A notable trend in 2024 has been a marked uptick in interest, not to mention funding, for startups focusing on women’s health.

Virtual menopause clinic Midi Health, period tracker developer Natural Cycles and Herself, a primary care provider for women over 65, all closed hefty series B or C rounds, while women’s health app Flo Health raised funding at a billion-dollar valuation.

But behind these more established companies, already at scaleup stage, there is a raft of smaller and newer startups with a range of interesting and innovative products emerging to address what’s still an underserved market. Here are some worth having on your radar:

Ru Medical

London, UK

Founded: 2021

Funding to date: Undisclosed

Ru Medical is the developer of Unpause, a smart wearable device that automatically provides relief from hot flushes for menopausal women.

The system, designed in collaboration with King’s College London and a range of general practitioners and menopause specialists, continuously monitors body temperature to identify the onset of hot flushes. It then cools the nape of the neck where the body is most receptive to cooling sensations.

The company’s sole venture funding so far came through a 2022 pre-seed round led by Singaporean angel investment firm Scalare Technologies that included several individual backers.

Eli

Montréal, Canada

Founded: 2019

Funding to date: $6.5m

Hormone analysis has become more widespread as more people wake up to their importance in the difference between male and female physiology, and Eli has created a kit that can provide daily hormone data gained by testing saliva.

The company was founded by CEO Marina Pavlovic Rivas and her partner, CTO Thomas Cortina, initially because Rivas couldn’t find a non-invasive, hormone-free contraceptive, but the product is expected to address everything from fertility and contraception to menopause and endocrine conditions. It is also building the world’s first large-scale longitudinal dataset for daily hormone levels.

Eli has raised just over $5m in equity and grant funding so far, most recently securing $3.6m from investors including Canadian telecoms firm Telus’s Pollinator Fund for Good in April last year. That round was expected to finance the completion of product development, clinical validation and regulatory approval.

Malaica

Nairobi, Kenya

Founded: 2022

Funding to date: $1m+

A number of startups have sprung up in recent years with digital offerings to help guide prospective mothers through their pregnancies, but Malaica has devised a programme that combines in-person and remote care for its home market of Kenya.

Malaica offers both antenatal care and postnatal care as well as personalised packages for delivery, and it has completed a pilot programme in Garissa, the town with the highest maternal mortality rate in the country. It is now talking to donors about extending that scheme to meet the needs of low-income mothers as it prepares to sign its first contract with a health insurance provider.

Markus Gemuend, formerly the managing director of Roche Africa, led a $1m pre-seed round for the company last month that also featured Bay Area venture firm Kapor Capital.

Leia

Stockholm, Sweden

Founded: 2021

Funding to date: $2.1m

Leia is also targeting childbirth, but from a completely different angle, having created an app that tracks postpartum health and helps new mothers combat depression.

The app offers postpartum depression and pelvic floor tests together with feeding tracking, expert content and personalised check-ins. The service is available to individuals or as part of a corporate care offering – Leia estimates one in three employees who are new mothers change jobs because of a lack of parental support.

People Ventures led Leia’s $1.5m pre-seed round at the start of 2023, less than a year after the startup raised almost $600,000 to support a pilot project for its app with research organisation Karolinska Institute.

Evvy

New York, USA

Founded: 2020

Funding to date: $19m

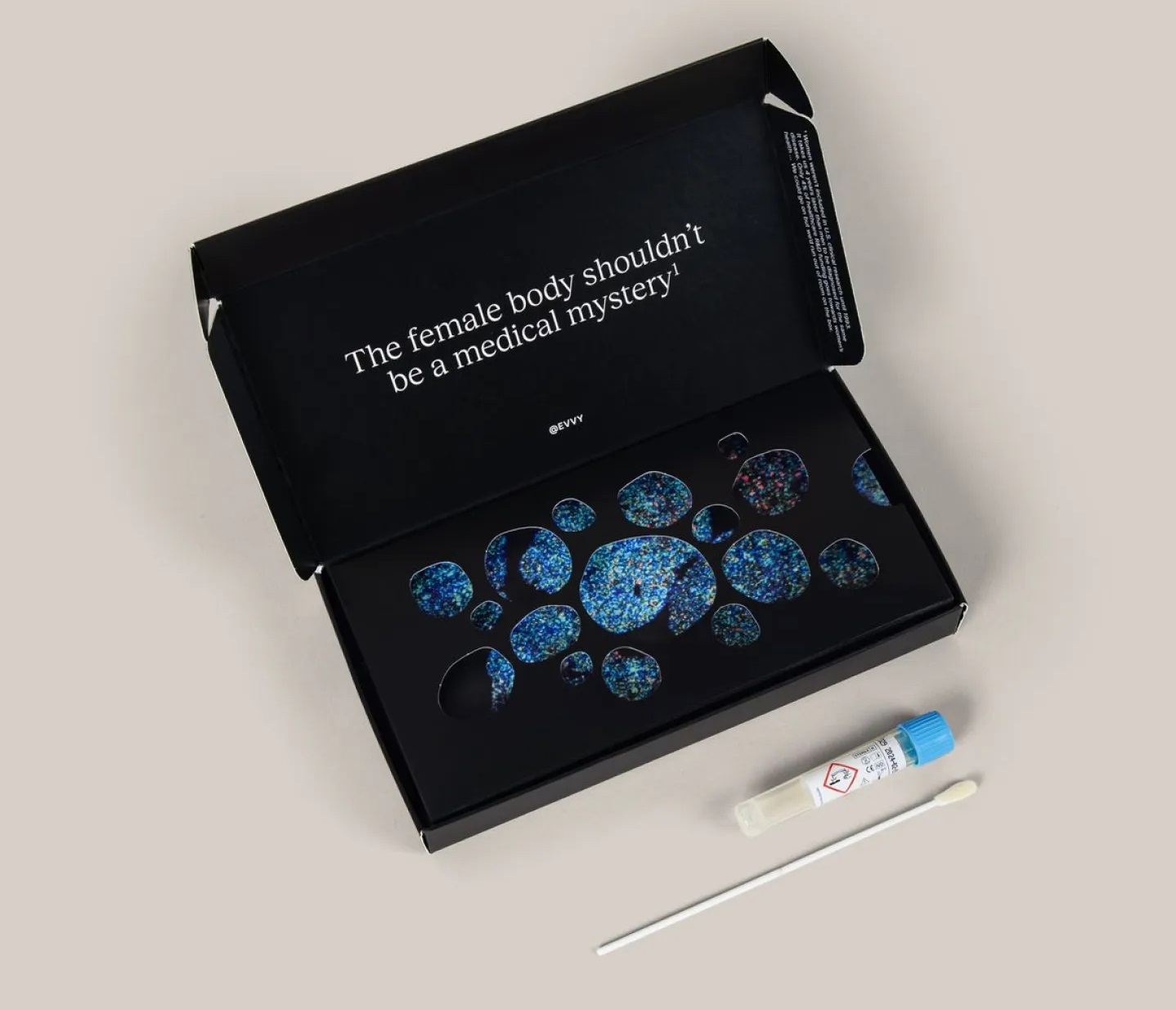

One of the more advanced startups on this list, Evvy launched its debut product, the first at-home vaginal microbiome test to use metagenomic sequencing to screen for all bacteria and fungi from the vaginal and urinary tracts in a single swab, in 2021.

Evvy has since turned its offering into an AI-powered vaginal healthcare platform that incorporates testing, precision care and coaching, adding tests for sexually transmitted infections and antibiotic resistance.

The company has raised a total of $19m, $14m of which came in a series A round last September that was backed by clinical laboratory network Labcorp’s Venture Fund.

KoKo Medical

Malvern, USA

Founded: 2020

Funding to date: $19m

KoKo Medical is developing medical device technology intended to prevent some 150,000 women a year dying from postpartum haemorrhaging – excessively heavy bleeding after birth.

The condition affects more than 10% of births according to the company, and it is caused when uterine muscles don’t contract enough after birth. The startup’s catheter-based system is designed to stop haemorrhaging by encouraging uterine contractions and removing excess blood.

KoKo says it is still operating in ‘deep stealth mode’, and so although regulatory filings show it has raised approximately $19m in funding between 2020 and 2023, the company has not revealed any of its investors.

Vyld

Berlin, Germany

Founded: 2021

Funding to date: Undisclosed

Germany’s Vyld is aiming to combine women’s health with the circular economy with a biodegradable tampon made from seaweed.

The Kelpon brand tampons are made from an extract derived from seaweed algae and are designed to avoid microplastics and to be used in situations where running water might not be available. The startup wants them to form part of an ‘Algaeverse’ of sustainable products, the next being a seaweed nappy.

Vyld most recently raised a ‘seven-figure amount’ in seed capital from investors including the German government and the European Union’s BlueInvest scheme in January this year. But much of its funding has come through Future Profit Partnership Agreements, a financing model it devised that is based on profit participation certificates rather than equity, so it won’t be the quick exit favoured by many traditional VCs.

FemTherapeutics

Montréal, Canada

Founded: 2021

Funding to date: $2.3m

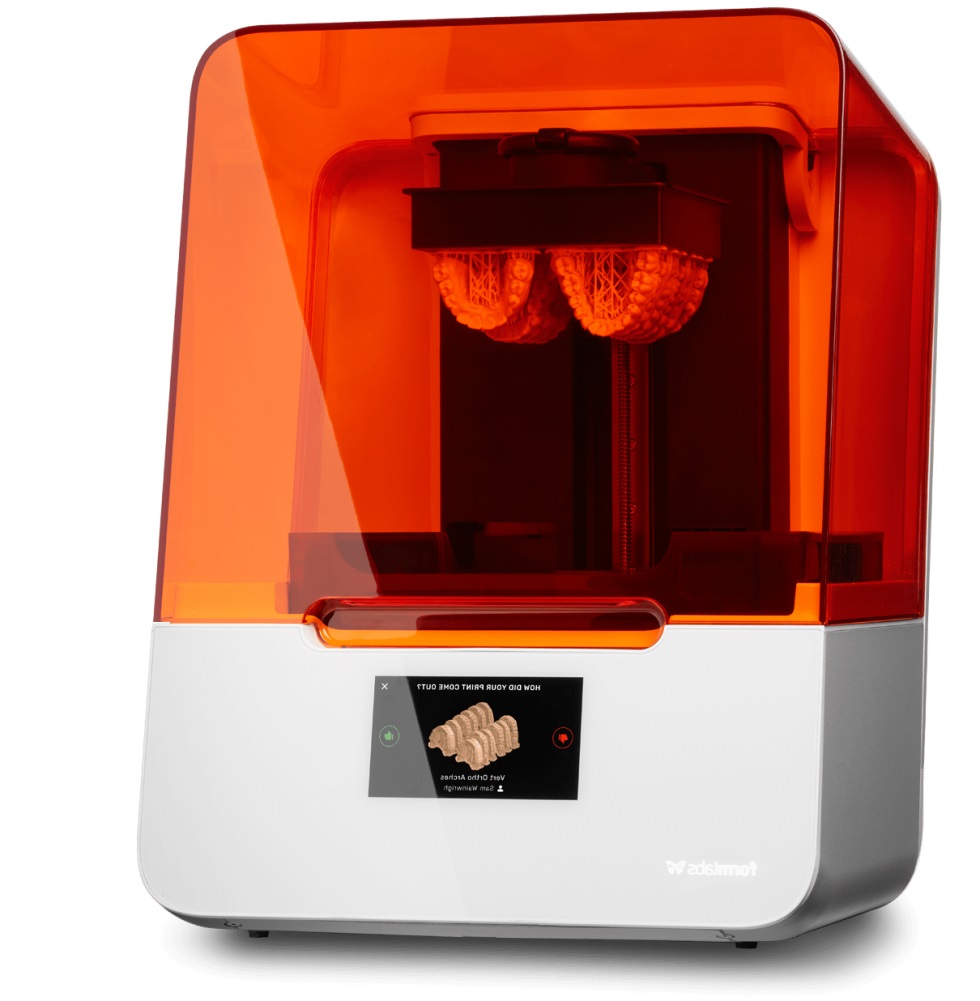

Roughly a third of women will experience a pelvic organ disorder in their lifetime, according to UCLA Health research, and FemTherapeutics has developed a system to help

FemTherapeutics is using artificial intelligence and 3D-printed biocompatible silicone to offer personalised intra-vaginal prosthetics to treat pelvic floor disorders. The process is intended to avoid trial-and-error fittings that can be intrusive and which may still result in prosthetics that are not sized correctly.

The company secured $1.85m in a May 2023 round led by 2048 Ventures that was put toward further developing its technology, initiating clinical studies, growing its team and supporting research and development.

Freya Pharma Solutions

Amsterdam, Netherlands

Founded: 2021

Funding to date: $8.5m

Viagra proved to be a revolutionary product for combatting physical sexual dysfunction in men, but only two similar options for women exist in the US market while none have received regulatory approval in Europe.

Freya Pharma Solutions is working on pharmaceutical options for women with female sexual interest/arousal disorder (FSIAD). Its lead drug candidate, Lybrido, targets known neurobiological mechanisms in female bodies and has passed through phase 2 clinical trials in the US.

Freya has not revealed details of its backers, but the company announced an $8.5m seed round in early 2022 it said was populated by new and existing investors.

Gabbi

Portland, USA

Founded: 2019

Funding to date: $5.4m

Breast cancer is the second most common cause of cancer death for women and screening remains one of the most potent weapons against the disease. Gabbi has built a service that uses artificial intelligence to boost results.

Gabbi’s at-home test uses artificial intelligence to compare individual inputs with large repositories of clinical data to create more accurate risk profiles spanning all ages and ethnicities and claims it can determine breast cancer risk with 90% accuracy. It then provides personalised treatment plans.

Bread and Butter Ventures led the company’s most recent funding, a $4.4m seed round in late 2022 earmarked for product development and hiring as it prepared to launch its service as an employee benefit option.

Juniper

London, UK

Founded: 2023

Funding to date: $1.9m

While healthtech is appreciated, in many countries healthcare isn’t just about the procedure itself, there’s also the issue of paying for treatment. That’s the side of the market Juniper is targeting.

Juniper offers reproductive insurance that covers a range of areas including menopause, cancer and sexual health screening, family planning and treatments for conditions such as endometriosis and polycystic ovary syndrome, bundled as a workplace benefit.

The startup’s sole funding came in February this year when InsurTech Gateway led a $1.9m pre-seed round that also featured 2100 Ventures, Exceptional Ventures, Heartfelt and several angel investors.