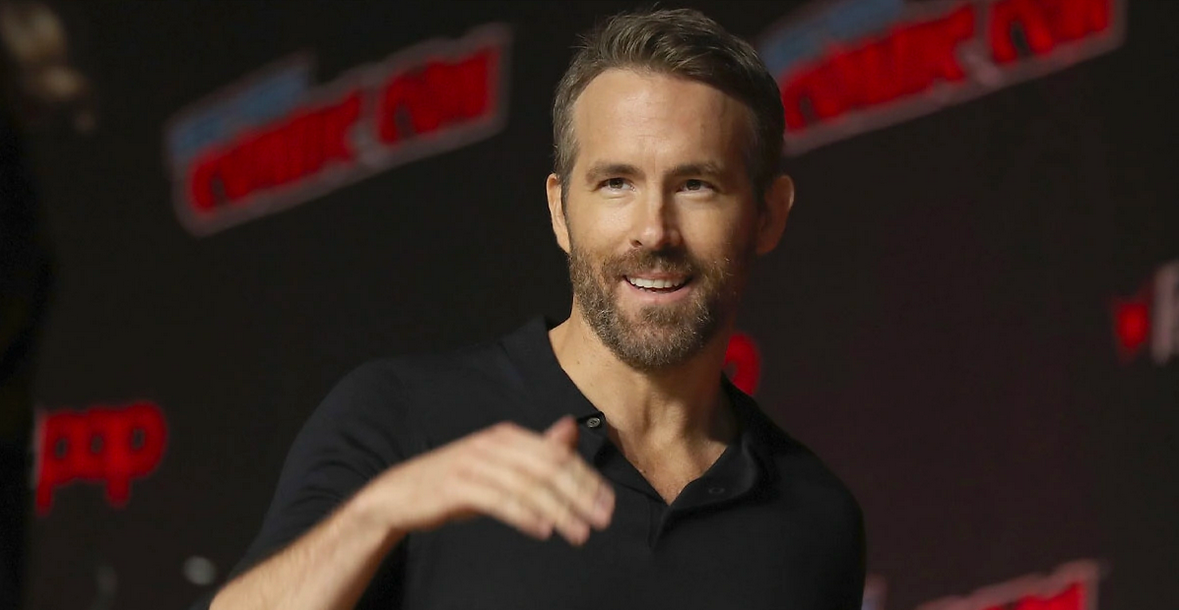

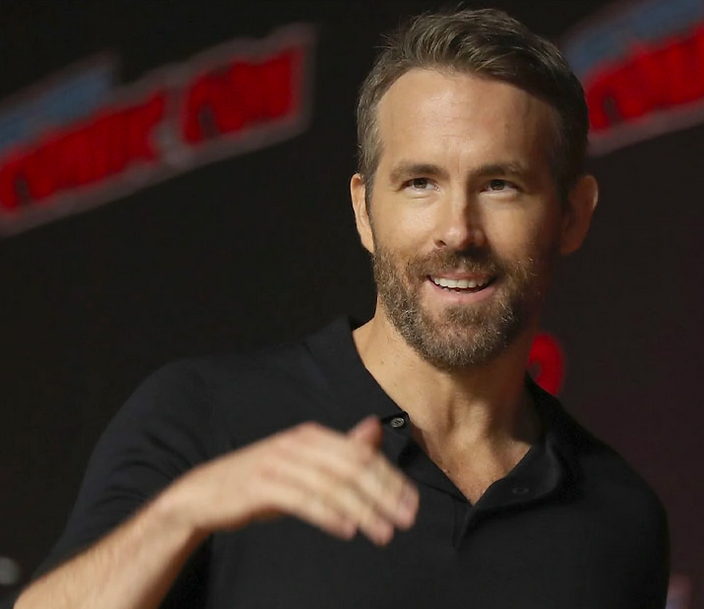

Celebrities begin to make the leap to corporate VC

We’ve had celebrities launching companies and celebrities forming venture capital funds, but actor Ryan Reynold’s film production company Maximum Effort Holdings investing in Bending Spoons’ $340m funding round is a rare case of a celebrity-owned business jumping into corporate VC.

Italy-based Bending Spoons has created a suite of products including photo-editing app Splice and image enhancement tool Remini and said part of the cash will be pumped into marketing activities.

Handily, the other side of Maximum Effort’s business is digital marketing, meaning it might be able to help with that in future. It’s the second investment for Maximum Effort, following its contribution to skincare brand Phyla’s July seed round, and it’s going to be interesting to see if these are the seeds of a proper CVC portfolio.

Milan’s coming out party as a startup hub

Elsewhere in Italy, SatisPay secured approximately $305m in a series D round featuring payment technology producer Block and internet group Tencent at a valuation it told TechCrunch was $955m.

SatisPay has built an independent payment network which does not require debit or credit cards and which allows people or businesses to send money with just a phone number and an international bank account number.

It’s easy to see how the product fits into the ongoing digitalisation of finance, but perhaps the banner news is that SatisPay – like Bending Spoons – is situated in Milan, not traditionally thought of as a major centre for new tech companies. Perhaps the Italian government’s €2.5bn investment in its CDP Venture Capital vehicle in January has given the country’s startup scene a confidence boost.

A shoot of hope in the fresh produce supply sector

The ongoing collapse of Chinese unicorn MissFresh is a reminder of the uncomfortable fact that no one seems to have found a way to make the online grocery delivery model profitable.

US-based GrubMarket reckons it might have unlocked the key to that, raising $120m from investors including food producer General Mills’ 301 unit at a valuation above $2bn amid a statement from its CEO claiming it’s on track to reach net profitability by the end of 2022.

The cash won’t be used for working capital either. GrubMarket intends to channel it into acquisitions as it looks to expand into new markets, and with many of its rivals struggling, there should be plenty of targets. Now all it has to do is face off a global recession.

Recycling proves a strategic bet in the electronics industry

ESG investment is becoming an ever-growing part of the corporate VC process, and while there are still very differing ideas of what that means in practice, it can sometimes be used to back essential but less glamorous parts of the economy – like recycling.

EverestLabs is attempting to do its bit with RecycleOS, a software platform which uses artificial intelligence to assist in the recovery of recyclable objects. NEC’s $150m Orchestrating Future Fund was among the investors in a $16.1m series A round this week, and it’s easy to see how RecycleOS could strengthen the recycling of its electronics, an issue sure to become more urgent as raw materials become sparser and supply chains potentially more vulnerable.

Infrastructure management in line for a 5G boost

A range of telecoms CVCs recently told Global Venturing they expect 5G to be a significant factor in future investments, and while we tend to think of that in consumer terms, it also has uses for industrial customers, for example in monitoring their assets.

National Grid Partners and NTT Docomo Ventures have contributed to a $96m round for Sitetracker, the creator of a software platform which allows critical infrastructure providers such as electricity (National Grid) and telecoms networks (NTT Docomo) to manage their operations.

The technology is particularly aimed at 5G networks and solar power installations, both areas expected to undergo big leaps forward in the coming years. It’s one thing for governments to announce large-scale infrastructure projects, but they need a range of underlying technologies to make them work, and that’s where startups can make their presence felt.

GV looks to life post-algorithm

Axios reported this week that GV is no longer using the famed algorithm that once controlled the investments its partners were allowed to make, introduced back in the days when the unit was still called Google Ventures. The decision was reportedly not due to any single factor, though the biggest difference is likely the growing confidence and experience of its team.

So, what kinds of startups is GV investing in? It backed a $50m round this week for Flatfile, a data onboarding software producer that is exactly the kind of company you’d expect to see in its portfolio, but also contributed to a $32m seed round for senior-focused mental healthcare provider Rippl. True, GV has been a frequent healthtech investor, but this is the largest seed round it’s taken part in so far (excluding the monster round for NFT issuer Yuga Labs earlier this year). The four seed rounds above $20m that it has backed have all taken place this year. Could that be a sign of what’s to come post-algorithm?