The flip side are those who thrive in challenging times with a growth mindset.

The coronavirus is putting pressures on all types of people in different ways given the human and economic costs already being counted, but there are always issues to face. SoftBank’s decision to halt its planned $3bn buyout of shareholders in WeWork, having invested $14bn in the co-working business, is now the subject of shareholder legal action over whether it is effectively alleged buyer’s remorse or simply due to required conditions not being met.

In South Africa, venture capital (VC) firm HAVAIC‘s decision to sue startup Custostech for $4.45m after an investment agreement fell through has “shocked” peers, according to Ventureburn.

Corporations are crucial elements in providing stability to the ecosystem and tend to have outsized influence given the reputation and size of their parent businesses.

In Australia this week, Boeing’s HorizonX unit took part in satellite connectivity system developer Myriota’s $19.3m series B round: an important signal of the corporate parent’s support of innovation despite the recent challenges in the airline industry and its own business.

Other corporate venturing units are showing similar commitment and I was delighted to record a podcast with BP Ventures’ David Hayes and Nacho Gimenez last night that will be published later this month, where similar points about the need to commit to portfolio companies were made.

However, one of the underexplored issues that will increasingly cause concern will be geopolitical tensions and how capital brings influence and control. Underreported in the Myriota deal was the presence of In-Q-Tel, the US intelligence community’s venture capital vehicle, as a new investor.

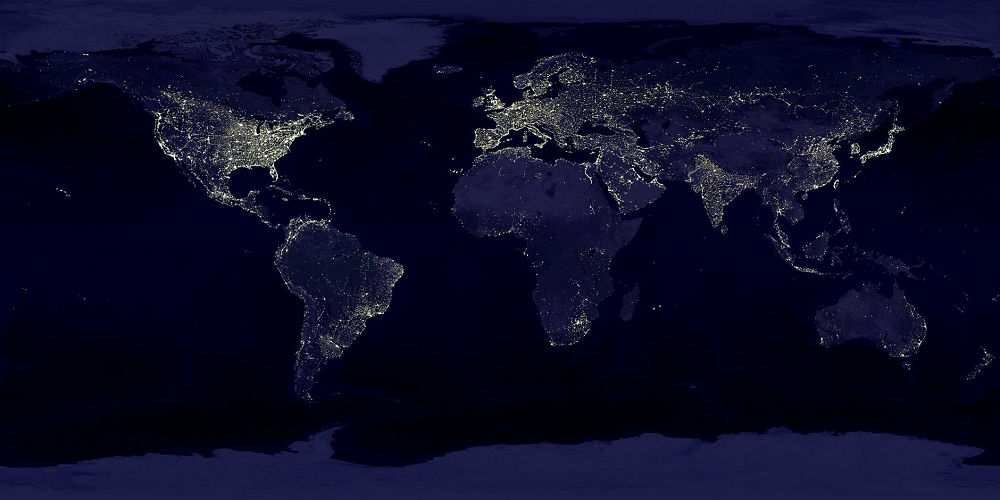

A globalised world with open borders for capital is increasingly challenged by localised, populist pressures, and spheres of influence are being developed similar to the Cold War between America and the USSR.

Ahead of our Triple Helix Venturing conference in California six years ago, Peter Thiel – the first outside investor in social network Facebook and co-founder of payment processor PayPal and data analysis services provider Palantir – said in an interview with Global Corporate Venturing: “Both globalisation and technology are important themes, but I think technology (because it is always new and one-of-a-kind) is less well understood than globalisation (because it involves copying things that works and that are tried and tested).”

State-controlled or influenced investment funds are now more firmly receiving attention. An attempt to seize control of the board of UK-listed graphics chipmaker Imagination Technologies by an investor linked to the Chinese state has failed after intervention by the UK government, according to the Financial Times.

A decade ago, US-listed corporates Intel and Apple had acquired strategic stakes in Imagination, with Intel Capital reaping a positive investment return on a majority sale of its stake a few years later. But while Apple renewed its supplier agreement with Imagination in January this year, the uncertainty over its plans had allowed Canyon Bridge, a US-based VC firm backed by Chinese investors, to buy into the business in 2017.

And while US-listed Zoom has gone from 10 million to 200 million daily users in the past few weeks(!), that comes with pain, according to noted investor Benedict Evans, who said in his weekly newsletter (disclosure: we are one of those increasingly active users): “A lot of the flaws people found look like simple product decisions to make installing and using easier – for example, it used the Facebook SDK so you could log-in with Facebook, but that sends some device data to Facebook.

“But it also claimed it was end-to-end encrypted and is not, and some of the traffic goes through Chinese servers, and so one has to assume that the Chinese state could listen in to anything if it wanted to. To its credit, Zoom has responded pretty well to most of these concerns, and some of this can be over-played (it seems pretty silly for a school system to ban it in case the Chinese intelligence agencies are listening to drama class), but I am not sure the UK cabinet should carry on using [Zoom].”

As US-China tensions remain high, other countries’ technologies remain important battlegrounds for strategic influence, and corporate venturers need to tread carefully.

I am delighted to share this thoughtful reader feedback from Neil Foster, global chair of the technology sector team at law firm Brown Rudnick, in response to our editorial yesterday:

- Loans are being offered by bailed out UK banks to emerging technology companies at 15-30% plus personal guarantees, because the banks don’t understand tech’s value. Banks understand revenues not IP. Their model is simply unsuited to innovator companies. So when they are told to lend, they offer terms which cannot be accepted, such as personal guarantees by directors.

- The US CARES Act appears to be substantially better, although it too has flaws. It will however save jobs. The loans are forgiven if, once the world returns to work, the jobs are saved. If not the interest is mandatorily low, unlike in the UK scheme.

- Equity is the only source of capital that doesn’t further impair solvency, but no one wants long term government equity investment, so an equity bridge facility is a good solution (or matched funding without red tape and delay). The team of VCs who lobbied the government last weekend on this point were right to do so, not “irritating”.

- Not all funds can bridge: some are closed, some have LP withdrawals, some simply aren’t well capitalised in the UK, and (for pre-series B), the UK relies on high nets, CVCs, EIS/VCTs, and not just funds.

- Enhancements to EIS (Enterprise Investment Schemes) for this one tax year would be the big winner. Uncapped EIS equity investments with tax relief at the tax-payer’s top marginal rate would save jobs now and allow tech companies to plan for the longer term, unlike other options. This could have the effect of the UK’s high-net-worth individuals bailing out the technology sector, rather than the government, and with long term capital, not debt on egregious terms.

Emerging companies require equity funding every year, and a large slice of this generation of innovator companies may simply die away this summer, stifling the very innovation that is utterly vital, now more than ever.

No one knows which company will become the next Arm Holdings, Sophos, Oxford Nanopore, SkyScanner or Babylon Health when they start. Now is not the time to cling to the true believer’s claim that only the fittest should survive.

Today, the issue is that it won’t be the fittest, just those with the timing to have just closed a financing round last month rather than trying to do so next month. The key is for innovator companies to survive the summer, in relation to which the government can and should help.”