Corporate venturing is not just for the biggest corporations — around a fifth of the corporate venture units we survey in the GCV Keystone global benchmarking survey each year are part of companies that have fewer than $1bn in annual revenues.

Naturally, CVC teams at these companies tend to be smaller, with 78% operating with five people or fewer and in 69% of cases investing with a capital allocation of less than $50m.

But these smaller-company CVC teams also have a couple of other characteristics which make them stand out from the rest of the industry.

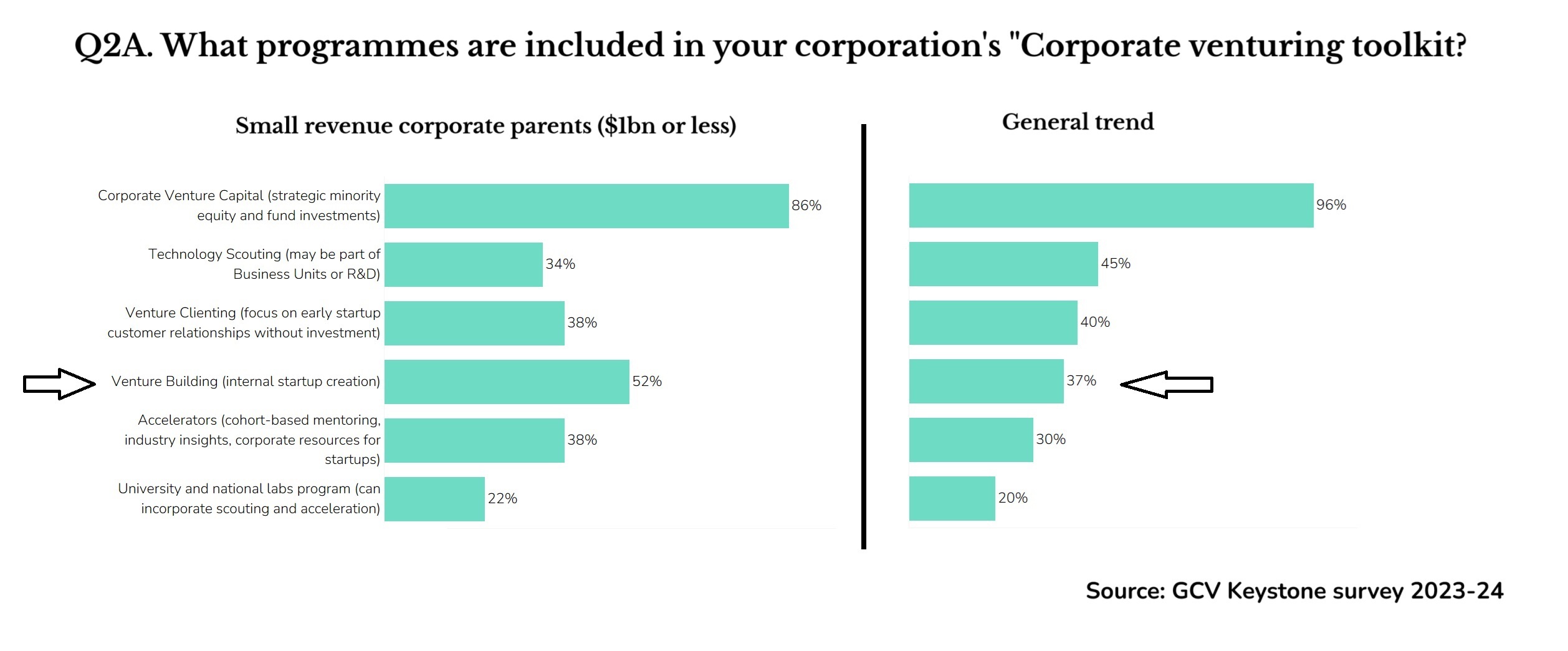

One of the most surprising is that they are much more likely to be building their own startups internally as well as taking minority equity investments in external startups. Corporations increasingly use multiple innovation tools, and according to our annual GCV Keystone benchmarking survey, some 37% of CVC units will also engage in venture building.

But this trend was noticeably higher in smaller corporations. More than half of the smaller corporations we surveyed built their own startups. This was unexpected, given that venture building is often a slow and expensive undertaking.

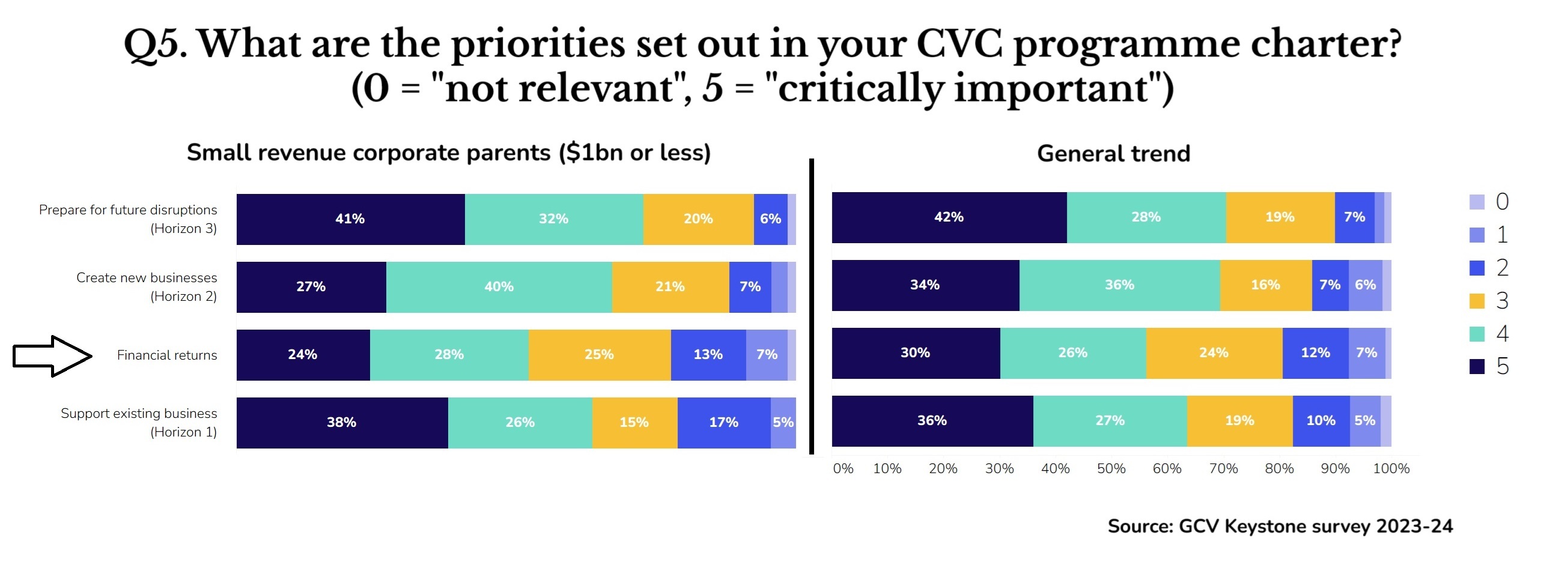

Corporate venturing teams at smaller corporations were less likely to say financial returns were a priority, with just 24% saying this was of high importance, compared with 30% in the general population of CVCs.

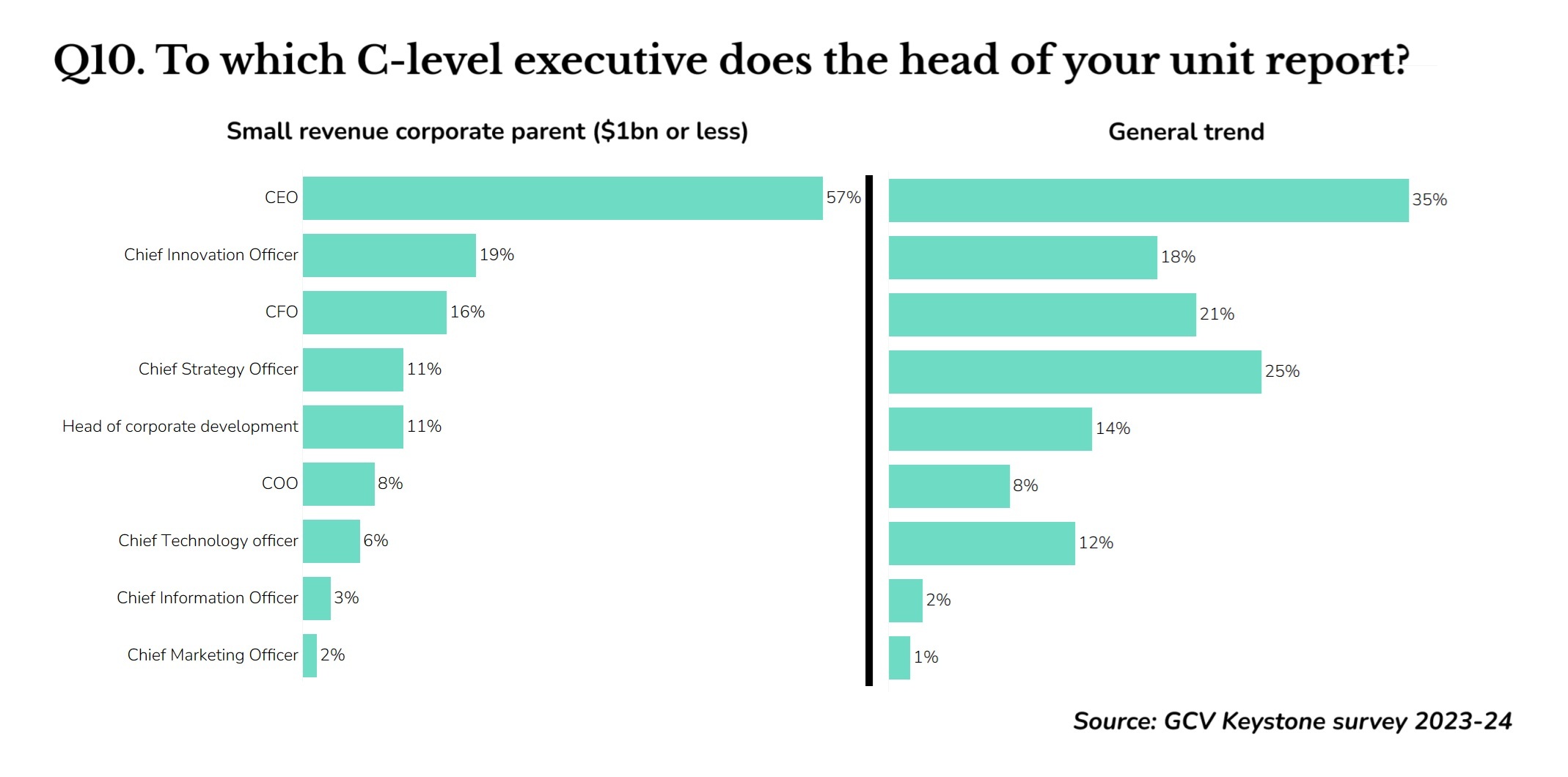

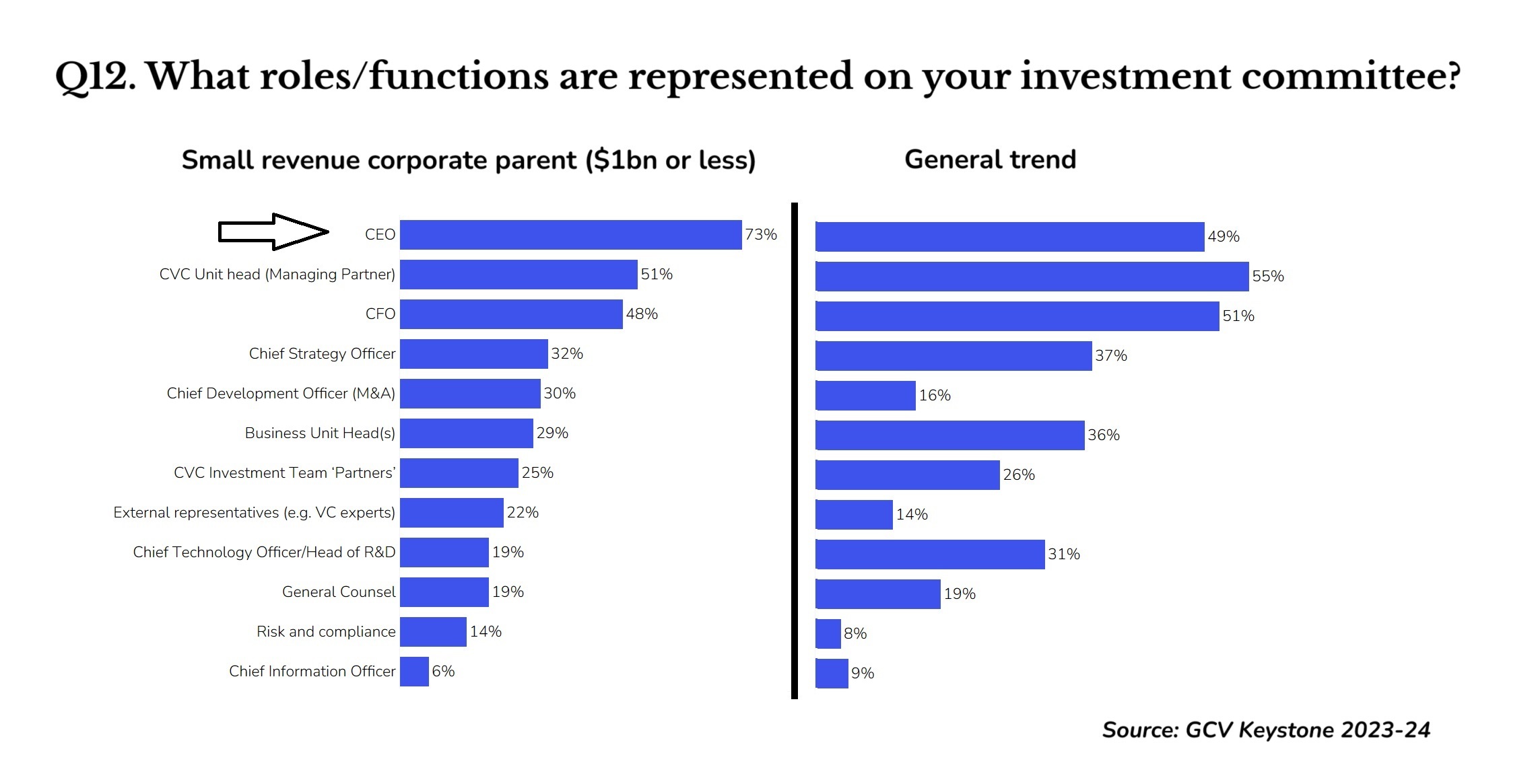

Another point of difference was that at smaller corporations the CEO appeared to be involved with the venturing unit much more than was the norm across the general population. At smaller companies, in 57% of cases the corporate venturing unit reported to the CEO, compared with 35% for the general population of CVCs.

The CEO was also on the investment committee in 73% of smaller companies, compared with less than half for the general population.

It makes sense that at a smaller business the CEO may want and be able to be personally involved with the corporate venturing operations. But this CEO-centric approach may not be a good idea in the long term.

When we looked at corporate venturing units that had managed to stay in operation for more than a decade, one unifiying feature in all these was that they had a far lower level of involvement with the CEO than the general population. For these smaller-company CVCs to maximise chances of survival they may have to detach themselves from the chief executive as time goes on.

These figures are from the 2024 GCV Keystone annual benchmarking survey. We are currently updating the data for 2025, and would like to ask all corporate venturing teams to help us by filling in their data. All respondents will get a free, advance copy of the survey results. Many CVC teams find these useful for measuring how they are performing compared with industry norms.

Please fill your details in here: