The value of VC deals in German-speaking countries has fallen 54% compared to 2022 levels, according to a report by PwC. However, the pullback of financial VCs is leaving an opportunity for corporate venture investors to step up dealmaking.

“Now it is the time to invest and take over from the VC that have left,” said Florian Nὃll, venturing lead at PwC, told the GCV Connect conference in Munich this week.

“Declining valuations of startups also offer an opportunity, for CVCs in particular. There is still a high demand and need for financing in the market and other investors are increasingly holding back, which, in conjunction with lower valuations, means that deals and investments are currently possible for CVCs that were not realizable two years ago due to the surplus of other capital in the market,” said Enrico Reiche, partner and venture deals lead at PwC Germany.

Deal value and number of deals have declined amid an economic downturn that has resulted in lower exit valuations, a lack of initial public offerings and an increase in bankruptcies.

But despite the bleak market many of the corporate venture investors at the GCV Connect event were upbeat about continuing to finance startups.

“The market is great right now,” said Tanya Kufner, head of ventures at Nemetschek Group, a German software developer. Kufner said her parent corporation wants her venture unit to do large deals, but she added that valuations have not yet come down enough to do large volumes.

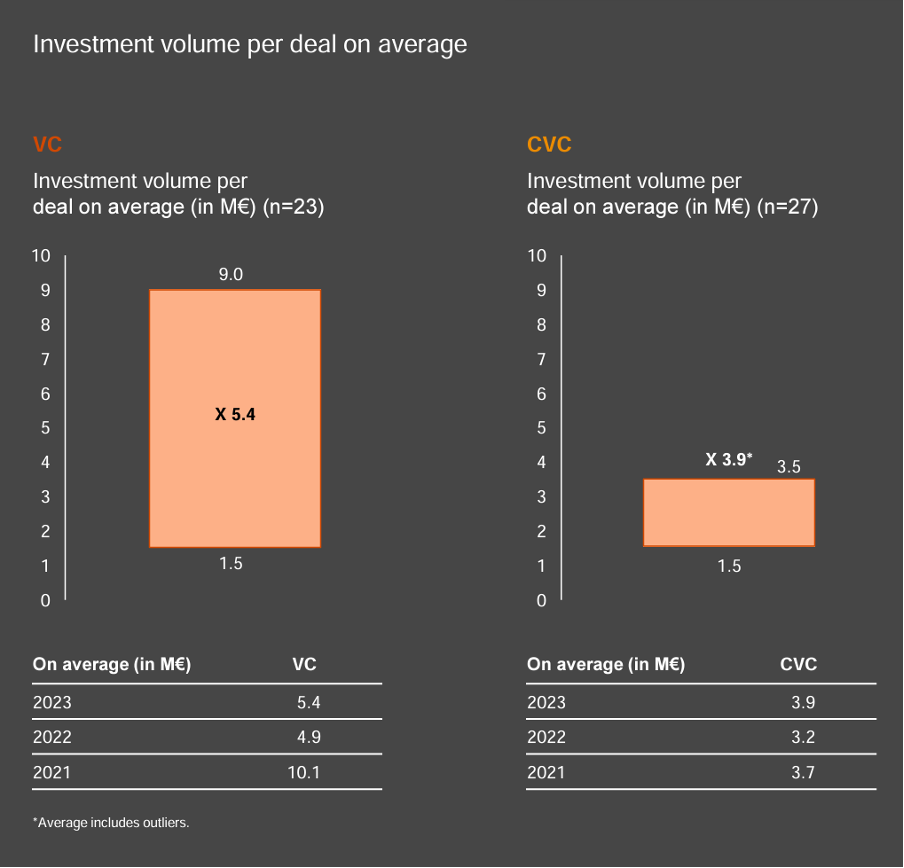

The PwC survey showed that VCs and corporate VCs have become much closer in terms of the average amounts they are willing to spend on a startup funding round. In 2021 VCs were spending on average around €10.1m per transaction, while CVCs were spending just €3.7m. Now, in 2023, as VC spending has come down dramatically, while CVC levels have remained the same, the difference has become far less stark — €5.4m for VC vs €3.9m for CVC.

Germany has been hit particularly hard by the economic downturn because its economy is reliant on manufacturing, car making and heavy industry, which are vulnerable to lower consumer spending and higher energy prices.

It is not as easy for strategic investors pull back from investing as financial VCs, as parent corporations have requirements for a constant stream of future market intelligence, said Jacqueline LaSage, managing general partner at Munich Re Ventures.

Corporate investors may also be able to offer startups more of the support they need during a market downturn, when reaching profitability becomes more crucial, said Tanja Rosendahl, managing director of F-Log Ventures, a venture fund which includes logistics company FIEGE Logistik as an anchor investor.

“Accordingly, not only the raising of capital but also the right investors who support startups with their network or knowhow in achieving the KPIs have become increasingly important for startups. That is why CVCs and corporate-backed VC are becoming increasingly relevant on the cap table as they often bring exactly that to the table,” said Rosendahl.

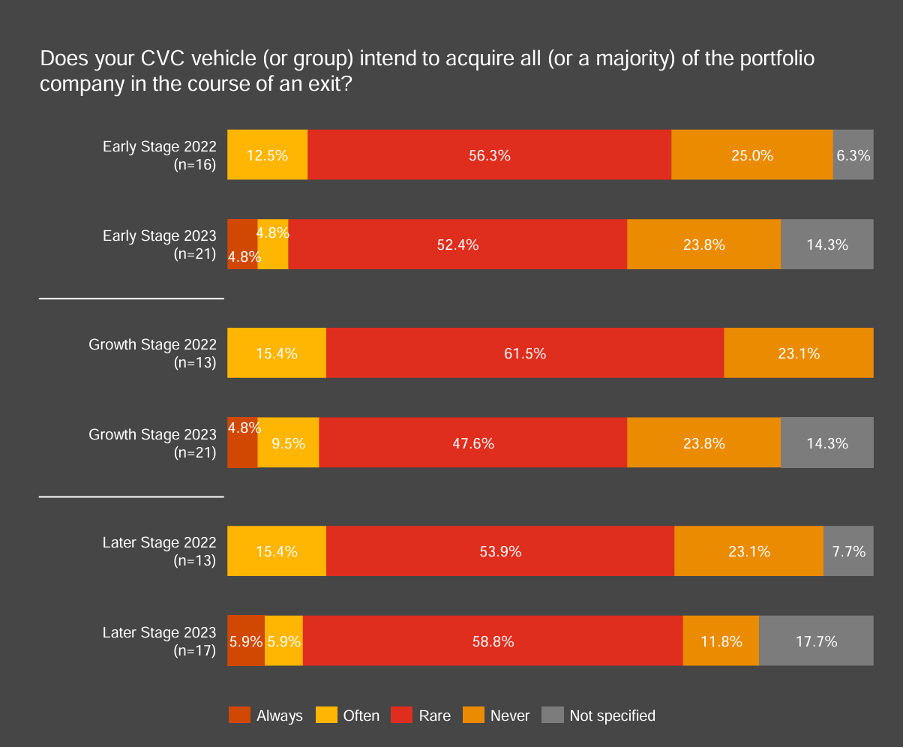

However, startups should not be looking to CVC investors as the potential exit route, as the PwC survey showed what GCV’s own Keystone annual survey has often highlighted, that corporate investors are rarely intending to acquire the companies they take minority investments in.

New entrants to the VC market that are taking advantage of lower valuations in the DACH region include family offices. “Family offices left the market because valuations went so high, but now they are back,” said Nὃll.

The PWC report is based on a survey of 63 investors in the DACH region. DACH refers to the three central European countries of Germany, Austria and Switzerland. Forty-six percent of respondents are from corporate venture capital.

Software, climate tech, industry 4.0 and robotics are the sectors that dominated investments in 2023, according to the report.

More venture capital funds were focused on financing early-stage startup deals than later stage compared with two years ago, the report found.