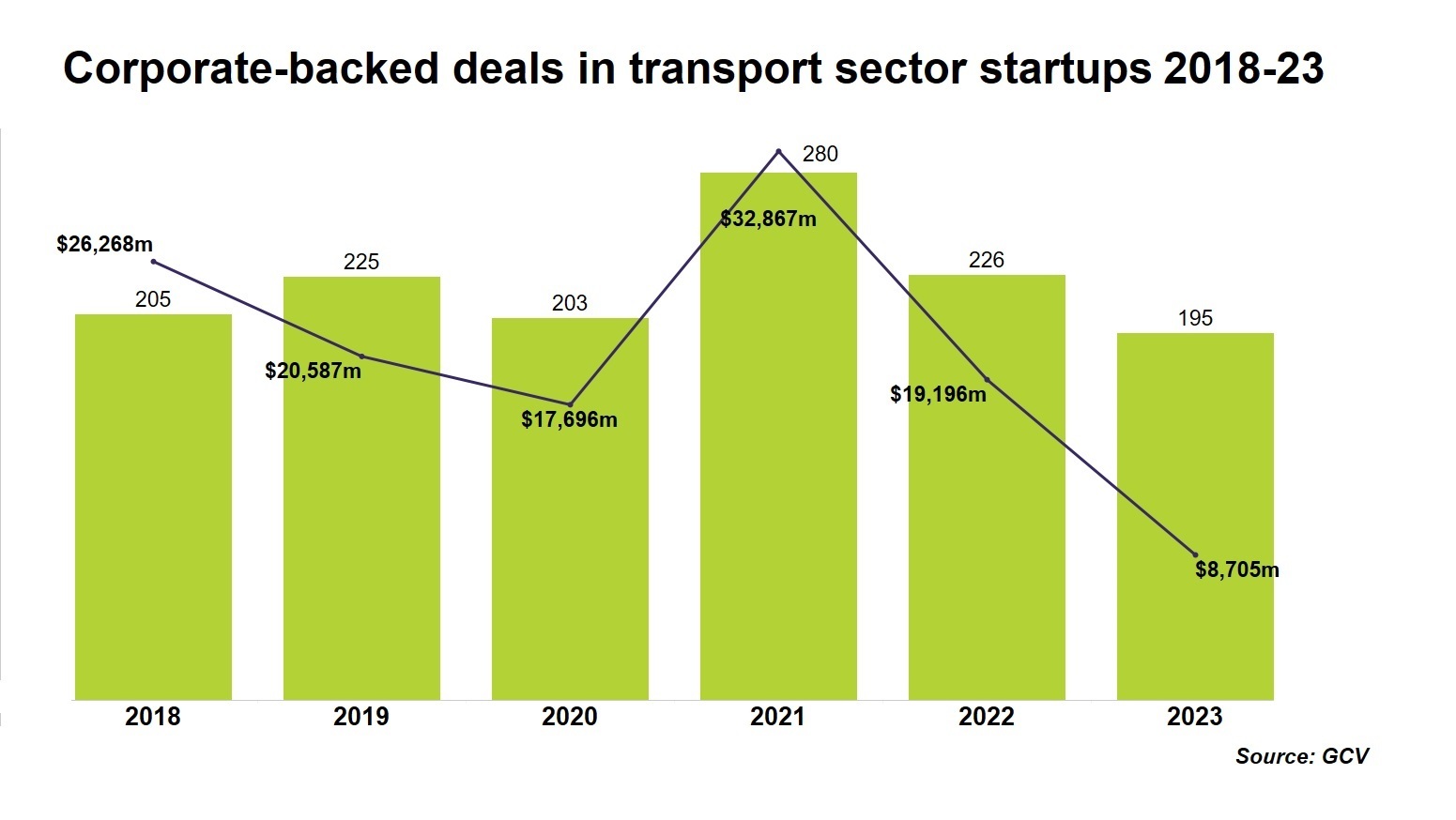

The past two years have seen a steady decline in corporate-backed deals in transport and mobility startups. According to GCV data, we’ve gone from nearly $33bn across 280 deals in 2021 to $8.7bn across 195 deals in 2023.

In part, this has been a reflection of the overall cooling of the venture market, but it also reflects specific setbacks in the transportation sector.

More forecasts for 2024

- Logistics in 2024: Labour shortages and climate to drive investment

- Energy in 2024: Plenty of funding rounds but few exits, say energy investors

Overall, worldwide automotive vehicle sales are estimated to increase by 2.8% year-on-year to 88.3 million units, according to S&P Global. Electric vehicle (EV) sales, however, are likely to continue to slow as manufacturers have difficulty shifting sales from early adopters to the mass market – the relative dearth of charging infrastructure and the higher cost of EVs relative to internal combustion vehicles act as a soft ceiling to demand.

According to a survey by Euromonitor, 42% of respondents opted not to buy an EV because of concerns over the availability of charging stations. This is exacerbated by the fact that a not-insignificant chunk of charging stations are out of order at any given time.

By a similar token, autonomous vehicles, which over the past few years have been hailed as the next frontier, have seen depleted investments from automakers in 2023. Trouble at vanguard companies like Cruise and Tesla have poured some cold water over what had been a much hotter prospect.

I don’t think I would have predicted that the OEMs would have pulled back…as much as some of them have

George Kellerman, founding managing director, Woven Capital

Air travel, too, is seeing a reversion to the mean relative to the post-pandemic spasm of demand as people were desperate to make up for lost time.

“Airlines came into 2023 guns-a-blaring – traffic through the roof, so much demand pent up from the pandemic. Obviously, things have stabilised a little bit, and that’s made for a different second half of 2023,” says Amy Burr, president of JetBlue Ventures, adding that there will still be great demand going into 2024, just not quite as much.

A stalled year?

The stalling demand for electric vehicles over the past year surprised George Kellerman, founding managing director of Woven Capital. “At the beginning of the year, I don’t think I would have predicted that the OEMs would have pulled back on some of this investment as much as some of them have,” he says.

A long-running issue for EV uptake has been not just the availability, but the compatibility of charging points. Over the past year, more and more automakers have been adopting Tesla’s standard charger, which helps them access Tesla’s supercharger network, but you also want to make sure that your customers can charge wherever they are.

There has been a great deal of progress, however, in terms of how governments are helping infrastructure build-outs. The Inflation Reduction Act in the US, for example, is pushing not just new chargers but bolstering the supply chain for batteries, whose complexity is a real bottleneck for the industry, and it’s expected to continue doing so into 2024.

“My overriding emotion [of the automotive sector] is just one of kind of being unsettled, I would say. I would very much describe it as kind of being unsatisfied,” says Mike Smeed, managing director at InMotion Ventures. Indeed, legislative uncertainty, climbing interest rates, plateauing appetite for autonomous driving systems and electric vehicles have meant a lot of things in the car industry are up in the air.

At the same time, the market is showing signs of real recovery, especially over the past year as incumbents are generally gaining their former strength again, according to Smeed.

“It’s almost like a year where some of the incumbent companies got their shit together. It just feels like everyone’s gone: Alright, what is the landscape looking like now? Where are we from these things that can bite us?”

Incumbents are pricing EVs lower in order to go for volume. Most automakers have made the decision that batteries are the propulsion for now, and battery costs, which tend to make up a large chunk of an EVs price, are set to come down with an expansion of cheaper technologies like sodium-ion.

In aviation, it’s been a big year for all things climate-tech. In particular, sustainable aviation fuel (SAF) has seen a massive bump in interest. Most CVCs from the aviation space have made some kind of investments in fuel made from alternate feedstocks in hopes of putting a dent in the gargantuan global demand for jet fuel. Multiple corporates have even teamed up for specialised SAF funds like the one headed up by United Airlines Ventures, which was subsequently expanded to nearly $200m over the summer.

A pick-up in 2024?

Much of the growth in the automotive sector in 2024 is expected to come from outside the vehicle. The infrastructure, as well as the supporting connectivity and energy technologies that keep the system as a whole running smoothly are set to see an influx of capital.

Smart traffic lights that use cameras and computer vision to measure traffic around the city and streamline it are gaining traction. Vehicle-to-grid (V2G) or vehicle-to-anything (V2X) charging, in which electric vehicles can sell their power back into the grid used to be hamstrung by expensive hardware costs, but is now also gaining traction as prices fall.

Existing technology is also being applied in new ways. Some car makers are looking at how to integrate radar technology into cars, not for automation but to look inwards to glean data from inside the vehicle. Is there a child still in the backseat? Is the driver sleeping? Is someone in the car about to have a health event? These are things that could potentially be detected without the need for cameras at all.

Propulsion technologies like hydrogen are promising, but consumer uptake will be difficult. Going from gas to electric is difficult enough, let alone introducing hydrogen fuelling forecourts. For fleets, however – given that they will typically only need fuelling at destinations – hydrogen is looking more viable.

In the aviation sector, there has been some slow progress on hydrogen as a fuel. This is still in nascent stages but electric-hybrid propulsion is starting to gain much more traction, with small manufacturers pursuing it in earnest.

It’s unlikely that full-electric systems will become mainstream any time soon – the battery technology is nowhere near where it needs to be to achieve real range – but the smaller, regional airlines may start looking at full-electric for short-hop flights.

Markets like electronic take-off and landing (EVTOL) have cooled down over the past couple of years, but the surrounding infrastructure – the vertiports, charging infrastructure, etc. – will still need investment.

Artificial intelligence

If there is one through-line across every sector in 2023, it was artificial intelligence. Transport companies are looking at various ways to apply it.

In the automotive sector, one area where AI is set to make a big impact is in predictive maintenance. Having to fix cars after something goes wrong is far more expensive than preventing the problem ahead of time. Embedded AI may be able to tell drivers that their battery is at risk of running out – or even worse, that it may soon catch fire – or that they’ll need an oil change soon, even that their tires are getting too worn down, just using the existing sensors in the vehicle and analysis the way they drive.

Generative AI will open up even more possibilities says Kellerman.

“I don’t believe we’ve even seen the tip of the iceberg on the true power and potential of generative AI. Even with what we have today, the applications are almost endless,” he says.

“I don’t even think startups can come up with new ideas as fast as the technology is changing. If you can put a camera on it, you can collect data and you can start processing it.”

A lot of the operational efficiencies you can receive from predictive AI are more exciting for us

Amy Burr, president, JetBlue Ventures

Predictive AI is also causing a lot of excitement in aviation, where it can be applied both in the cockpit and across an airline’s business units.

“There are some great use cases in generative AI, but that’s not really the exciting stuff for me in aviation,” says Burr. “A lot of the operational efficiencies you can receive from predictive AI are more exciting for us.”

“There’s going to be a lot of process efficiencies and communication efficiencies that are going to come out of that, but I think what’s going to really be the win is the excitement around using AI in general. Taking datasets, of which we have a lot, and really finding ways to be more efficient.”

Investment landscape

Broadly speaking, valuations have been coming down, but that doesn’t mean startups haven’t been raising money. While deal count and investment volume have been down by some margin, insider convertible notes have been used more frequently behind the scenes as a funding mechanism.

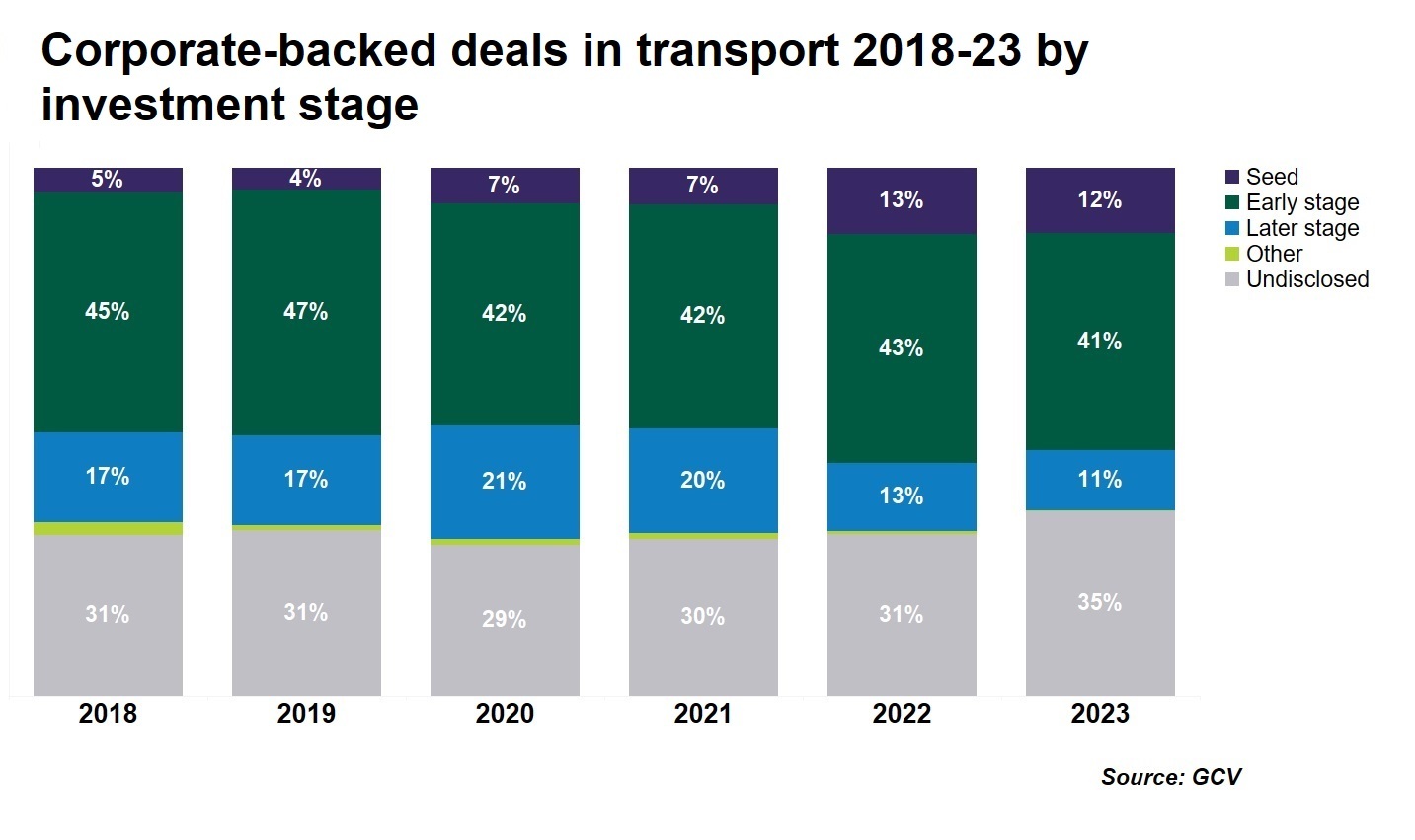

Those who are pricing rounds are trying to make sure they have more money on hand. “I think that people are being a lot more cautious now around when they do fundraise, you know, making sure that they’ve got maybe an extra six months of runway,” says Smeed, adding that InMotion Ventures is likely to do more early-stage deals this coming year, which may increase its deal flow while decreasing ticket size. Smeed believes the early stage is where InMotion can provide the most value to startups.

It’s going to be really interesting to see – as some of the technologies that we didn’t choose to invest in now start to scale and mature – whether we were right or not

Mike Smeed, managing director, InMotion Ventures

The shift to the earlier stage broadly tracks with what we’ve been seeing over the past couple of years. Seed-stage investments in transport have roughly doubled from 7% in 2021 to 13% and 12% in 2022 and 2023, respectively. Seed-stage investments are at triple the level they were at before the pandemic.

Over at JetBlue, investments in sustainability are set to slow as the unit feels it’s had ample coverage of the area this year, and investments are to stay steady, with focus being shared with managing a growing portfolio.

Investing is also as much about what you chose not to invest in, and InMotion’s Smeed believes 2024 will be about seeing whether these decisions were correct. “It’s going to be really interesting to see – as some of the technologies that we didn’t choose to invest in now start to scale and mature – whether we were right or not,” says Smeed.