyes Are Now Obsolete, hundreds of blind people benefited from a retinal technology sold by a company called Second Sight, only to be left literally in the dark when their devices powered down after it neared bankruptcy. The clash of for-profit medical technology and people’s basic wellbeing creates an ethical minefield but also one for insurers.

Alternative funding

Drug discovery and development is a very slow and unpredictable process. Repurposing existing, safe drugs already on the market for new treatments offers a shortcut, but runs up against funding challenges.

Nobel Prize winner Leland Hartwell and Gennaro D’Urso, co-founders of Genetic Network, in a webinar organised by Karim Nurani at Lingto, said blockchain technology could reduce time to market in the pharmaceutical industry.

Blockchain can enable decentralised autonomous organisations (DAOs) to effectively become “wallets with a purpose” and enable token holders to vote for the types of research and projects to fund.

D’Urso said: “There are 7,000 human-approved drugs by the [US regulator] FDA and most are

off-patent. There is no incentive for drugs companies to look at whether they can work elsewhere, but DAOs decentralise the risk.

“The analogy is to what Steve Jobs said about PCs 25 years ago – they are decentralised and democratic Now, we are decentralising knowledge of the genome through DAOs.”

Maggie Hsu, a venture capitalist at Andreessen Horowitz (A16Z), outlined a “go-to-market” framework for DAOs – called Web3 projects.

Different types of projects require different approaches and have distinct key metrics, but one idea is for a generalisable legal framework for IP-based non-fungible tokens that could be used to catalyse drug development, she said. It can also mean DAOs can use tokens to reward patients or others, similar to how pay-to-play games have development in Web3.

Hsu added: “Web3 changes the entire approach to bootstrapping new networks, since tokens offer an alternative to the traditional approach to the cold-start problem. Rather than spending funds on traditional marketing to entice and acquire potential customers, core developer teams can use tokens to bring in early users, who can then be rewarded for their early contributions when network effects were not yet obvious or started. Not only are those early users evangelists who bring more people into the network (who would like to similarly be rewarded for their contributions), but this essentially makes early users in Web3 more powerful than the traditional business development or salespeople in Web2.”

Healthcare IT prints money

US-based provider of biomedical data analysis software DNAnexus received $200m in funding from investors including GV, a corporate venturing subsidiary of internet and technology conglomerate Alphabet.

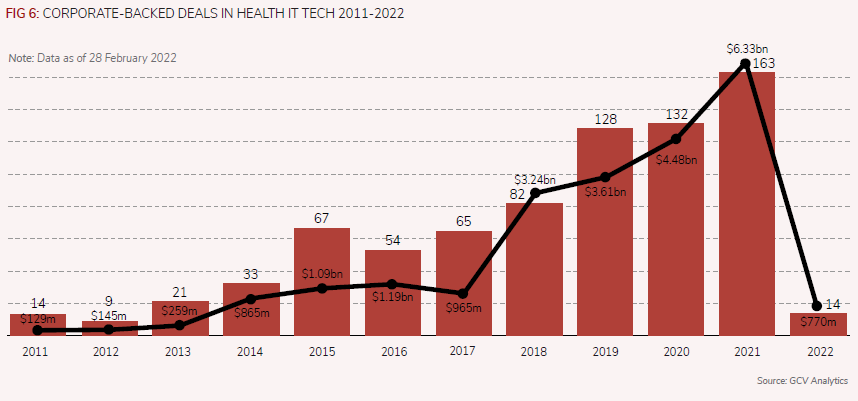

DNAnexus is part of the broader healthcare IT space, which has attracted the attention of corporate venture investors over the years (see Figure 6). The number of corporate-backed deals in this space has been on the rise over the past few years, having reached a peak by the end of 2021, when we reported 163 deals in that space, up from 82 in 2018. The same applies to the total estimated capital which nearly tripled over the same period – from an estimated $2.24bn in 2018 to $6.33bn in 2021.

This implied surge in valuation, all too common in recent years of the pandemic in many areas of life sciences and healthcare, is also due to the enormous potential advances which IT applications to health may bring.