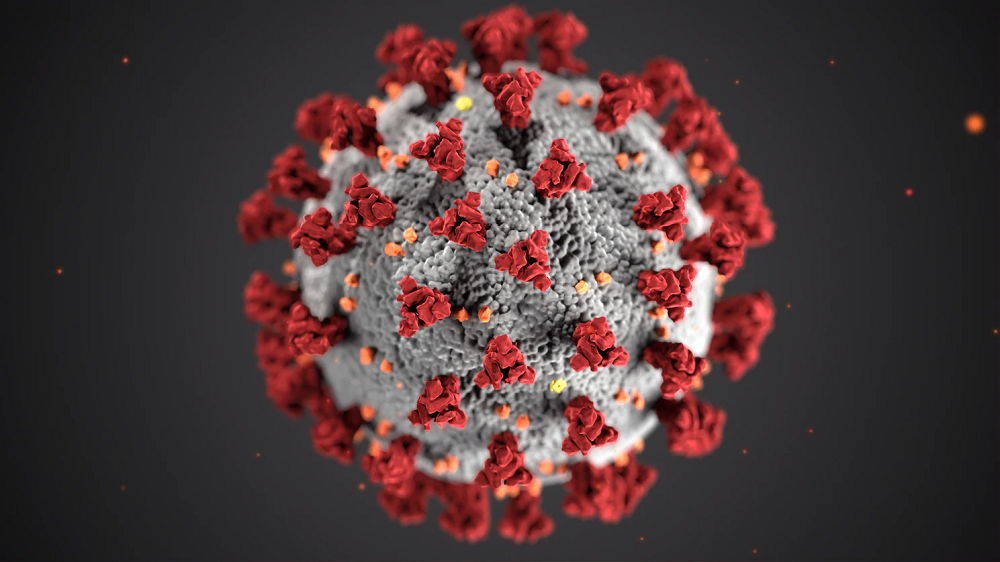

Adam Lashinsky at Fortune’s data sheet newsletter pointed to this hilarious yet tragic video as a sign we are living through eventful times with the covid-19 disease as almost a sports. Alex Danco on his blog tries to unpick the reasons why “the urgent topic occupying all of the air time in elite circles isn’t the pandemic, or its generational economic devastation; it is ‘how bad should other people be allowed to make you feel online?’”

But while the air time is focused elsewhere there are some seismic developments happening in the economy outside of healthcare.

As my colleague Kaloyan Andonov writes in the latest Oil and Gas Q2 2020 Sector Review: “After the eventful start of the year with the outbreak of the Covid-19 pandemic, it would not be an under-statement to say that the second quarter was also intense for the oil and gas industry.”

In the oil and gas space, pressures on both the demand and supply side caused oil prices to fluctuate between $20 and $30 a barrel in Q1, with breakeven prices for most oil companies and exporting countries standing generally between $40 and $50 a barrel or higher as noted by the Economist this week.

The rapid drop in cost for renewables over the past decade is enabling other technologies and business models to emerge, particularly around hydrogen. (We are preparing a report on the hydrogen economy for our next GCV Digital Forum 2.0 on 29 September so do reach out with insights or connections.)

AP Ventures, a multi-corporate venture firm started by mining company AngloAmerican Platinum, led an over-subscribed fundraising round in Norway-based Zeg Power, co-investing alongside its limited partner, Mirai Creation Fund (Sparx), and sovereign-backed Nysnø Climate Invest.

Zeg is commercializing a hydrogen production technology based on methane, featuring integrated carbon capture, and last week gained grant funding to commercialise its blue hydrogen production technology at the CCB Kollsnes Energy Park, near Bergen.

The 240 tonnes per year plant will supply hydrogen to the Norwegian maritime sector as early as next year.

A similar-sized project is underway by a consortium in Denmark, including AP Moller-Maersk, SAS and Ørsted, to develop industrial-scale sustainable fuels to replace fossil fuels for buses, trucks, maritime vessels and planes.

Hydrogen as an attractive way for renewable energy providers to increase value. Hydrogen Europe has produced a report outlining a roadmap for installing 40GWs of capacity in Europe, North Africa and Ukraine by 2030.

The report indicates that 6GW of this capacity will be captive (hydrogen production at the demand location) and 34GW will be located near the resource (i.e. near renewable sources and therefore subject to hydrogen storage and transportation), as AP Ventures notes in its latest newsletter.

Hydrogen might remain a niche for parts of the industrial economy but is part of the electrification and renewables surge driving the new economy.

The news cycle for now is on covid-19 but soon enough it will return to climate change and corporations through their venture investments are wisely using this interlude to prepare.